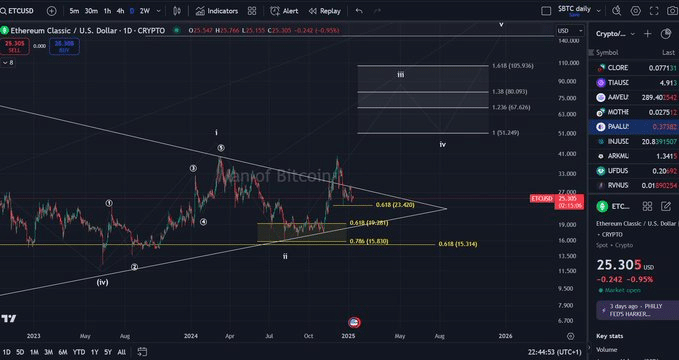

- Fibonacci retracement levels indicated areas of strong support and resistance, providing insights into future price movements.

- This declining MVRV ratio aligns with ETC’s price’s proximity to the 0.618 Fibonacci level, reinforcing the possibility of a rebound.

As a crypto analyst, I’ve observed some significant fluctuations in the value of Ethereum Classic (ETC), a well-known digital currency, which has piqued the attention of both traders and fellow analysts alike.

Each day’s graph shows the emergence of a descending triangle formation, which is typically an indicator of possible breakout chances.

Furthermore, the significant Fibonacci retracement levels highlighted potential zones for robust support and opposition, offering valuable insights about possible future price trends.

Fibonacci retracement analysis

Currently, the value of Ethereum Classic is frequently found close to the 0.618 Fibonacci support level, which is around $23.46 – a region that has traditionally shown robust resistance in the past.

At this stage, it frequently acts as a pivotal moment. If investors regain their trust, the bullish trend might pick up speed again.

If the price of ETC experiences a more significant drop beyond its current level, it might reach the next significant support at around 0.786 Fibonacci ratio, which is approximately $15.14. This substantial correction could be a reflection of broader market instability or external influences like regulatory pressures.

Positively speaking, if ETC manages to exceed the upper boundary of the triangle pattern, it might aim for the projected levels of wave iii, which could encounter resistance at approximately $37 and $63.

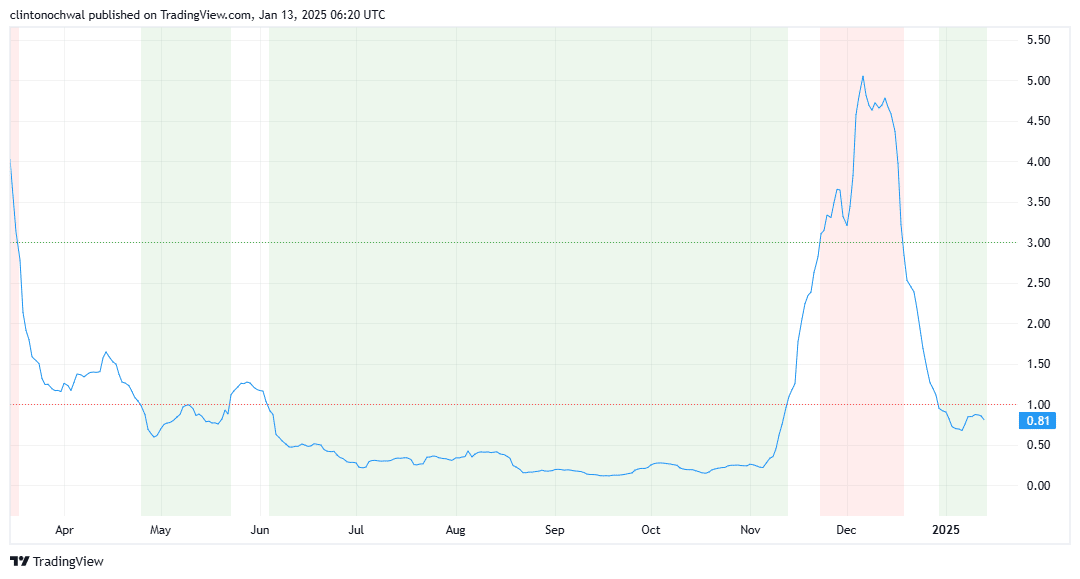

MVRV Ratio analysis

As a researcher, I’m observing an intriguing trend in Ethereum Classic (ETC). The MVRV (Majority Below-Cost Valuation) ratio is indicating that the asset may be underpriced. Historically, when this ratio drops below 1, it suggests that most investors are holding ETC at a loss. This scenario often precedes a price rebound, implying that ETC could be poised for a potential recovery.

As the MVRV ratio decreases, it seems ETC’s price is approaching the 0.618 Fibonacci level, suggesting that a potential increase may be imminent.

Long-term investors typically consider periods of undervaluation as excellent opportunities to invest. Yet, if this ratio keeps falling, it might be a warning sign for more price decreases, possibly reaching around $15.14.

Based on the present market setup and past patterns, Ethereum Classic may hold steady around its current price points prior to any potential surge. A change in investor attitude or increased altcoin activity might fuel a rapid increase.

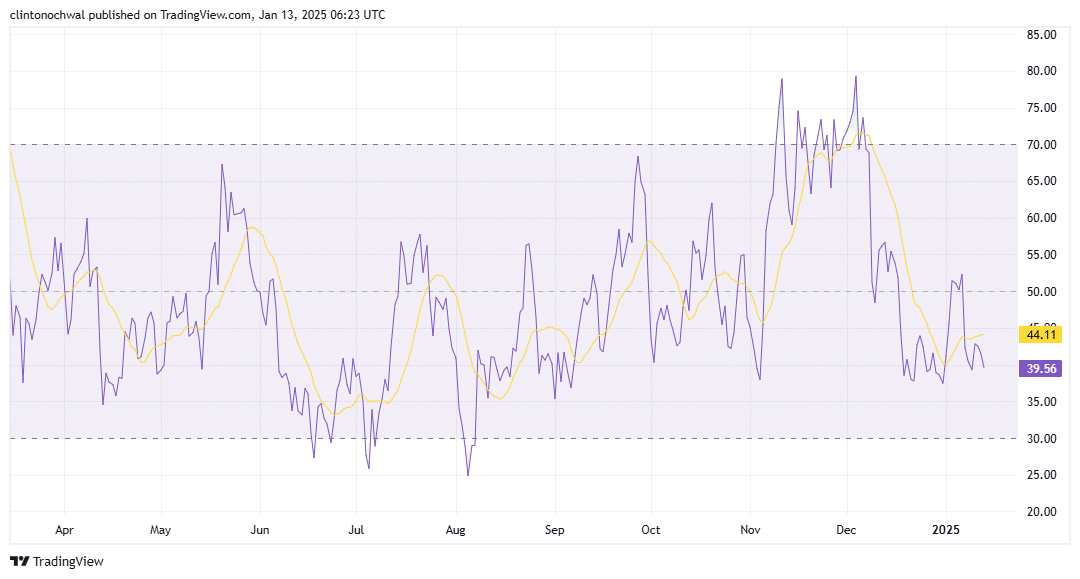

Relative Strength Index of ETC points to…

The Relative Strength Index (RSI) offers valuable information about the momentum of ETC, helping us determine if it’s moving too quickly in either a buying (overbought) or selling (oversold) direction.

At the daily scale, the Relative Strength Index (RSI) for ETC is presently around 40-50, indicating a neutral to slightly oversold trend. This mirrors the recent price drop and the assessment of the 0.618 Fibonacci level.

If the Relative Strength Index (RSI) falls below 30, it typically indicates an ‘oversold’ situation, a phase that frequently aligns with significant turning points in the price trend.

In this situation, there’s a higher chance we might see a recovery, possibly bouncing back from $23.46 or even falling as low as $15.14 if the downtrend continues.

In other words, when the Relative Strength Index (RSI) rises above 50, it may indicate a resumption of positive or bullish market momentum, which can strengthen the possibility of a breakout from the descending triangle chart formation.

External factors impacting Ethereum Classic’s movement

Although technical indicators offer useful information, it’s important to consider that external elements have also played a role in the recent price fluctuations of Ethereum Classic (ETC). The unpredictable nature of the cryptocurrency market, which is influenced by Bitcoin‘s dominance and broader economic trends, has led to a turbulent trading landscape for altcoins such as Ethereum Classic.

In significant financial hubs such as the United States, ambiguity surrounding regulatory issues has led to a decrease in investor trust, prompting numerous alternative cryptocurrencies to experience price drops due to selling pressures.

Additionally, the relatively slow growth in the development of Ethereum Classic’s ecosystem compared to other networks is making it less attractive for institutional investors, which in turn puts more pressure on its price.

Typically, Ethereum Classic (ETC) tends to reflect Bitcoin’s price movements. When Bitcoin fails to maintain its upward push beyond significant resistance points, it often leads to a weak response in the bull market for ETC as well.

On the other hand, a revived focus on Bitcoin or favorable market trends might serve as triggers for Ethereum Classic (ETC) to break free from its downward-sloping triangle formation.

Final thoughts

From my perspective as an analyst, the picture for Ethereum Classic appears to be somewhat nuanced. It exhibits signs of technical support, hints of undervaluation, and momentum that could potentially work in favor of traders. However, these positive aspects are countered by external challenges. In simpler terms, while there seems to be a foundation for optimism based on certain technical indicators, the broader market conditions pose significant hurdles.

– Realistic or not, here’s ETC market cap in BTC’s terms

Keeping an eye on the significant $23.46 point where the 0.618 Fibonacci level lies, as it’s bolstered by a moderately balanced RSI (Relative Strength Index) reading and a Multiple-Value-Ratios (MVRV) ratio hinting at potential undervaluation.

As a crypto investor, I’ve got my eyes firmly fixed on Ethereum Classic. Its resilience in holding current support levels and its potential to seize opportunities from market fluctuations hints at a possible breakthrough. This coin is definitely worth keeping an eye on for both short-term and long-term investors like myself who are looking for promising growth opportunities in the crypto space.

Read More

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Gold Rate Forecast

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

2025-01-14 08:08