As a seasoned researcher with over a decade of experience in the crypto markets, I have seen my fair share of bull runs and bear markets. The current outlook for Ethereum Classic [ETC] is undeniably challenging, but it’s not all doom and gloom.

Unlike Ethereum [ETH], which forked a new version of its network following the DAO hack, Ethereum Classic [ETC] has preserved its original blockchain history.

Priced at $18 at press time, ETC significantly lagged behind Ethereum’s value of $2300.

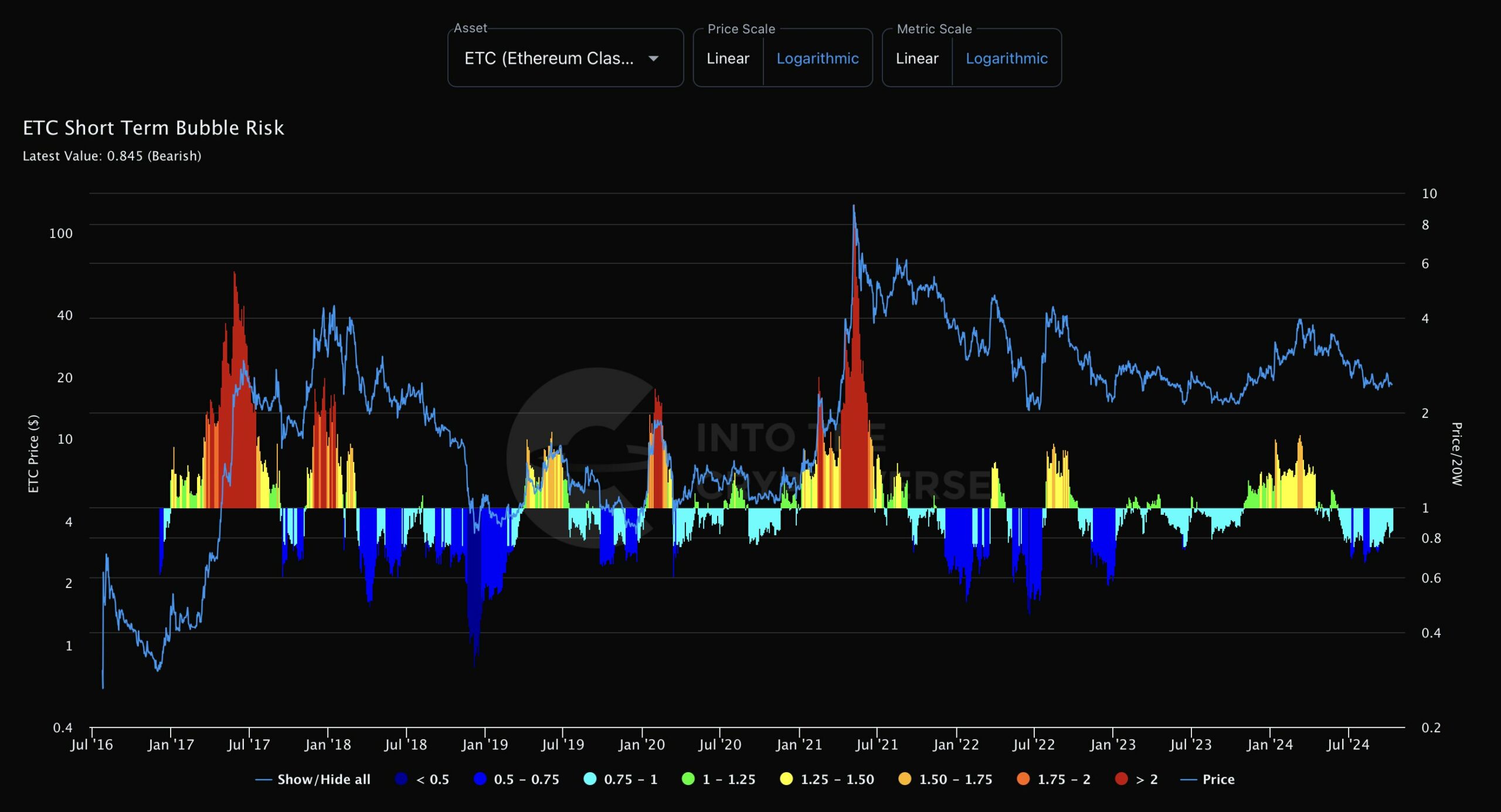

New findings suggest that the immediate risk of a bubble for ETC has shifted negative, possibly hinting at an ongoing decline or further drop in its price trend.

This pessimistic view is reinforced by multiple signs suggesting a continued drop. Ever since reaching $186 in April 2021, Ethereum Classic (ETC) has consistently moved downwards.

The value of ETC relative to Bitcoin (BTC), the foremost cryptocurrency, is likewise decreasing. This downward trend reflects Ethereum’s (ETC) overall performance, underscoring Bitcoin’s prevalent influence throughout the market.

Although cryptocurrencies often see increases in value during the last three months of the year, Ethereum Classic’s current undervaluation might mean it won’t adhere to this trend.

Historically, Bitcoin’s performance tends to impact other cryptocurrencies. However, ETC appears susceptible to persistent fall even though there’s typically a sense of optimism during the fourth quarter.

ETC below weekly MAs, but trendline broken

It’s clear that ETC is showing further indications of vulnerability in its moving averages. At the moment of reporting, it was trading beneath all its Simple Moving Averages (SMA), even the 8-day SMA, suggesting a downward or bearish pattern.

The decline in Ethereum Classic’s price underscores an elevated risk level for traders currently investing or planning to invest, with the hope of realizing profits by the end of Q4.

For Futures traders, shorting ETC might be a viable option, especially since trading below moving averages typically signals a bearish trend direction.

Despite the current challenges, Ethereum Classic maintains a flicker of optimism. An examination of the ETC/USDT market reveals a recent breach of a downward trendline that had kept its value in check since May 2024.

A break in the trendline frequently indicates a possible market shift, and ETC surpassing $18 might hint at the formation of a base. If the cost persists above this point, there’s a chance it could surge to $25, potentially providing returns exceeding 40%.

Conversely, should ETC not maintain its present support and drop beneath the significant $18 mark, there could be a continuation of the downward trend. Breaching this crucial level is likely to trigger more depreciation in the price.

Read Ethereum Classic’s [ETC] Price Prediction 2024–2025

Even though Ethereum Classic has substantial potential for a downturn, it could still experience a brief uptrend if the overall market situation strengthens favorably.

The future of Ethereum Classic is primarily influenced by market trends and the success of prominent digital currencies, as it usually is.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Elden Ring Nightreign Recluse guide and abilities explained

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

2024-10-10 23:35