- Ethereum ETFs just recorded their highest single-day inflows, surpassing Bitcoin ETFs

- ETH might be on the verge of a major rally after hikes in Exchange Reserves and Open Interest

As a seasoned researcher with years of experience in the dynamic world of cryptocurrencies, I find these recent developments particularly intriguing. The flip-flop between Bitcoin and Ethereum ETF inflows is a testament to the ever-evolving landscape of digital assets.

This year’s approvals of Bitcoin and Ethereum Exchange-Traded Funds (ETFs) were undoubtedly significant steps towards increasing institutional liquidity. Although Bitcoin has consistently led in terms of investment inflows, it’s worth noting that for the very first time, daily inflows to Ethereum ETFs managed to surpass those of Bitcoin.

Based on recent ETF figures, it’s interesting to note that $332.9 million flowed into Ethereum ETFs last Friday, surpassing Bitcoin ETFs which saw $320 million during the same trading period. This is significant because this was the first instance where Ethereum ETF investments outpaced those in Bitcoin ETFs.

On this particular day, Friday saw the greatest one-day influx of funds. This influx was not just the highest reported for November, but it also surpassed every other single-day inflow recorded since Ethereum ETFs began trading.

Is Ethereum on the verge of a major breakout?

Could it be that the consistent higher daily investments into Ethereum ETFs compared to Bitcoin ETFs could indicate an upcoming surge for Ethereum? This trend might suggest that Bitcoin’s influence is waning, leading investors to pay closer attention to Ethereum. But keep in mind, this doesn’t tell the whole story…

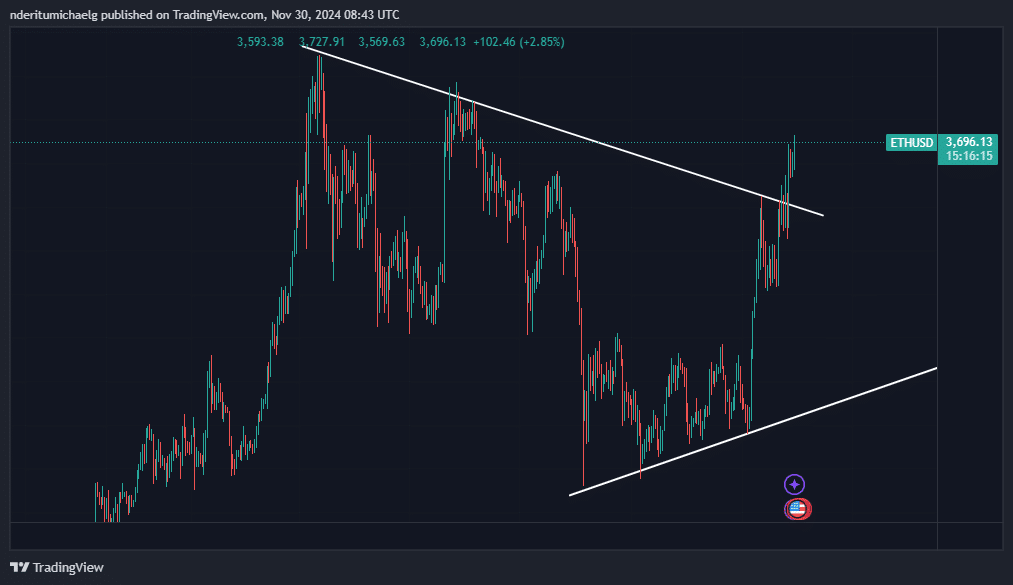

During the past week, Ethereum (ETH) showed a significant surge in positive energy, indicating a successful escape from its prolonged triangular pattern, often referred to as a wedge. This escape also revealed a long-term pennant formation for ETH, which is typically associated with a bullish trend. In summary, these signs collectively imply that Ethereum could be gearing up for a potential bull run in December.

Currently, the value of the altcoin stands at approximately $3,694. A persistent interest following a surge past the falling resistance line might indicate growing optimism among buyers, suggesting potential bullish trends ahead.

Furthermore, it appeared that several other indicators concurred with the previously mentioned results. For instance, the Open Interest of ETH reached an all-time high of $24.08 billion on November 28th – a record peak.

source: Coinglass

Evidence indicates a robust demand for Ethereum derivatives, as well as ETFs, which has recently set a new Open Interest record.

The data from Exchange Reserves further supports the increasing trust among Ethereum holders. In fact, there was a significant increase of approximately 750,000 Ethereum coins in the last month, resulting in a total exchange-held Ethereum amount of roughly 19.72 million coins now.

Ethereum’s exchange reserves have reached a level not seen since April 2024, marking the first two-month period this year where the cryptocurrency has had positive exchange reserves.

The attitude of Ethereum (ETH) owners appears to be changing, which could indicate less ETH being sold in the market. If this trend continues, the price of ETH might surge past $4,000 and potentially reach even higher levels.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2024-12-01 01:11