- Ethereum broke out of a symmetrical wedge on the price charts

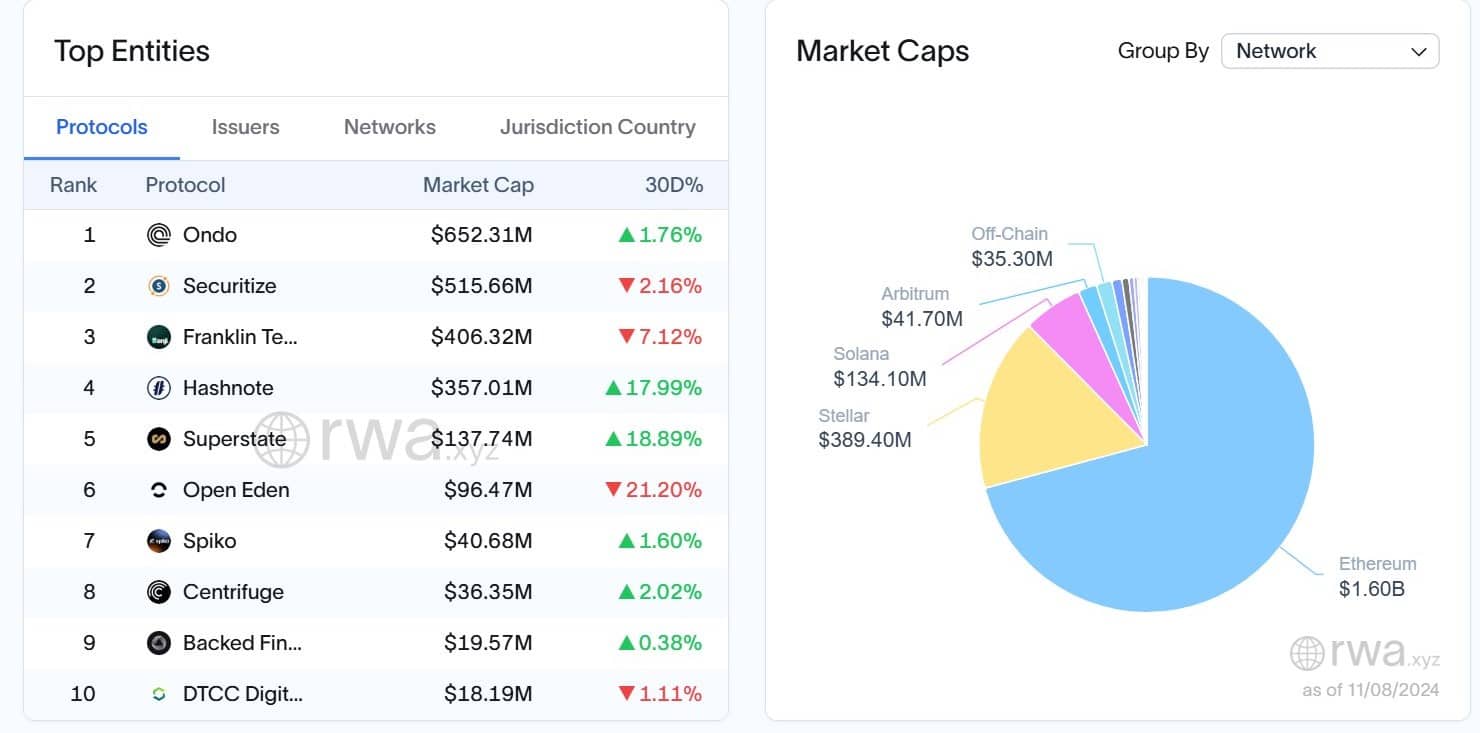

- ETH scooped up 70% in RWA tokenization

As a researcher with over a decade of experience in the crypto market, I have seen my fair share of bull and bear runs. However, the recent breakout by Ethereum (ETH) has caught my attention for its potential to disrupt the ongoing narrative that ETH is dead.

Initially, Ethereum’s (ETH) graphs have indicated potential changes that could disprove the idea “ETH is Finished.” This comes after ETH has managed to break free from a symmetrical wedge pattern and has soared to trade near its $3,000 resistance level, as we speak.

Previously mentioned price surge suggests a robust bullish trend – A clear signal that Ether might maintain its value above $3,000. Notably, this significant leap beyond the upper limit of the pattern was driven by several indicators within the Ethereum market.

If the prevailing market trend persists, ETH could soon challenge its higher resistance levels.

As I analyze the current market trends, if Ethereum (ETH) maintains its position above $3,000, it could signal a higher probability of additional growth and a possible challenge of the new resistance level at $4,000. This becomes even more plausible as chatter about an upcoming altseason gains traction.

ETH/BTC signals and prediction

On its weekly chart, Ethereum displayed signs of being overbought as indicated by its Relative Strength Index (RSI). This occurrence is quite rare, happening just five times in total.

Previously, when the Relative Strength Index (RSI) reached similar levels, it often indicated a strong possibility for a bullish turnaround. In this case, the RSI also displayed a bullish divergence, increasing the chance of an upward trend on the charts. Collectively, these signs hint that the asset’s price may not remain near the $3k-level for an extended period.

An optimistic candlestick formation has emerged, suggesting a potential increase in positive trends for Ethereum. Based on these technical signs, Ethereum might exceed its projected performance quite soon. If the altseason materializes as expected, Ethereum could reach a new peak, possibly even surpassing $5000.

Those expecting a decline in Ethereum’s potential will be disappointed if it shows signs of recovery soon, as indications of a turnaround in the following weeks could prove vital for taking advantage of possible increases in ETH’s value.

Share in RWA and sentiment

The value of tokenized U.S Treasuries exceeded its maximum historical level, surpassing $2.33 billion, indicating substantial expansion in tokenized assets, according to Leon Waidmann’s observation on platform X.

As I pen this, Ethereum remains the leading player in the realm of real-world assets (RWA), with approximately 70% of all assets residing on its platform. This strong presence underscores its enduring significance and usefulness within the blockchain community.

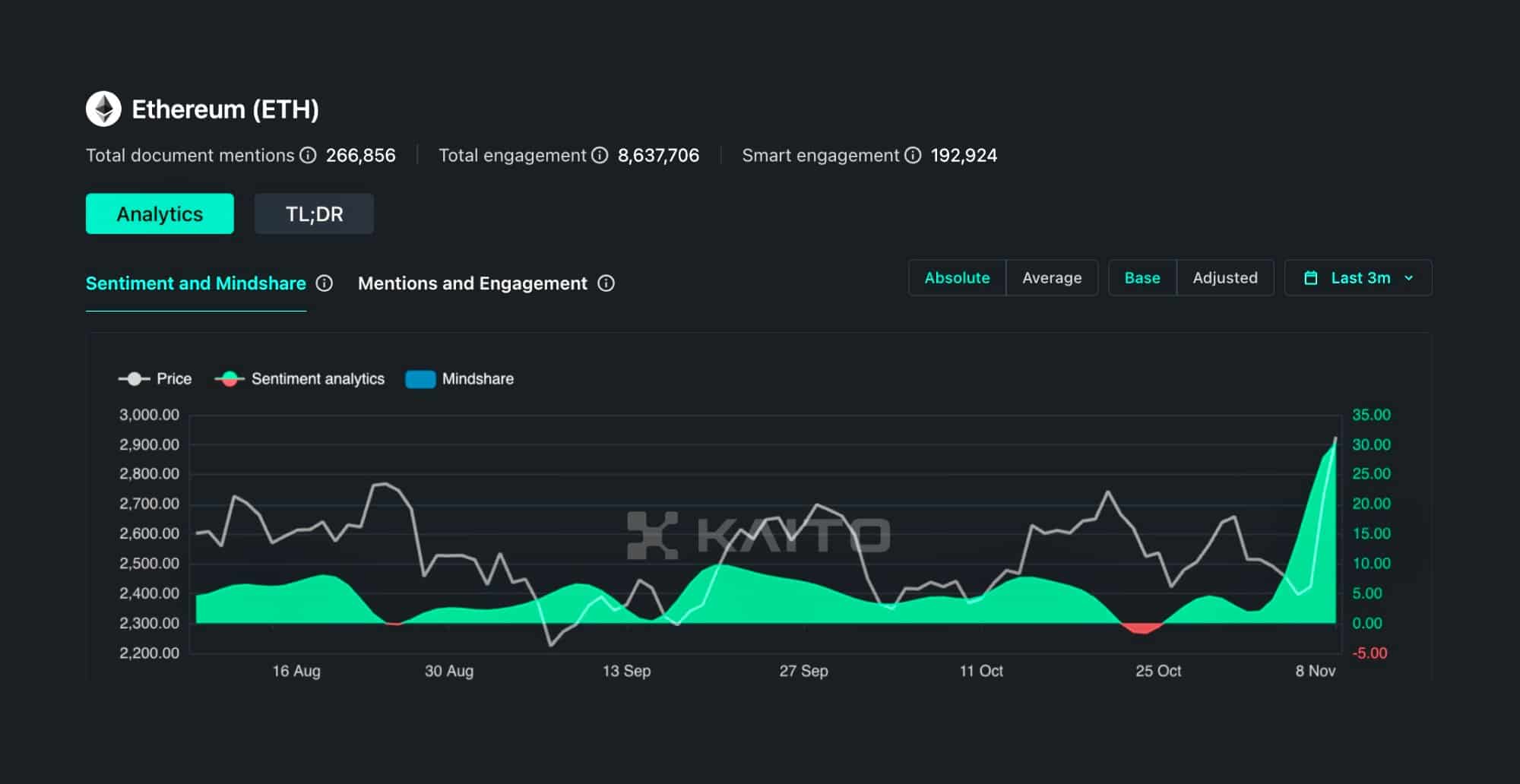

Indeed, it’s worth noting that Kaito AI has detected an increase in positive sentiment towards Ethereum (ETH) lately, suggesting a robust restoration in its overall view and trust.

With positive market feelings growing, both the cost and involvement in Ethereum noticeably increased, indicating renewed curiosity towards the platform.

In unison, the findings point towards Ethereum’s resilience, hinting that it may outgrow the $3k mark. The substantial tokenization of U.S Treasuries and the favorable change in market sentiment highlight Ethereum’s strength within the market, setting it up for more expansion and acceptance.

The renewed popularity and practical use of Ethereum may guide its future actions in the market, possibly resulting in continuous price growth and increased acceptance within the financial industry.

Read More

2024-11-09 18:15