- ETH’s short-term outlook shows signs of a bullish reversal around the $3,000 psychological level.

- On-chain metrics suggest selling pressure, but most ETH holders remain in profit.

The price of Ethereum (ETH) likewise experienced a decline due to the recent correction in altcoins, falling more than 20% following rejection at the $4,000 resistance point.

Yet, the downward trend in Ethereum might not necessarily be substantial, given its technical indicators and blockchain analytics hint at conflicting signs of an impending price increase or increased volatility.

ETH approaching key support at $2.8k

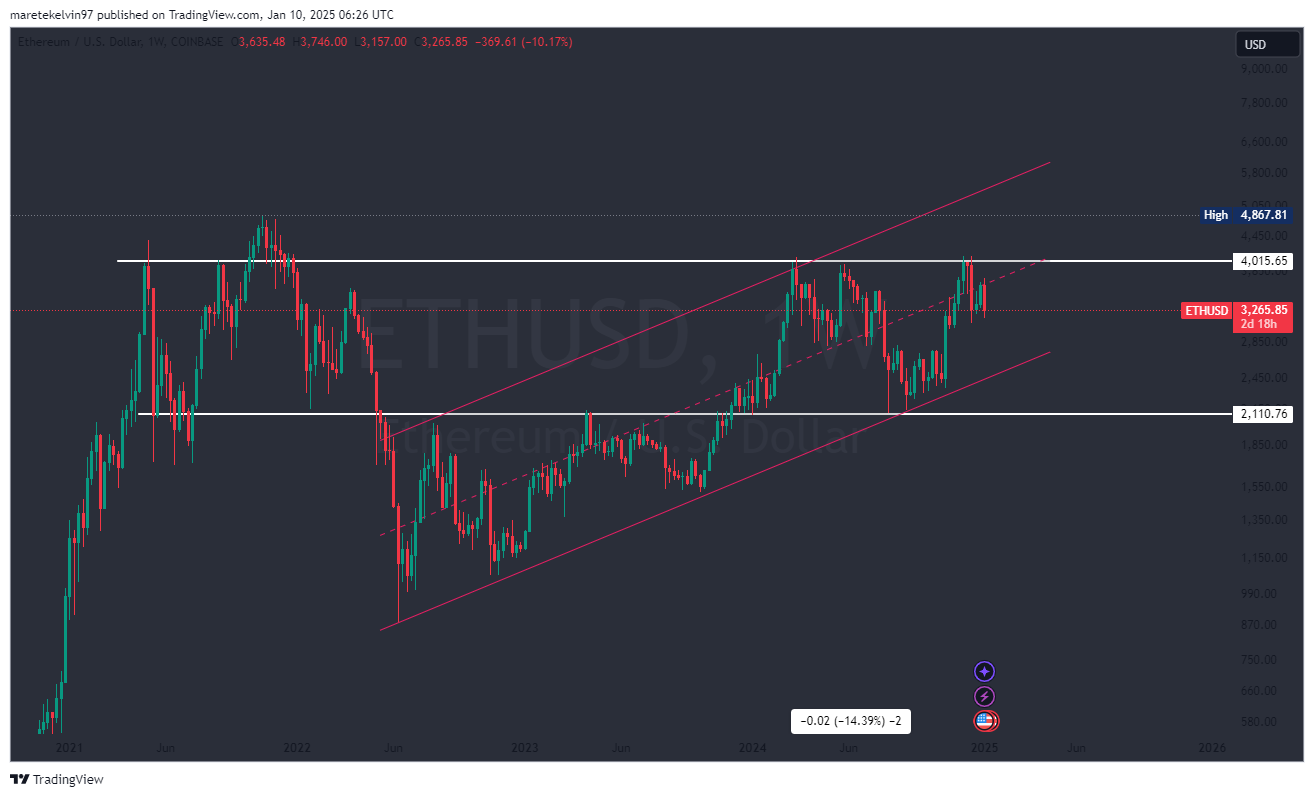

Looking at the weekly graph, Ethereum’s price trend indicates a bullish flag consolidation, which typically signals an upcoming surge. Currently, Ethereum is approaching the lower edge of this rising flag around $2,800, following a recent drop.

Should this level maintain its strength, it might serve as a launchpad for an impressive surge towards the next significant goal of around $6,000 for Ethereum. If we see a solid recovery at this point, it could propel Ethereum in that direction.

However, failure to maintain this support could expose ETH to further downside.

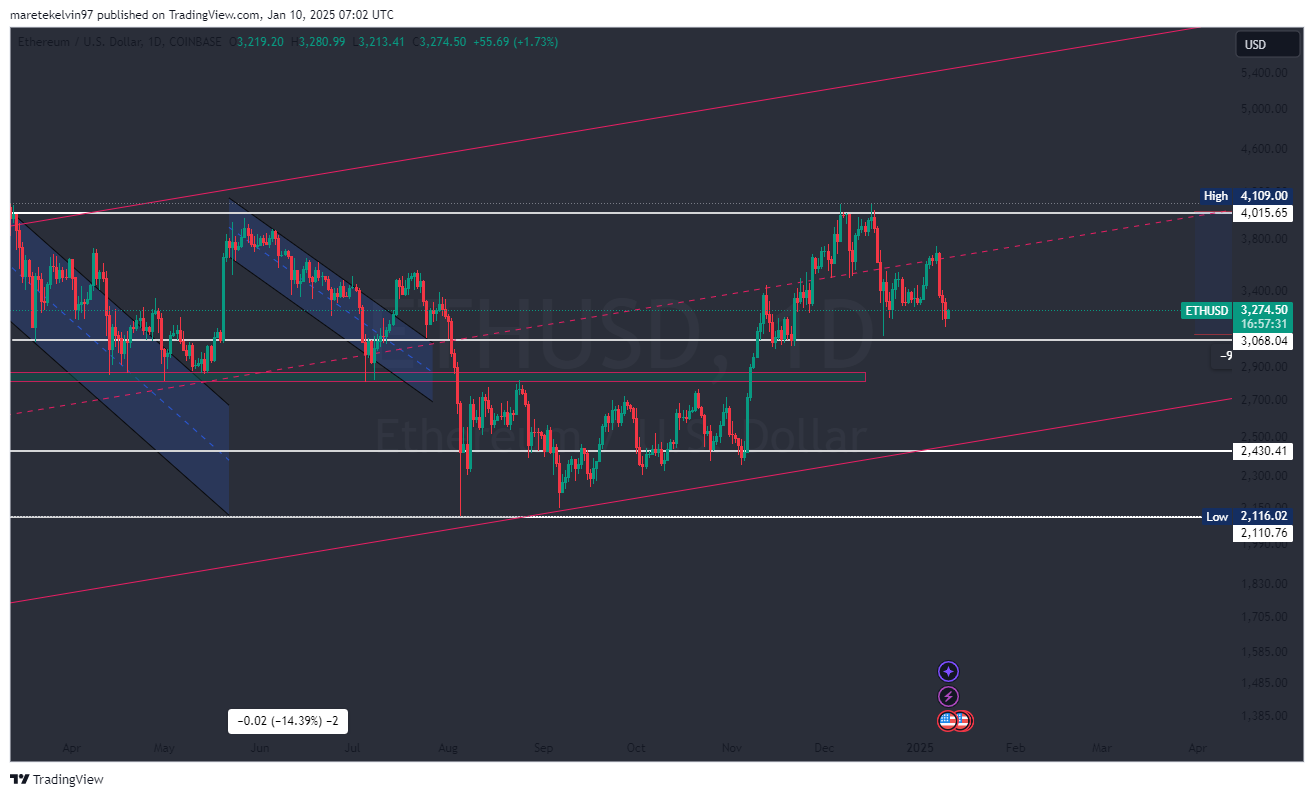

Signs of a short-term reversal at $3,000

Looking closely at the day-by-day graph, Ethereum’s price movements hint at a possible short-term upturn in its trend.

Over the past day, there’s been a slight uptick in Ethereum trading activity, with the key price point of approximately $3,000 showing significant influence.

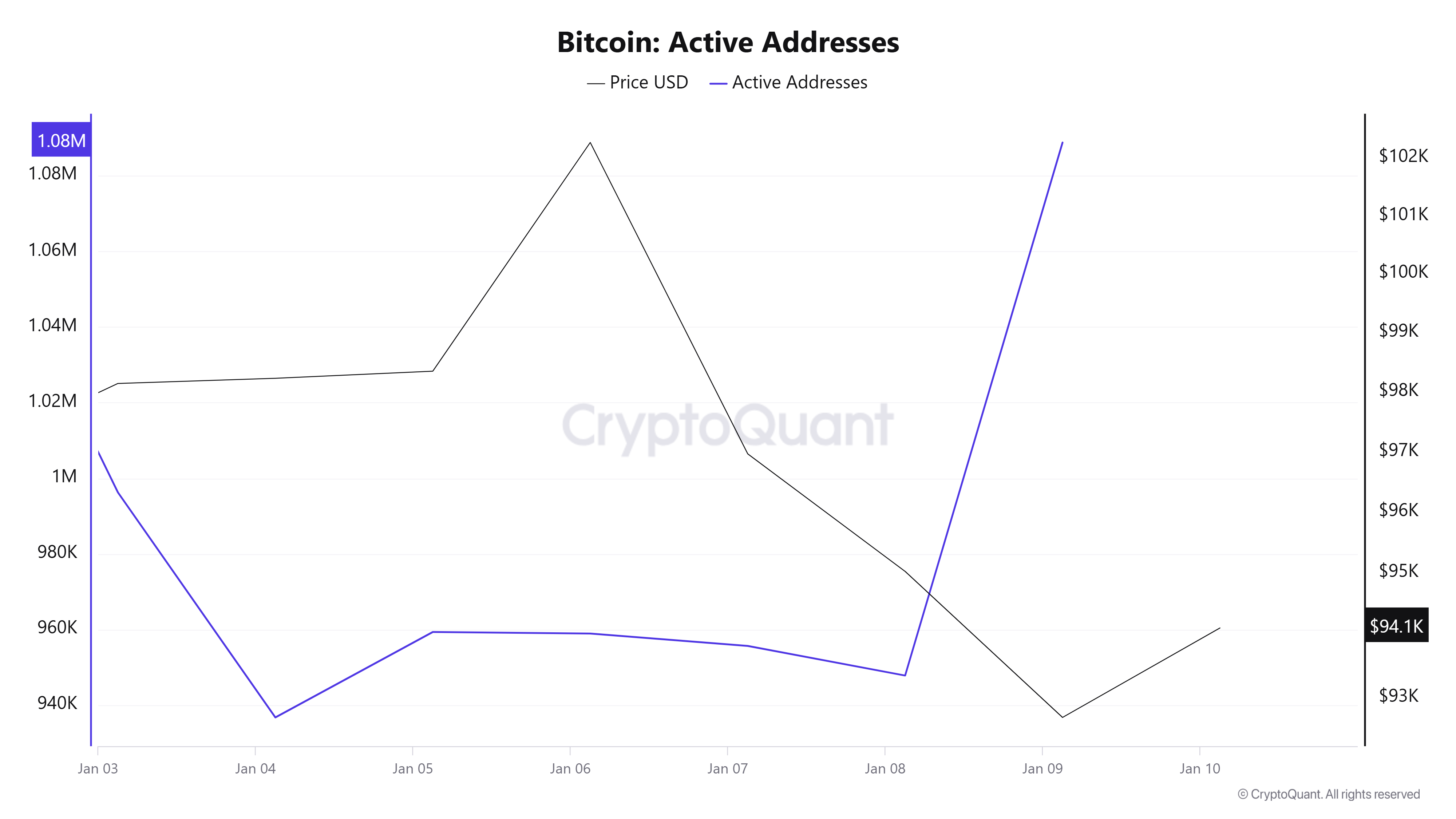

According to information from CryptoQuant, there’s been a significant increase in the number of active users on the network during that timeframe. This kind of heightened activity could indicate revived curiosity, which might help maintain or even boost prices.

Rising exchange outflows indicate profit-taking

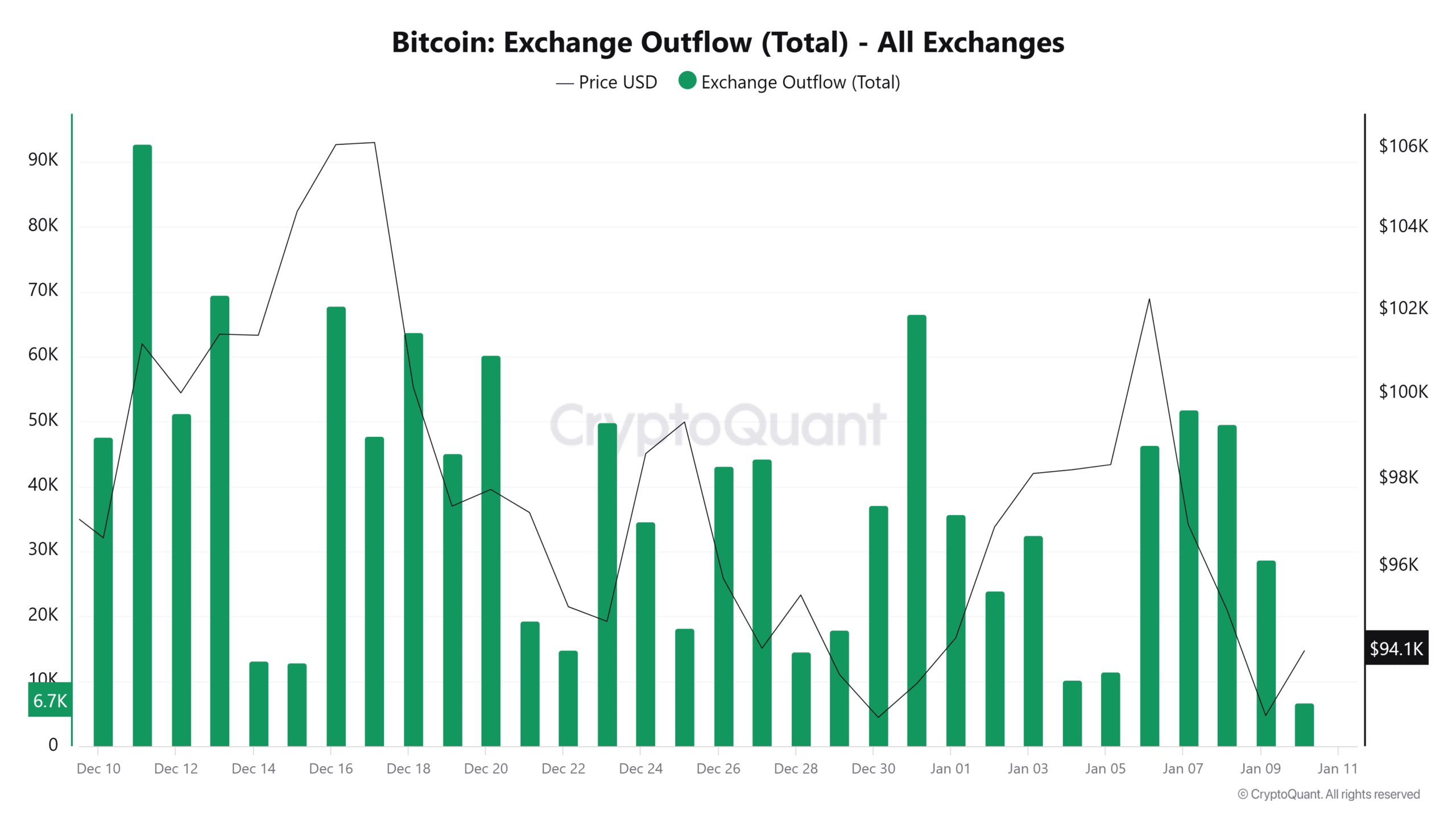

Although short-term indicators show a positive outlook, the long-term perspective suggested by on-chain metrics paints a different picture.

Based on data from CryptoQuant, it appears that there has been a significant increase in Ethereum (ETH) being withdrawn from exchanges over the past 24 hours. This surge may suggest that sellers are putting more ETH up for sale as they cash out their profits around the $3K price point, which is considered psychologically important by many investors.

Previously, these outflow patterns have oscillated between highs and lows, and the present increase might indicate a buildup of selling pressure on the market.

ETH holders remain profitable despite…

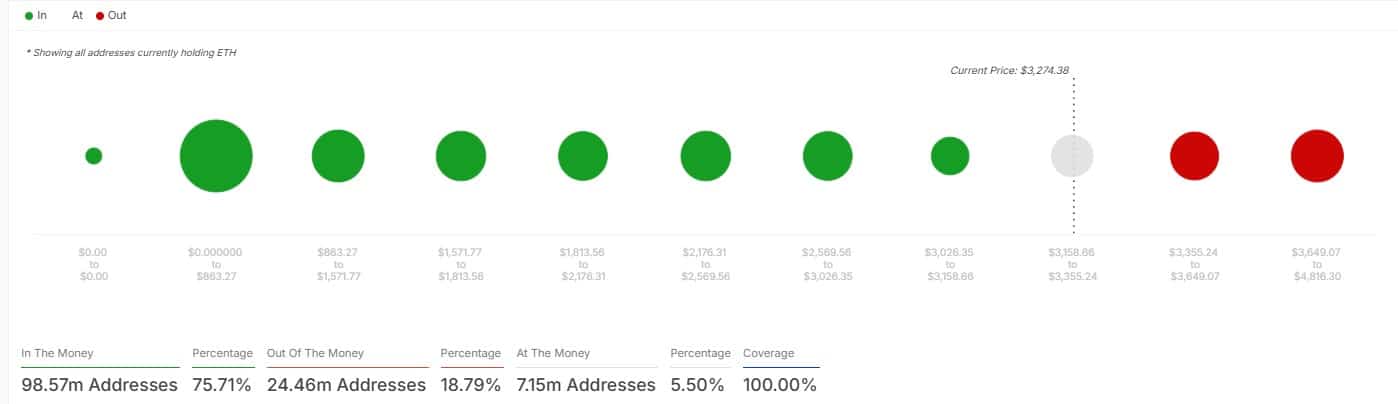

As a proud ETH investor, I’ve weathered some short-term dips, but the good news is that over 76% of us are still in the green. IntoTheBlock’s data shows this to be true at current prices. This high percentage underscores the faith long-term investors have in Ethereum and suggests a robust base for its potential ongoing surge.

Read Ethereum’s [ETH] Price Prediction 2025–2026

The future price movement of Ethereum largely depends on several crucial points. If the support level at approximately $2,800 (referred to as the “flag”) remains strong, it could trigger a substantial price surge. Furthermore, heightened network activity around the $3,000 psychological barrier adds weight to a positive forecast.

With most holders still in profit, ETH long-term trajectory remains optimistic.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

2025-01-11 02:15