-

ETF analyst believes there is hope for Ethereum ETFs after outflows reached $524 million.

ETH price has plunged by nearly 6% amid an influx in selling activity.

As a seasoned crypto investor with battle-scarred fingers from navigating through countless market fluctuations, I can’t help but feel a sense of deja vu reading about the current state of Ethereum ETFs and ETH price. It seems like history is repeating itself, only this time with slightly different players on the stage.

Since their debut on July 23rd, Ethereum-based exchange-traded funds (ETFs) have collectively experienced net withdrawals totaling $524 million. In the month of August, these investment products recorded positive inflows for only seven days, according to SoSoValue

Due to a significant withdrawal of $47 million from ETH Exchange-Traded Funds (ETFs) on the 3rd of September, which is the most substantial outflow in more than four weeks, the interest in these products appears to be decreasing

Over the past three trading days, the BlackRock iShares Ethereum Trust (ETHA) has not seen any new investments flowing into it

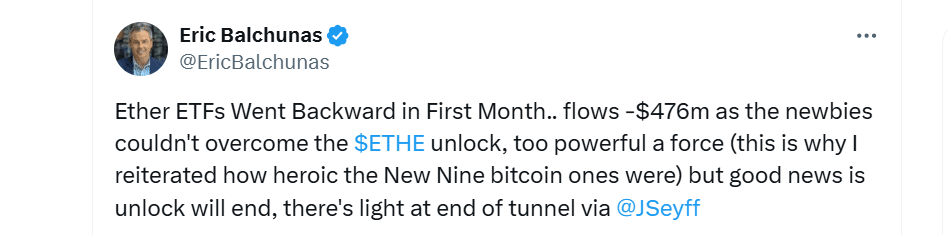

According to Bloomberg ETF analyst Eric Balchunas, the releases from the Grayscale Ethereum Trust ETF (ETHE) acted as a “strong influence” that suppressed demand in August. Nevertheless, once these outflows cease, the ETFs may recover

As a crypto investor, I’ve noticed that it’s not just Ether ETFs experiencing diminished interest. Over the past five days, Spot Bitcoin [BTC] ETFs have been facing consecutive withdrawals as well

How is ETH performing?

The price of ETH has taken most of the impact due to withdrawals from Ethereum ETFs and a generally negative market outlook. Over the past day, ETH has fallen approximately 6%, currently trading at $2,368 as I speak

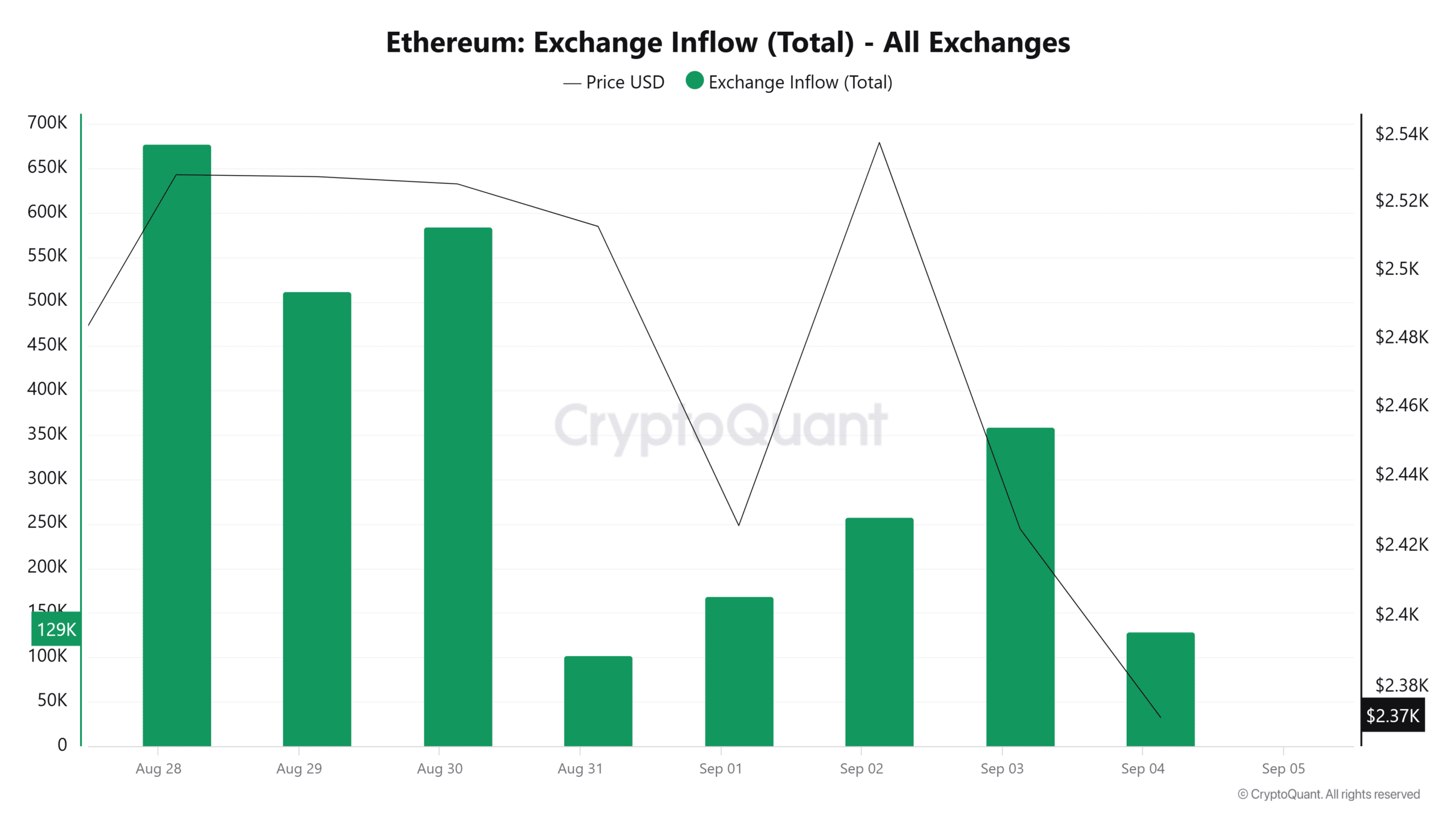

It seems like the decrease in value is due to increased selling actions. According to CryptoQuant, during the period from August 31st to September 3rd, more than 257,000 Ether was moved to trading platforms, suggesting a high likelihood of these tokens being offloaded

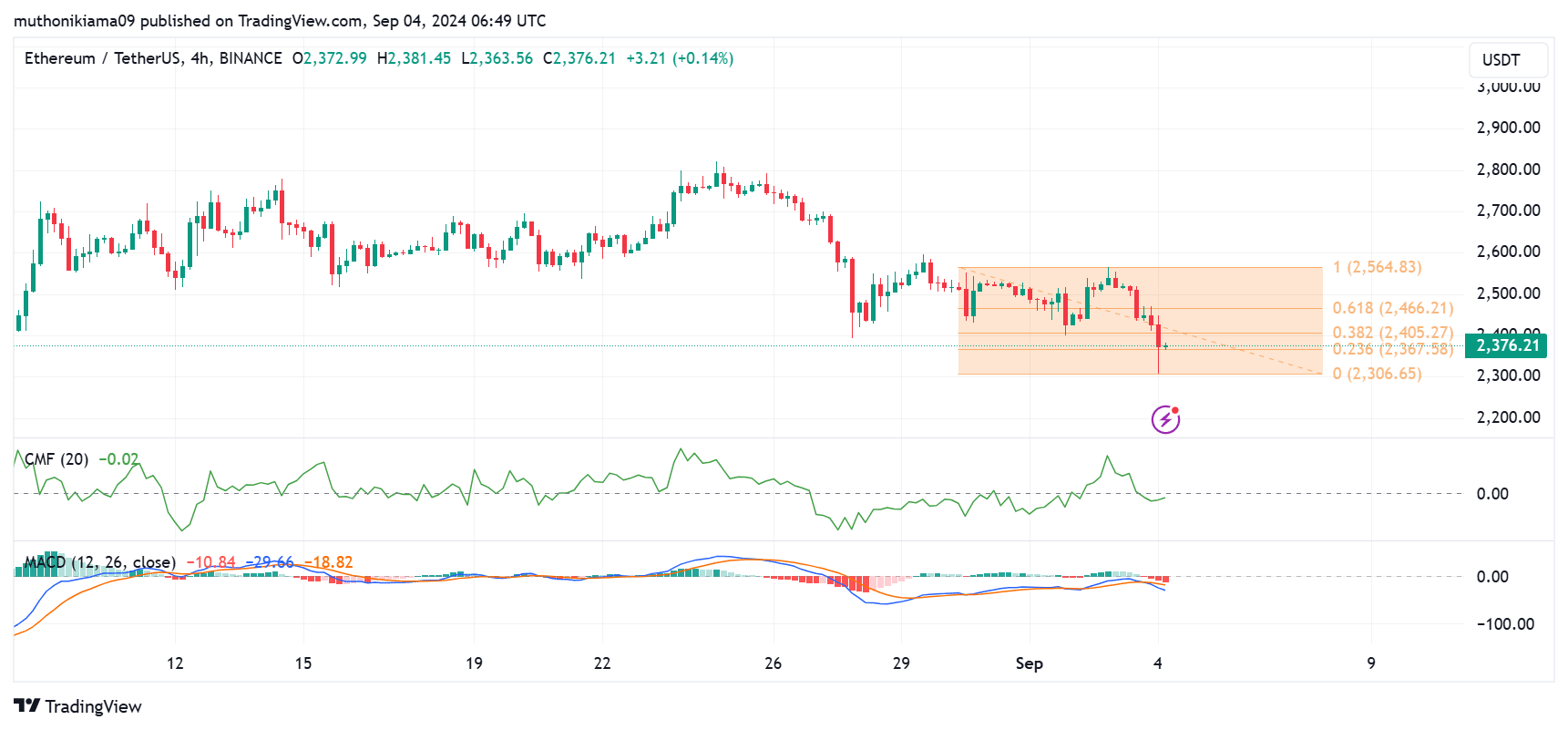

After the Chaikin Money Flow (CMF) indicator moved into a negative zone following a short spell of buying, technical indicators are suggesting an increase in selling activity

In addition, for the last week, the Moving Average Convergence Divergence (MACD) line is hovering beneath the signal line, and the histogram bars have switched to red. This indicates a strong trend of selling activity as well

It’s plausible that traders rushed into the ETH market following its inability to maintain a significant support point at around $2,405 (which is approximately 0.382 Fibonacci level). Nevertheless, ETH has identified another potential support area at roughly $2,367. However, there’s a possibility of a drop in liquidity causing the price to dip further down to about $2,306

Information from Hyblock Capital showed a high volume of liquidations when the price dropped to approximately $2,280. Consequently, this price point could serve as another significant support level where potential buyers may decide to join the market

ETH needs to break past resistance at $2,466 to confirm a bullish reversal.

Read Ethereum’s [ETH] Price Prediction 2024–2025

It seems that the Ethereum network is finding it difficult to handle rising prices because the number of active wallets is decreasing significantly. According to CryptoQuant, this reduction has almost reached 50% since mid-August

When network activity decreases, Ethereum (ETH) may require backing from the wider market and an increase in market enthusiasm for a sustained upward trend

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Elden Ring Nightreign Recluse guide and abilities explained

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

2024-09-04 17:55