-

Ethereum outperformed Bitcoin as a whale moved 5000 ETH.

ETH liquidations cooled off as ETF flow stabilized.

As a seasoned researcher with over two decades of experience in the ever-evolving world of cryptocurrencies, I must say that the recent surge in Ethereum [ETH] has caught my attention. The outperformance of ETH over Bitcoin [BTC], coupled with the whale’s significant move of 5000 ETH, suggests a shift in market dynamics that could potentially signal the start of an altcoin season.

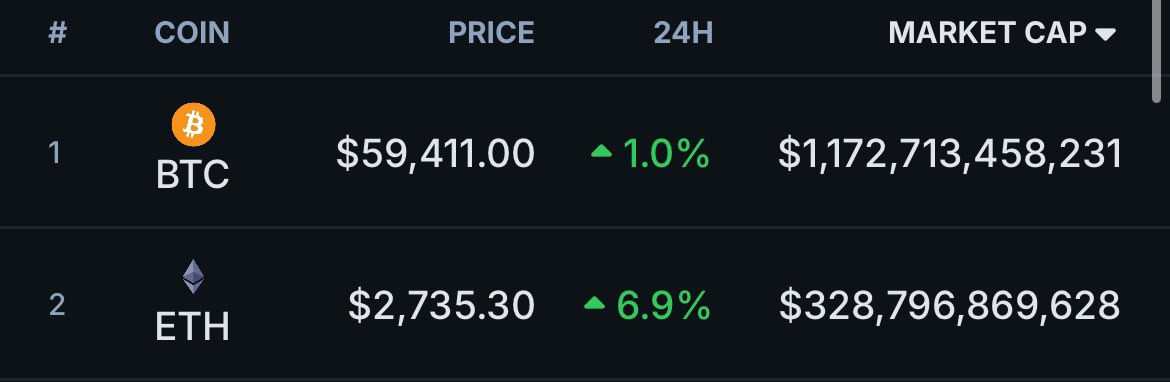

In the past day, Ethereum (ETH) experienced an increase of 6.9%, which was more than Bitcoin’s (BTC) 1% growth. This significant jump indicates growing optimism within the cryptocurrency market following a difficult week.

Given my years of experience in the crypto market, this recent surge in altcoin performance has me questioning: Could this be the dawning of a new altcoin season? As I’ve seen before, when traders and investors begin to focus more intently on alternative cryptocurrencies, it often signals a shift in the market. This is an exciting time for those who have been patiently holding onto their altcoins, as we may be on the cusp of significant growth and potential profits. Let’s keep a close eye on the trends and make informed decisions based on our research and analysis.

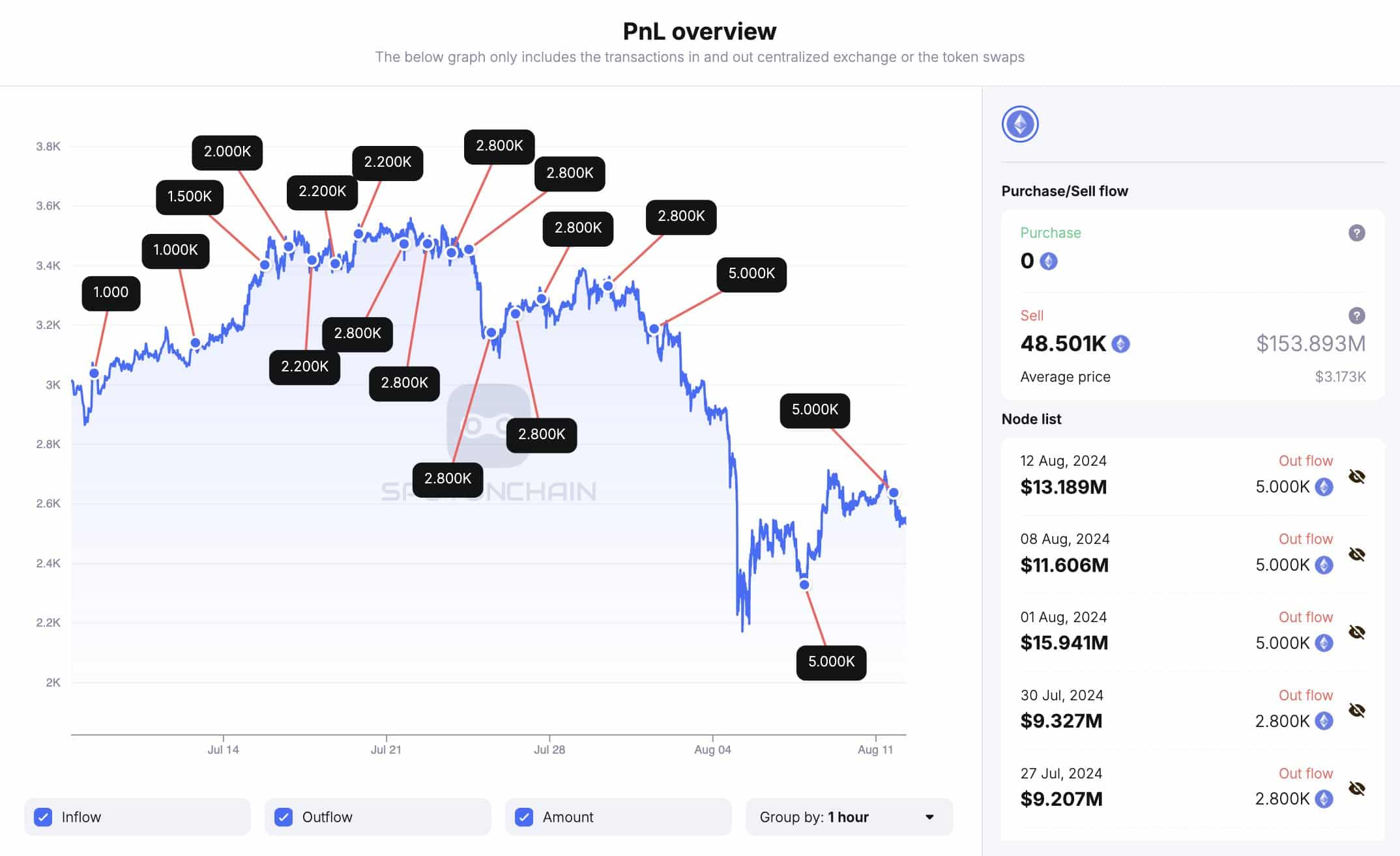

In simpler terms, following Ethereum’s recent strong performance compared to Bitcoin, a significant investor in Initial Coin Offerings (ICOs), often referred to as a “whale,” transferred another 5,000 Ether (equivalent to $13.2 million) to the OKX exchange just before a price drop occurred.

Starting from July 8th, a significant whale has been accumulating Ethereum (ETH), with a total of 48,501 ETH worth approximately $154 million, each ETH being valued around $3,173. This whale currently holds an additional 303,500 ETH ($744 million) distributed across two digital wallets. This large accumulation could potentially indicate the beginning of an altcoin market surge.

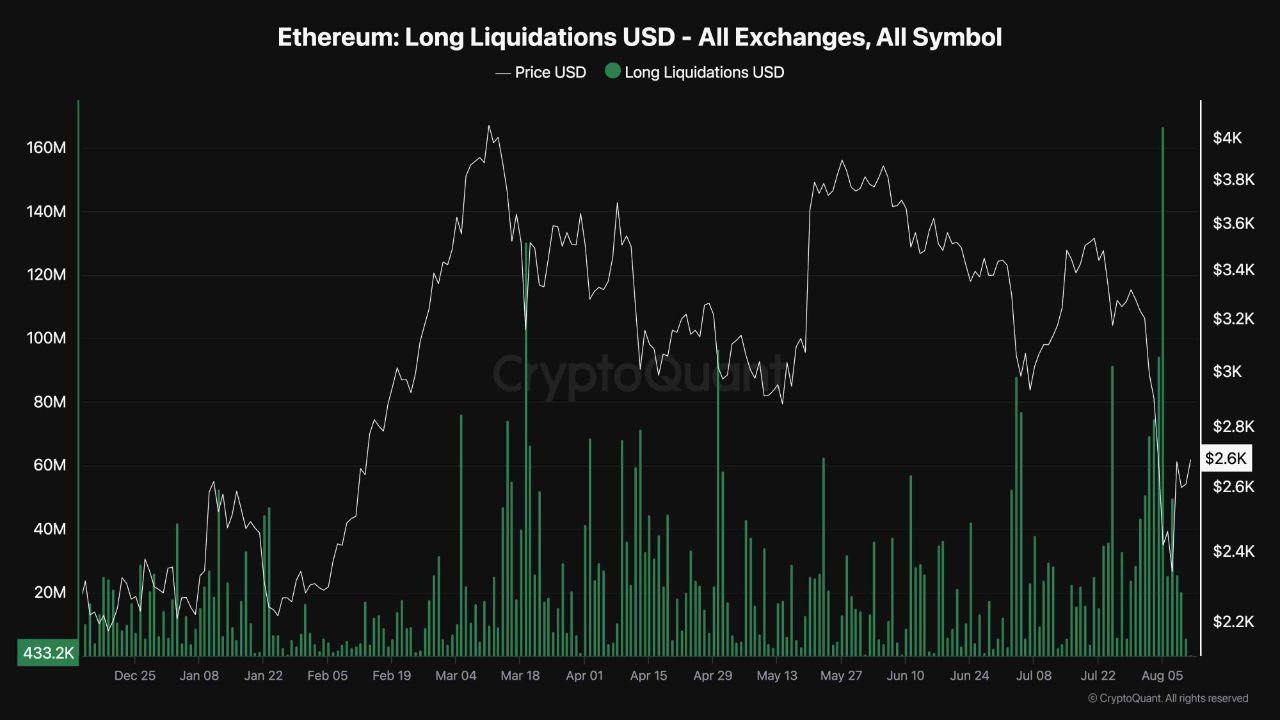

ETH long liquidations cooling off

The decrease in Ethereum’s value has sparked worry among those who predict a downward trend, yet significant withdrawals suggest that the futures market could be regaining its balance.

With ETF inflows becoming more consistent, there’s a possibility of a bullish market rebound. This could trigger heightened demand for Ethereum, sparking renewed enthusiasm that might sustain a robust upward trend.

The market’s reaction in the coming days will be key to determining the trend’s direction.

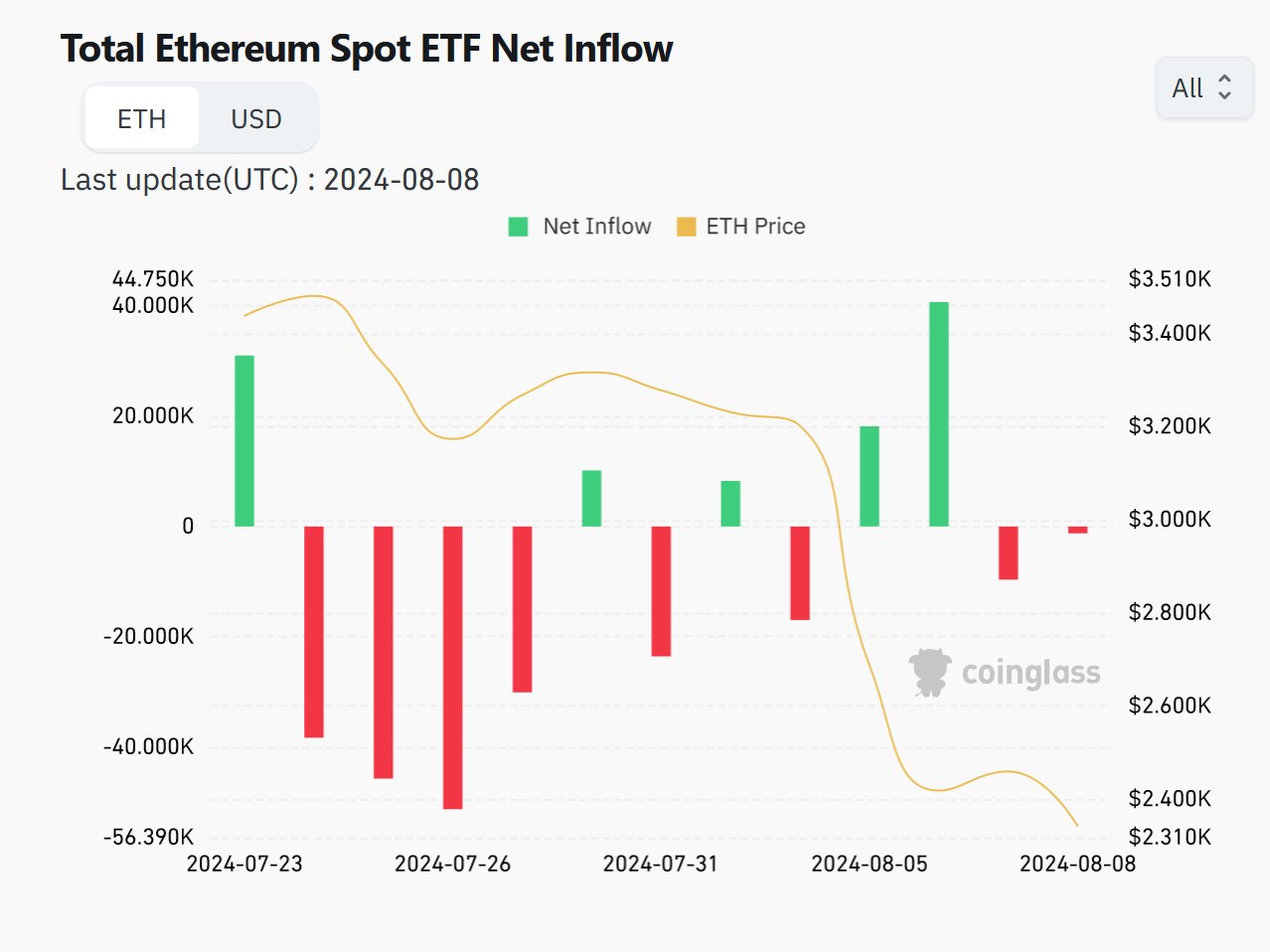

ETF flow stabilizes

The perspective on Ethereum is becoming more optimistic as Exchange Traded Fund (ETF) investments settle down and highly-leveraged traders withdraw from the market. Encouragingly, data from blockchain analytics indicates that we might have seen the toughest phase pass by.

As a seasoned cryptocurrency investor with years of experience under my belt, I have noticed that certain patterns tend to repeat themselves in the market. Based on my observations, all signs point towards a potential price increase for Ether (ETH) in the coming weeks. This bullish trend could be an opportunity for those who are keen on capitalizing on the crypto market’s volatility. However, it is crucial to remember that past performance does not guarantee future results and always do your own research before making investment decisions.

ETH to fill CME gap

The recent fluctuations in Ethereum’s price have left an open gap on the Chicago Mercantile Exchange (CME), which usually gets filled. Given this trend, there’s a strong possibility that Ethereum will increase in value to close this gap.

The increasing trend might signal the start of an altcoin boom period, implying potential good fortune for Ethereum and other alternative coins in the coming days.

Read Ethereum’s [ETH] Price Prediction 2024-25

In the 2020-2021 cryptocurrency surge (often referred to as a ‘bull run’), Ethereum initially broke through, followed by a period of stabilization, and then another increase. It’s predicted that this pattern might reoccur during the 2024-2025 altcoin boom.

It’s anticipated that a surge or significant increase, referred to as a “breakout,” will occur around November/December 2024. This will likely be followed by a robust upward trend commencing in the first quarter of 2025. These indications point towards Ethereum and other digital currencies potentially preparing for another period of increased value, often referred to as a “bull run.”

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- The Battle Royale That Started It All Has Never Been More Profitable

- Everything Jax Taylor & Brittany Cartwright Said About Their Breakup

- Tainted Grail: The Fall of Avalon Review

- Taylor Swift and Travis Kelce: A Love Story Unfolds at Chiefs’ AFC Celebration!

- Michael Saylor’s Bitcoin Wisdom: A Tale of Uncertainty and Potential 🤷♂️📉🚀

- Your Friendly Neighborhood Spider-Man Boss Teases Surprising Doc Ock Detail

- Black State – An Exciting Hybrid of Metal Gear Solid and Death Stranding

- Meghan’s Sweet Kids Tribute in Latest Vid!

2024-08-13 17:12