-

ETH remains in a strong bull trend according to its RSI, around 56.

Its price declined by 0.73% in the last trading session.

As a seasoned researcher with years of experience in the crypto market, I find Ethereum’s current situation intriguing. On one hand, it’s showing signs of strength with its short-term bullish momentum and increasing number of holders in profit. On the other hand, the 200-day moving average looms as a formidable obstacle for any long-term breakout.

Over the past day, Ethereum (ETH) has experienced a minor dip, yet technical signals hint at an impending short-term uptrend.

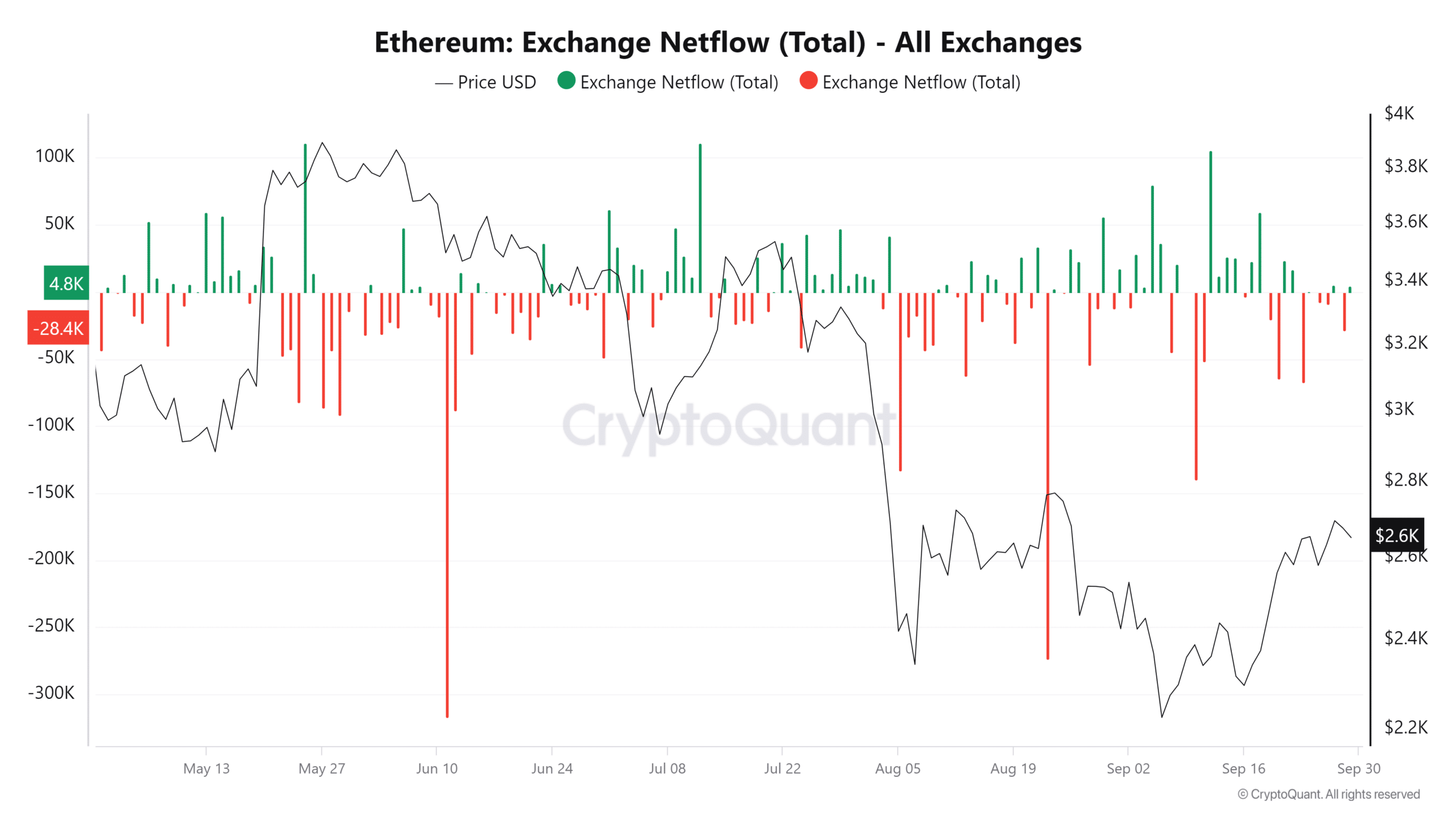

As a researcher, I’ve observed an interesting trend in Ethereum (ETH) lately. Although there have been recent sell-offs, the net flow on its exchange indicates a predominance of outflows. This suggests that more ETH is being withdrawn from exchanges than deposited, potentially signaling increased buying interest and decreased selling pressure.

Ethereum’s price action and technical indicators

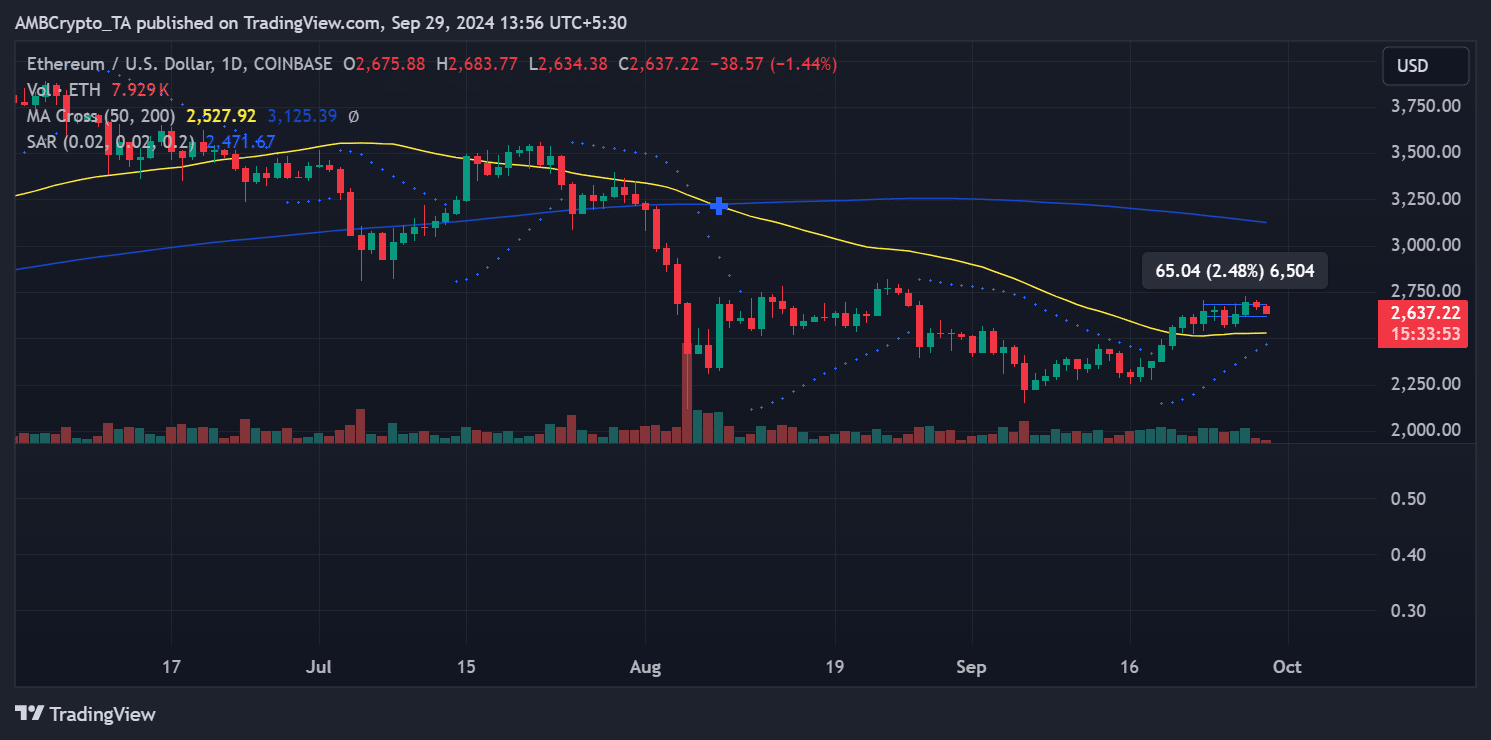

Currently, Ethereum is priced at approximately $2,637.22 per unit, showing a minor decrease of 1.44% over the immediate term. Looking at the daily graph, its 50-day moving average (represented in yellow) stands at around $2,527.92, whereas the 200-day moving average (in blue) is slightly higher at $3,125.39.

If ETH‘s price is currently higher than its 50-day moving average, this indicates a temporary increase in bullish sentiments. Yet, it’s important to note that ETH’s price is still significantly lower than its 200-day moving average, indicating that the overall long-term trend continues to lean bearish.

The Parabolic SAR (Stop and Reverse) indicator lends credence to the temporary bullish perspective, as the dots are situated under the current prices. This placement suggests that the ongoing upward trend continues unbroken, with traders currently dominating the market, maintaining control for the moment.

In the short run, Ethereum appears robust, but its progress might be halted by the formidable barrier presented by the 200-day moving average, potentially hindering a sustained upward trend.

Increasing number of Ethereum holders in profit

Regardless of the recent drop, the surge in Ethereum’s price earlier this week had a substantial influence on the earnings of its investors. As per data from the Global In/Out of the Money graph, the proportion of Ethereum holders who are in profit rose from 59% to 68%.

This translates to over 83 million addresses now holding ETH at a profit.

Conversely, about 29.47% of the addresses, which amounts to 36.17 million, are currently in a negative position, meaning they’re holding assets at a loss. Around 2.38%, or 2.93 million addresses, however, are neither gaining nor losing, as they are breaking even.

Exchange netflow: Outflows dominate

Over the past week, the movement of Ethereum on exchanges has been going back and forth between deposits and withdrawals. Nevertheless, it’s worth noting that there’s been a noticeable increase in Ethereum being taken off exchanges compared to what’s been put on them, suggesting more Ethereum is being withdrawn than deposited.

The substantial outflow we’re seeing here is particularly notable given the sell-offs by both individual and institutional investors earlier in the week.

At the end of the previous trading day, more than 28,000 units of Ethereum were taken out of circulation, indicating a greater movement of Ethereum off exchanges. This pattern implies that investors may be choosing to hold onto their Ethereum, potentially limiting immediate sell-offs.

Read Ethereum (ETH) Price Prediction 2024-25

Conclusion

At the moment, Ethereum finds itself in a market that’s showing both positive and negative trends. It’s seeing a temporary upward push, or “bullish momentum,” since it’s trading above its 50-day moving average. Additionally, there’s been an increase in the amount of Ethereum being withdrawn from exchanges.

Nevertheless, the strong opposition presented by the 200-day moving average continues to be an obstacle for prolonged upward market tendencies.

Furthermore, an uptick in profitable investors indicates a restored faith among stakeholders, even amidst the current downward trend in prices.

Read More

2024-09-30 04:08