- Given the golden cross on EMAs and ascending channel pattern, Ethereum Classic’s medium-term prospects look promising.

- Derivates data showed a slight edge for bulls, but buyers should closely track BTC’s movement.

As a seasoned researcher with over two decades of experience in the cryptocurrency market, I must admit that the recent price action of Ethereum Classic (ETC) has piqued my interest. The golden cross on EMAs and the ascending channel pattern suggest a promising medium-term outlook for this altcoin. However, as we all know too well in this volatile industry, past performance is no guarantee of future results.

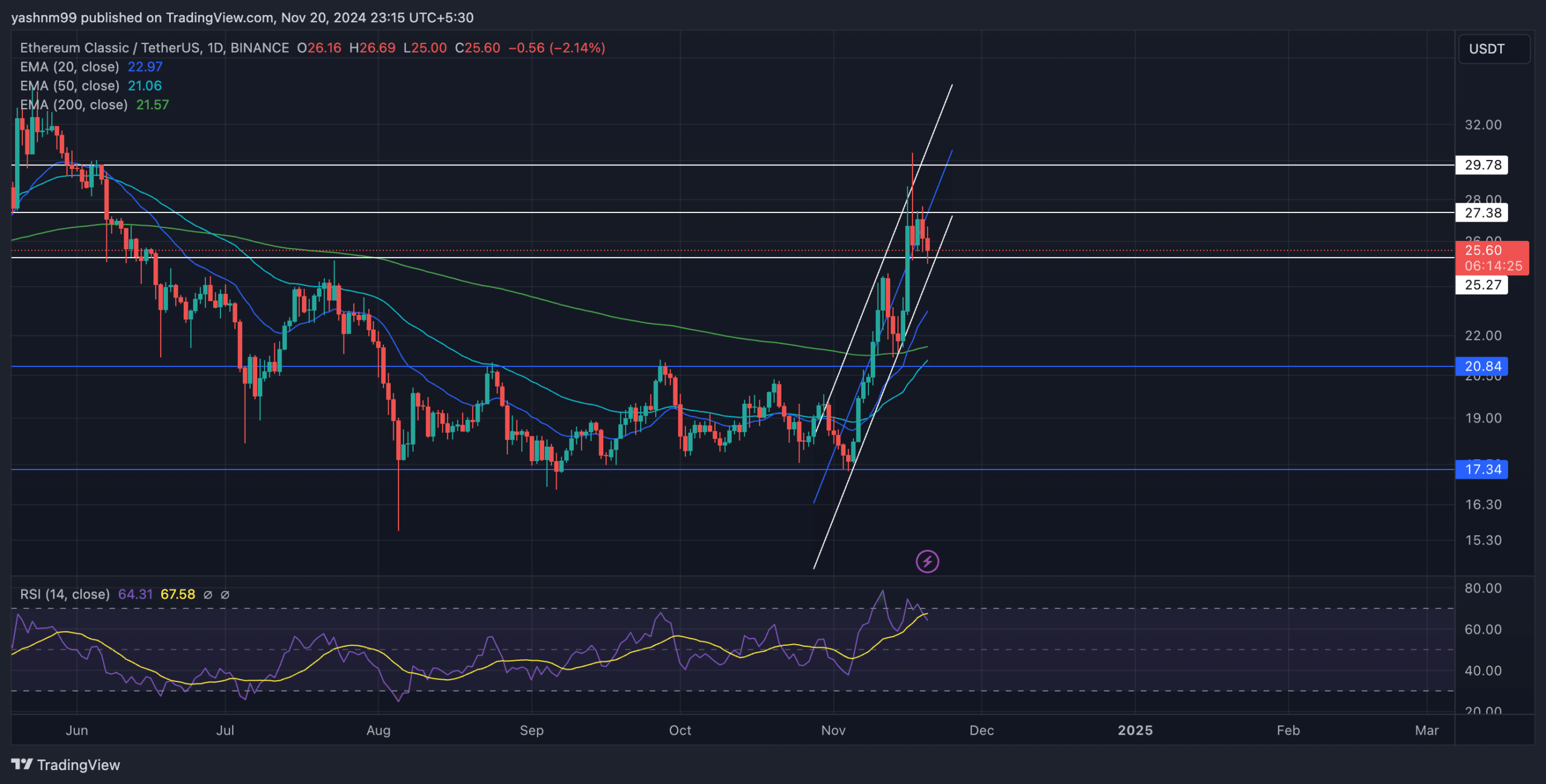

Amid the recent Bitcoin bull run, Ethereum Classic [ETC] saw a steep rise and touched its 6-month high on 17th November. However, despite the ongoing gains, ETC struggled to break past the $27 barrier after testing it multiple times over the past few days.

Recent price action and EMA overview

Previously, ETC had been following a rising trendline on the daily graph, which is often a sign of a short-term reversal. Over the past few weeks, it has seen a sequence of lower lows and higher highs, propelling its overall upward movement.

Currently, the value of the altcoin was approximately $25.46 per coin. Over the past day, it had decreased by 2.68%. However, a positive sign for potential buyers is that its 20-day Exponential Moving Average (EMA) has risen above both its 50-day EMA and 200-day EMA. This suggests a strong upward trend, or bullish momentum. Here’s how the values look:

However, the $27.38 and $29.78 levels continued to offer stiff resistance for buyers.

If the existing uptrend continues, Ethereum Classic (ETC) might revisit its upper limit, approximately in the $29-$30 zone. Conversely, if bears manage to push the price below the lower trendline, short-term support could be found around the moving averages at around $23.

As an analyst, I’ve observed that the Relative Strength Index (RSI) is currently hovering around 64, suggesting slightly overbought conditions. This could potentially signal a short-term correction, pushing the market towards the 50-mark. This adjustment would help restore more balanced dynamics within the market. For buyers, it’s crucial to keep an eye on any potential dips in the RSI as they may present opportunities for a corrective move.

ETC’s Derivatives revealed THIS

As a researcher observing the market trends, I noticed a decline of approximately 4.56% in the Open Interest across all exchanges, bringing it down to around $148.63 million. Similarly, trading volume saw a decrease of about 14.03%, settling at roughly $338 million. This suggests a noticeable reduction in market activity.

It’s worth noting that the Long/Short ratio for a 24-hour period was approximately 0.86 (0.8577 to be exact), indicating a bearish inclination. On the other hand, traders on Binance and OKX exchanges appeared more optimistic, as their ratios stood at 2.11 and 2.7 respectively, suggesting a positive sentiment among them.

Lately, a significant increase in open trades among the prominent traders on Binance has shown a predominantly optimistic outlook, as evidenced by a Long/Short ratio of 2.1 for individual accounts and 1.2 for positions. This suggests that these top traders are still strategically preparing for continued market growth.

Read Ethereum Classic’s [ETC] Price Prediction 2024–2025

In the short term, the actions of Ethereum Classic (ETC) may significantly follow Bitcoin’s (BTC) trends, particularly when Bitcoin starts showing signs of being overbought, given its potential impact on ETC.

Should Bitcoin’s upward trend persist, Ethereum Classic (ETC) might surpass its current resistance at $27 and target the $30 region. Conversely, if Bitcoin’s growth slows down, Ethereum Classic could potentially slide back towards the vicinity of $21 to $22.

Read More

- PI PREDICTION. PI cryptocurrency

- How to Get to Frostcrag Spire in Oblivion Remastered

- How Michael Saylor Plans to Create a Bitcoin Empire Bigger Than Your Wildest Dreams

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- S.T.A.L.K.E.R. 2 Major Patch 1.2 offer 1700 improvements

- We Ranked All of Gilmore Girls Couples: From Worst to Best

- Kylie & Timothée’s Red Carpet Debut: You Won’t BELIEVE What Happened After!

- PS5 Finally Gets Cozy with Little Kitty, Big City – Meow-some Open World Adventure!

- Quick Guide: Finding Garlic in Oblivion Remastered

- Florence Pugh’s Bold Shoulder Look Is Turning Heads Again—Are Deltoids the New Red Carpet Accessory?

2024-11-21 13:11