- Ethereum fell 24% in seven days amidst the broader crypto market bloodbath.

- Though selling pressure remained high, the NVT ratio dropped, showing increased chances of a price rebound soon.

As a seasoned analyst with years of experience in the volatile crypto market, I have witnessed numerous ups and downs, bull runs, and bear markets. The recent 24% plunge in Ethereum (ETH) within seven days is reminiscent of such turbulence, but it’s important to look beyond the immediate red figures.

As an analyst, I’ve observed a significant downturn in Ethereum’s [ETH] value last week, with its price plunging by double-digit figures. Yet, within the past 24 hours, there have been promising indicators of recovery for this token.

Let’s have a better look at Ethereum’s current state to understand what’s going on with the token.

Ethereum’s fate

According to information from CoinMarketCap, Ethereum had dropped by more than 24% in value during the past week. At the moment, Ethereum was being exchanged at approximately $2,514.29, and its total market capitalization surpassed $302 billion.

As I’ve been observing, I’ve noticed a significant update shared by Lookonchain, a well-known figure on the platform previously known as Twitter, in one of their recent posts.

According to the posted tweet, an Ethereum wallet belonging to LonglingCapital moved approximately 20,000 ETH, equivalent to more than 50.3 million dollars, to the wallet address “0x3478” following a two-year period of inactivity.

Instead, AMBCrypto decided to closely examine the token’s current status to predict future developments.

Which way is ETH headed?

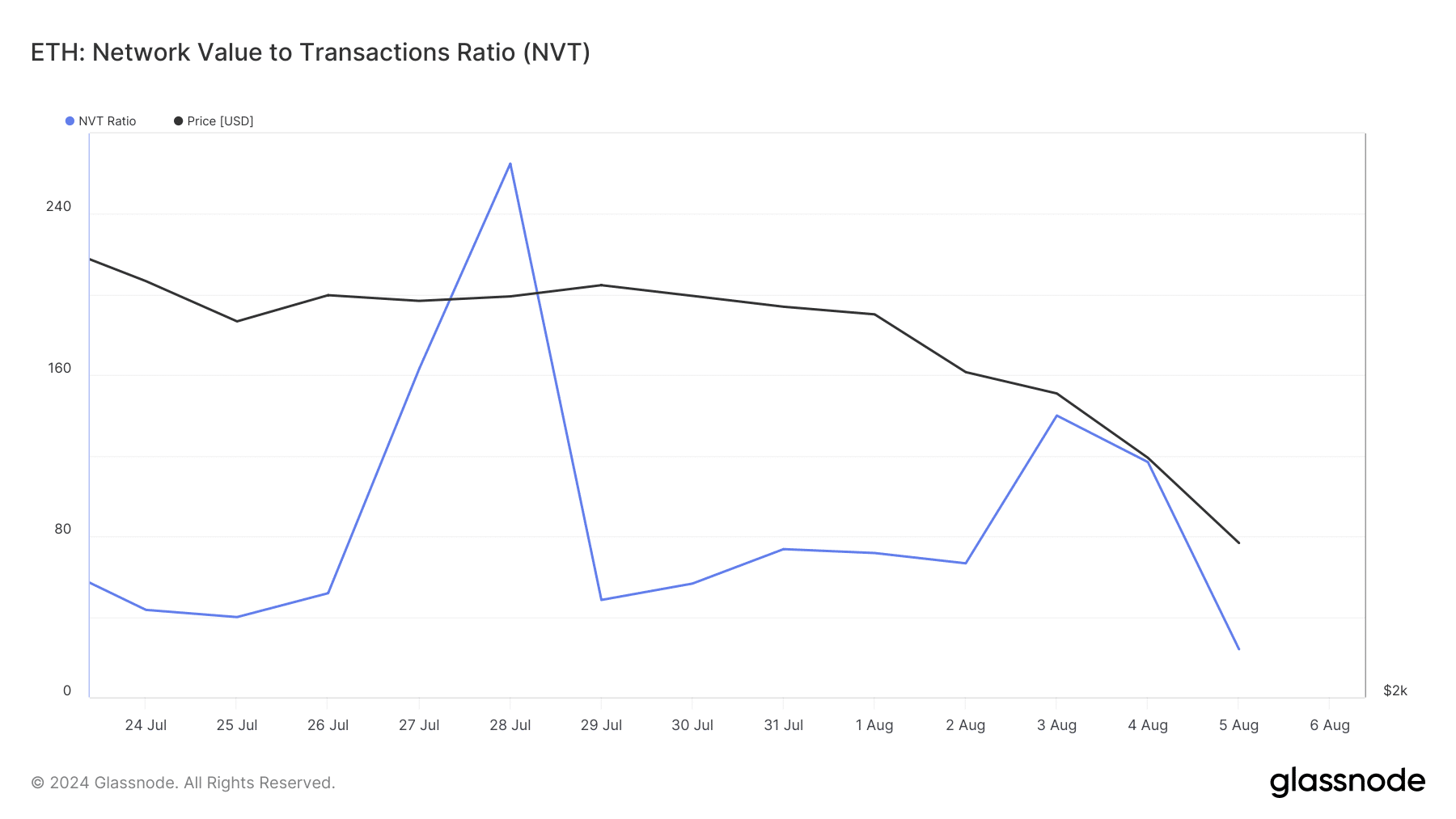

Based on my examination of Glassnode’s data, I’ve observed a significant decrease in Ethereum’s NVT ratio. When this metric falls, it usually signals that the asset is underpriced, implying a higher likelihood of an upward price trend.

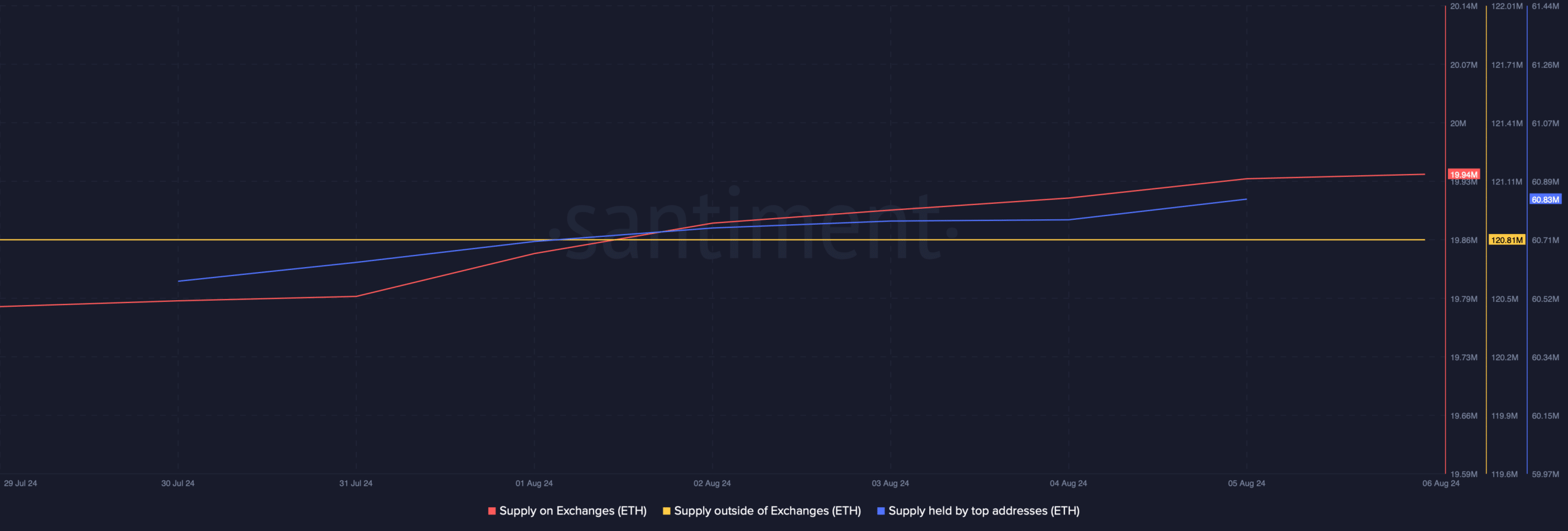

After examining data provided by Santiment, it’s clear that there has been an uptick in Ethereum (ETH) being held on exchanges during the past week. Such a trend suggests a rise in selling pressure.

At the given moment, it appears that the demand for ETH outside the exchanges remained steady, suggesting that many investors were not actively purchasing ETH at that point. Nevertheless, a significant increase in ETH ownership by large-scale investors, or “whales,” was observed, as indicated by the surge in the supply held by top addresses.

What to expect from Ethereum

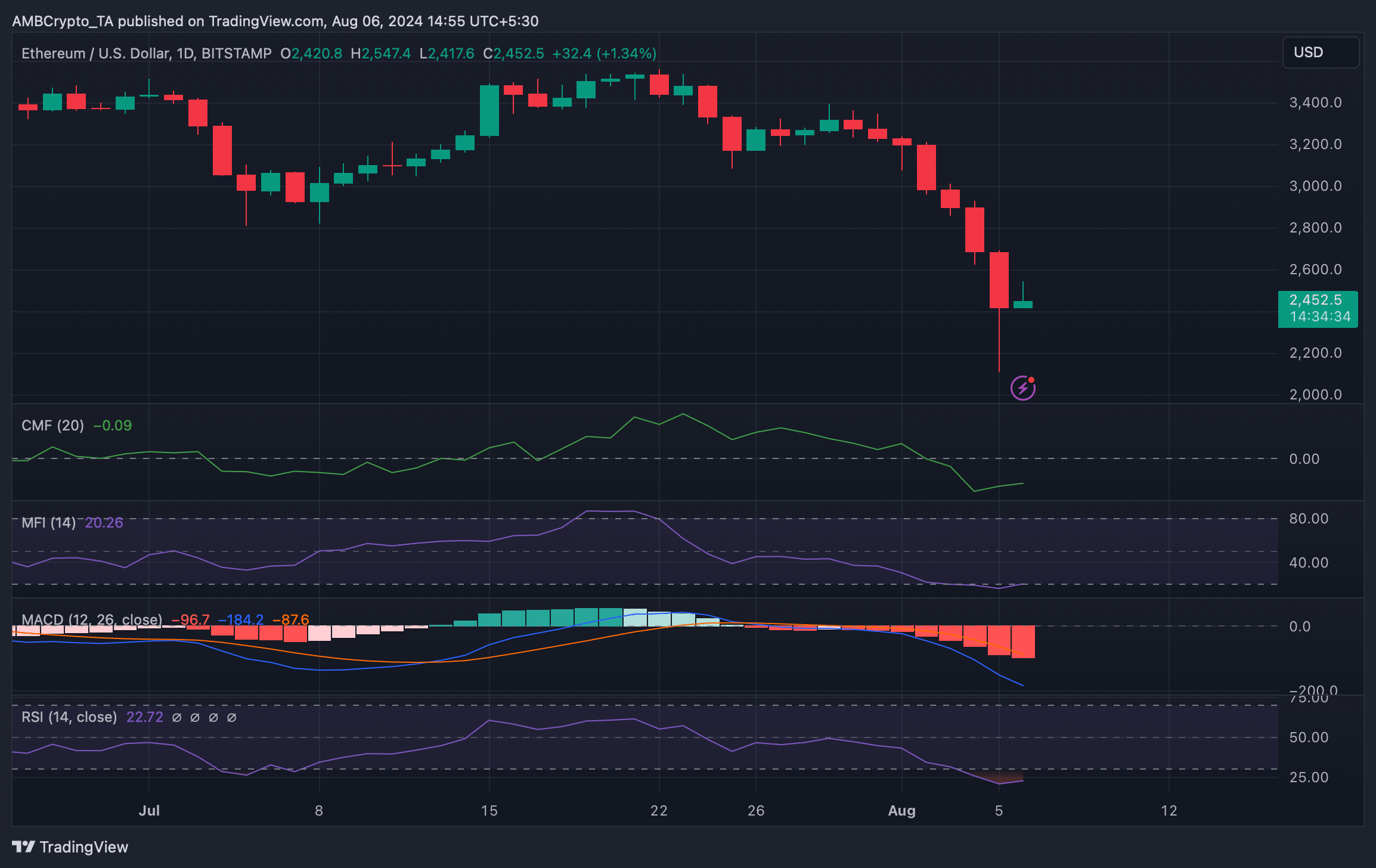

To gain insights about Ethereum’s future performance, we examined its daily graph. According to our study, the MACD technical indicator showed a bullish edge in the market.

The Relative Strength Index (RSI) and Money Flow Index (MFI) showed they were in an oversold state, implying a potential recovery for Ethereum (ETH), as these indicators pointed towards increased likelihood of it regaining its losses.

As an analyst, I’ve noticed a rise in the Chaikin Money Flow (CMF), suggesting a potential upward trend for Ethereum’s price in the near future.

Read Ethereum’s [ETH] Price Prediction 2024-25

After examining Hyblock Capital’s data, we found that if Ethereum (ETH) starts to increase in value, there’s a strong possibility it could reach around $3.3k again soon. This pattern has emerged because as liquidation levels are hit, it often leads to price adjustments.

If the bears maintain their grip on the mallet, it’s quite plausible that ETH could fall to $2k within the near future.

Read More

- WCT PREDICTION. WCT cryptocurrency

- PI PREDICTION. PI cryptocurrency

- Viola Davis Is an Action Hero President in the ‘G20’ Trailer

- EastEnders’ Balvinder Sopal hopes for Suki and Ash reconciliation: ‘Needs to happen’

- Has Unforgotten Season 6 Lost Sight of What Fans Loved Most?

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- Michael Saylor’s Bitcoin Wisdom: A Tale of Uncertainty and Potential 🤷♂️📉🚀

- Michelle Trachtenberg’s Mysterious Death: The Unanswered Questions

- Upper Deck’s First DC Annual Trading Cards Are Finally Here

- Buckle Up! Metaplanet’s Bitcoin Adventure Hits New Heights 🎢💰

2024-08-06 18:15