-

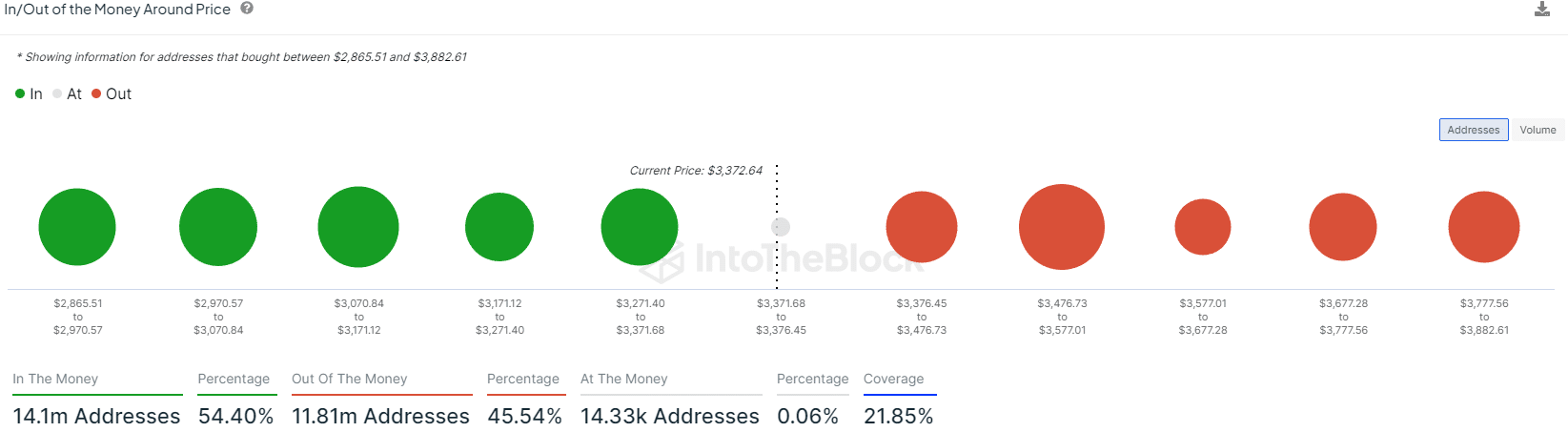

Data of holders in/out of the money provided valuable insights into where Ethereum could halt its downtrend.

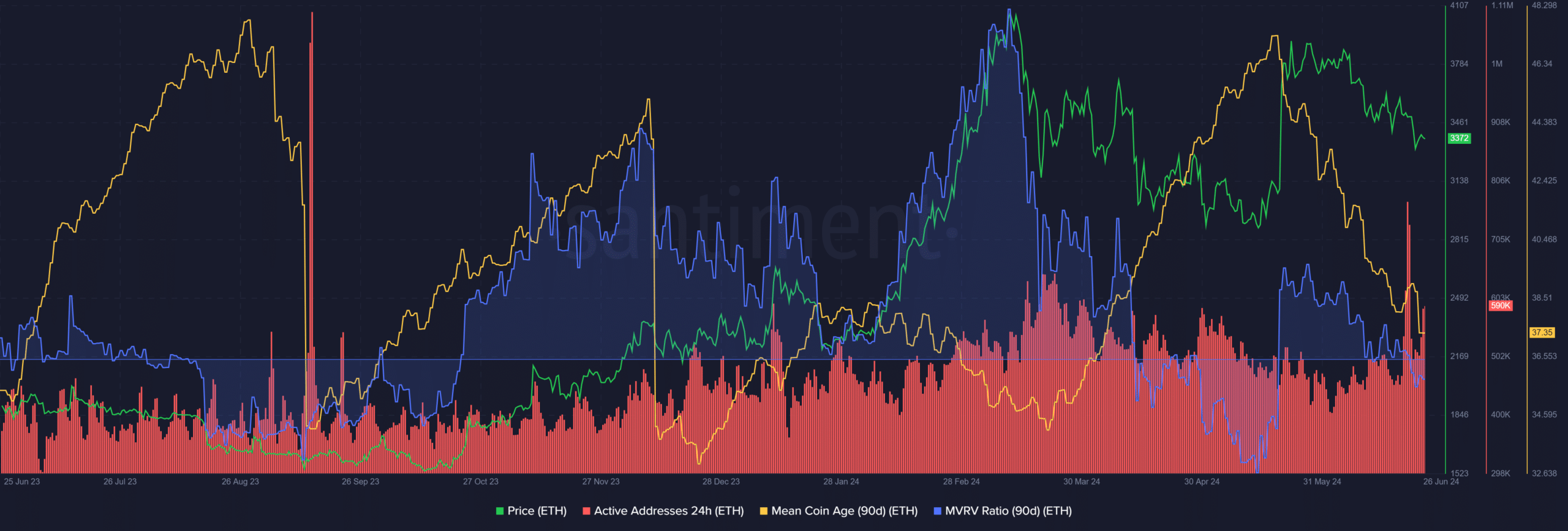

Two network metrics showed increased selling pressure behind ETH in recent weeks that has not yet let up.

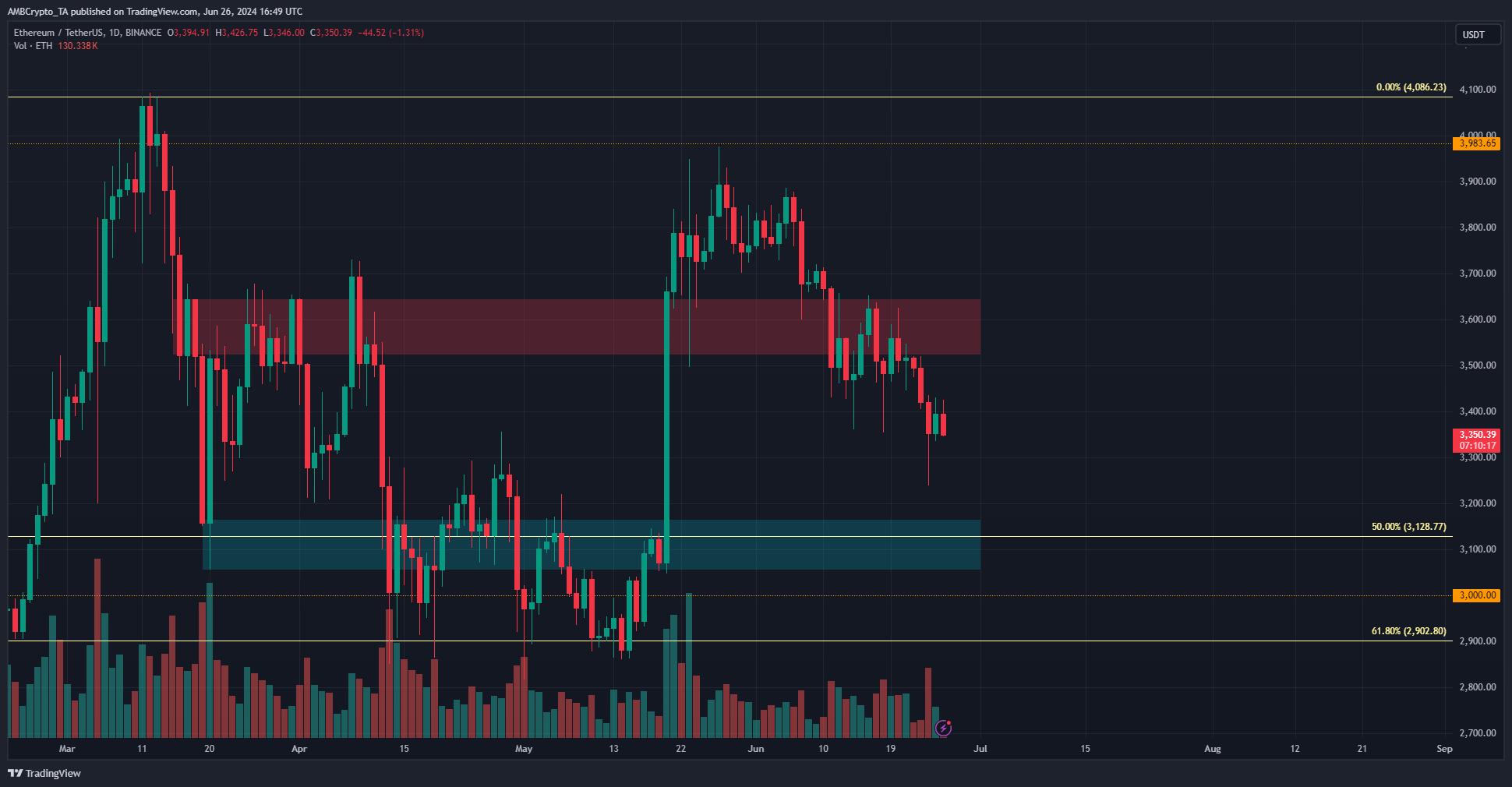

As a seasoned crypto investor with experience in the market’s volatile swings, I find the recent data on Ethereum [ETH] intriguing. The failure of bulls to defend the $3.6k demand zone and the subsequent breach of the $3600-$3650 resistance turned support zones have left me concerned about where the price could correct next.

Supporters of Ethereum [ETH] faced a predicament when they couldn’t protect the $3,600 area of interest as a buying point earlier in the month.

In March and the initial part of April, the price range between $3600 and $3650 functioned as a resistance level. However, towards the end of May, this range shifted to become a support area instead.

The excitement surrounding the Ethereum ETF was growing in anticipation of July, but Bitcoin‘s [BTC] impending selling pressure from miners and Mt. Gox, as well as a weak market demand, could pose significant challenges for Ethereum bulls.

Based on current market trends, it is expected that the price will experience a decline approaching the next support level. However, determining exactly where the correction may come to a halt can be unpredictable and requires careful analysis of various factors including market sentiment, technical indicators, and potential news events.

Major support and resistance zones

According to AMBCrypto’s analysis, approximately 2.28 million Ethereum were purchased around the price range of $2970 to $3171, based on the data from IntoTheBlock.

As a crypto investor, when the price gets close to a certain level, I notice an uptick in the number of people holding at that price point. This makes it more challenging for the market to push through and break past this resistance level.

Any price surge above $3,500 could face resistance due to numerous investors being close to breaking even. Fearing market instability, they might choose to sell.

Therefore, in the coming weeks, the $3.1k and $3.5k levels are the ones to watch out for.

Active address count reflects positively on network health

As an analyst, I’ve observed an uptick in the number of daily active addresses on the network during the month of June, despite a downward trend in prices. This increase in active addresses is a positive indication of increased network usage. However, other metrics presented bearish signals.

As a researcher studying cryptocurrency trends, I’ve noticed a significant decrease in the average age of circulating coins over the last month. This observation is reflected in increased token activity and redistribution across the network. Furthermore, the MVRV (Market Value to Realized Value) ratio has dipped below zero, indicating that a majority of holders are currently facing losses.

In unison, their presence pointed to a potential deepening of the downtrend. For any signs of price recuperation, the Moving Average Convergence Divergence (MCA) line must start ascending.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Solo Leveling Arise Tawata Kanae Guide

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- Elden Ring Nightreign Recluse guide and abilities explained

- Jack Dorsey’s Block to use 10% of Bitcoin profit to buy BTC every month

2024-06-27 09:14