- Market structure flashed hopeful signs, but the longer-term trend was unfavorable for buyers

- Short-term sentiment was bearish and spot buyers were weakened too

As a seasoned crypto investor with battle-scarred fingers from previous market fluctuations, I find myself cautiously optimistic about Ethereum Classic [ETC]. The bullish structure flashed hopeful signs on Friday, 23 August, but the longer-term trend remains unfavorable for buyers.

On Friday, 23rd August, Ethereum Classic (ETC) surpassed the $20 mark, driven by optimistic forecasts about the token. However, Bitcoin‘s [BTC] slide under $60k triggered a change in overall market sentiments.

If Ethereum Classic manages to hold its ground at the nearby support levels of approximately $18.3 and $17.68, it could potentially spark optimistic expectations. Notably, a spike in buying activity has been indicated by a volume indicator. Yet, the question remains: Is this alone sufficient?

Bullish structure, bearish trend

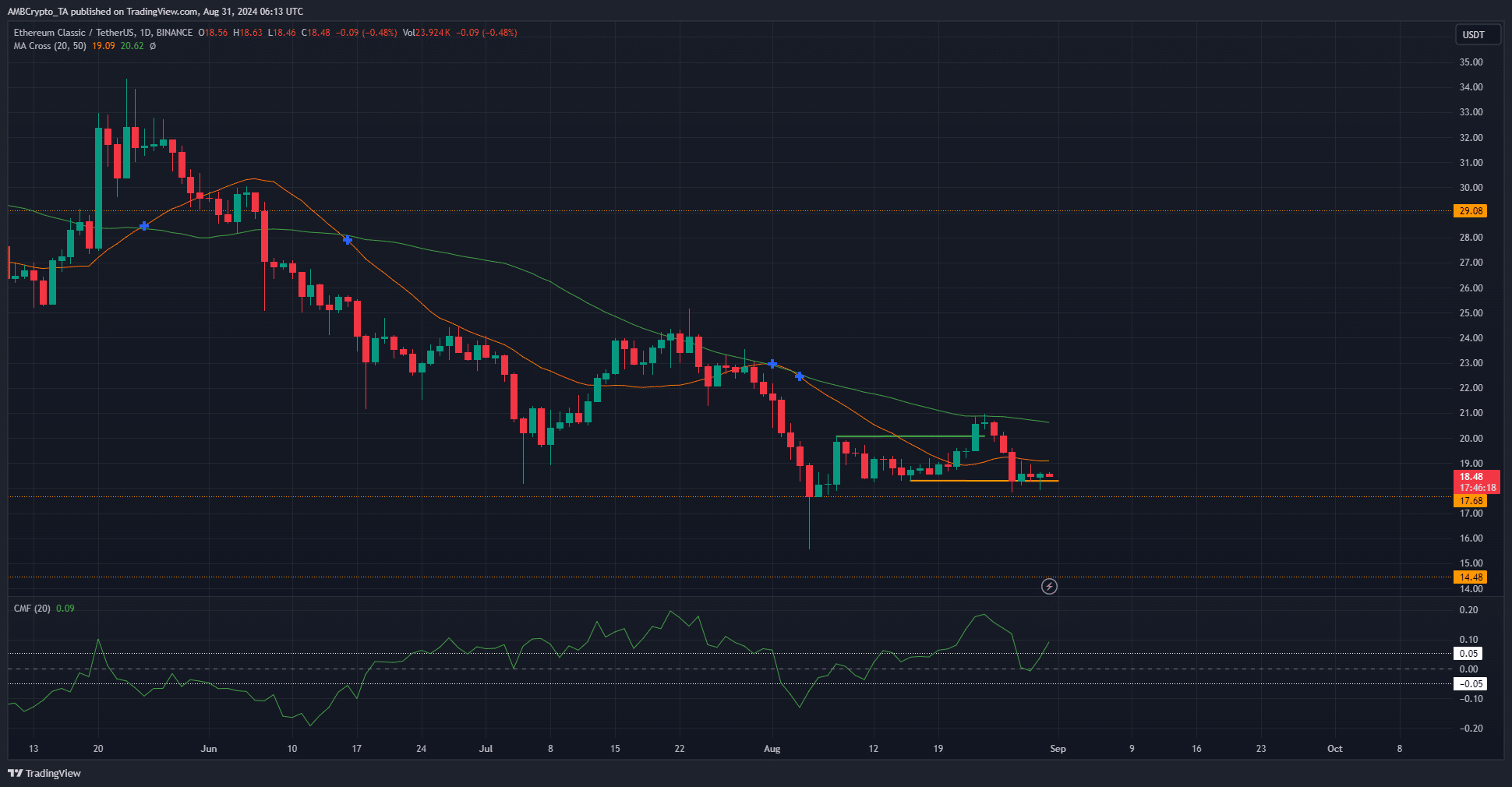

On its daily chart, Ethereum Classic showed a positive, or bullish, market pattern after surpassing its recent resistance level at $20.07. At this moment, it has not yet fallen below the previous support level of $18.3. But since May, the overall trend for Ethereum Classic has been downward.

1. Both moving averages showed the same signal; they haven’t crossed over yet in a way that signals an upward trend. Moreover, Ethereum Classic was recently denied by its 50-day moving average around a week back.

The Capital Movement Fund showed a significant increase (+0.09), suggesting substantial inflows of capital. However, the token’s price was below its 20-day Simple Moving Average (SMA). Investors should exercise caution as another potential bearish trend might occur and could consider waiting for more definite signals before making a move.

Short-term outlook not favorable for ETC bulls

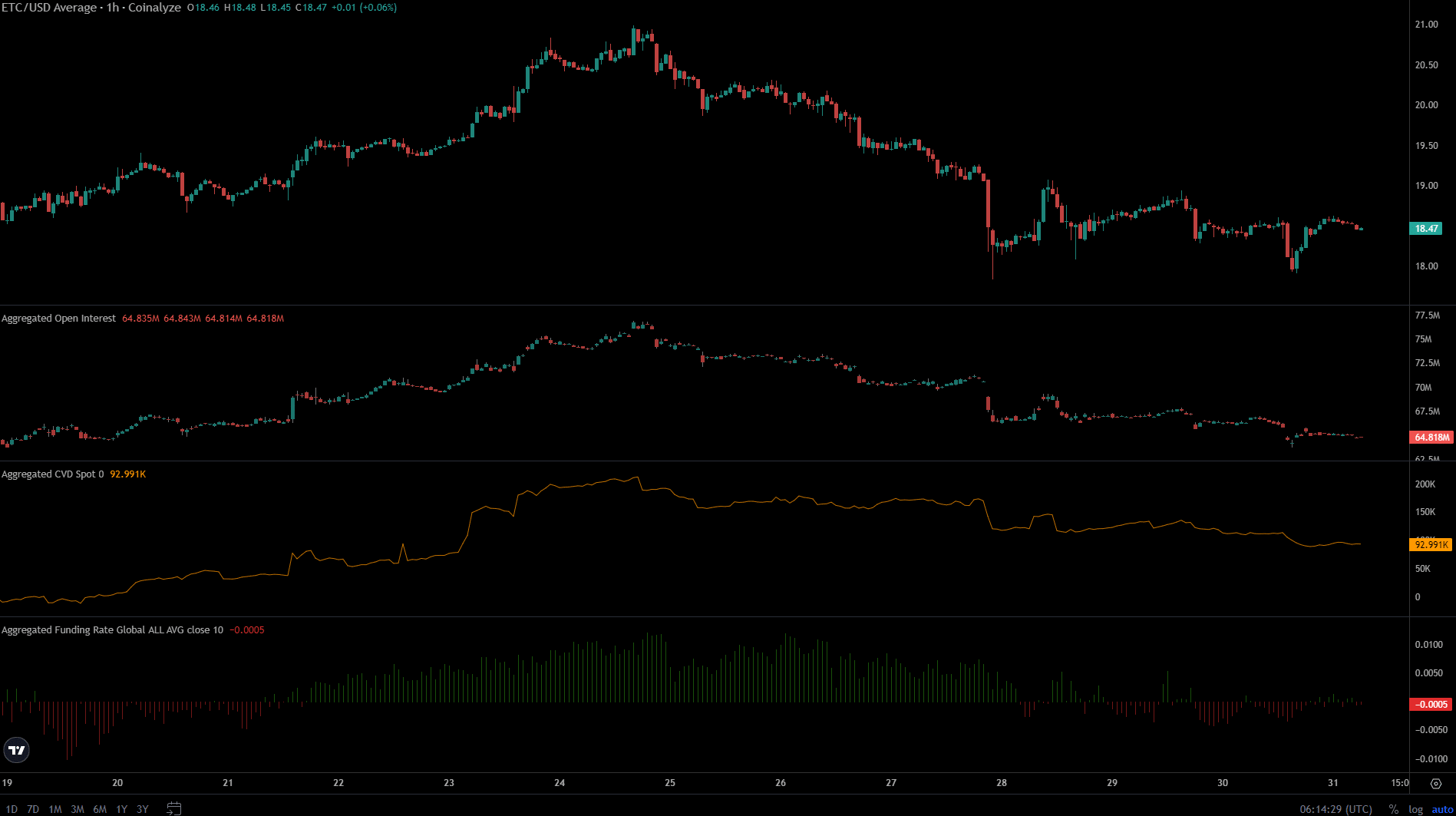

Over the last three days, Ethereum Classic has found it tough to surpass the $19 mark and has moved more significantly towards $18. This shift led to a decrease in Open Interest from $71 million down to $65 million, indicating a pessimistic market outlook.

Read Ethereum Classic’s [ETC] Price Prediction 2024-25

During this period, the funding rate showed a slight bias towards pessimism in the Futures market, strengthening the prevailing negative sentiment. Traders dealing with the spot market also showed little interest in purchasing ETC, and the spot CVD has been on a downward trajectory since then.

Overall, the trend of the next few days is likely to be sideways or downwards.

Read More

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- New Mickey 17 Trailer Highlights Robert Pattinson in the Sci-Fi “Masterpiece”

- The 5 Best Mission: Impossible Trailers Ranked

- SOL PREDICTION. SOL cryptocurrency

- Sea of Thieves Season 15: New Megalodons, Wildlife, and More!

- PI PREDICTION. PI cryptocurrency

- Is Trump’s Presidency a Game Changer for the US Dollar and Bitcoin?

2024-08-31 20:07