-

The ETH burn rate has dropped to record lows amid a decline in Ethereum network activity.

In contrast, Ethereum rival Solana has seen its DeFi TVL jump by nearly four-fold year-to-date.

As a seasoned crypto investor with a portfolio that has weathered multiple market cycles, I’ve learned to keep a watchful eye on trends and network activities within the ever-evolving blockchain landscape. The recent dip in Ethereum’s [ETH] burn rate and the surge in Solana’s [SOL] DeFi TVL have certainly piqued my interest.

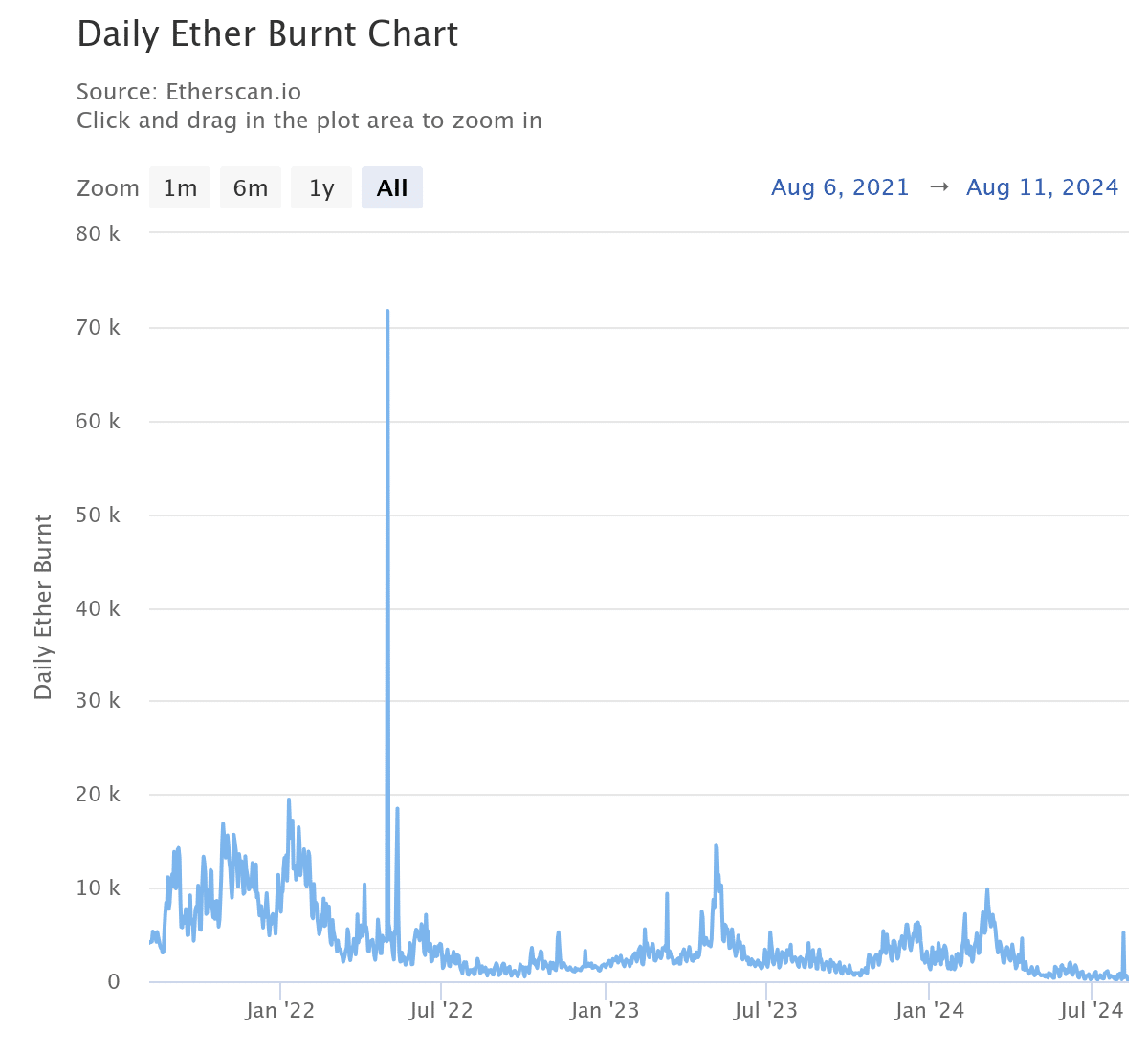

The rate at which Ethereum’s Ether tokens (ETH) are being destroyed has reached an all-time low following the burning of 121 ETH tokens on August 10th. This is the lowest level since the introduction of the EIP-1559 update.

The rate at which Ether transactions are being processed, as shown on Etherscan, is decreasing, suggesting that the Ethereum network’s influence within the Decentralized Finance (DeFi) sector is waning.

Declining activity on Ethereum

As a market analyst, I can confirm that Ethereum maintains a dominating position within the Decentralized Finance (DeFi) sector, boasting a staggering Total Value Locked (TVL) of approximately $47 billion, based on data from DeFiLlama.

Nevertheless, competing networks like Tron (TRX) and Solana (SOL) have been steadily taking over its market share, leading to a substantial 17% decrease in Total Value Locked (TVL) since the 1st of August.

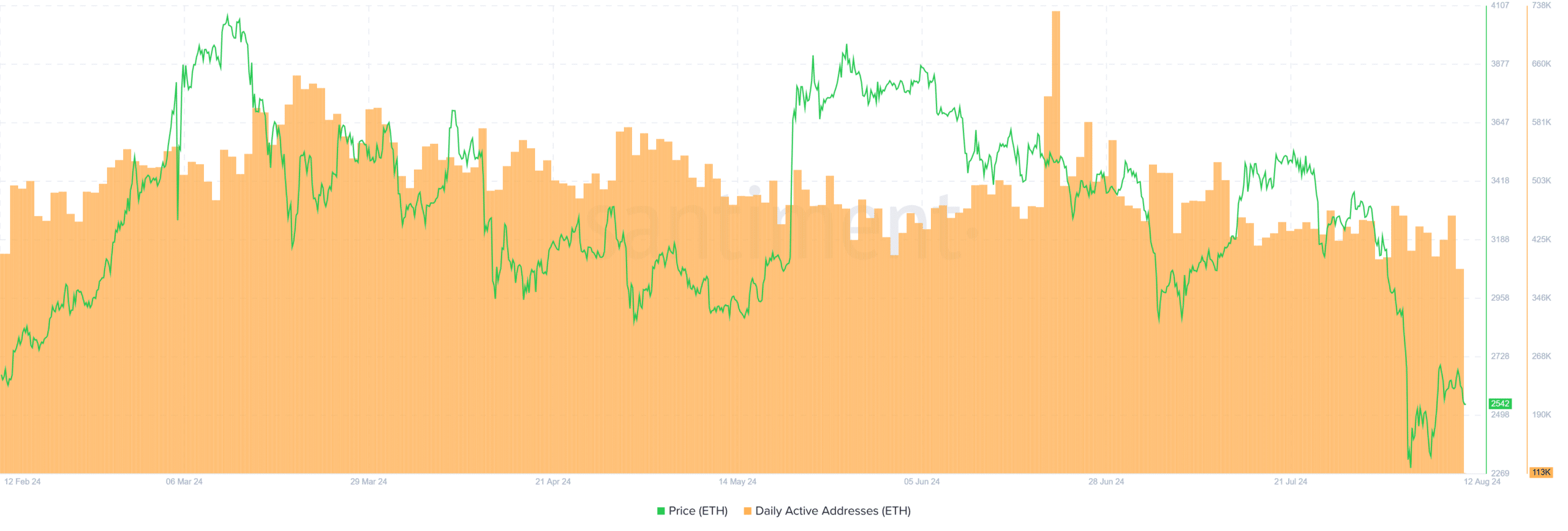

The waning DeFi activity has also led to a drop in the number of daily active addresses.

Based on my analysis of the data provided by Santiment, as an analyst, I’ve observed a significant decrease in the number of daily active Ethereum addresses. On the 22nd of July, there were approximately 731,000 active addresses, but as of the 11th of August, this figure has dropped to roughly 386,000.

A decline in Total Value Locked (TVL) and user interaction with the platform results in less transaction activity. Consequently, this reduction affects the amount of gas fees gathered and destroyed. Recently, this trend has led to a significant drop in Ethereum’s burn rate, which is now at its lowest level in years.

According to AMBCrypto’s analysis of Ultrasound Money data, within the past week, approximately 3,885 Ether tokens were destroyed, while around 18,000 new Ether tokens entered circulation.

Therefore, it’s worth noting that Ethereum has become an inflationary asset, as approximately 14,206 Ether have been added to the current supply.

Is ETH losing to SOL?

Despite Ethereum experiencing a drop in network usage, Solana, its primary competitor, has seen an increase in the total value locked in Decentralized Finance (DeFi).

At the moment of reporting, Solana’s Total Value Locked (TVL) stood at approximately $4.72 billion, marking nearly a four-fold rise from roughly $1.4 billion as of the 1st of January.

Over the course of the last year, Solana’s price growth surpassed that of Ethereum. To be more specific, while Ethereum experienced a 39% rise, Solana witnessed an astounding 487% surge in value.

ETH was trading at $2.581 at the time of writing after shedding 13% in the last two weeks.

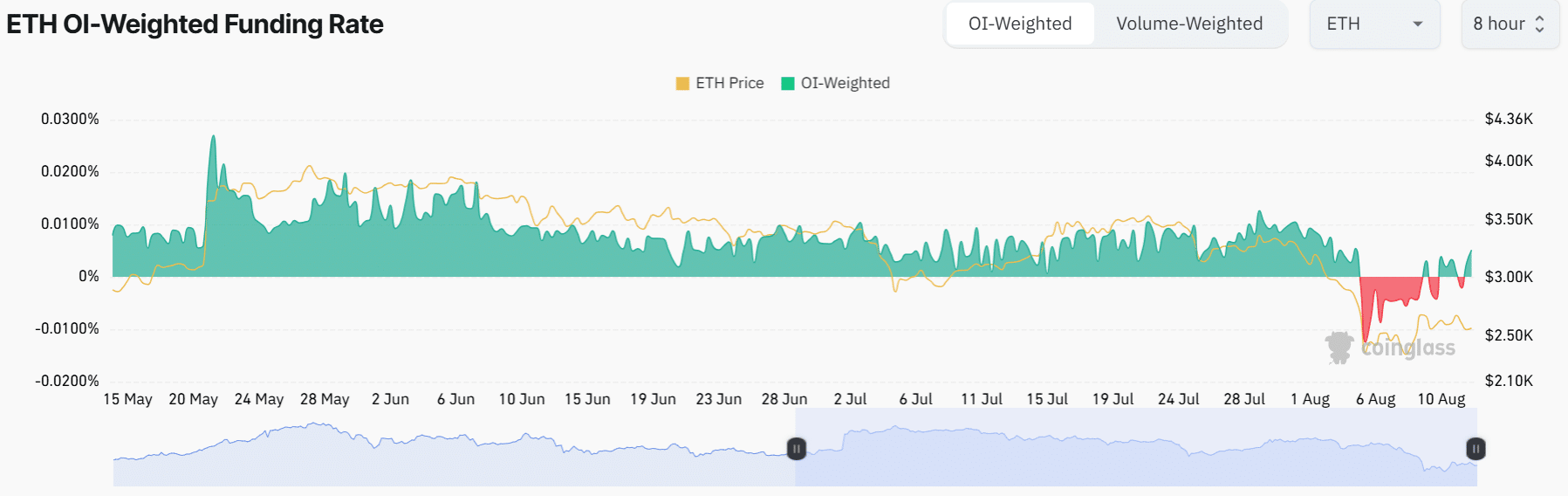

At the moment I’m analyzing, I’ve noticed that Ethereum’s Funding Rate has shifted from negative to positive. This could indicate that traders are now leaning towards a bullish outlook, anticipating a favorable price movement.

Based on my years of trading experience, I have noticed that when I see more and more traders taking long positions, it typically signals a shift towards a bullish sentiment. This means that the market is expected to rise, which could potentially lead to profitable trades for those who follow this trend. However, it’s important to remember that while historical data can provide valuable insights, it doesn’t guarantee future results and I always advise caution when making investment decisions. In my experience, a combination of technical analysis, fundamental analysis, and risk management strategies can help mitigate potential losses and maximize gains in the market.

Demand driven by spot Ether exchange-traded funds (ETFs) is also a catalyst for further gains.

Read Ethereum’s [ETH] Price Prediction 2024-25

Starting from the 23rd of July, financial titans such as BlackRock and Fidelity have collectively acquired approximately $1.04 billion in Ether through their respective ETH Exchange-Traded Funds (ETFs), as per SosoValue’s data.

Last week, Ethereum received the largest amount of inflows totaling approximately $155 million, as per a recent report from Coinshares.

Read More

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Gold Rate Forecast

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

2024-08-13 04:08