- Ethereum Classic regained its bullish market structure on the daily after a 20% rally

- Liquidity levels indicate that a pullback below $20 is likely before a move beyond $22

As a seasoned crypto investor with a penchant for altcoins and a soft spot for Ethereum Classic [ETC], I find myself rather optimistic about its current performance. The recent 20% rally is a promising sign, suggesting that ETC might be gearing up for a significant breakout.

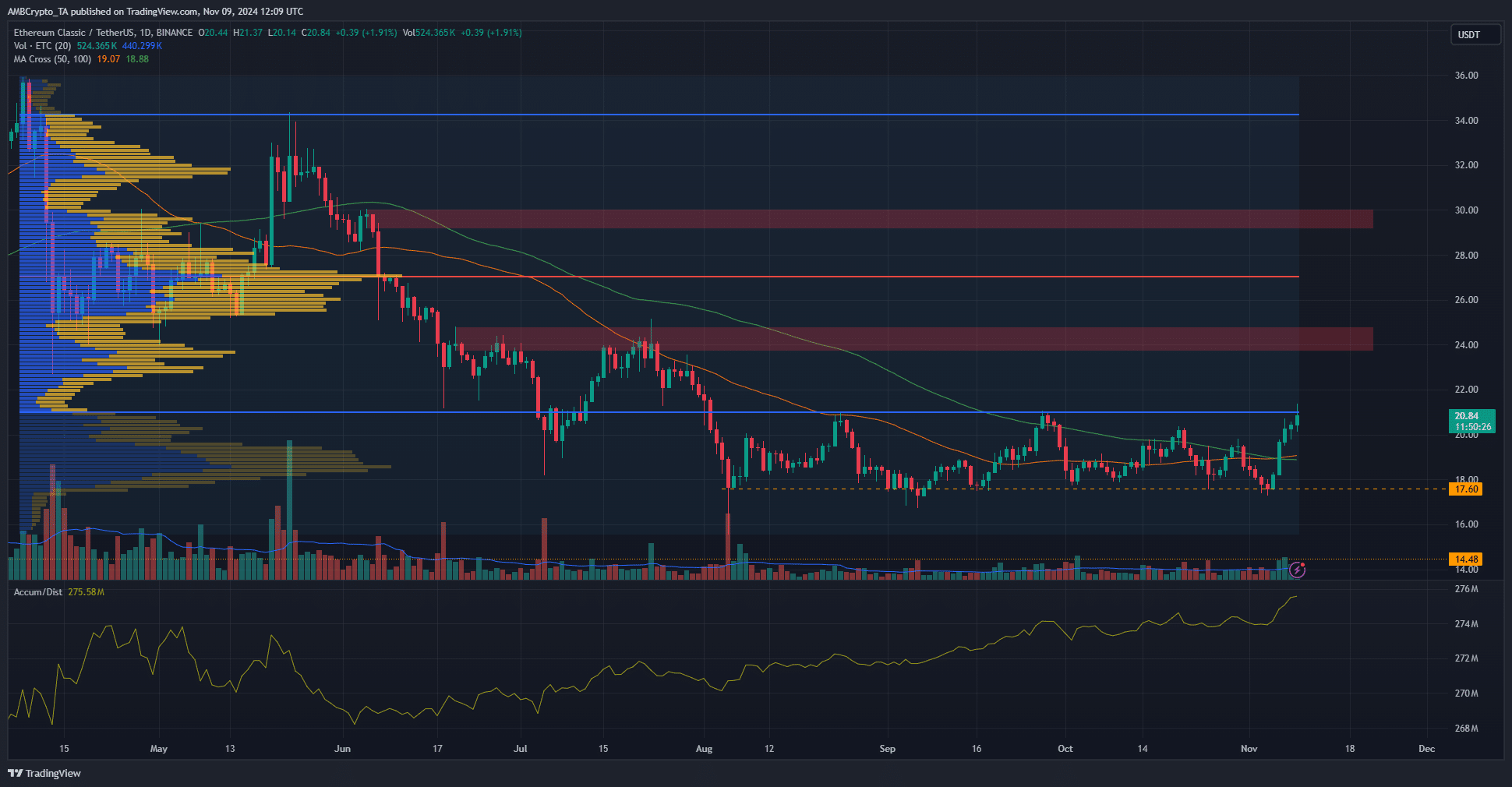

Since November 4th, Ethereum Classic (ETC) has shown strong performance. Likewise, Bitcoin [BTC] has also seen notable growth, as both have recorded a 19% increase in value since they reached their respective lows of $17.29 on that day.

Although there have been recent improvements, the price hasn’t managed to surpass the resistance at around $21, a level that has thwarted buyers since August. Could this time be any different?

Accumulation indicator shows breakout is likely

Earlier this week, the market’s trend shifted positively on the daily graph when it surpassed the latest peak at $19.82.

Since August, the A/D indicator has been steadily climbing upwards, whereas the price has fluctuated within a band of $17.6 to $21.

As optimism builds within the cryptocurrency market, Ethereum Classic (ETC) appears poised to surpass the $21 mark. According to the Fixed Range Volume Profile, the $21 level has been a significant barrier of resistance.

The lower boundary of the price range, which accounts for about 70% of the trading activity since April, has been a significant zone. Penetrating this price area has proven to be difficult.

As a crypto investor, I’ve noticed a promising development – a bullish crossover between the 50 and 100-day moving averages. This technical indicator suggests that the probability of an uptrend is on the rise, adding another positive sign to my investment outlook.

Beyond the price level of $21, the next potential zone where prices might face strong resistance is approximately $23.8. This region hosts a bearish trading pattern and a significant volume node.

Short-term sentiment favors ETC bulls

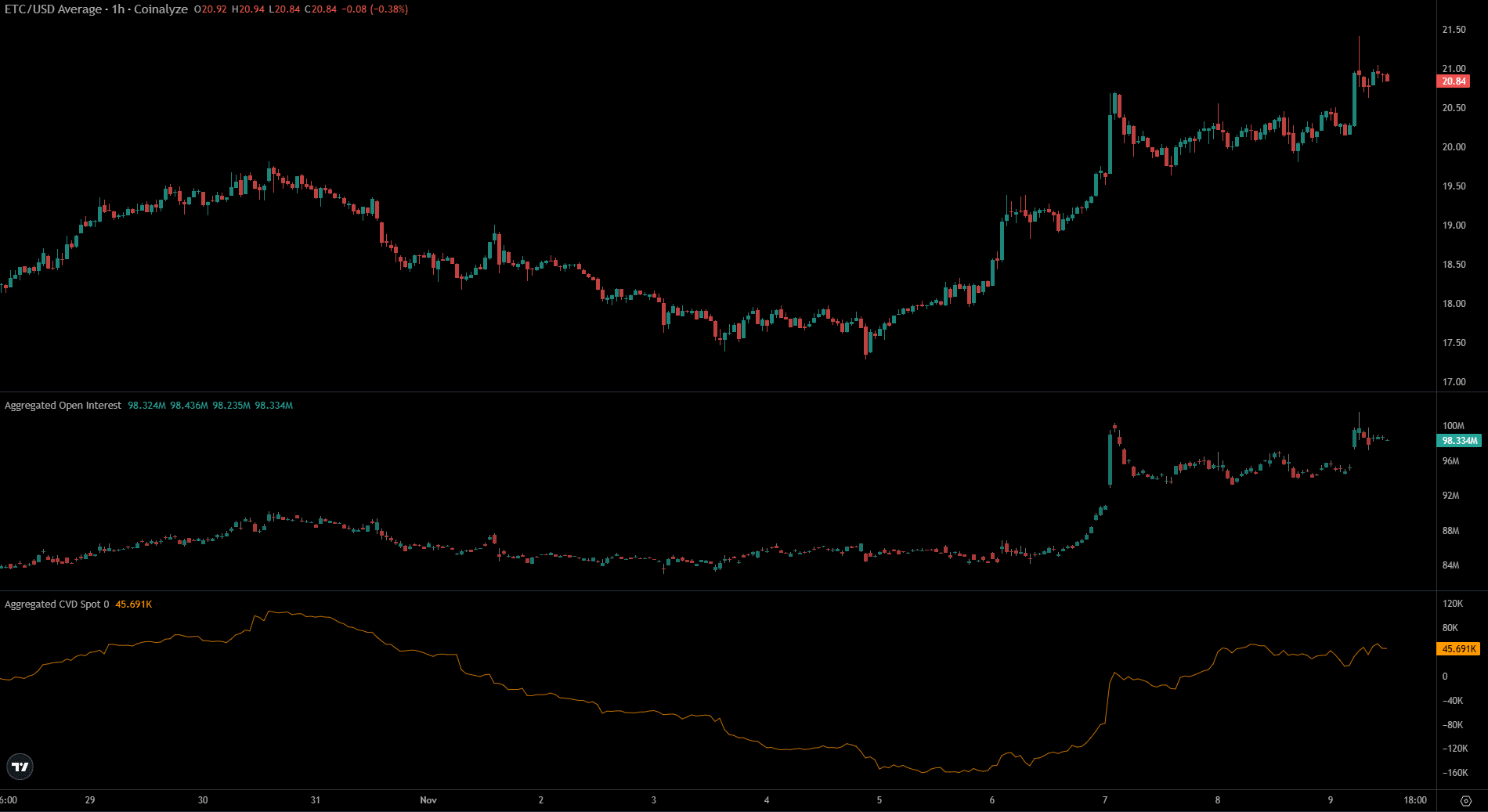

On November 6th, the Open Interest jumped from $86 million to $98.3 million as of the current news update, and simultaneously, the price experienced a 20% increase. This upward trend suggests that investors holding optimistic views, or “bulls”, are dominating the speculator market.

The spot CVD also climbed higher in recent days, showcasing demand in the spot markets.

Read Ethereum Classic’s [ETC] Price Prediction 2024-25

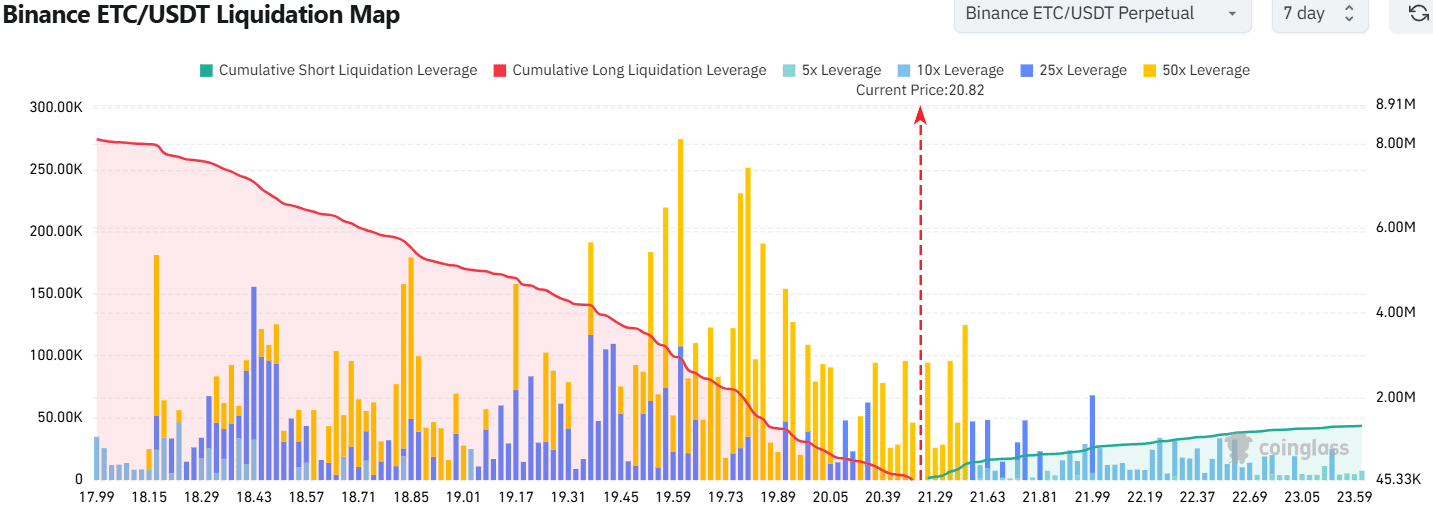

According to the ETC liquidation map, a drop in price to around $19.61 or $19.37 could trigger a significant number of long positions being closed due to liquidations. As we move upward, the liquidity pools become less abundant, with levels up to $21.99.

Given that high liquidity tends to influence prices, it’s possible that Ethereum Classic (ETC) could fall beneath the $20 mark over the next few days, thereby triggering these pre-arranged long liquidation events.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Masters Toronto 2025: Everything You Need to Know

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Elden Ring Nightreign Recluse guide and abilities explained

- Solo Leveling Arise Tawata Kanae Guide

2024-11-10 11:03