- Etherium to retrace to $3.7k to retest a support zone before a price surge to $4k.

- Most metrics hinted at a price correction in the near future.

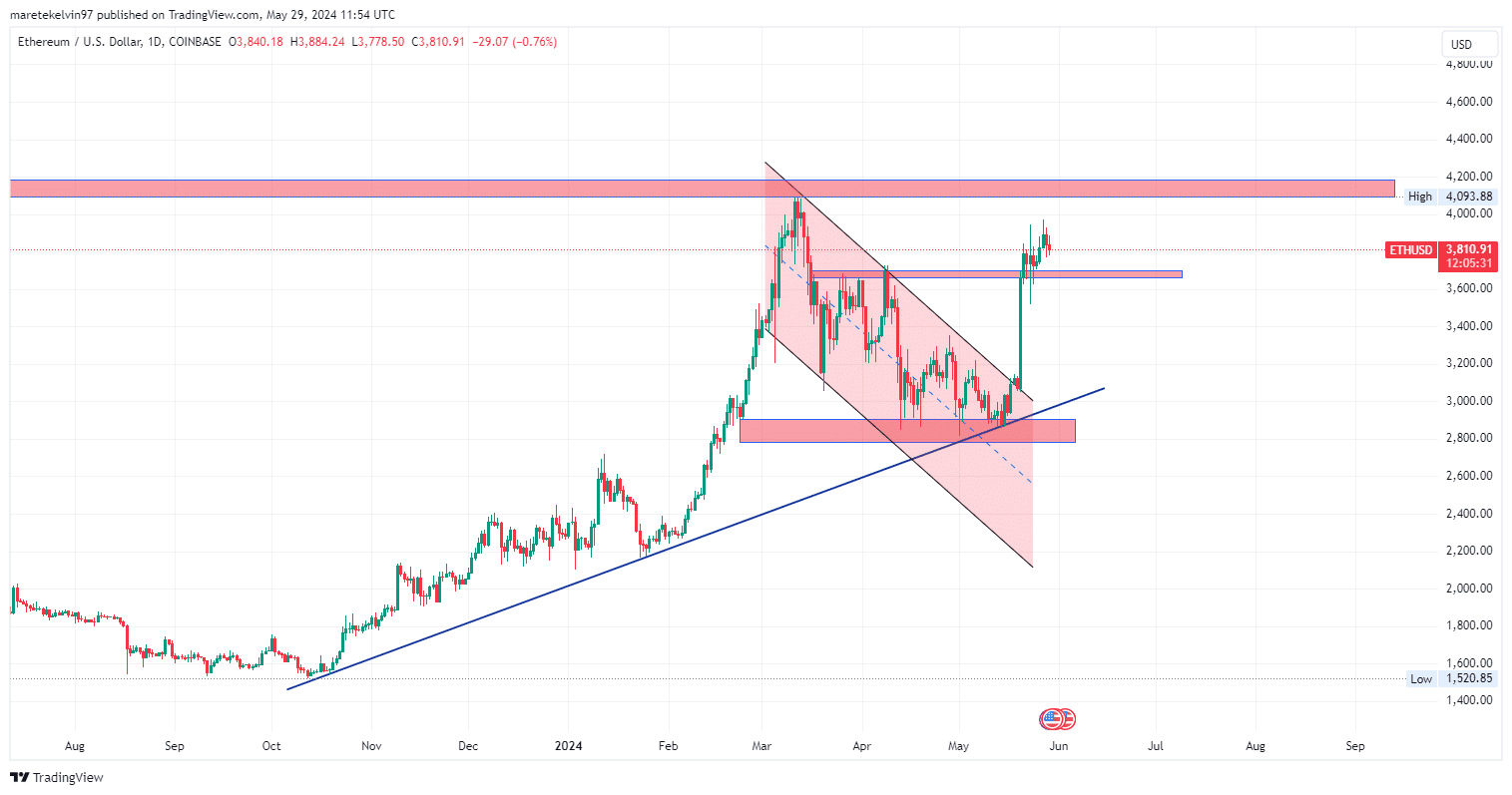

As a researcher with extensive experience in cryptocurrency analysis, I believe Ethereum (ETH) is currently retracing to the support zone of $3.7k before potentially surging towards the target high of $4k. This support zone is crucial as it has previously acted as resistance but now could act as a solid support level. However, the fair value gap below $3.7k might pull the price lower and potentially break this support.

Ethereum [ETH] is currently pulling back to around $3,700, which was previously a resistance level. However, this level may now act as a supportive foundation, potentially propelling ETH upwards towards its objective peak of $4,000.

As a researcher, I’ve observed that the fair value gap beneath $3,700 could function as a magnetic force for price, possibly drawing it downward and potentially shattering this support level. In the event that bearish momentum manages to push the price past the support zone, a revisit to the upward trendline support becomes plausible.

I’ve analyzed the current market data, and according to CoinMarketCap’s latest update, there has been a 2.24% price decrease within the last 24 hours. However, over the past week, Ethereum has experienced a 2.16% increase in value. Despite this short-term volatility, the overall trend for Ethereum appears bullish as investors remain focused on the critical support level of $3,700.

Is a bullish surge to $4k possible after the retracement?

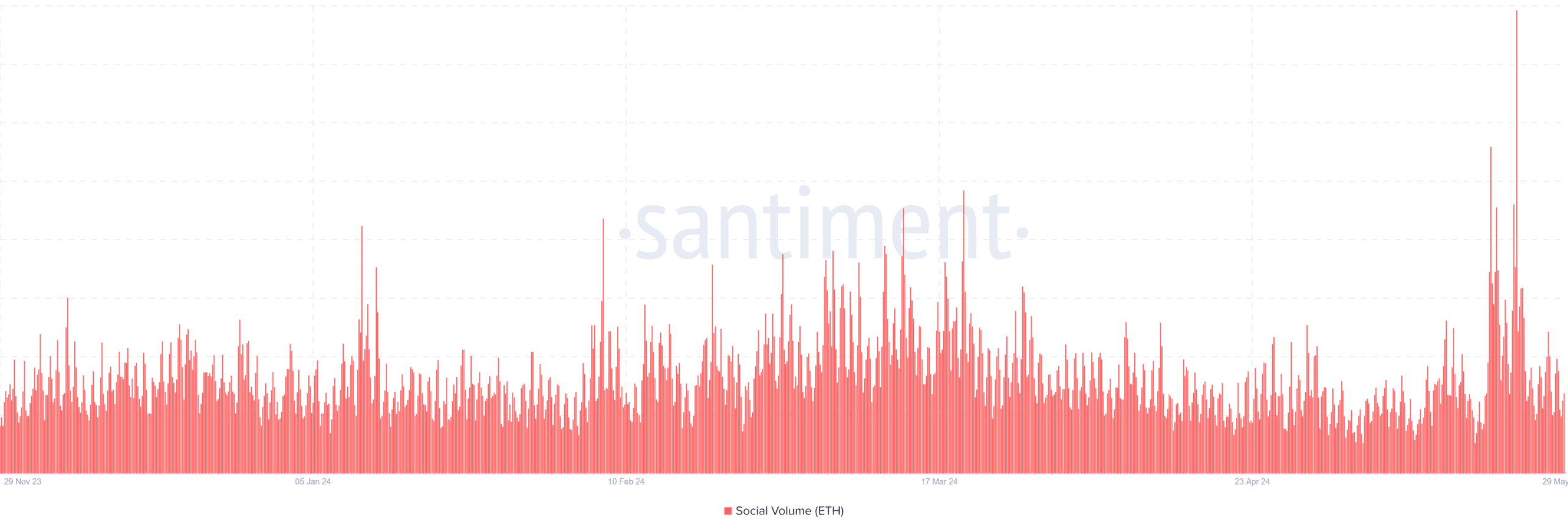

Santiment’s Social Volume chart, as examined by AMBCrypto, revealed numerous peaks during mid-May, which coincided with substantial price fluctuations. The subsequent pullback to around 3.7k could signify an uptrend based on the heightened social activity observed.

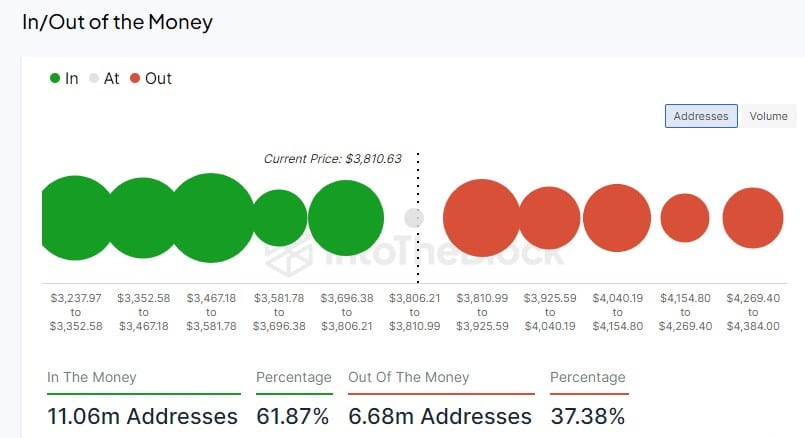

An in-depth examination of IntotheBlock’s In/Out of Money chart by AMBCrypto revealed that approximately 61.87% of addresses holding $11.06 million are currently making a profit, while around 37.38% of addresses with a balance of $6.68 million have incurred losses.

The data also revealed that approximately 135,000 addresses are currently breaking even. It is important to note that the profitable ranges for this asset lie between $3,300 and $3,600, while losses are incurred within the $3,900 to $4,000 price range. This distribution signifies significant support and resistance levels based on the profitability of holders.

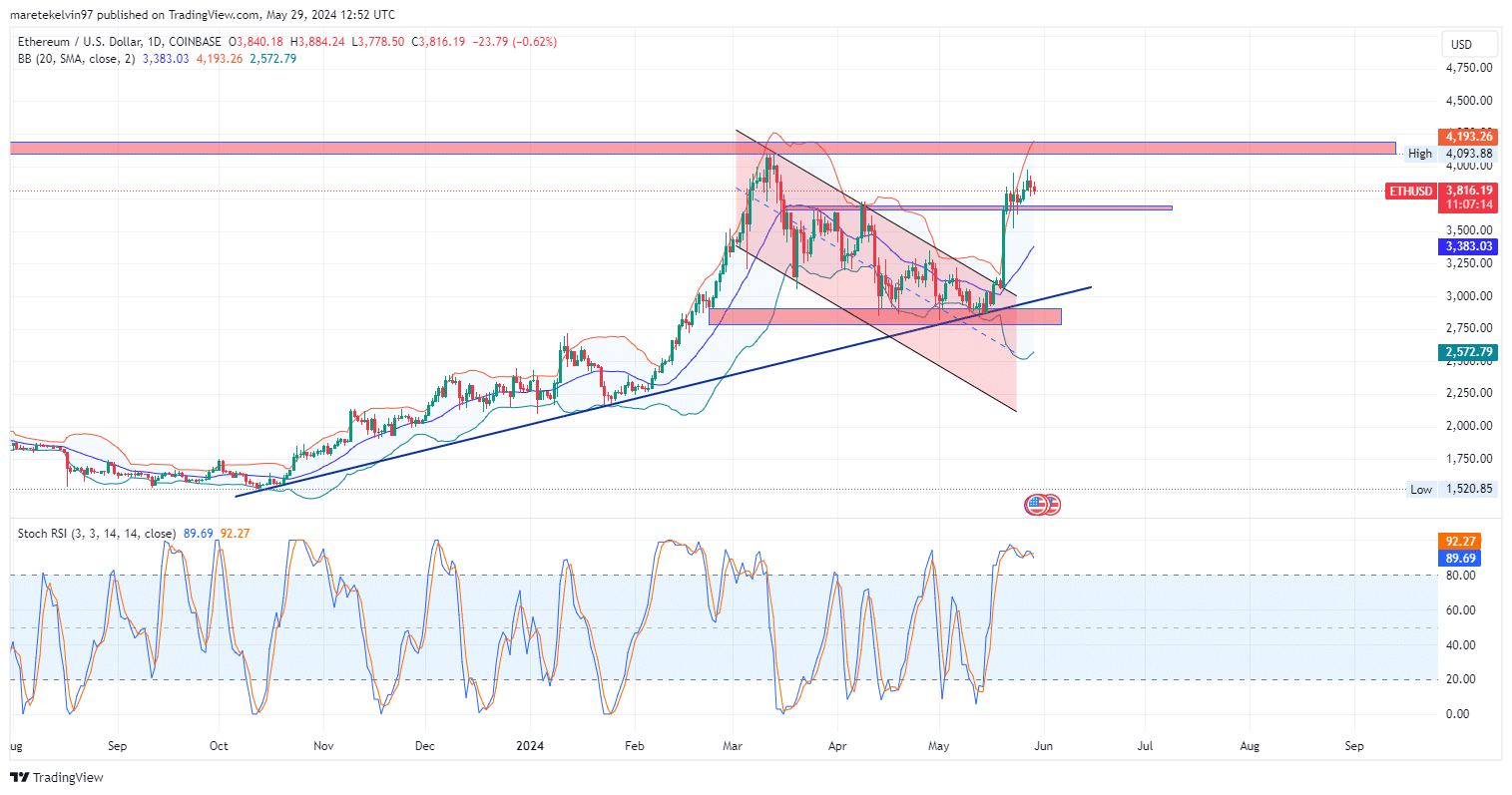

In simpler terms, the Bollinger bands on the daily chart have expanded, signaling a market with significant volatility. This volatility could potentially cause a slight downturn towards the support area around $3,700 and lead to a breakout that propels the price up to the $4,000 target.

Based on the current stochastic RSI reading of 89.69, there are signs of the market being overbought, which could indicate a brief pullback prior to the resumption of the ongoing bullish trend.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2024-05-30 10:15