-

ETH’s inflationary state persisted as issuance remained 3X the burn rate.

Analysts were bullish on ETH post-ETF approval, but short-term drop could not be overruled.

As an experienced analyst, I have closely followed Ethereum’s [ETH] price action and network fundamentals for quite some time. The recent debate surrounding Ethereum’s inflationary state, in light of the ongoing ETF approval speculation, is a topic that has piqued my interest once again.

The discussion about Ethereum‘s [ETH] inflationary nature has resurfaced once more on social media platform “Crypto Twitter,” fueled by rumors of an upcoming ETH Exchange-Traded Fund (ETF) approval.

Significantly, Ethereum’s Chief Investment Officer, Matt Huogan, disclosed that the cryptocurrency’s daily issuance is around $10 million.

“Total ETH issuance is ~$10 million per day. That’s before you consider the burn.”

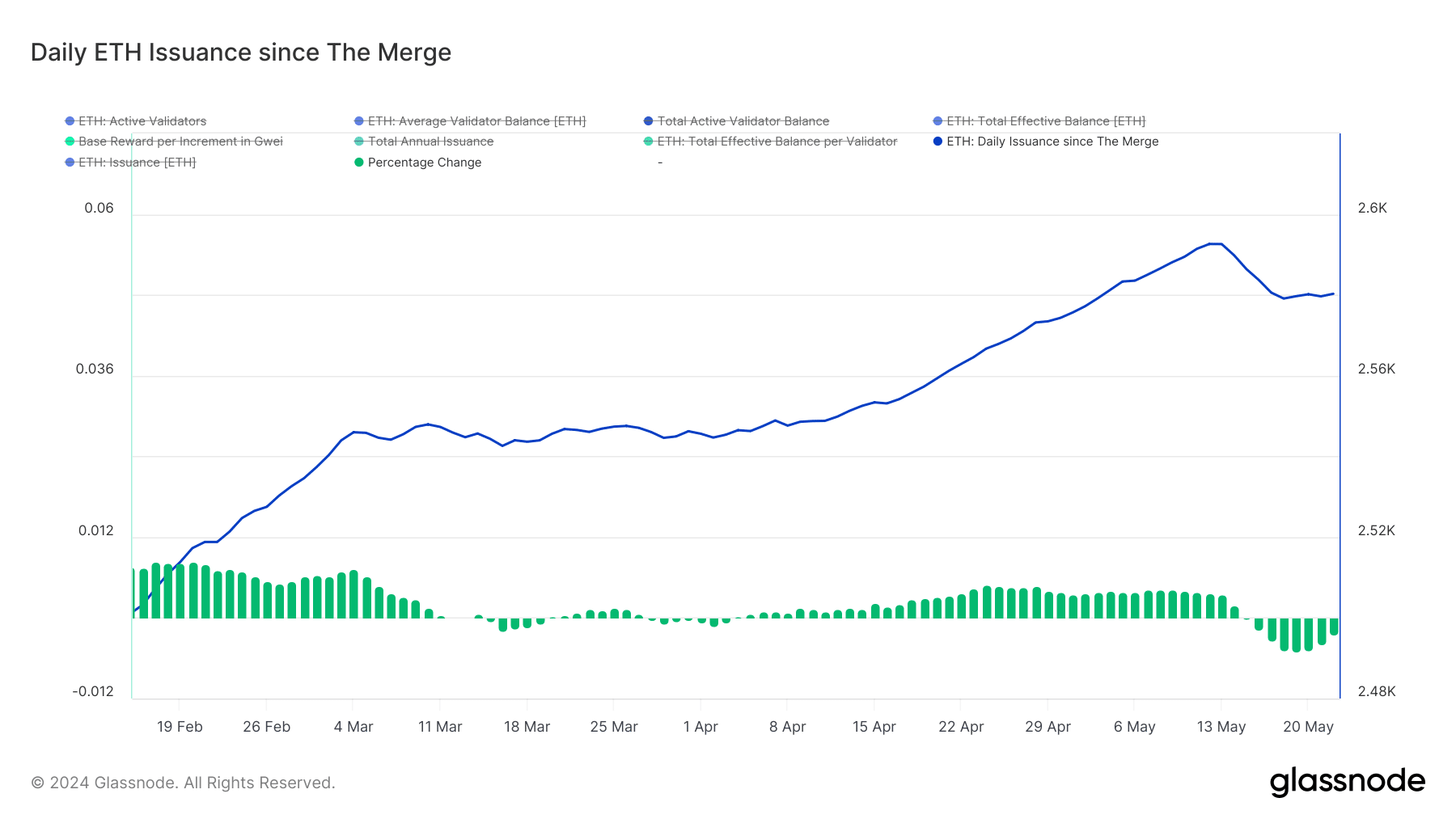

According to Glassnode’s verification, Hougan’s statement held true: The daily production of Ethereum on the 22nd of May amounted to approximately 2,580 Ether, as reported by the reputable crypto data provider.

Based on press time market prices of $3.7K, that translated to $9.5 million.

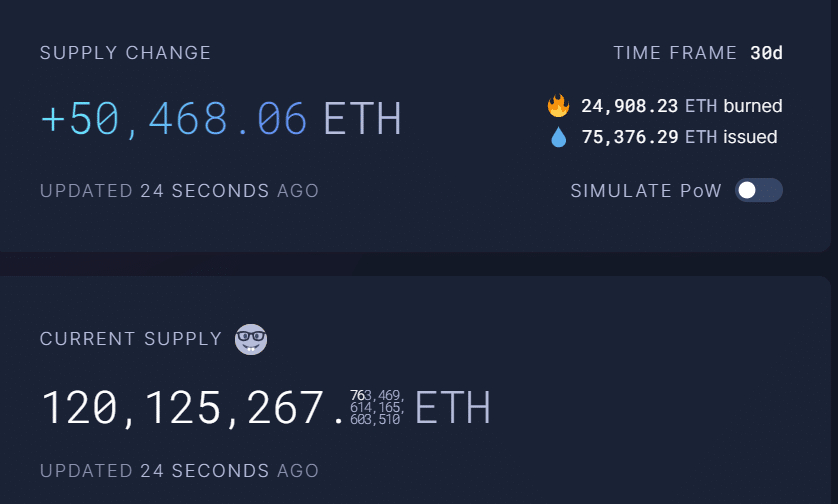

Following the Denver upgrade, Ethereum no longer maintained its deflationary nature because the speed at which Ether was being destroyed (burn rate) fell behind the rate at which new Ether was being generated (issuance rate).

Over the past thirty days, the Ethereum issuance on our network outpaced its burn rate by a factor of three. This pattern was also evident in the seven-day data.

It meant that there was more ETH supply that could derail further price prospects.

Following the Merge in 2022, ETH‘s issuance shifted to a deflationary stance, which Arthur Hayes, founder of BitMEX, identified as a significant factor fueling the subsequent bull run for ETH.

Adriano Feria, one of the Ethereum instructors, pointed out that it might take several months before Ethereum (ETH) becomes deflationary once again.

ETH to rally 75% post-ETF approval confirmation?

Despite the inflationary nature, the approval of the ETF could be a significant catalyst, potentially leading to a large surge in price.

Based on Bernstein’s analysis as a private investment firm, Ethereum (ETH) might experience a 75% surge and reach a price of $6,600 following its approval, drawing a parallel to Bitcoin‘s (BTC) price behavior after the Bitcoin ETF was launched.

As a crypto investor, I’ve noticed that QCP Capital, a leading crypto asset trading firm, has expressed a shared perspective regarding market trends, although their specific take might differ depending on Ethereum’s funding rates and volume fluctuations.

Based on the latest announcement from the company on Telegram, Ethereum’s price may experience stability in the near future and potentially surge in the intermediate term.

As a researcher studying the Ethereum Perpetual Futures (ETH Perp) market, I’ve observed an intriguing development: the funding rate dropped from 50% to zero within just a 12-hour timeframe. However, long positions held by traders during the month of June are still generating a yield of around 15%. This could suggest that short-term speculation has waned, but medium-term bullishness remains strong.

Traders in the futures market anticipated ETH‘s price increase in the upcoming weeks based on this information. Nonetheless, QCP Capital cautioned about potential short-term fluctuations causing a decrease in ETH’s value.

Ethereum’s large investors, or “whales,” have been preparing for potential Ethereum Exchange Traded Fund (ETF) approval by increasing their holdings. If the ETF receives confirmation, the price of Ethereum could surpass the $4,000 mark.

Currently, Ethereum is holding steady around $3,800 in value, marking a 22% decrease from its previous peak of $4,867 during the prior market cycle.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

2024-05-23 17:44