-

If ETH’s price falls to $2,705, nearly $323 million worth of long positions will be liquidated

According to one expert, Ethereum’s market cap will surpass Bitcoin’s market cap within the next five years

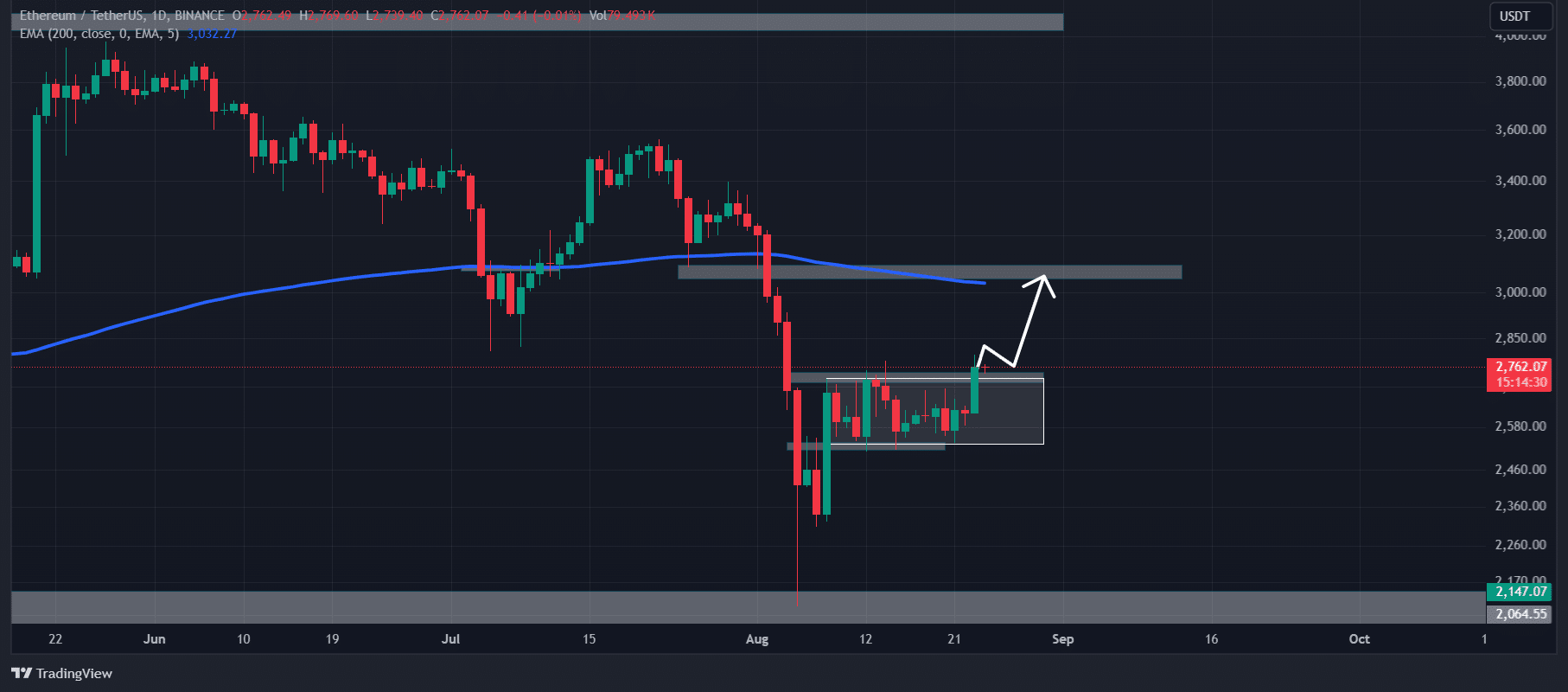

As a seasoned crypto investor with a knack for recognizing potential opportunities and understanding market dynamics, I find myself quite optimistic about Ethereum (ETH) at present. The recent breakout above its consolidation zone and the subsequent bullish sentiment are encouraging signs that ETH could potentially reach its next resistance level of $3,000.

The broader cryptocurrency industry saw a strong surge following the Federal Chair’s hint at lowering interest rates. Notably, Ethereum (ETH), one of the largest cryptocurrencies by market value, broke out of its two-week holding pattern and started trending upward.

Ethereum’s breakout and upcoming levels

From the 8th to the 23rd of August, Ether (ETH) was holding steady within a narrow band, fluctuating between approximately $2,730 and $2,725. After the announcement of the Fed Chair’s rate cut, though, it surpassed this range and ended the day with a close above $2,760.

A move beyond this resistance level and ending the candle above it could indicate a positive trend for Ethereum, even though at the moment it’s trading under the 200 Exponential Moving Average.

According to recent trends and technical evaluations, it’s quite likely that the altcoin’s value may climb up to around $3,000 – representing its next potential ceiling for growth.

Currently, Ether (ETH) was found close to $2,760 during trading, due to an increase of more than 3.5% in the past 24 hours. Over this timeframe, its trading volume escalated by approximately 40%. This surge suggests a rise in trader involvement following the breakout and interest rate reduction announcement.

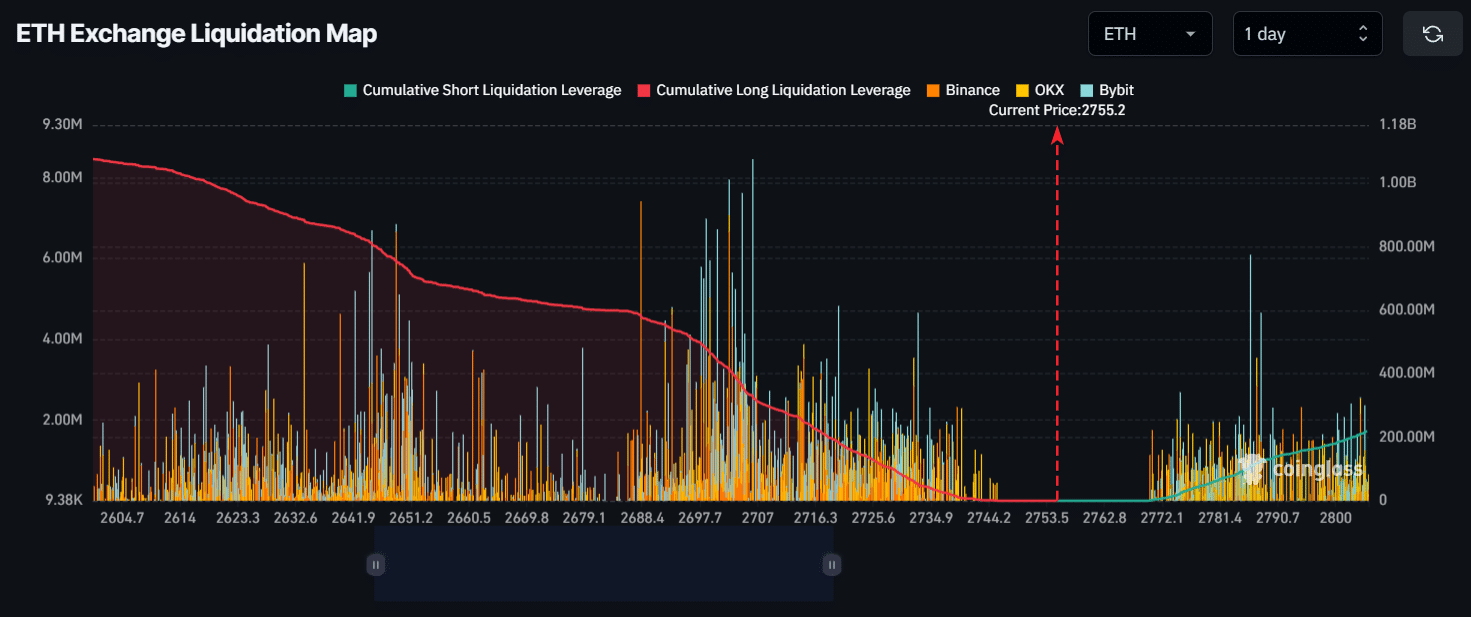

Ethereum’s major liquidation levels

Currently, significant selling and buying points are around $2,705 (lower) and $2,786 (higher), based on data from CoinGlass, which indicates that traders have a high level of leverage at these price points.

If the market outlook remains positive (bullish) and Ethereum’s price reaches approximately $2,786, it would lead to the closure (liquidation) of about $111 million in short positions. Alternatively, if the market sentiment changes (shifts) and Ethereum’s price drops to around $2,705, close to $323 million in long positions could be liquidated.

From the analysis of current market positions, it seems that buyers (bulls) have returned, which could be a promising indicator for Ethereum and its investors.

Crypto expert’s views on ETH

Amid this bullish outlook, recently, 1confirmation Founder Nick Tomaino shared something. He believes that Ethereum’s market cap will surpass Bitcoin’s market cap within the next five years, which is approximately 4x. In the post on X, Nick said,

1. “Bitcoin, often referred to as ‘digital gold’, has a well-established storyline that major institutions have embraced. On the other hand, Ethereum serves as the foundation where top global developers are constructing the future decentralized web, with Ether acting as the fuel that drives this network.”

Following the debut of the Spot Ethereum exchange-traded fund (ETF) within U.S. markets, there’s been a marked increase in its acceptance level. Furthermore, it appears that those trading ETFs are expressing considerable enthusiasm towards this new product.

Read More

- We Ranked All of Gilmore Girls Couples: From Worst to Best

- PI PREDICTION. PI cryptocurrency

- Jujutsu Kaisen Reveals New Gojo and Geto Image That Will Break Your Heart Before the Movie!

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- How to Get to Frostcrag Spire in Oblivion Remastered

- Why Tina Fey’s Netflix Show The Four Seasons Is a Must-Watch Remake of a Classic Romcom

- Assassin’s Creed Shadows is Currently at About 300,000 Pre-Orders – Rumor

- Is the HP OMEN 35L the Ultimate Gaming PC You’ve Been Waiting For?

- S.T.A.L.K.E.R. 2 Major Patch 1.2 offer 1700 improvements

- First U.S. Born Pope: Meet Pope Leo XIV Robert Prevost

2024-08-25 04:07