- Ethereum broke the $3,000 price level recently.

- Over 2.8 million addresses bought ETH at the current price level, making it a key level.

As a seasoned researcher with years of experience tracking the crypto markets, I must say that Ethereum’s recent break above $3,000 is nothing short of impressive. The surge in institutional support, as evidenced by record-breaking inflows into Ethereum’s spot ETF, has fueled this rally and set a new phase for bullish momentum.

Meanwhile, as Bitcoin [BTC] grabbed attention due to its record highs, Ethereum [ETH], frequently referred to as ‘digital silver’, also experienced significant growth.

As a researcher delving into the dynamic world of cryptocurrencies, I recently observed an intriguing event unfold. The second-largest digital currency, according to market capitalization, surpassed the $3,000 threshold – a barrier it hadn’t breached for quite some time. This resistance level had been robustly upheld for months, but it finally succumbed to the relentless forces driving this market.

This significant development occurred at the same time as unprecedented inflows into Ethereum’s spot ETF, signaling a new period of bullish energy.

Can Ethereum sustain this rally as it navigates a new territory?

Record spot ETF inflow fuels Ethereum’s breakout

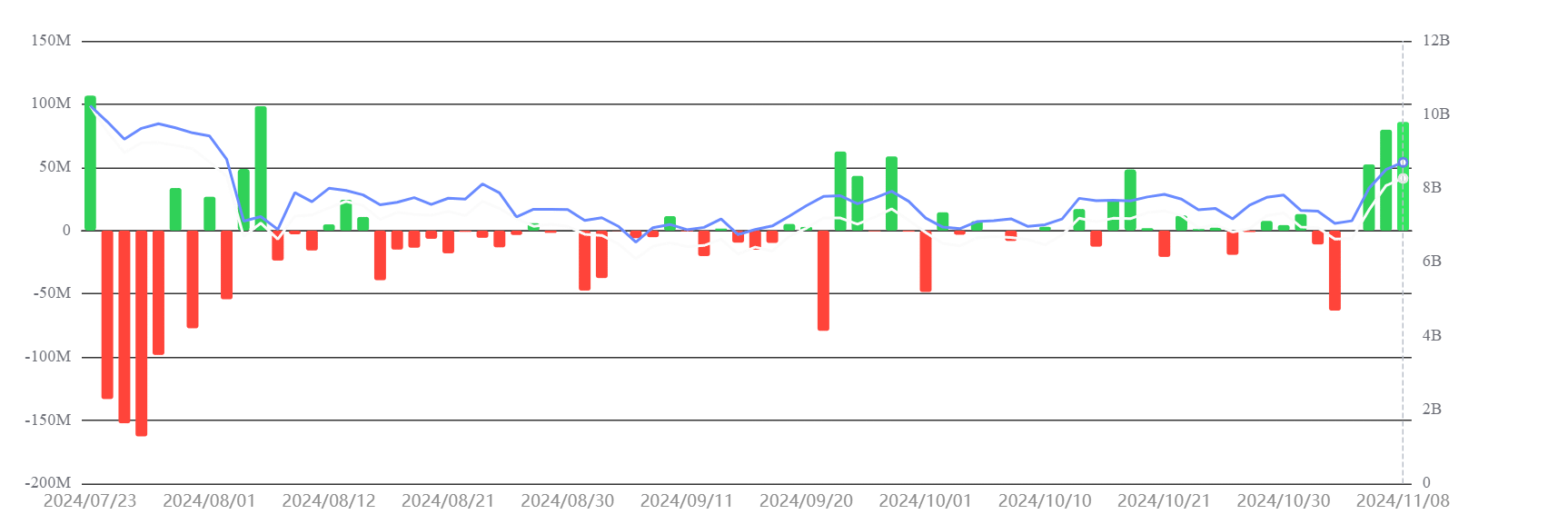

For the last seven days, an overall increase of $154.66 million in assets has been observed in Ethereum-based Exchange Traded Funds (ETFs). This marks a record high in weekly positive inflows.

According to data from SosoValue, this marks the second week in a row where Ethereum has seen overall inflows into its ETF – an unprecedented achievement for this specific product.

As an analyst, I’ve observed an intriguing pattern in Ethereum’s ETF. During its launch week, a significant outflow of approximately $341.35 million was recorded, marking the largest weekly net flow. However, the tide has since turned, with a clear shift towards positive inflows. These consecutive inflows have been instrumental in bolstering Ethereum’s price rally.

The increase in backing from institutions has propelled ETH over the $3,000 mark, strengthening its continued rise.

Ethereum moves to secure its position above $3k

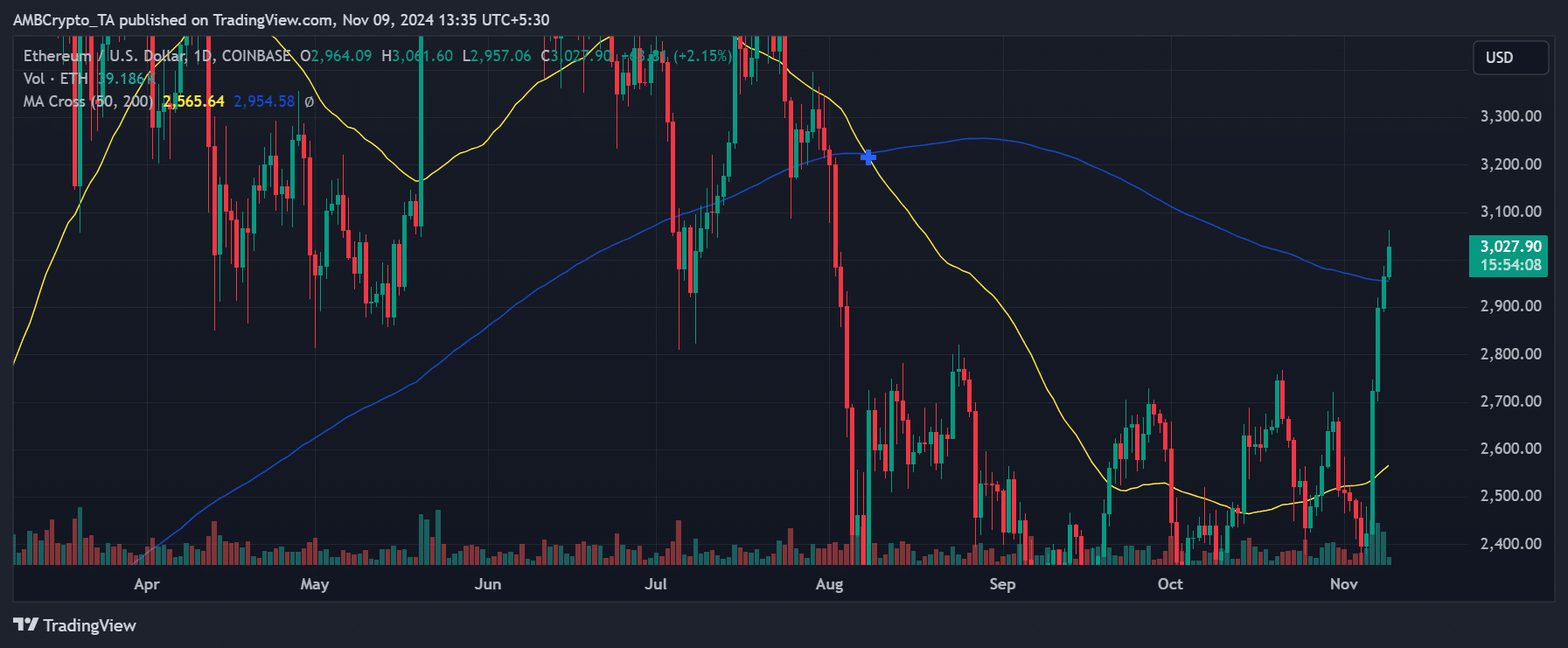

Currently, Ethereum has spiked up to $3,027.90, indicating a powerful burst in its price trend. This surge has pushed it significantly over both its 50-day and 200-day Moving Averages (MA), suggesting strong momentum in the market.

This action signified a substantial upward trend because Ethereum broke through the $3,000 symbolic barrier, which indicates strong investor optimism towards the asset.

Currently, the 50-day Moving Average is located at $2,565.64 and the 200-day Moving Average is at $2,954.58. These levels have been acting as potential support points during this ongoing bullish trend. Additionally, there’s been a rise in trading volume, suggesting robust buying activity.

Based on this current trajectory, Ethereum (ETH) may continue to climb if its bullish energy persists. Potential peaks might be reached at approximately $3,200 or even beyond, depending on the strength of the momentum.

As an analyst keeping a close eye on this trend, I believe there could be an opportunity for entry when the price pulls back towards the 200-day moving average to test support. This potential dip might offer a strategic moment for traders to consider entering the market.

Reaching the $3,000 barrier by Ethereum marks a substantial milestone, backed by historic ETF investments and robust technical signs.

Maintaining its current pace, Ethereum (ETH) might keep rising, with $3,000 potentially serving as a fresh foundation for the coin as we approach the end of the year.

MVRV ratio shows increasing profitability among holders

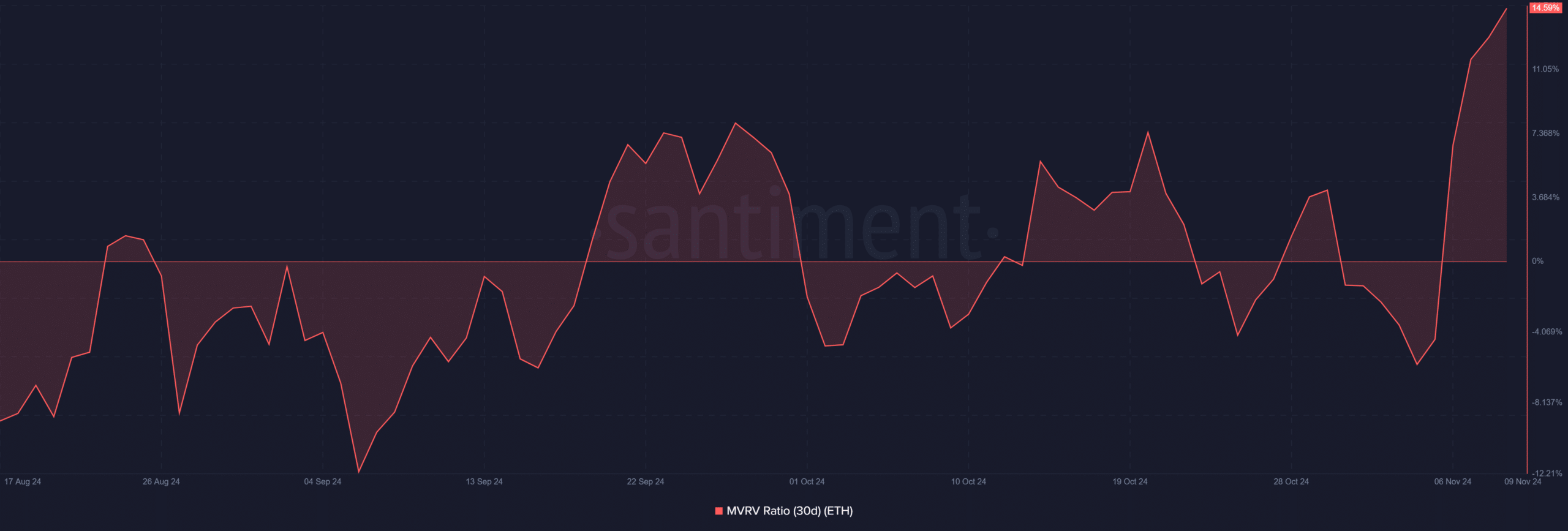

In simple terms, when the 30-day Market Value to Realized Value (MVRV) ratio for Ethereum is positive, it suggests that a majority of its holders are currently enjoying profits since the price of Ethereum exceeds $3,000.

An increasing MVRM ratio indicates that it may be time for investors to start taking profits, potentially leading to increased selling activity.

At the time of writing, the MVRV was almost at 15.6%, the highest since May.

Furthermore, data from IntoTheBlock indicates approximately 2.86 million wallets purchased Ethereum at its current price point. Consequently, if prices surpass this level, it may initiate a new All-Time High (ATH).

If the MVRV (Momentum Value Ratio) keeps increasing, it means more investors are in profitable situations. This trend might lead to a normal adjustment or correction within the market.

As more institutions show interest, it’s possible that Ethereum’s new base price might approach around $3,000, thereby lessening the effect of minor market corrections.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

2024-11-10 02:16