-

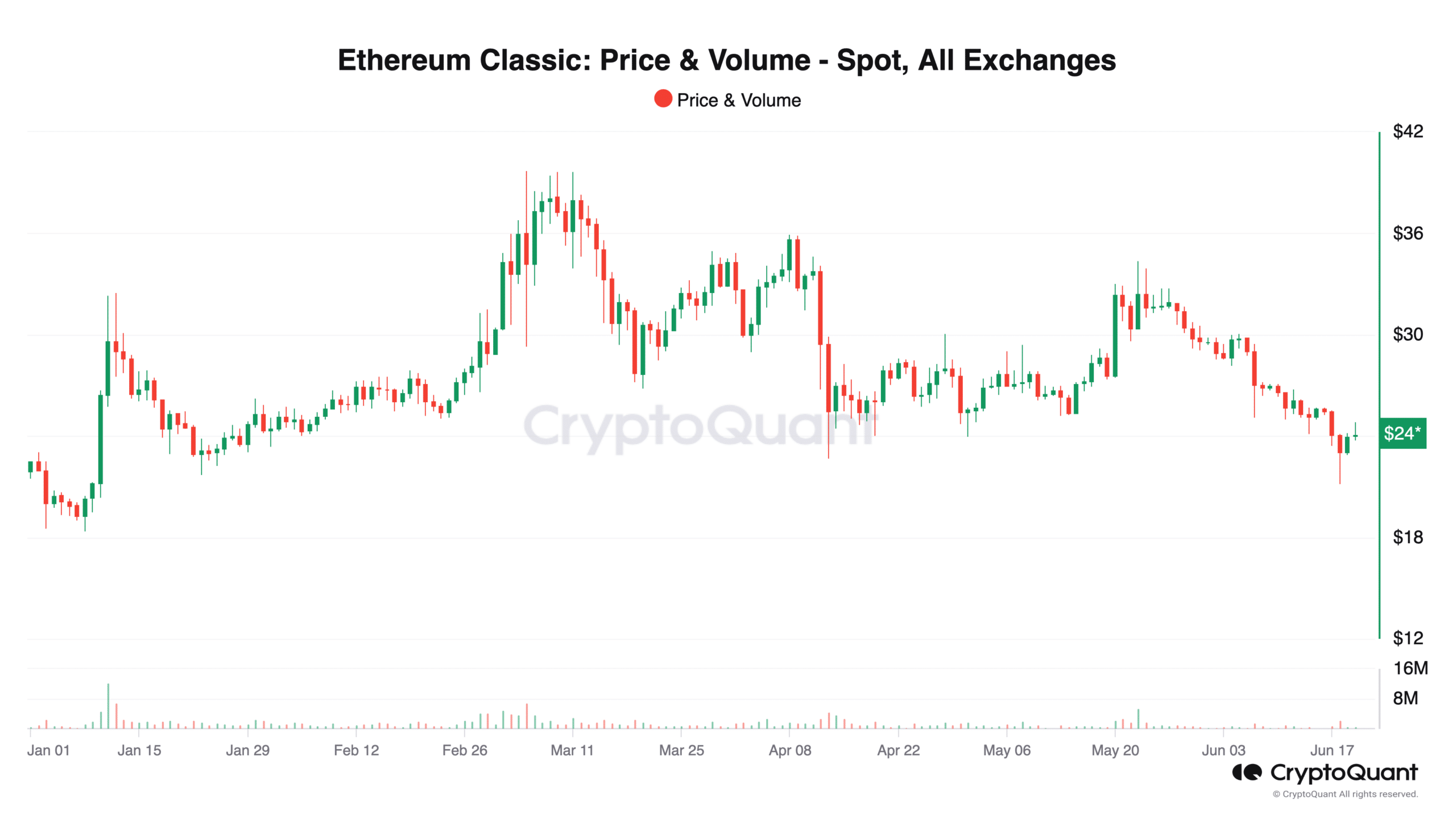

Ethereum Classic (ETC) flashed a general downtrend with decreasing price highs and lows, coupled with diminishing trading volumes

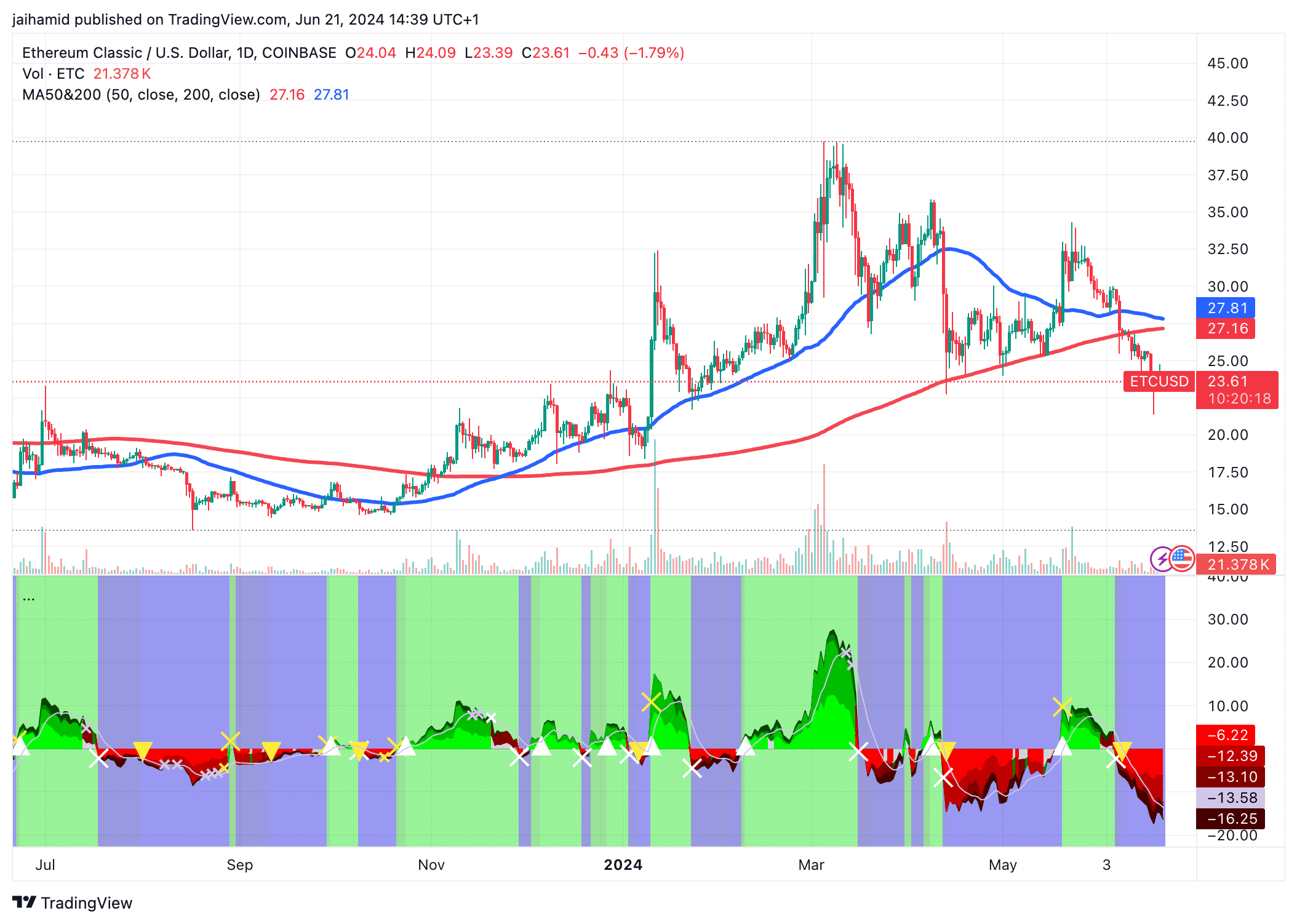

A bearish ‘death cross’ suggested a potential long-term downtrend

As an experienced analyst, I’ve seen my fair share of market trends and patterns. And based on the current state of Ethereum Classic (ETC), I believe we’re looking at a prolonged downtrend.

Ethereum Classic (ETC) has long been a reliable presence in the cryptocurrency sector, yet not typically forecasted to surge 100-fold. Nevertheless, there’s widespread belief that the market will experience significant growth by 2024, potentially even more than what we’ve seen so far. However, there’s been a recent downturn, and markets have taken a hit.

So, what about ETC? What’s its fate for the rest of the year?

Starting from late May, the pattern has shifted towards a bearish outlook for ETC‘s price as it reached successively lower highs and lower lows. This downward trend is a clear warning sign. Additionally, the volume of trading in ETC has been decreasing – A telltale symptom of waning investor enthusiasm and market exhaustion.

In a downtrend, a low trading volume may indicate hesitation among sellers to push prices down further, or it could signify a decreased interest from buyers to buy and reverse the trend.

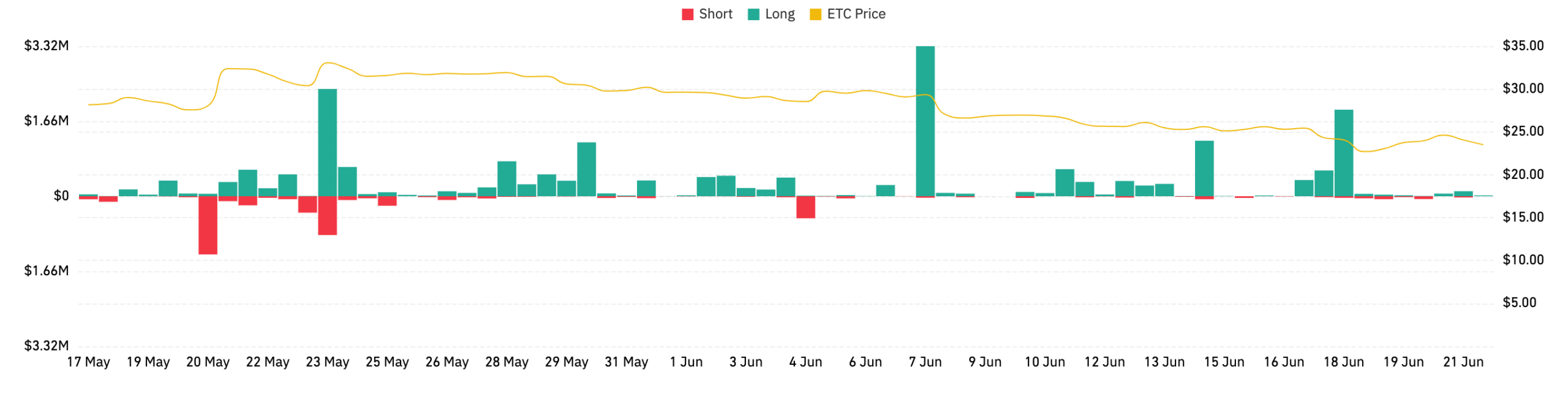

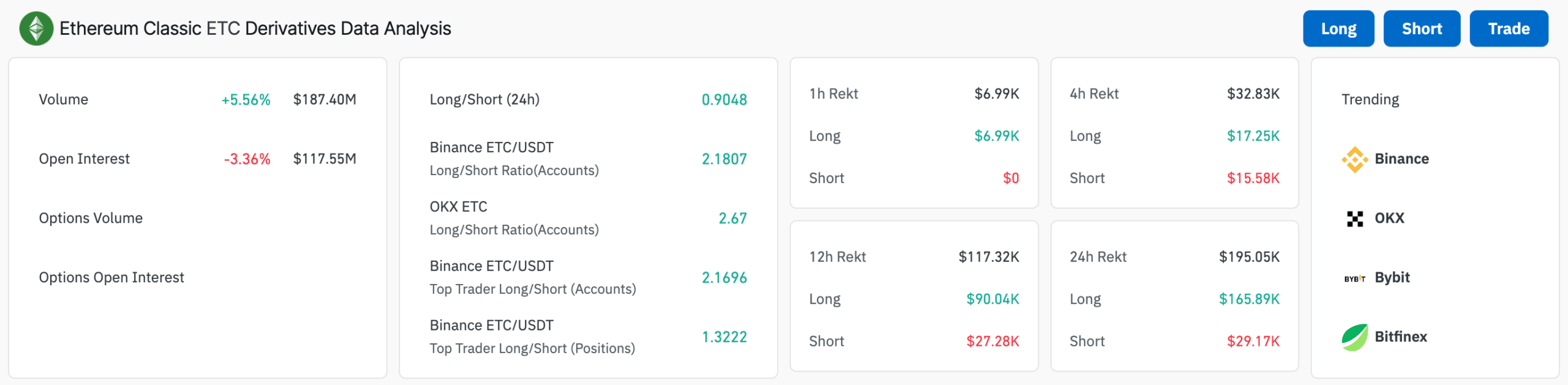

As a crypto investor, I’ve noticed that a 5.56% increase in ETC derivatives trading activity can be attributed to either buying or selling actions, which might be driven by speculation. This surge in trading seemed to coincide with a peak in ETC’s price chart, suggesting a potential speculative frenzy that didn’t last and resulted in the subsequent price drop.

Death Cross signals prolonged downtrend

Recently, the 50-day moving average has dropped beneath the 200-day moving average, signaling a bearish “death cross” in the chart. This trend reversal often indicates a prolonged period of declining prices.

In March, the price reached a high of approximately $35. Following this peak, there was a significant drop in price. Subsequently, the price stabilized around the $30 level. Later on, it fell beneath the 200-day moving average.

As a researcher studying market trends, I’ve noticed that the previous support levels have been surpassed and now hover around the $25 mark. These levels may potentially act as resistances during any price recovery attempts. Looking ahead, if the current bearish trend persists, the next significant support level could be found near the $20 threshold.

To summarize, the increase in sales volumes and the breaking of previous support levels indicate that bears are currently dominant in the market.

Read More

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- PI PREDICTION. PI cryptocurrency

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Masters Toronto 2025: Everything You Need to Know

2024-06-22 13:11