-

Ethereum Classic’s price increased by more than 3% in the last 24 hours.

ETC was awaiting its fourth halving, which is scheduled for the 31st of May.

As an experienced analyst, I believe Ethereum Classic’s (ETC) recent price surge of over 3% in the last 24 hours is a significant development that should not be overlooked. This happens while the market focuses on ETH and its ETF approval, but ETC has managed to outperform with its impressive price increase.

The king of altcoins, Ethereum [ETH], drew the focus of all spectators as the US Securities and Exchange Commission gave its nod to exchange applications for listing spot Ethereum ETFs. However, Ethereum Classic [ETC] subtly took center stage with a noteworthy price surge in recent days.

Does this mean a fresh rally for ETC?

Ethereum Classic’s response to ETF approval

The United States Securities and Exchange Commission (SEC) granted approval for the listing of Ethereum-based exchange-traded funds (ETFs) on May 23rd. Since this announcement, there has been much buzz surrounding this development. However, following the approval, the price of Ethereum experienced a downturn.

Instead of “However, Ethereum Classic reacted in a different manner,” you could say “On the other hand, Ethereum Classic displayed contrasting results.” Or, “While Ethereum experienced a downturn, Ethereum Classic saw significant gains.”

I. At present, Ethereum Classic (ETC) is being traded at a price of $32.07. Its market value exceeds $44.7 billion.

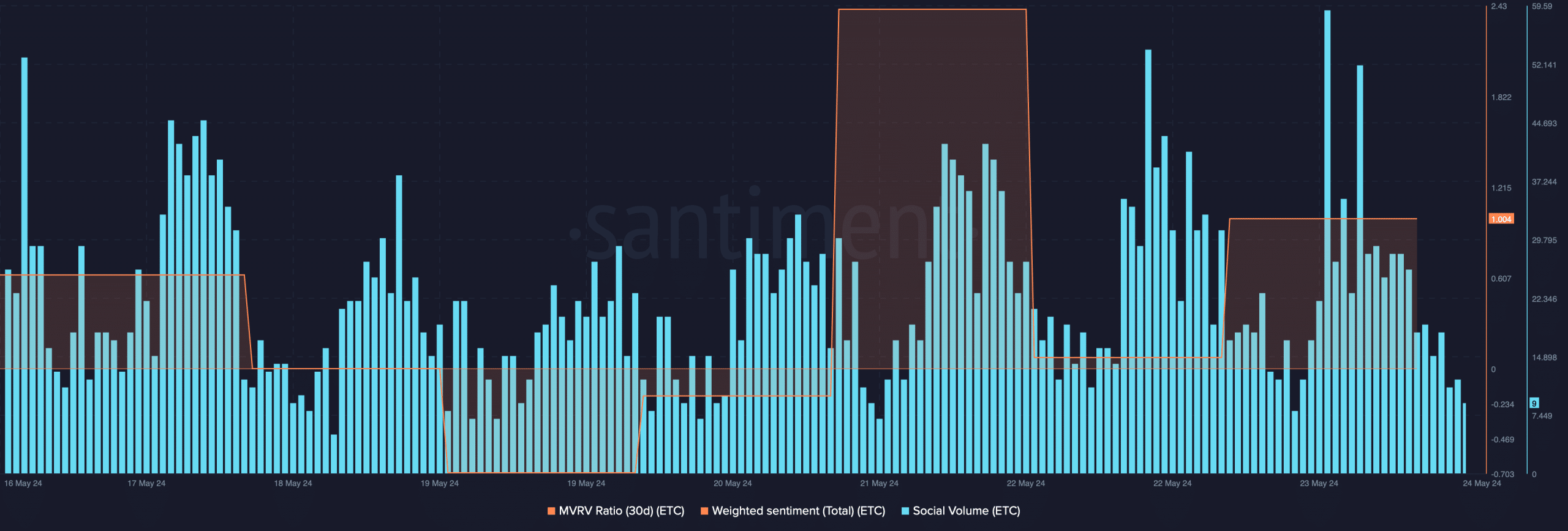

Due to the price hike, there was a significant surge in public interest towards it, highlighting its growing popularity. Furthermore, the overall sentiment toward it stayed favorable, implying that optimistic feelings prevailed within the market.

Ethereum Classic awaits halving

During this time, various events unfolded as Ethereum Classic prepared for its upcoming fourth halving, an event slated for May 31st, 2021. It’s important to note that the last such occurrence took place on May 11th, 2020.

The event could fuel optimistic feelings among investors, enabling the token to continue climbing in value during the next few days.

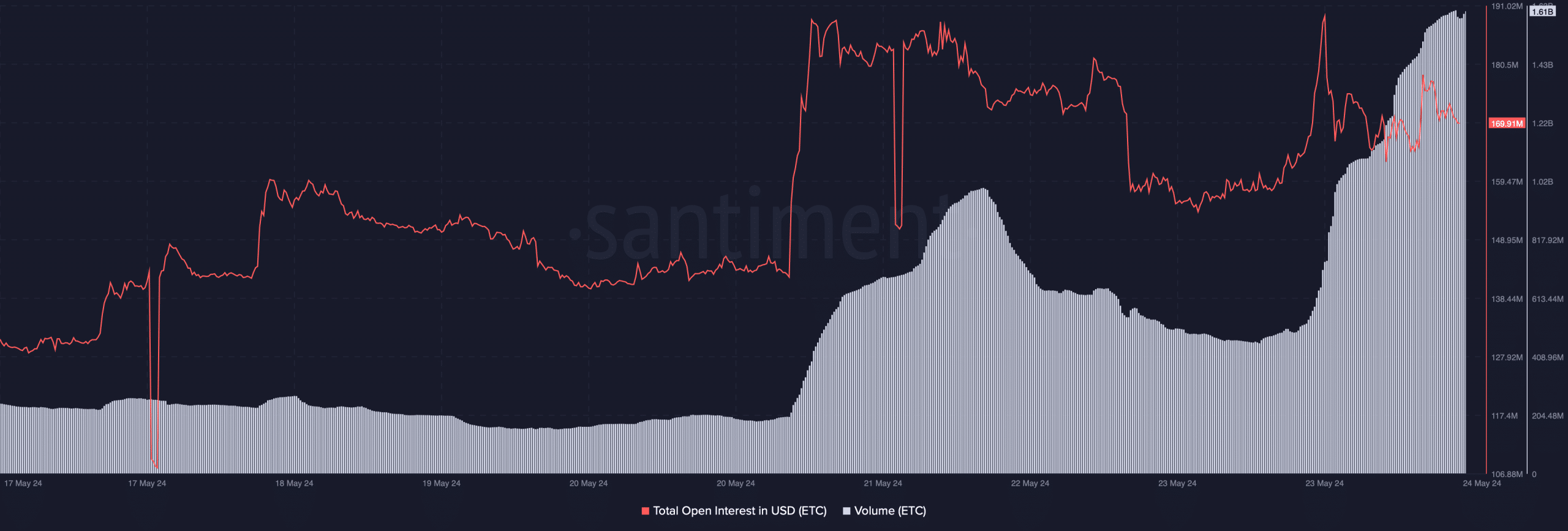

To determine if metrics were indicative of a sustained bull market for Ethereum Classic, AMBCrypto examined the data provided by Santiment. Notably, both the trading volume and price of Ethereum Classic experienced significant increases.

This is a positive sign, as an increase in trading activity can serve as the base for a bull market surge.

Additionally, the open interest level stayed elevated. This implies a strong likelihood that the current price trend will persist.

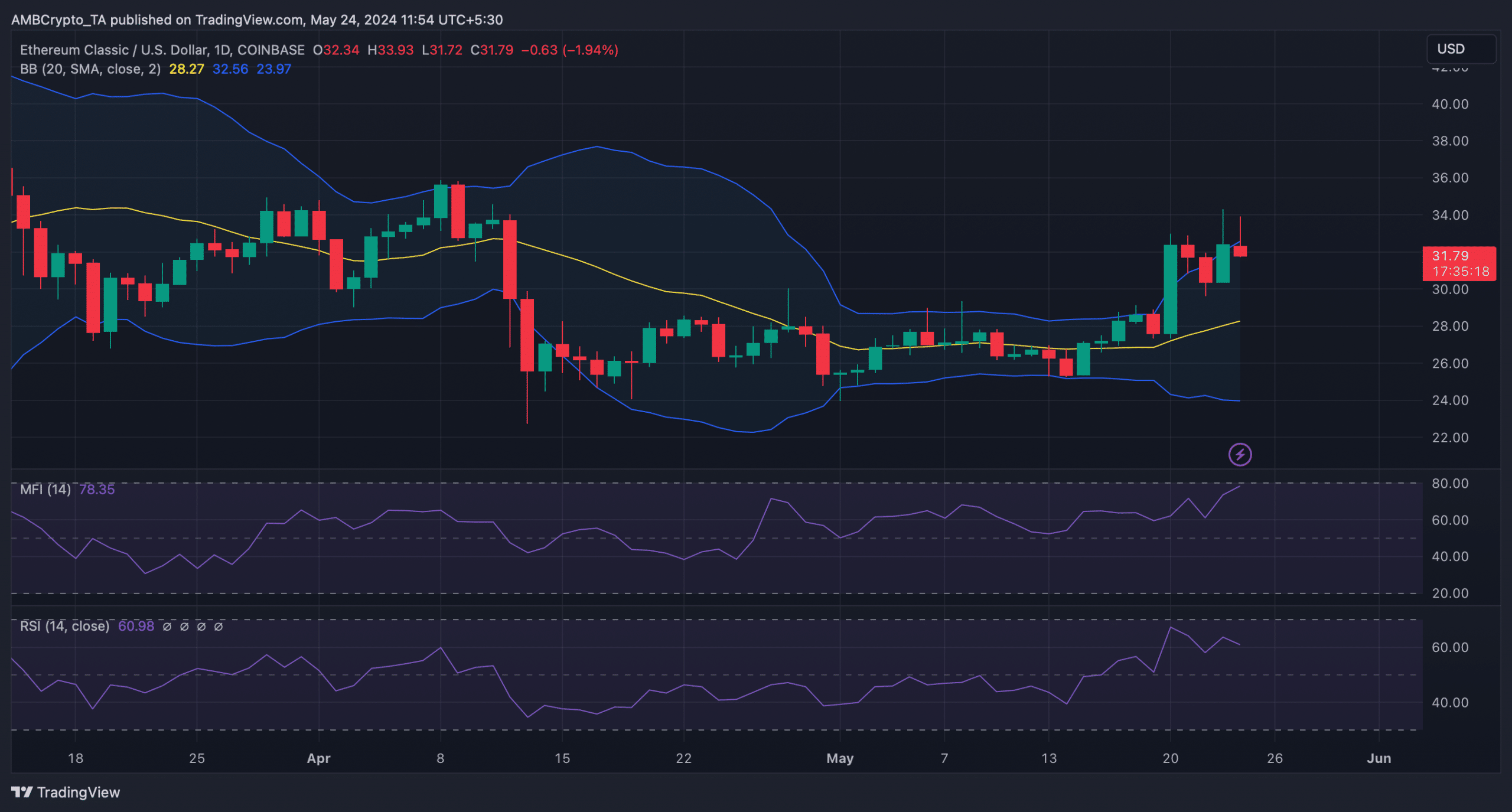

In addition to these indicators, the Money Flow Index (MFI) of Ethereum Classic experienced a significant surge, implying a potential increase in its price.

Although its Relative Strength Index (RSI) declined and the price of ETC approached the upper boundary of the Bollinger Bands, not everything seemed ideal. This price behavior might lead to potential issues.

Read Ethereum Classic’s [ETC] Price Prediction 2024-25

As a crypto investor, if Ethereum Classic (ETC) shifts to a bearish trend, I would expect to see its price potentially dropping down to around $29. It’s essential to note that at this price point, ETC could present an attractive buying opportunity for investors looking to capitalize on potential future price increases.

If the price falls more, Ethereum Classic (ETC) might reach a new low at around $27. On the other hand, if the bullish trend persists, ETC may initially hit the resistance levels of $34 to $35 within the next few days.

Read More

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- PI PREDICTION. PI cryptocurrency

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Masters Toronto 2025: Everything You Need to Know

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

2024-05-25 04:07