-

Ethereum was trading at a key support zone at $2.6k.

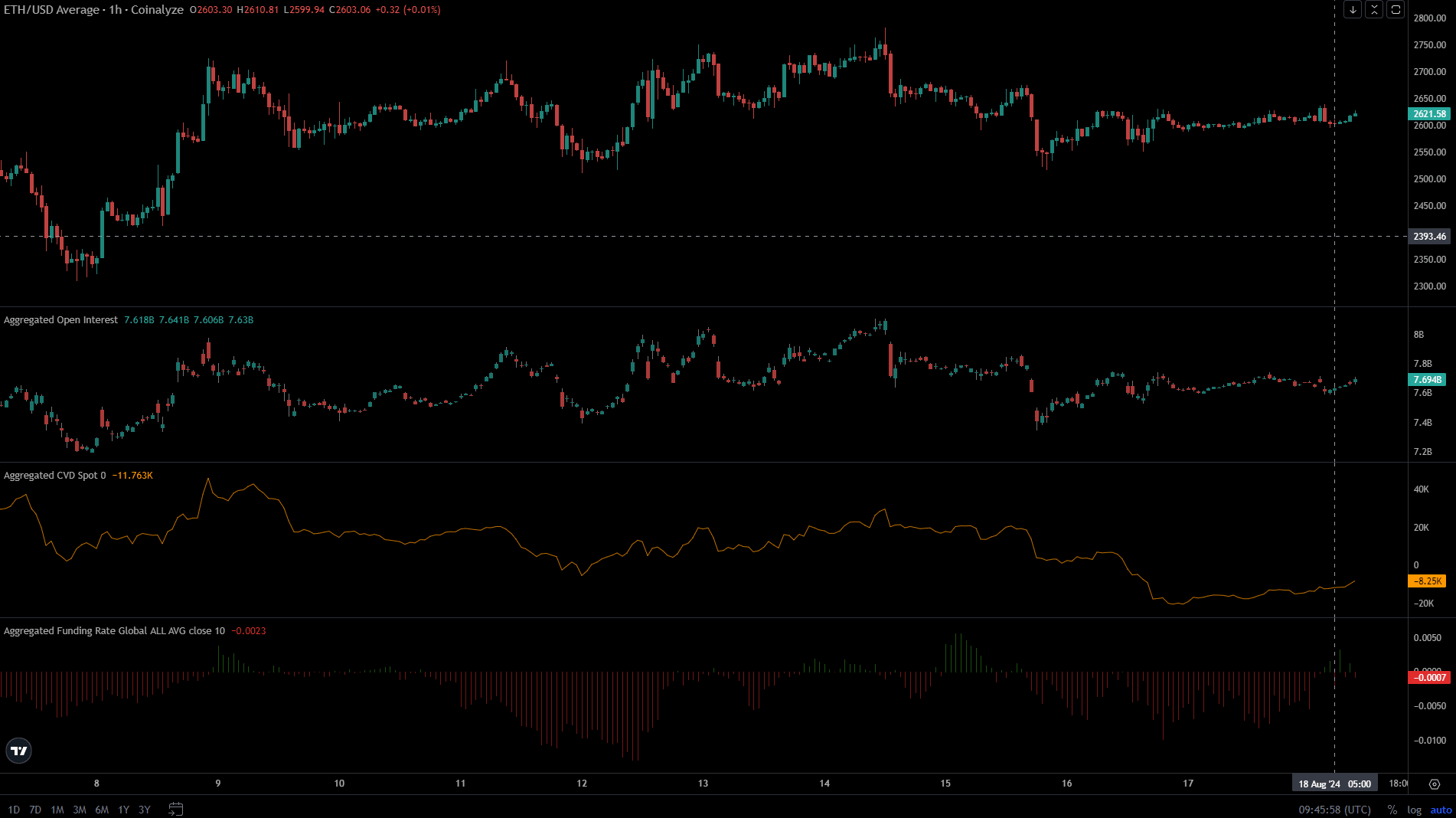

Coinalyze data showed slight bullishness, but it might not be enough to propel an ETH rally.

As a seasoned analyst with years of experience under my belt, I find myself cautiously optimistic about Ethereum’s [ETH] current situation. While the bullish sentiment is palpable, the $2.6k resistance zone remains formidable. The recent high-value transaction to Coinbase could potentially signal a wave of selling that might force the bulls to retreat once more.

In simpler terms, it appears that Ethereum (ETH) might be poised for a positive trend based on its on-chain analysis. Additionally, there seems to be more consistent accumulation of ETH compared to Bitcoin [BTC] in exchange transactions. However, the $2,600 area has proven to be a significant barrier so far.

According to a current report, there was a significant transaction involving 32 million dollars in Ethereum sent to Coinbase. This might indicate another round of selling, leading to speculation about whether the bullish trend could potentially weaken again.

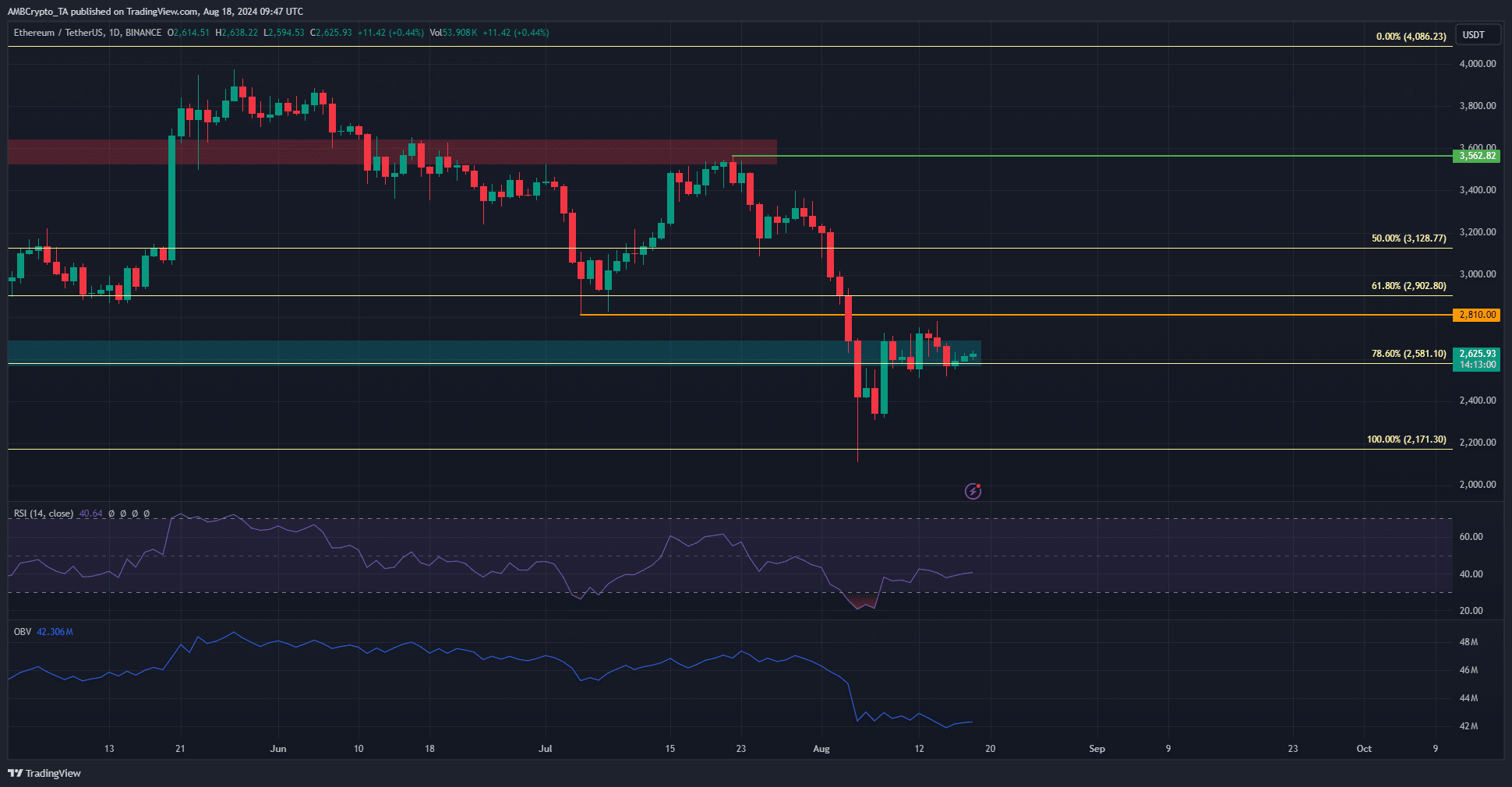

The OBV spiral did not help the bullish case

Over the last day, the market structure for ETH displayed a robust bearish trend. Furthermore, the On-Balance Volume (OBV) has been steadily decreasing. Although ETH’s price briefly rebounded from $2,200, the OBV has formed lower peaks over the past ten days.

This was a strong sign that the token does not have the demand necessary to initiate a rally.

Any further increase in price might not last, as the On-Balance Volume (OBV) needs to shift its direction upward to suggest that there is increasing buying pressure in the market before such a rise could be considered sustainable.

Do not expect a quick rally yet

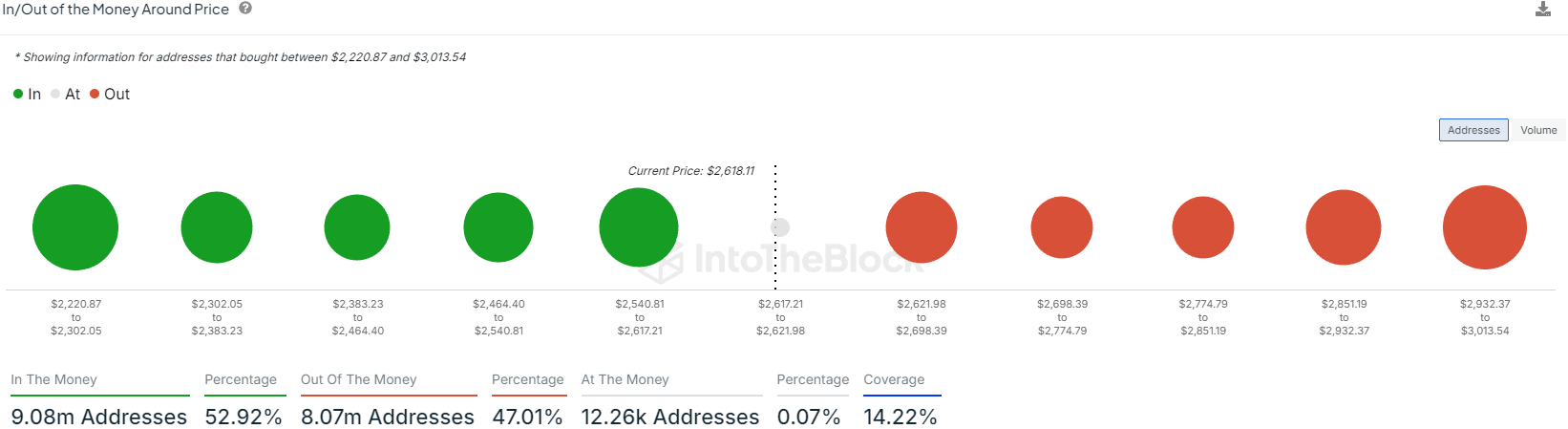

As a researcher examining market trends, I observed that the range between $2540 and $2617 served as a robust support area, providing stability for prices. Although the resistance levels above, extending towards $2.9K, were relatively smaller, they still carried significant weight in potential price movements.

When the price surpassed $2.6K, it indicated that more than half of the investors who purchased Bitcoin in August realized a profit.

As a crypto investor, I’ve noticed a significant change in the funding rate, hinting at a potential shift towards optimism, as more and more bullish speculators are entering the market. Additionally, the escalating spot CVD reflects a growing confidence among us investors.

Over the past week, I’ve noticed a relatively modest increase in Open Interest, indicating a somewhat neutral to mildly optimistic market sentiment.

In simpler terms, whenever Ethereum’s price rose significantly, buyers were eager to jump in, but sellers managed to maintain control over the market.

Read More

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Gold Rate Forecast

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

2024-08-19 00:07