-

Ethereum’s price soared by 20%, overtaking Mastercard in market cap, amid strong buying pressure.

SEC’s shift towards likely approval of an ETH ETF has sparked a market rally.

As a researcher with a background in cryptocurrencies and blockchain technology, I am thrilled to observe Ethereum’s impressive surge in the market. The recent price increase of nearly 20% has pushed Ethereum’s market capitalization above Mastercard’s, marking a significant milestone for the cryptocurrency.

Over the past day, Ethereum [ETH] has witnessed a significant gain, rising by approximately 20%, causing its price to soar above $3,600 – a new peak since 19th April.

As an analyst, I’ve noticed that the trading volume for this asset is increasing, which suggests robust buying activity in the market. This trend emerges during a time when Ethereum’s influence and adoption are becoming more evident, solidifying its standing as the second-largest cryptocurrency by market capitalization.

Noted on-chain expert Leon Waidmaqnn brings attention to the fact that Ethereum’s market cap currently outpaces Mastercard’s, which stands at $427 billion, with Ethereum reaching a value of $440 billion.

The transition signifies more than Ethereum’s rising status; it symbolizes the increasing mainstream recognition and incorporation of cryptocurrencies in traditional financial systems.

Regulatory changes and market dynamics

The surge in Ethereum’s value lately can be attributed to recent advancements in its regulatory environment. Notably, the US Securities and Exchange Commission (SEC) has indicated a more favorable stance towards accepting applications for Ethereum spot exchange-traded funds (ETFs).

According to Bloomberg’s analysis, the likelihood of an Ethereum ETF being approved has significantly increased from 25% to 75%. This shift is due to signs that the Securities and Exchange Commission (SEC) is changing its position, leading exchanges to prepare 19b-4 filings in anticipation of a potential approval as soon as May 22nd.

The regulatory shift seems to be fueling the recent surge in Ethereum’s market value.

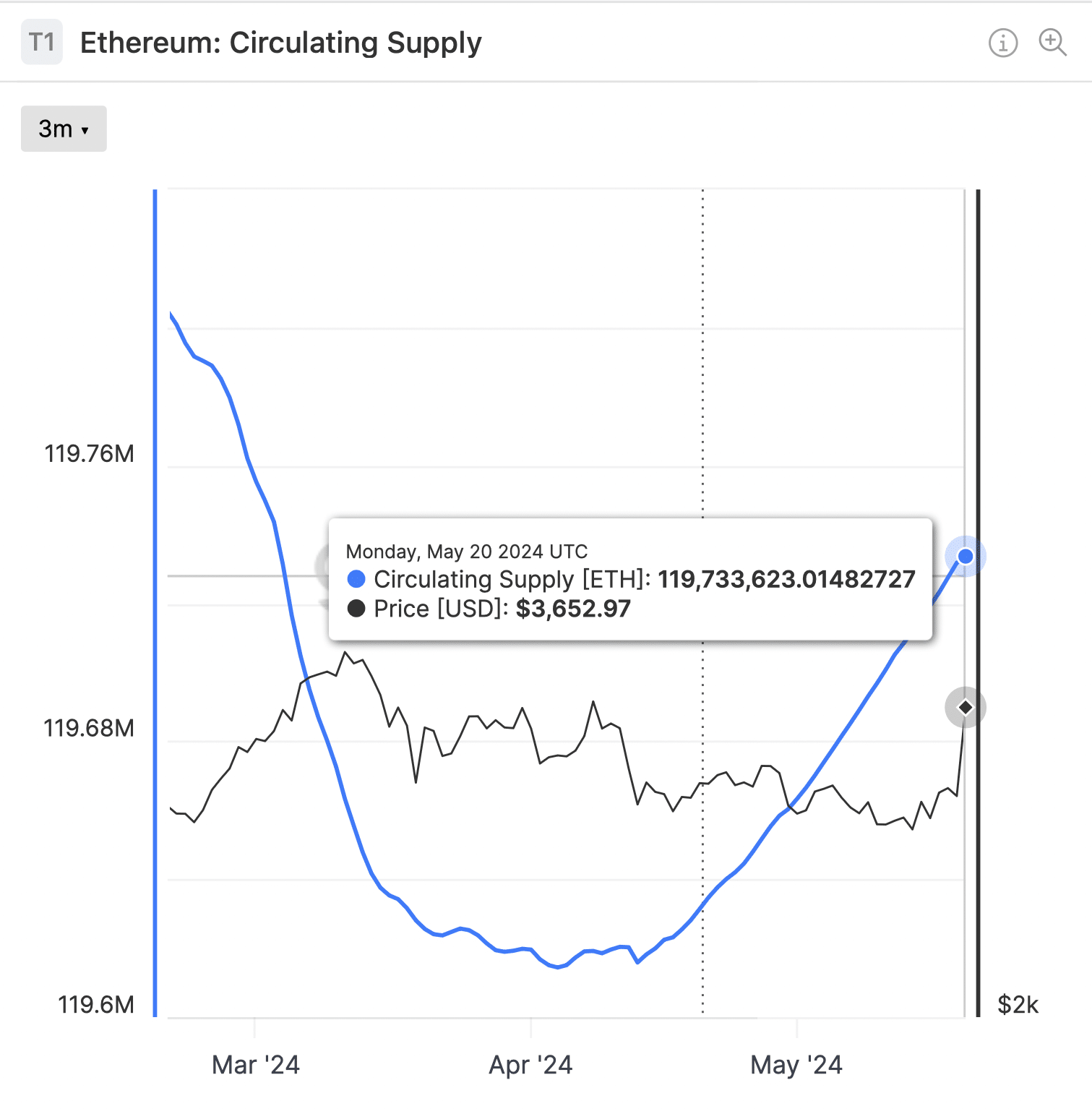

During this period, the Ethereum circulating supply grew slightly from approximately 119.6 million ETH around mid-April to around 119.73 million ETH currently, as indicated by Glassnode’s data. This expansion implies that more Ethereum tokens are now in circulation for trading and use in transactions.

Despite the potential implication of heightened demand for selling, the present market conditions suggest that demand stays strong. This strength may be attributable to the prevailing expectation of ETH spot ETF approval.

Market response and future outlook

As a researcher studying the cryptocurrency market, I’ve noticed some intriguing trends with Ethereum recently. Its price has experienced a notable increase amid various advancements, yet it’s essential to delve deeper and examine how these developments have influenced other significant market indicators as well.

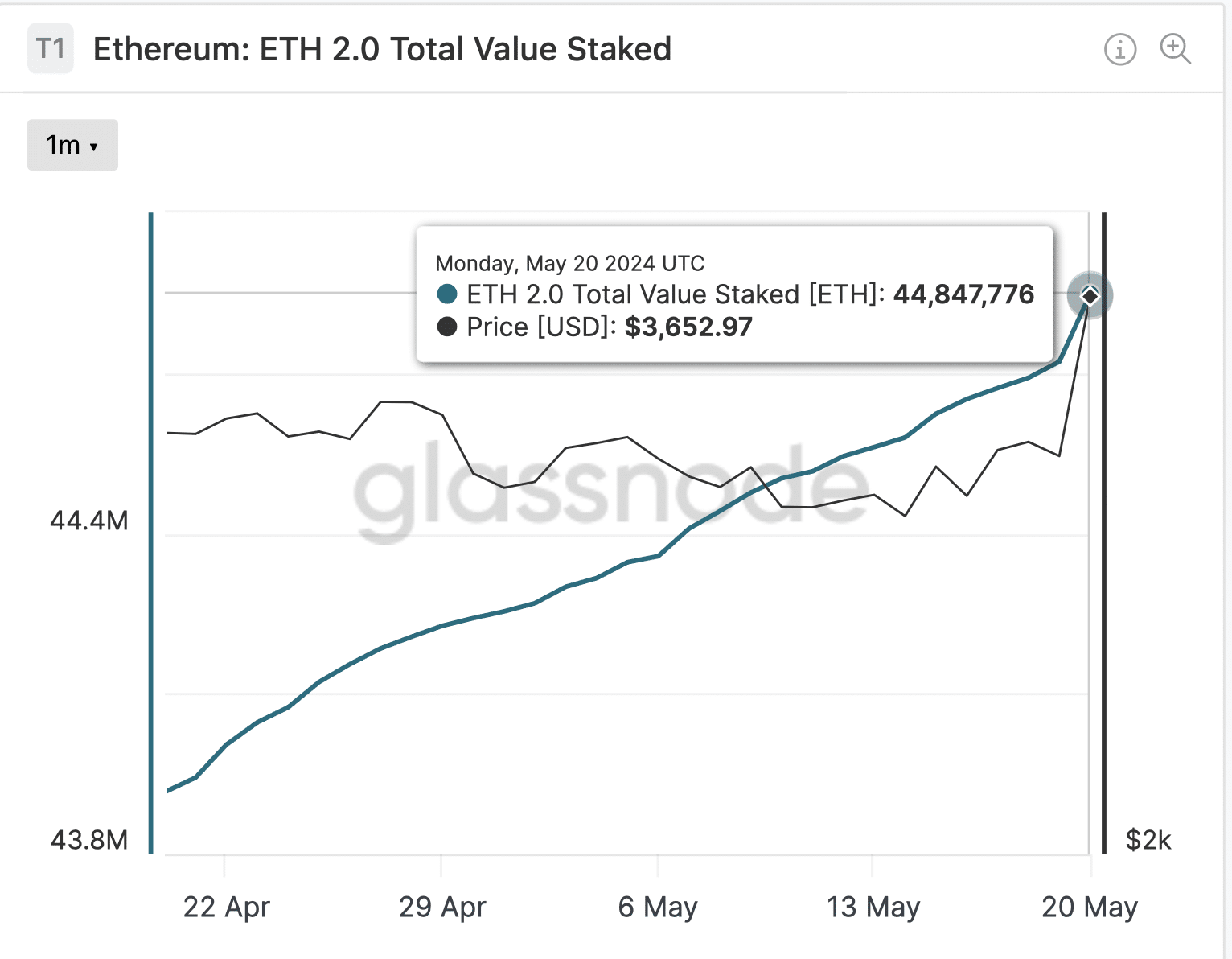

The amount of Ethereum wagered in total has increased from approximately 43 million ETH a month ago to more than 44 million ETH, based on data from Glassnode.

The rising amount of ETH being staked is a testament to investors’ growing belief in Ethereum’s enduring worth and usefulness.

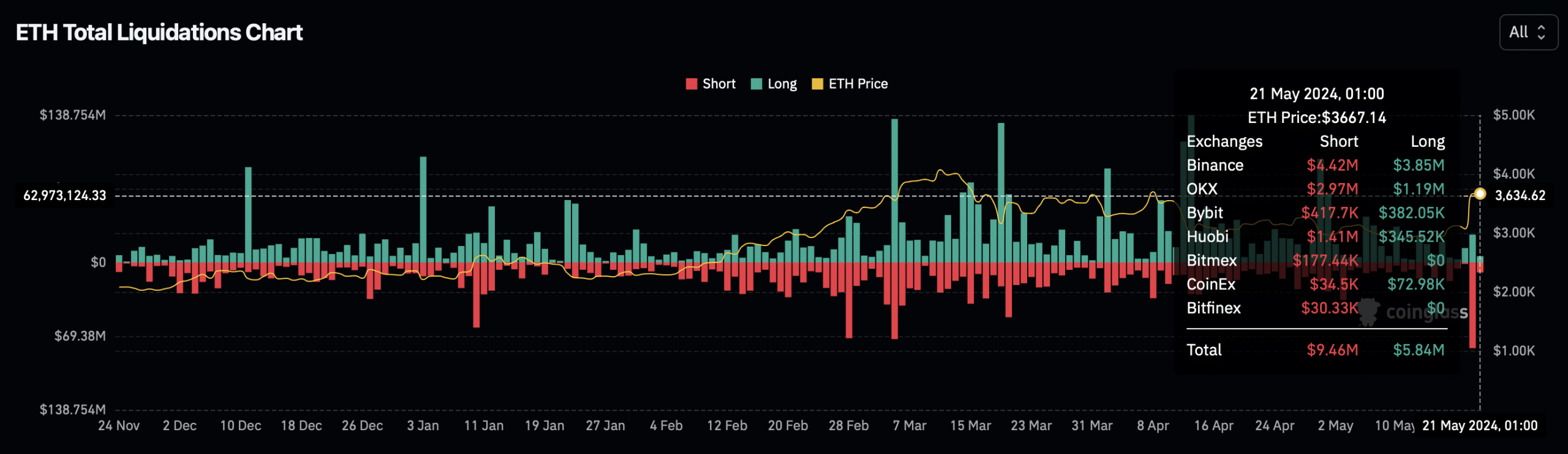

As an analyst, I’ve observed that while some market participants have gained from the recent surge in Ethereum prices, others have incurred significant losses. According to data from Coinglass, over $10 million in Ethereum positions were liquidated within the last 24 hours. The hardest hit were those who had bet against Ethereum by short selling.

Yesterday’s massive liquidation of short positions on Ethereum, totaling over $80 million, underscores a broader pattern: numerous traders who had wagered against Ethereum were unexpectedly caught in the market’s swift upward surge.

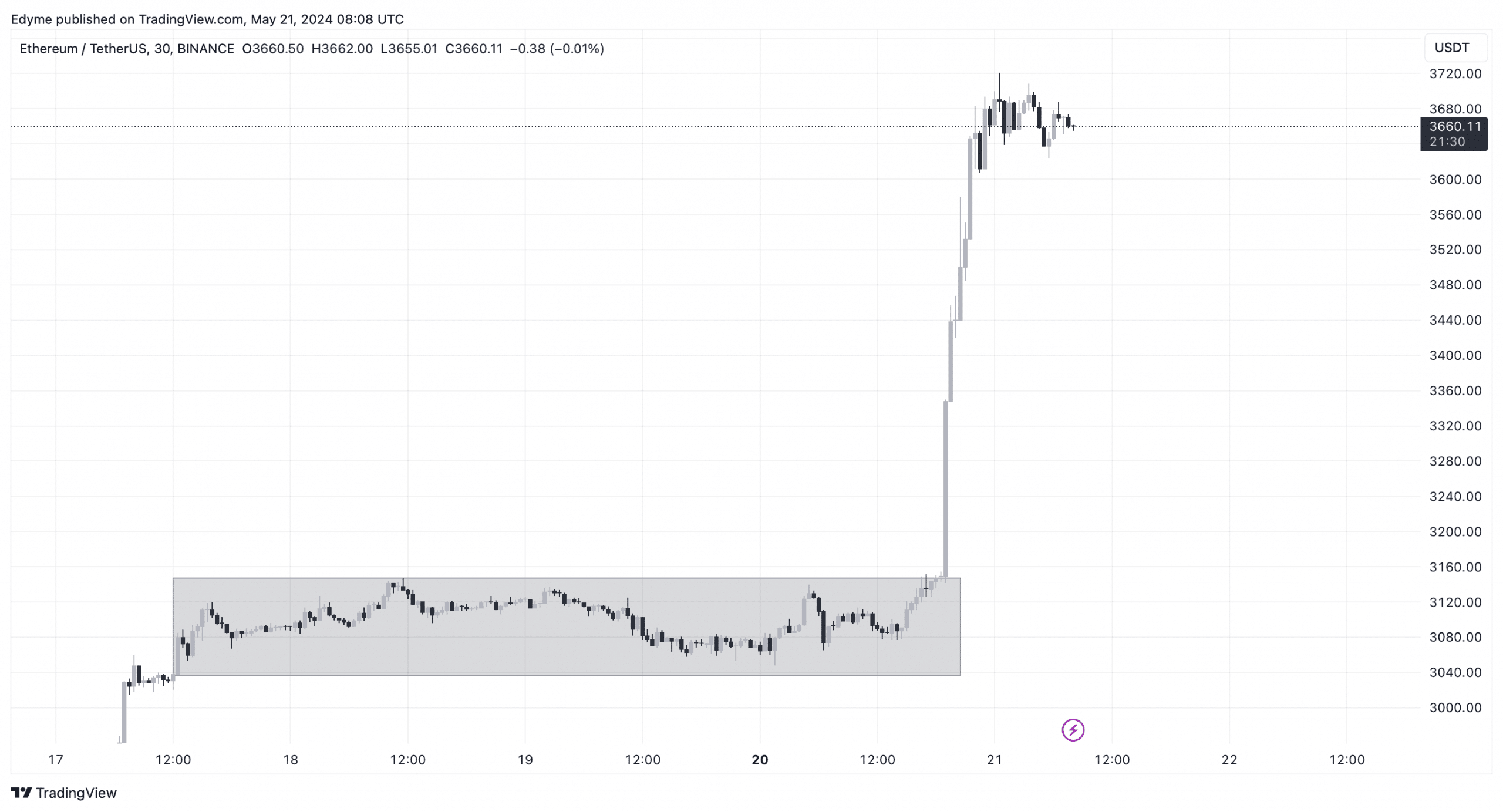

Looking at Ethereum’s price chart, the asset appears poised for further gains.

Is your portfolio green? Check the Ethereum Profit Calculator

Recently, it has burst past the resistance level of a consolidation area, indicating strong buying power in the market.

The combination of this surge in value, favorable regulatory decisions, and strong market indicators paves the way for further price growth in Ethereum.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

2024-05-21 20:08