-

Ethereum’s price surged nearly 30%, coinciding with significant SEC regulatory updates.

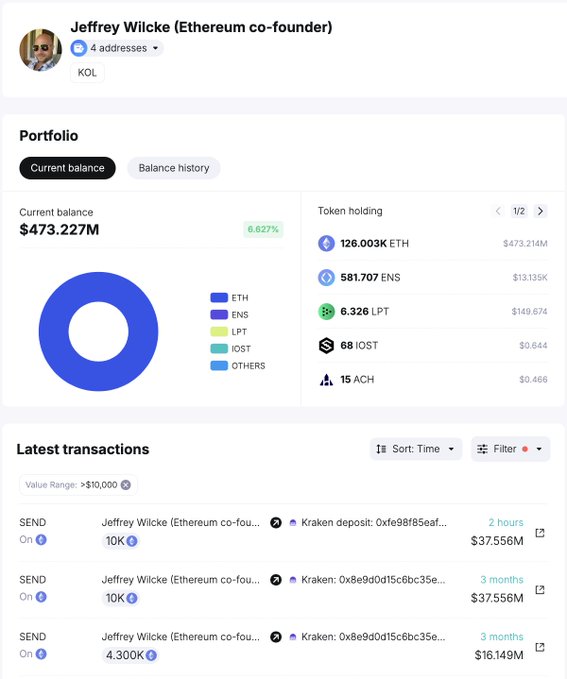

Co-founder Jeffrey Wilcke capitalized on the rally by depositing over $75 million worth of ETH into Kraken.

As an analyst with experience in the cryptocurrency market, I find Ethereum’s recent price surge and the regulatory updates surrounding it to be a significant development. The nearly 30% increase in ETH‘s value within a week is noteworthy, especially when considering the U.S. Securities and Exchange Commission’s (SEC) revised stance on Ethereum spot ETFs.

The cryptocurrency market has been buzzing with Ethereum’s [ETH] recent price surge.

The value of the asset surged by nearly 30% over the past week, rising from approximately $2,900 last Tuesday to a peak of $3,810 on Wednesday.

This uptick coincided with significant regulatory movements.

As an analyst, I’ve observed that the U.S. Securities and Exchange Commission (SEC) has shifted its position regarding Ethereum spot Exchange-Traded Funds (ETFs), leading exchanges to amend their 19b-4 applications in response.

Several applications from Ethereum ETF providers have been recently updated this week. A decision regarding the approval of VanEck’s Ethereum ETF is anticipated soon.

Institutions like Standard Chartered already predicted that an Ethereum ETF approval is imminent.

As a financial analyst following the Ethereum market closely, I’ve noticed some significant regulatory advancements recently. Among these developments, Jeffrey Wilcke, one of Ethereum’s co-founders, has gained attention due to reports suggesting that he liquidated some of his holdings during this price surge.

Detailing the Ethereum co-founder’s transactions

Approximately 10,000 Ether tokens, equivalent to around $37.38 million, were moved from Wilcke’s account to the Kraken exchange by SpotonChain, with each Ether exchanging for roughly $3,738 during the transaction.

Starting from early 2024, Wilcke transferred a sum of 24,300 Ether, equivalent to approximately $75.52 million, to the Kraken platform.

As a researcher studying Wilcke’s transactions, it appears that he adopted a strategy to maximize profits as the Ethereum prices continued to surge. Despite maintaining a significant Ethereum stash of around 126,000 ETH, worth approximately $473 million at the time.

As a crypto investor, I’ve been keeping a close eye on Ethereum co-founder Jeffrey Wilcke’s latest moves in the market. His recent actions have left me pondering his investment strategy.

As a researcher observing Wilcke’s actions, I notice that he has been transferring substantial quantities of Ether (ETH) into Kraken exchange. This move suggests that he is capitalizing on the recent price surge by purchasing more ETH at its current value.

The sequence of his deposits indicates a strategic move, with the earliest ones made when ETH‘s value was relatively low, and the latest one happening just before a major price increase.

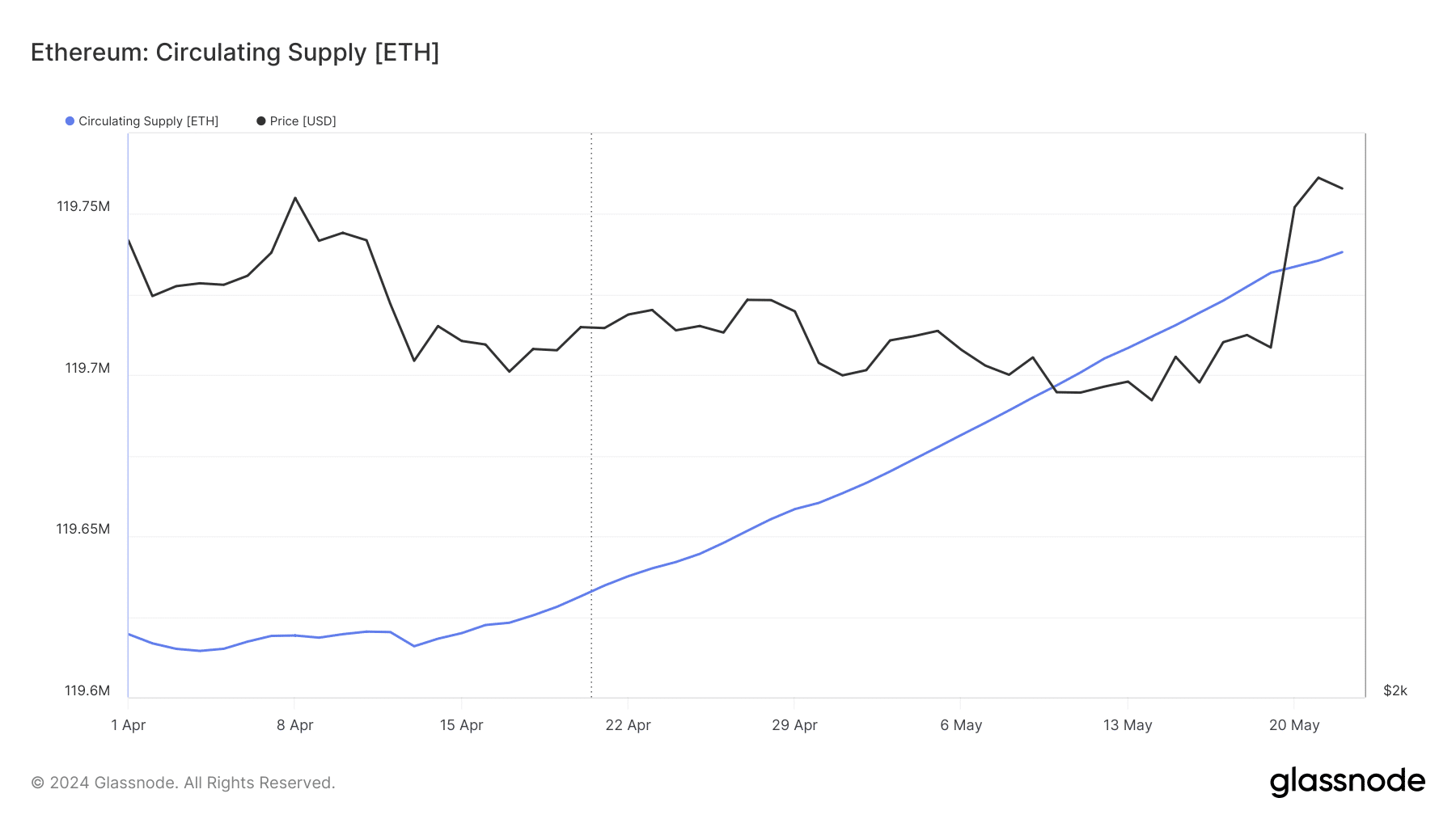

Over the past month, a noteworthy rise in Ethereum’s circulating supply, as observed by AMBCrypto through Glassnode data, might typically lead to a decrease in its price due to market supply and demand dynamics.

Despite a rise in Ethereum’s supply, its price has similarly climbed up, indicating that demand has remained consistent with the growing accessibility.

As a crypto investor, I recognize the importance of keeping a close eye on the balance between supply and demand in the market. A healthy market is one where new supply is effectively absorbed by increasing demand, ensuring price stability.

Market trends and technical analysis

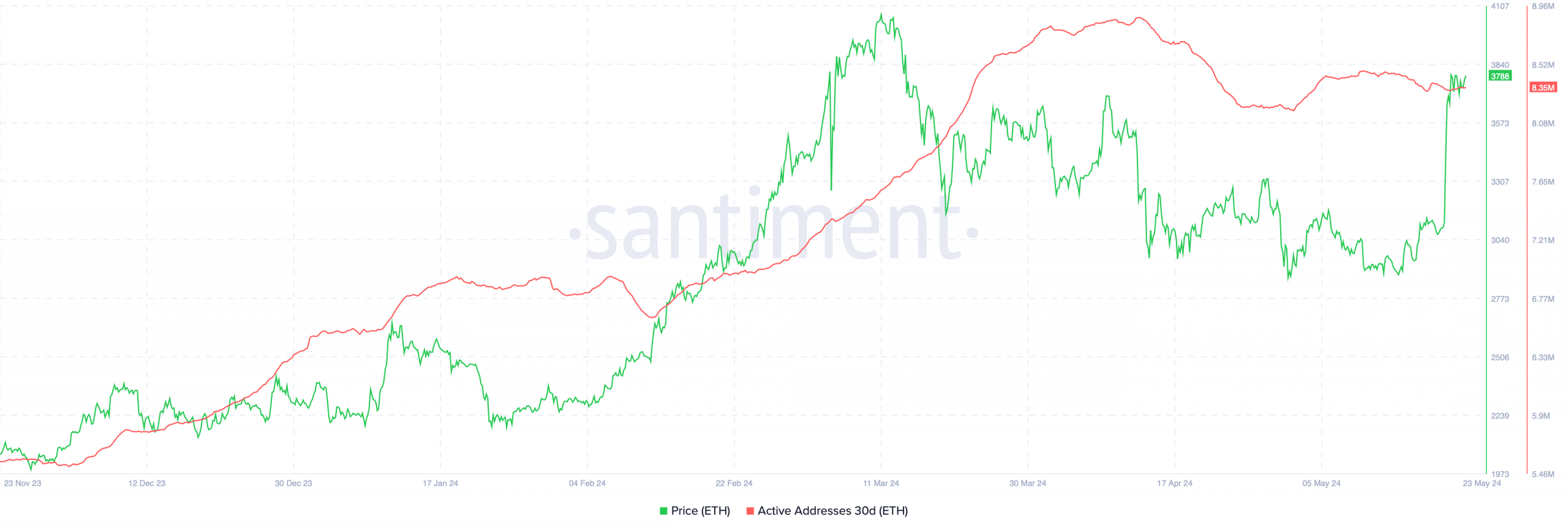

Ethereum’s market behavior is fascinating, given the rise in its circulating supply and the surge in active user addresses.

The number of active Ethereum addresses has significantly increased from approximately 7.9 million in March to around 8.9 million in April, but it has since dipped slightly to roughly 8.35 million as of the present moment.

A decline in the number of active Ethereum addresses, while the supply increases, serves as a significant sign of decreased demand. Consequently, Ethereum may experience a price adjustment or correction from its current market value if this trend persists.

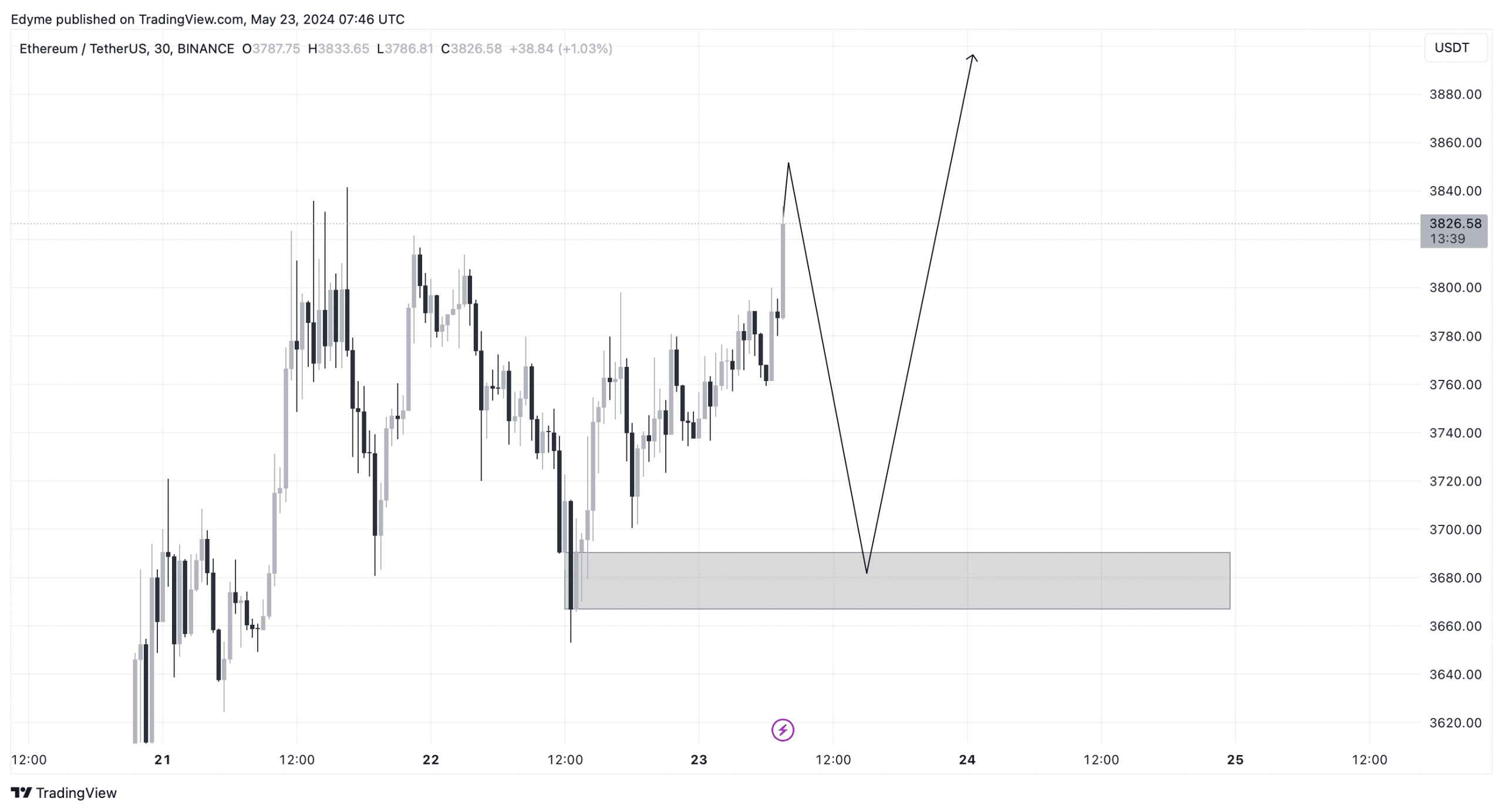

As a researcher studying Ethereum’s price action, I identified a bullish trend in its 30-minute chart. This was indicated by multiple instances of the price breaking through resistance levels and moving higher.

Alternatively, according to AMBCrypto’s forecast, Ethereum might experience a pullback towards approximately $3,600. This area is considered significant due to its high liquidity, which may serve as the catalyst for further growth.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

2024-05-23 18:16