-

Steady decline of Ethereum was partly due to lowered transaction fees

Other leading L2s saw rising transaction counts while ETH lost out slightly

As a seasoned crypto investor with over a decade of experience in this volatile market, I must admit that the recent decline of Ethereum has left me somewhat disheartened. Having witnessed the meteoric rise of ETH since its inception, it’s disappointing to see it struggle against Bitcoin, especially given its potential as the leader of the altcoin market.

Ethereum (ETH) has been underperforming since April, showing a significant gap compared to Bitcoin (BTC). Given its position as the head of the altcoin market, some investors anticipate ETH to spearhead the bullish surge among alternative coins. However, at this point in time, Ethereum is finding it challenging to match the pace set by the market.

Since April 2023, the ETH/BTC graph has shown a significant drop in value. The dip from June 2022 at 0.049 was maintained until April 2024, but the ongoing six-month downtrend led ETH/BTC to levels not seen since April 2021.

Reasons for Ethereum losing value

Concerns might arise among long-term Ethereum backers, given its swift decline compared to Bitcoin. One reason for this dip could be the inflation within the network that emerged post the Denecun update in March 2024.

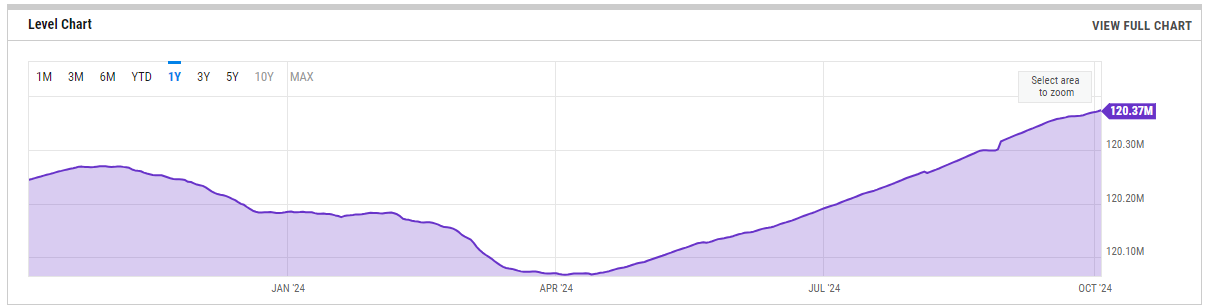

The recent Dencun update implemented EIP 4844, significantly cutting down the expenses associated with L2 transaction costs. This change brings relief to users but also means that less Ether is getting destroyed as network fees decrease, resulting in a slight increase of Ethereum supply over the past six months, making it somewhat inflationary.

This was seen in the rising ETH supply chart.

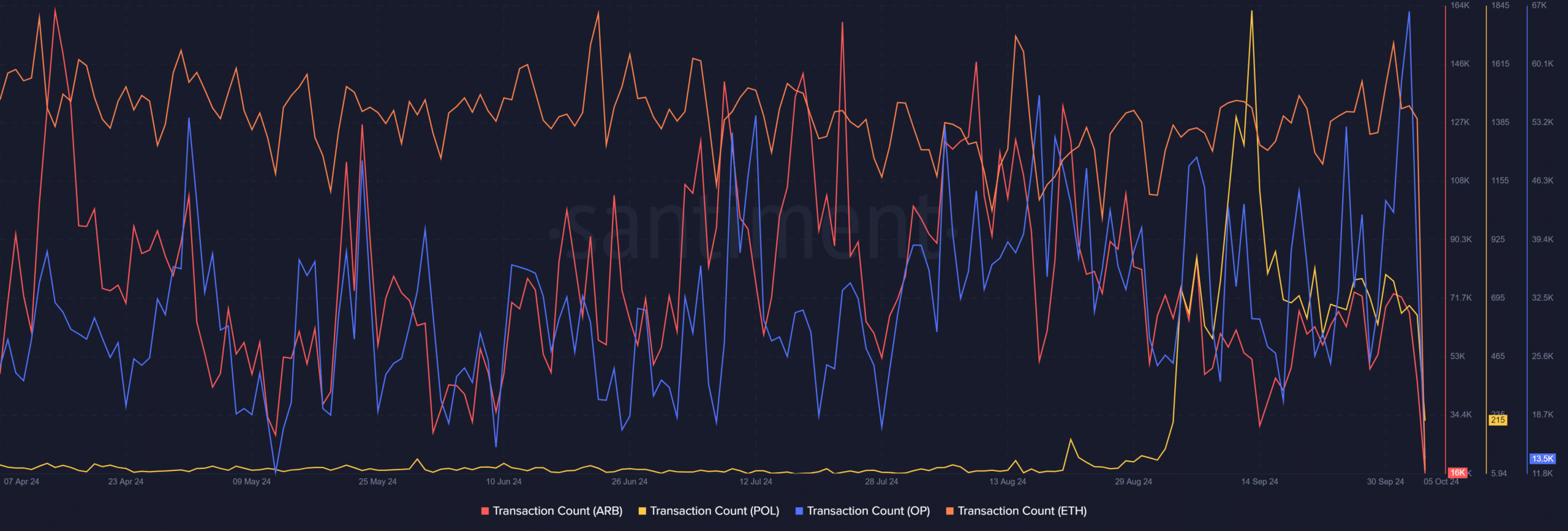

Optimism activity trends firmly higher

It turns out that Arbitrum’s token [ARB] and Polygon Ecosystem’s token [POL] experienced an increase in transaction numbers, yet it was Optimism’s [OP] platform that clearly stood out as the most popular among the layer-2 solutions (L2s), suggesting a growing interest in these platforms.

Specifically, the superior performance of Optimism could be primarily due to the growth of Coinbase’s Base L2 layer built upon the Optimism Superchain.

Read Ethereum’s [ETH] Price Prediction 2024-25

An inflationary ETH and its performance against Bitcoin challenge the idea that Ethereum is money. An uptick in activity could alleviate this problem, but the lack of market conviction in ETH can be exemplified by the ETH/BTC chart.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- The Lowdown on Labubu: What to Know About the Viral Toy

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Microsoft Has Essentially Cancelled Development of its Own Xbox Handheld – Rumour

- Gold Rate Forecast

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

2024-10-06 04:07