- Ethereum Classic is likely to face rejection at its former support zone

- OBV and Open Interest showed buyer enthusiasm was low

As an experienced market analyst, I believe Ethereum Classic (ETC) is poised for rejection at its former support zone of $22.9. The technical indicators and price action suggest a bearish trend, which could result in further losses for ETC bulls.

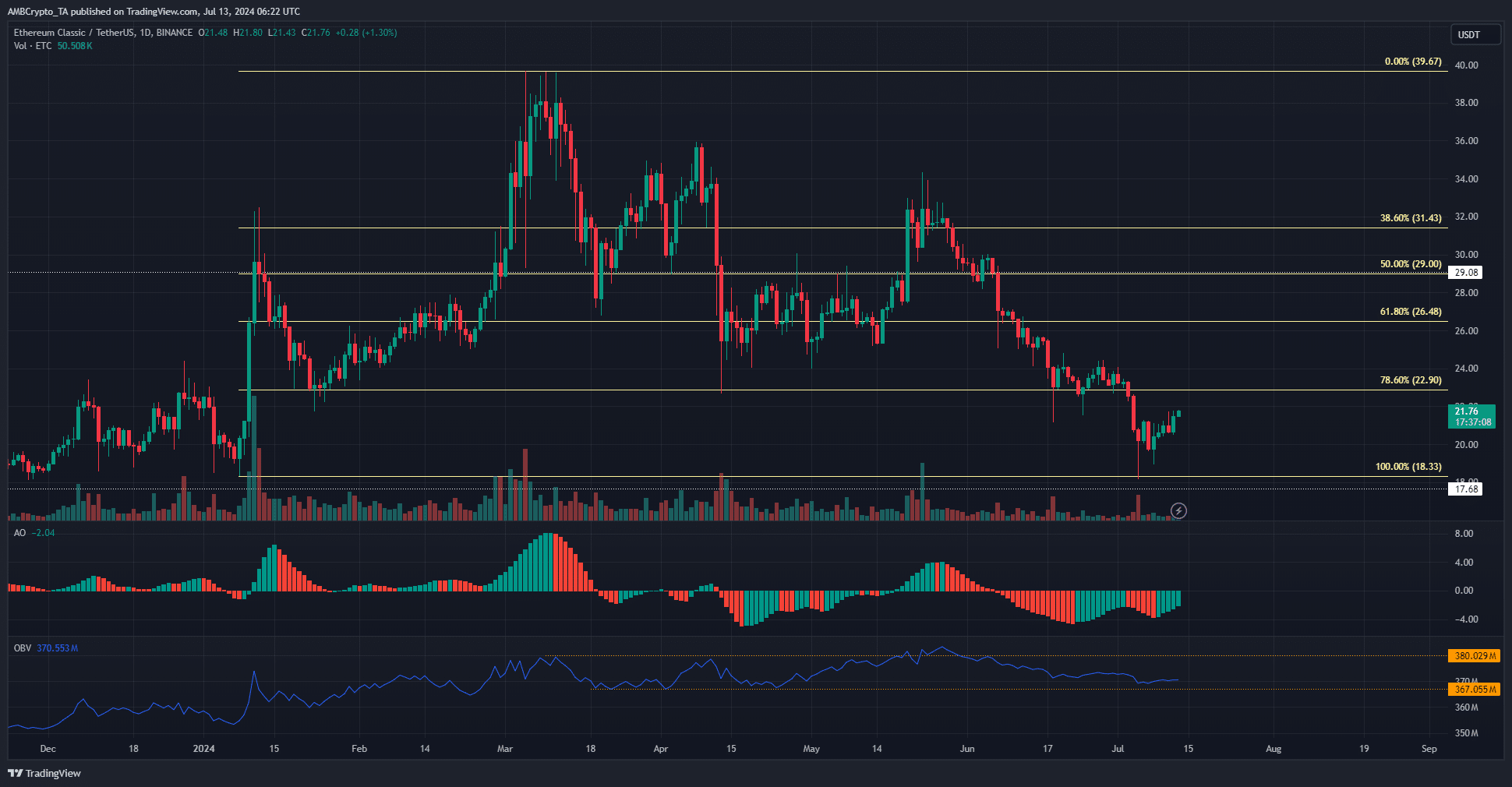

As an analyst, I would put it this way: Since reaching its peak price of $39.67 in March, Ethereum Classic [ETC] has completely erased all the gains it had made during the January to March rally, which saw its price surge from $18.33. Regrettably, demand from buyers has been insufficient since then.

If the price drops beneath $22.9, it appears more probable that a downtrend will continue instead of a rebound for ETC swing traders. Keep an eye on these key levels and corresponding situations:

Former support level is now the short-term bullish target

In April and then once more in June, the $22.9 level, representing a 78.6% retracement, was put to the test as a support line. Yet, the Awesome Oscillator and price movements suggested that a robust downtrend was unfolding in June.

At the 50% and 61.8% resistance levels, support was weak and gave way to sellers in July. Prices plummeted below $22.9, granting another triumph to the bears. The recent rebound from $18.3 does not necessarily imply that the bulls have regained control.

For Ethereum Classic swing traders, consider taking short positions around the $23.2 to $24.1 range instead. More cautious bear investors may prefer waiting for a bearish engulfing candle before initiating shorts. The On-Balance Volume (OBV) is barely holding above its three-month support line, while the Average Trend Indicator (AO) remains firmly below neutral zero, bolstering the bearish stance.

Open Interest at its lowest since October 2023

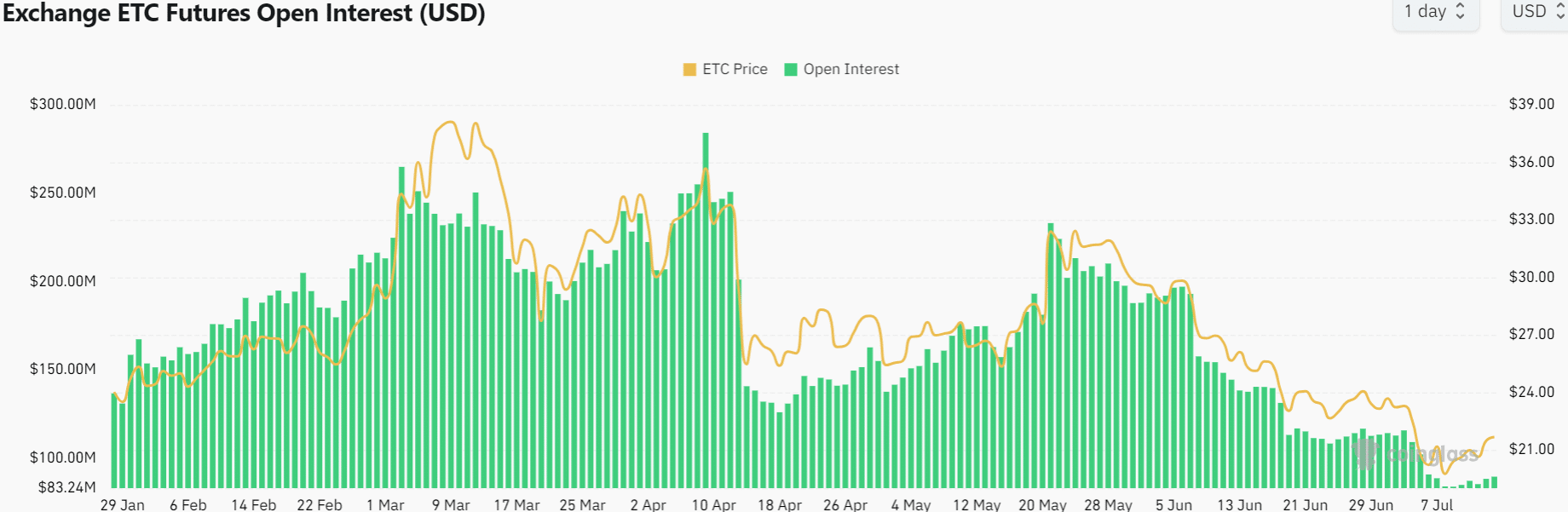

The Open Interest chart revealed the vulnerability of the bulls, with this figure declining consistently and amounting to $89.7 million as of the latest report.

Despite the 10.6% price hike over the past week, the speculators did not seem too keen to bid.

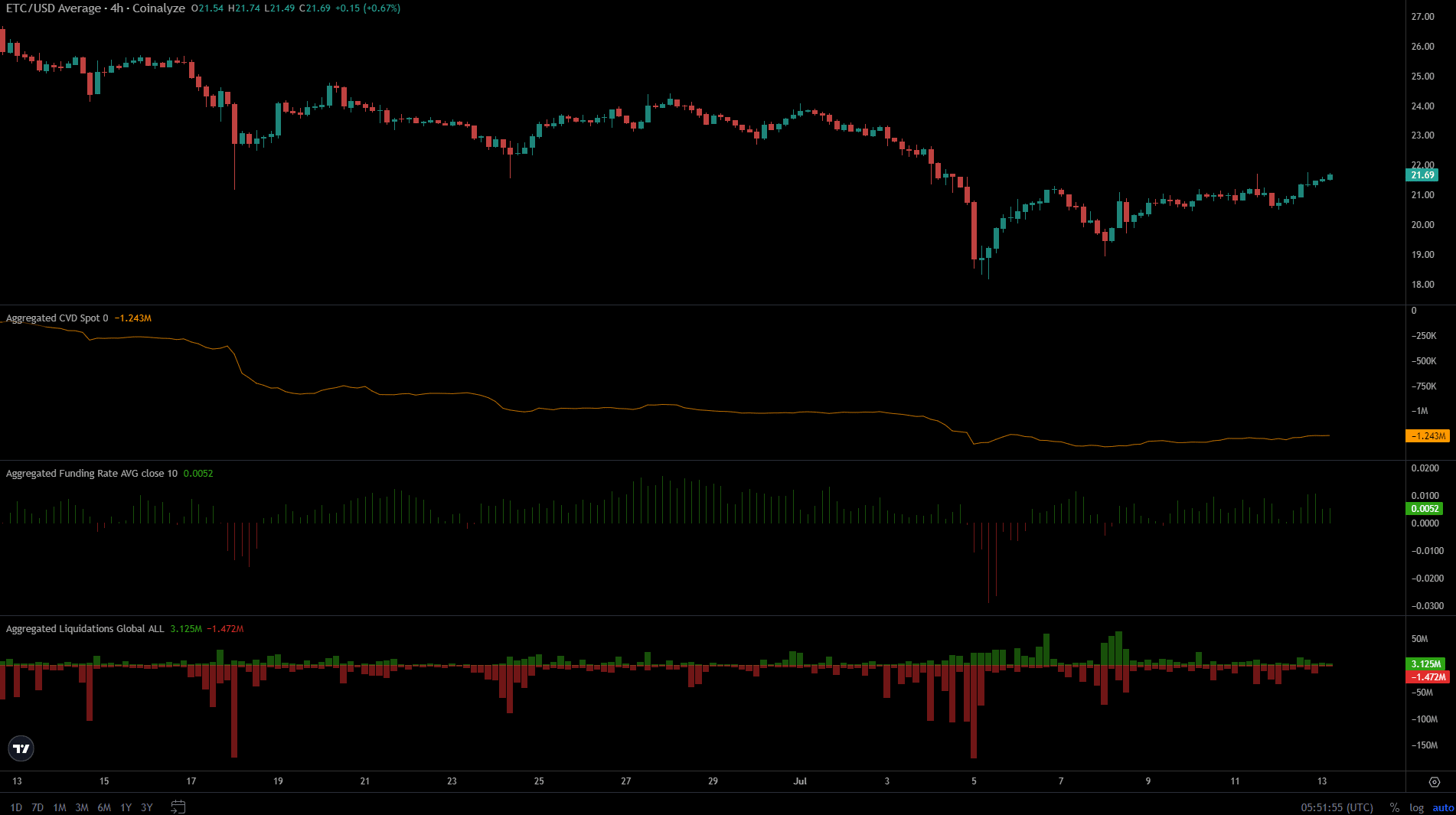

Over the last week, the price of CVD experienced a halt in its decline and began to rise again, with a positive funding rate indicating growing optimism among traders.

Read Ethereum Classic’s [ETC] Price Prediction 2024-25

As a crypto investor, I noticed some significant short liquidations on July 8 following the unsuccessful attempt to break past the $21 mark. This sudden sell-off could be indicative of market participants scrambling for liquidity, and as such, we should keep an eye out for a price spike that clears short positions. If this occurs, it may serve as a warning sign of a potential liquidity crunch in the opposite direction during our advance toward the $23 resistance area.

Read More

- Gold Rate Forecast

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Rick and Morty Season 8: Release Date SHOCK!

- PI PREDICTION. PI cryptocurrency

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Masters Toronto 2025: Everything You Need to Know

2024-07-13 14:47