-

ETH traded above the $2,700 price level in the last trading session.

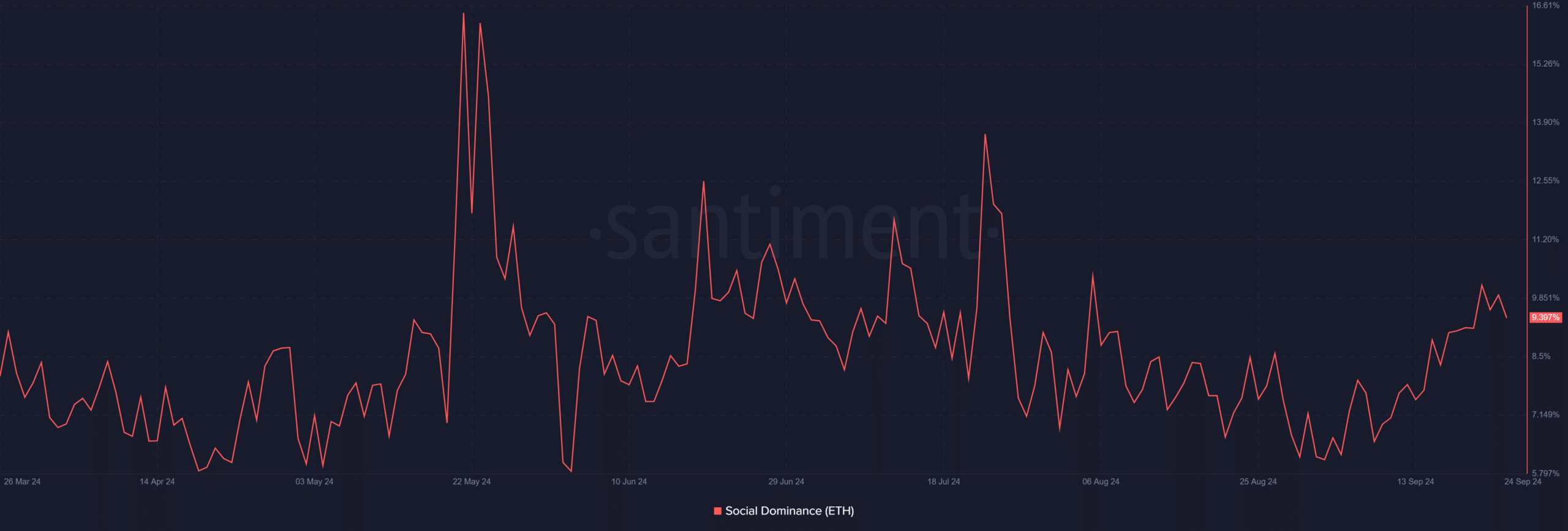

At press time, the ETH social dominance was close to 10%.

As a seasoned analyst with years of experience dissecting market trends and dynamics, I find myself intrigued by Ethereum’s recent performance. The surge above $2,700 and the increase in social dominance to nearly 10% are clear indicators that ETH is back in the spotlight.

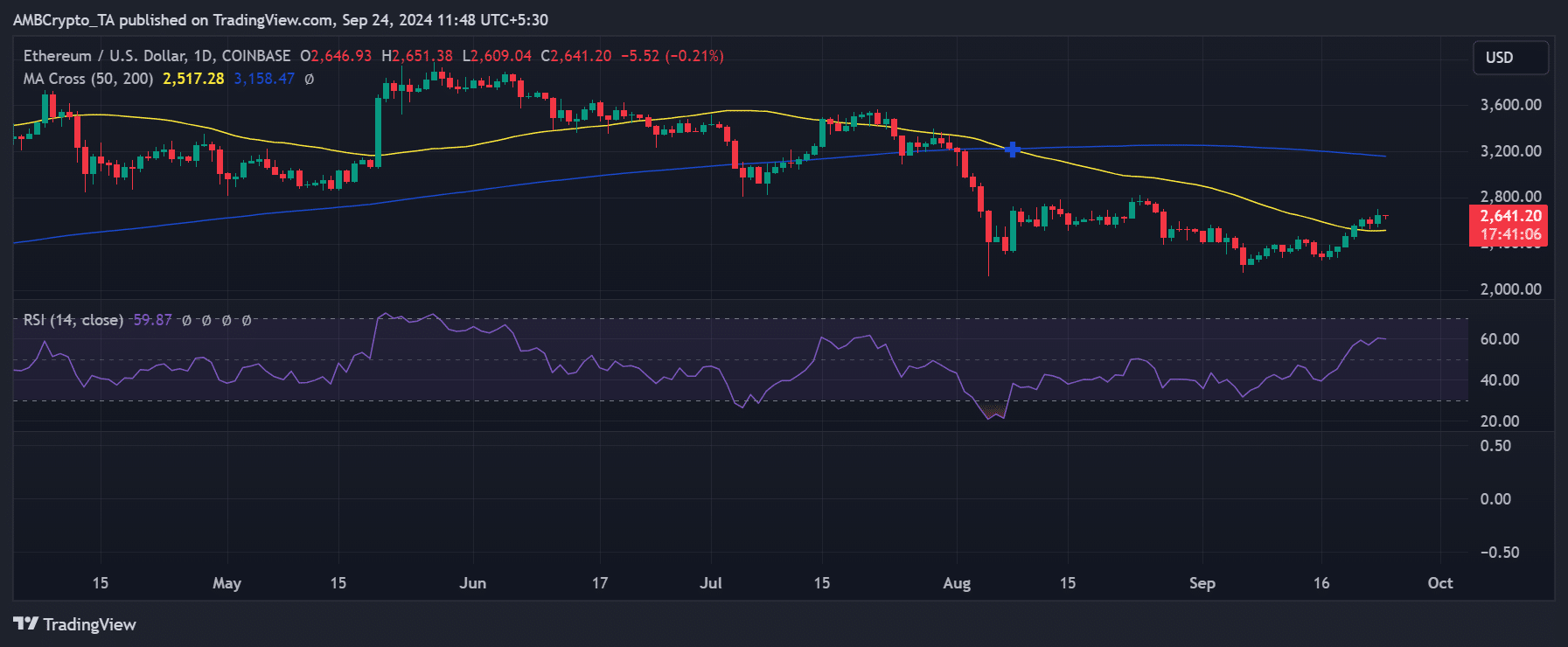

Recently, Ethereum [ETH] surpassed its temporary resistance level, having been beneath its moving averages since late July, a timeframe marked by a ‘death cross’ formation. Additionally, there has been an increase in market discussions about Ethereum, and a growing curiosity among derivative traders over the past couple of weeks.

Ethereum sees increased social dominance

According to Santiment’s analysis, Ethereum’s influence on social media platforms has significantly grown in recent times. As of September 21st, its social dominance surpassed 10%.

For the first time in approximately seven weeks, it dropped slightly to roughly 9.9% on the 23rd of September, marking a return to these levels.

This increase suggests a spike in conversations surrounding Ethereum, demonstrating growing interest in this asset. The rising popularity on social platforms aligns with Ethereum’s recent price fluctuations, hinting at a shift towards a more optimistic market outlook.

Ethereum price breaks short-term resistance

Looking at Ethereum’s price graph reveals an increasing public curiosity about it. Over the last week, Ethereum has experienced a series of upward trends.

On the 20th of September, it surpassed its short-term moving average (represented by the yellow line), following an approximately 3.90% growth which brought its value close to roughly $2,562.

At the close of the previous trading day, Ethereum was valued around $2,642, reaching as high as $2,700 momentarily. Moreover, the short-term average price line has switched to serve as a more robust support point.

It appears that further examination shows a significant resistance point lies around the $2,800 mark for Ethereum (ETH). Should ETH surpass this level, there’s potential for another test of the $3,000 price range. This upward trend has sparked increased curiosity among derivative traders as well.

Read Ethereum’s [ETH] Price Prediction 2024–2025

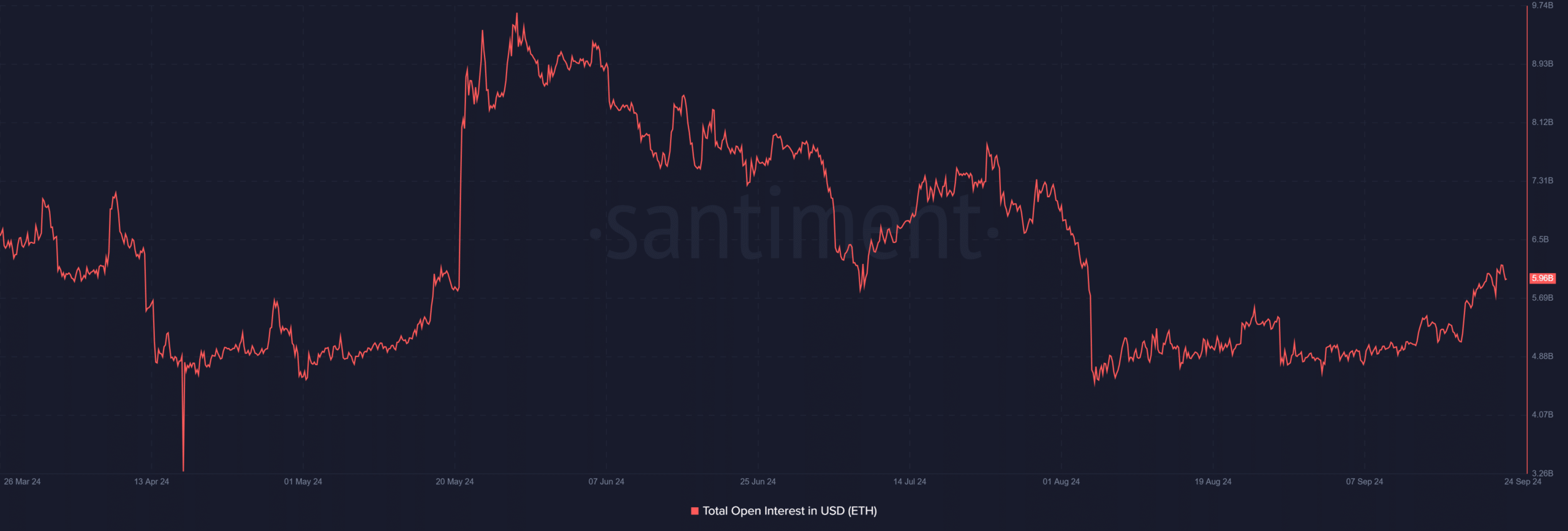

Open interest sees increased volume

A significant sign of growing strength is the increasing open interest in Ethereum. Latest findings suggest that this figure surpassed $6 billion on the 23rd of September, marking a high not seen in roughly seven weeks.

The increase in open interest indicates that more funds are flowing into derivative trading related to Ethereum, possibly due to its recent surge in price. If this trend persists, Ethereum could potentially reach the $3,000 price range again soon.

Read More

- Gold Rate Forecast

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Rick and Morty Season 8: Release Date SHOCK!

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

2024-09-24 19:03