-

Activities related to NFT trading and staking ensured the rise in dApp activity.

While new demand for ETH fell, withdrawals from exchanges jumped.

As a researcher with experience in blockchain analysis, I’ve been closely monitoring the trends in the Ethereum [ETH] network, and based on recent data, it appears that Ethereum is currently leading other blockchains in terms of dApp volume. This surge in dApp activity can be attributed to the rise of Non-Fungible Token (NFT) trading and staking.

As a blockchain analysis expert, I’ve observed a significant surge in Ethereum [ETH]’s activity over the past week. The dApp (decentralized application) volume on this platform has spiked by an impressive 92.43%. To put it into perspective, these applications are decentralized and run autonomously on the blockchain, making Ethereum a standout choice among other options in the market.

Applications that run on a blockchain network utilize smart contracts for trading and user interactions, resulting in high volumes due to affordably priced transactions.

Ethereum beats BNB Chain, others to the spot

As a financial analyst, I’d rephrase that as: I’ve observed that users don’t have to bear excessive costs for executing token trades or transfers on the chosen platform. Notably, during periods of sky-high transaction fees on Ethereum, some alternative chains managed to offer more cost-effective solutions.

This time around, the preeminence of Ethereum might be attributable to the affordable gas fees instated following the Denasis upgrade in March. Currently, the total value locked in Ethereum’s decentralized applications amounts to $71.13 billion.

The value of this asset surpassed those of BNB Chain, Polygon (MATIC), and Tron (TRX) significantly. Yet, AMBCrypto pointed out that not all application sectors experienced uniform growth.

As an analyst, I’ve observed some significant surges in the usage of dApps such as Blur, EigenLayer, and Uniswap (UNI) when it comes to NFT aggregation. Conversely, Uniswap V2 and V3 have experienced a downturn instead.

The data indicated a substantial increase in NFT trading and staking activities, which significantly contributed to the volume surge. In contrast, the exchange of tokens on the blockchain did not approach these levels.

As a researcher studying the behavior of users on this network, I anticipated observing a significant reduction in the number of unique active wallets (UAW). This metric represents the level of engagement and activity among network users.

As a researcher observing user activity on Ethereum, I’ve noticed that an uptick indicates a surge in transactions. Conversely, a downturn implies a decline in active engagements, which was the situation we encountered with Ethereum.

ETH caught in between two sides

Meanwhile, ETH’s price changed hands at $3,365 which was a 2.32% decrease in the last 24 hours.

Despite expectations that Ethereum’s price may rise this month, it could instead remain stable or even drop further based on current market trends.

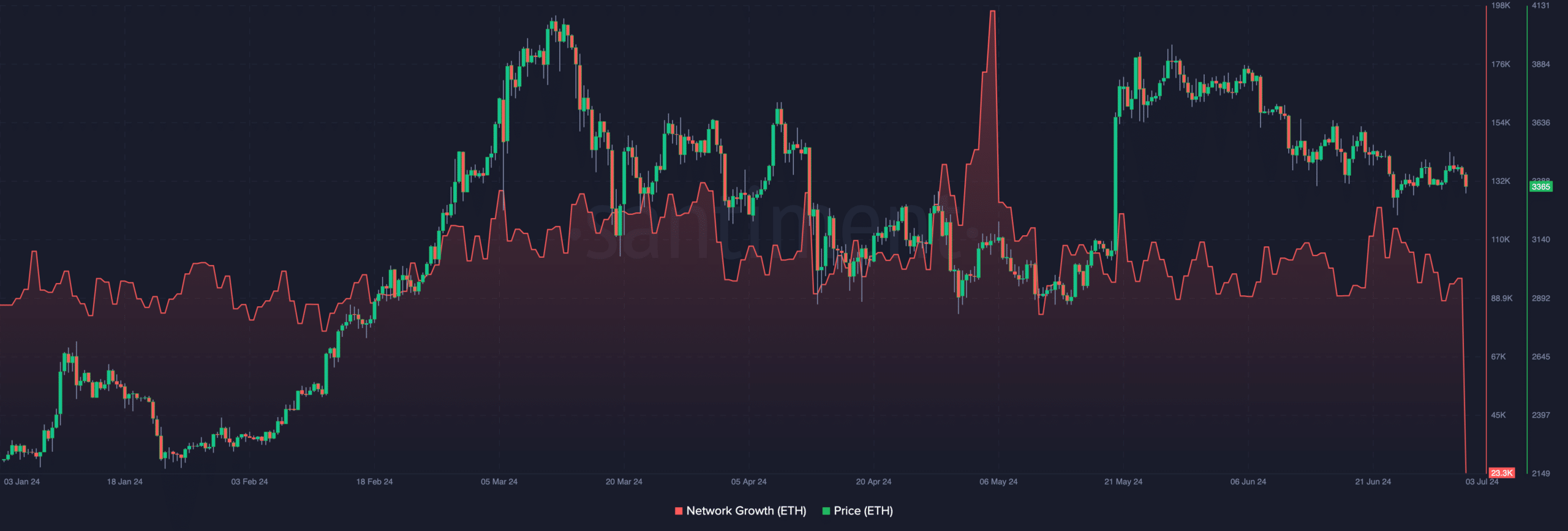

One explanation for this forecast is the decline in Ethereum’s network growth as reported by AMBCrypto’s assessment. Specifically, their analysis indicated a decrease in the Ethereum network size to approximately 23,300.

This metric measures the number of new addresses making their first successful transaction.

If the number continues to rise, it’s a sign that the blockchain is gaining popularity and making good progress. Conversely, if the number decreases, this may indicate that adoption is lagging, as appears to be the case with Ethereum (ETH) currently.

historically, an uptick in Network Growth has been followed closely by a rise in Ethereum’s price, while a decline in the number of new addresses tends to be preceded by a drop in Ethereum’s value.

As mentioned before, it is possible to sell ETH drop from $3,300 in the short term.

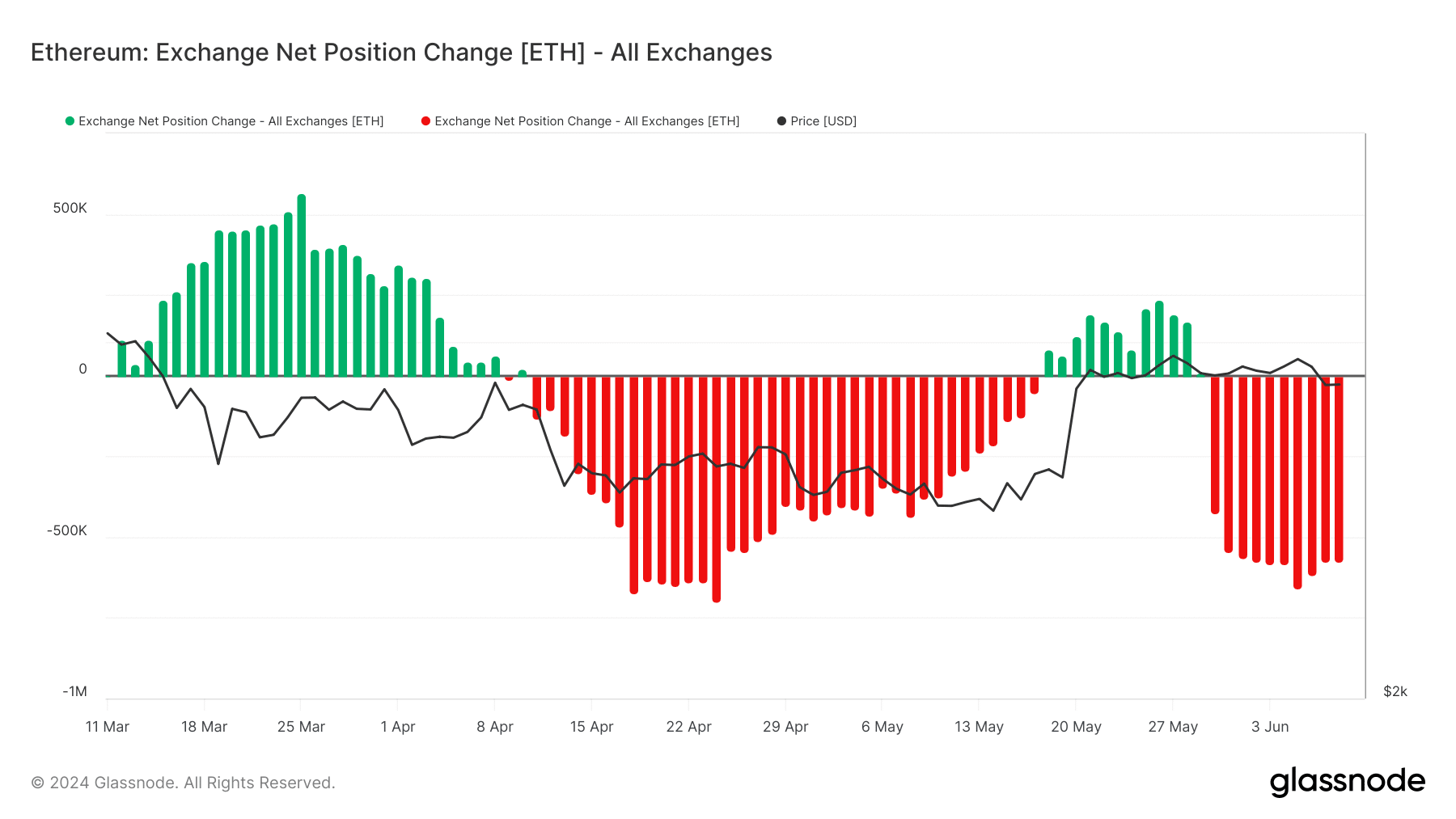

Although the pessimistic view prevails in the near future for Ethereum (ETH), there is optimism in the long run. This is primarily due to the significant shift in exchange net positions on Ethereum.

This metric tracks the 30-day supply of cryptocurrencies held in exchange wallets.

An uptick indicates that deposits at exchanges are accumulating, enhancing the possibility of sell-offs. Conversely, a decrease signifies an increase in withdrawals, implying reduced pressure to sell.

Read Ethereum’s [ETH] Price Prediction 2024-2025

Based on Glassnode’s analysis, Ethereum investors have been transferring their tokens off exchanges for several months. This trend could potentially contribute to a more stable Ethereum price if it persists.

So, ETH could target hitting $4,000 this quarter or surpassing its all-time high.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

2024-07-03 14:16