- Buying pressure on ETH remained high in the last few days.

- Technical indicators supported the possibility of a price increase.

As a seasoned crypto investor with battle scars from the 2017 bull run and the subsequent bear market, I’ve learned to navigate through turbulent waters with a steady hand. The latest price correction of Ethereum [ETH] has been no exception, but it presents an opportunity rather than a setback.

In a continued downtrend, Ethereum (ETH), much like other cryptocurrencies, experienced price adjustments or drops.

Currently, the recent downturn serves as a challenge for the bulls regarding Ethereum (the leading altcoin), since it hasn’t managed to surpass the $3,900 resistance level yet.

Ethereum bulls under pressure

In the past day, ETH saw a drop in value exceeding 3%, causing its price to dip below $3,000. At this moment, it is being traded at $3,760.02, and holds a market capitalization of over $452 billion, making it the dominant altcoin.

As the price of the token fell, it was announced that the Ethereum Foundation had taken action. According to a recent tweet by Spot On Chain, the Ethereum Foundation has sold 100 ETH, receiving approximately 374,334 DAI in return.

In the year 2024, they managed to sell a total of 4,366 Ether, amounting to approximately $12.21 million. The average price per Ether was around $2,796.

To see whether this selling trend was dominant in the market, AMBCrypto checked other datasets.

It’s fortunate that some investors chose not to sell their investments. This could potentially trigger a rebound for the bulls, paving the way for ETH to surpass the $3.9k mark once more.

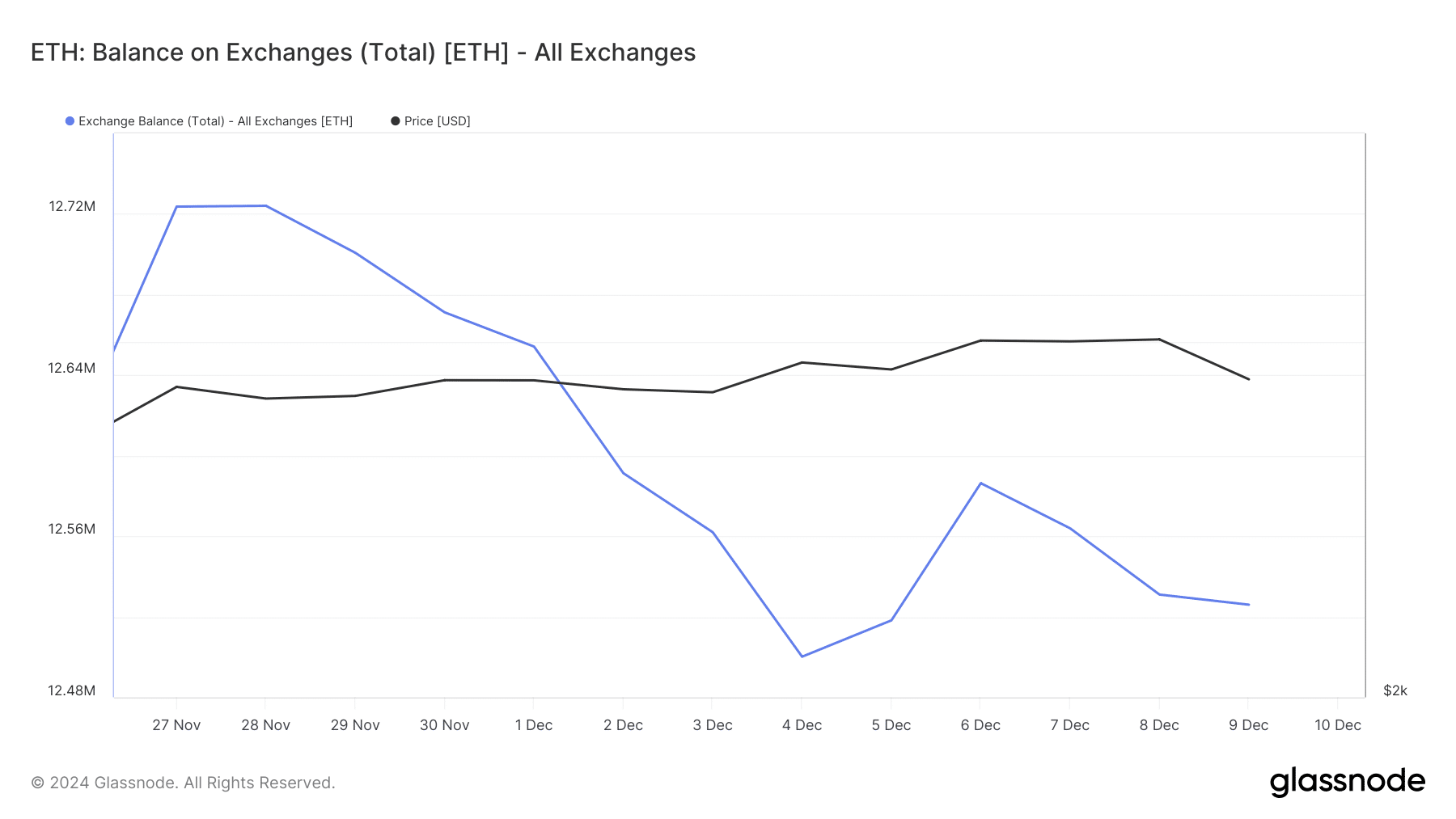

This trend was evident from the decline in ETH’s balance on exchanges over the last two weeks.

According to findings from Hyblock Capital, the sell volume of ETH dipped to 9.6 after experiencing a peak, which suggests a lower level of selling pressure since numbers nearer to zero typically indicate reduced selling pressure, whereas values close to 100 suggest significant selling pressure.

According to CFGI.io’s data, whale sentiment was quite high at 61.5%, indicating a strong likelihood of whales selling their holdings, and they opted to go in the opposite direction instead.

Will ETH bulls reverse the bearish trend?

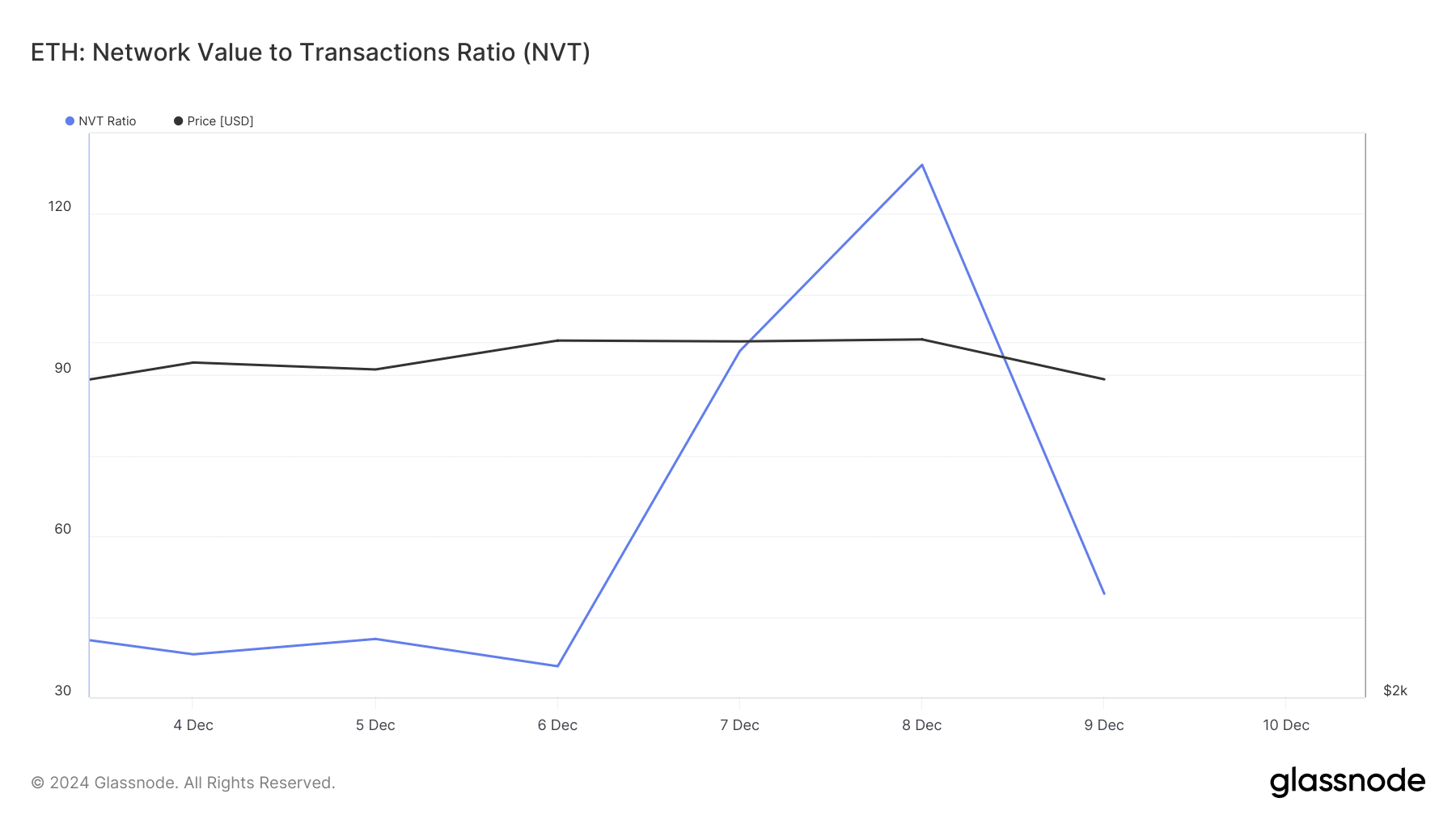

Even though some whales might be cashing out, Ethereum’s bullish supporters could potentially drive the price of ETH higher. The Network Value to Transactions (NVT) Ratio for Ethereum has seen a decrease over the past few days.

When the metric decreases, it implies the asset is underpriced, potentially leading to a price increase in the near future.

In addition to this, AMBCrypto noted an increase in Ethereum’s Long/Short Ratio within a 4-hour time period.

This situation indicated that there were more buyers (long positions) compared to sellers (short positions) in the market, typically suggesting a growing optimism or bullish attitude towards the token.

Some technological signals hinted at a potential resurgence for Ethereum by the bulls. For example, the Relative Strength Index (RSI), a common technical indicator, showed a minor increase.

Read Ethereum’s [ETH] Price Prediction 2024–2025

The Chaikin Money Flow (CMF) also moved up. A rise in CMF indicates that buying pressure is increasing and that the market or asset may be entering an uptrend.

Consequently, Ethereum optimists may manage to pass this challenge, potentially causing ETH’s price to rise once more in the short term.

Read More

- Gold Rate Forecast

- Masters Toronto 2025: Everything You Need to Know

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Rick and Morty Season 8: Release Date SHOCK!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- PI PREDICTION. PI cryptocurrency

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

2024-12-11 01:12