- Ethereum has registered the highest dApp volume in the last 30 days.

- ETH’s price trend has been less active.

As a seasoned crypto investor who’s been around since the days of the “CryptoKitties” craze, I’ve seen my fair share of bull and bear markets. Lately, Ethereum [ETH] has caught my attention due to its surging dApp volumes—a trend that reminds me a bit of the old-timer who keeps finding new life in a fresh pack of cards.

The activity within Ethereum’s [ETH] network of decentralized applications (dApps) has seen a significant increase, as transaction volumes have risen by approximately 38% during the last month.

This surge indicates a resurgence of enthusiasm towards DeFi, NFTs, and gaming industries. But the crucial query still stands: could this blockchain activity trigger a bullish surge in Ethereum’s pricing?

On the Ethereum network, we’re seeing a surge in activity as gas consumption rises, more transactions are being processed, and there’s growing interest in decentralized applications (dApps). However, the price trend is showing a tentative optimism.

Ethereum dApp volumes on the rise

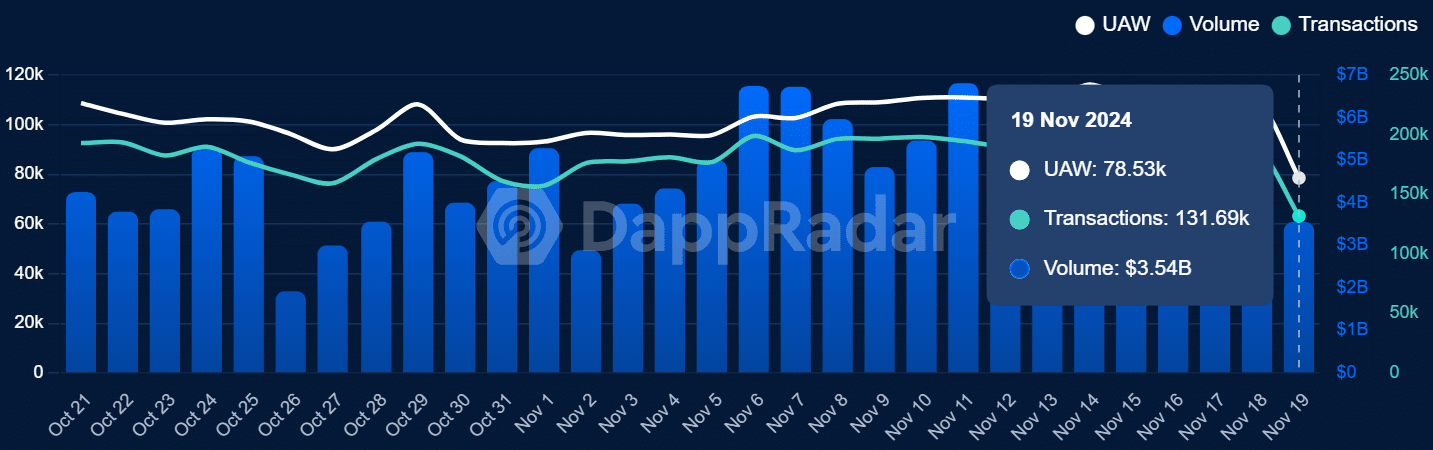

Recent data from DappRadar highlighted a steady increase in Ethereum dApp usage.

As of November 19, 2024, the total transactions amount has hit a staggering $3.54 billion, demonstrating an expanding involvement in the system. Additionally, the number of daily distinct active wallets (UAW) spiked to 78,530, indicating a significant increase in participation.

Moreover, the analysis indicates that over the past month, its dApp volume peaked at nearly $150 billion, making it the highest recorded figure.

The data also showed a 37.67% increase in the last 30 days, making its increase the most impactful.

Decentralized Finance (DeFi) systems have significantly fueled this expansion, thanks to a larger share of funds locked-in (Total Value Locked or TVL), as more people participate in lending and trading transactions.

Additionally, NFT marketplaces and online gaming platforms built on blockchain technology have significantly boosted the number of transactions being processed.

On-chain activity reflects increased demand

AMBCrypto’s examination of Ethereum’s on-chain activity offered a more comprehensive understanding of the expanding decentralized application (dApp) environment it supports.

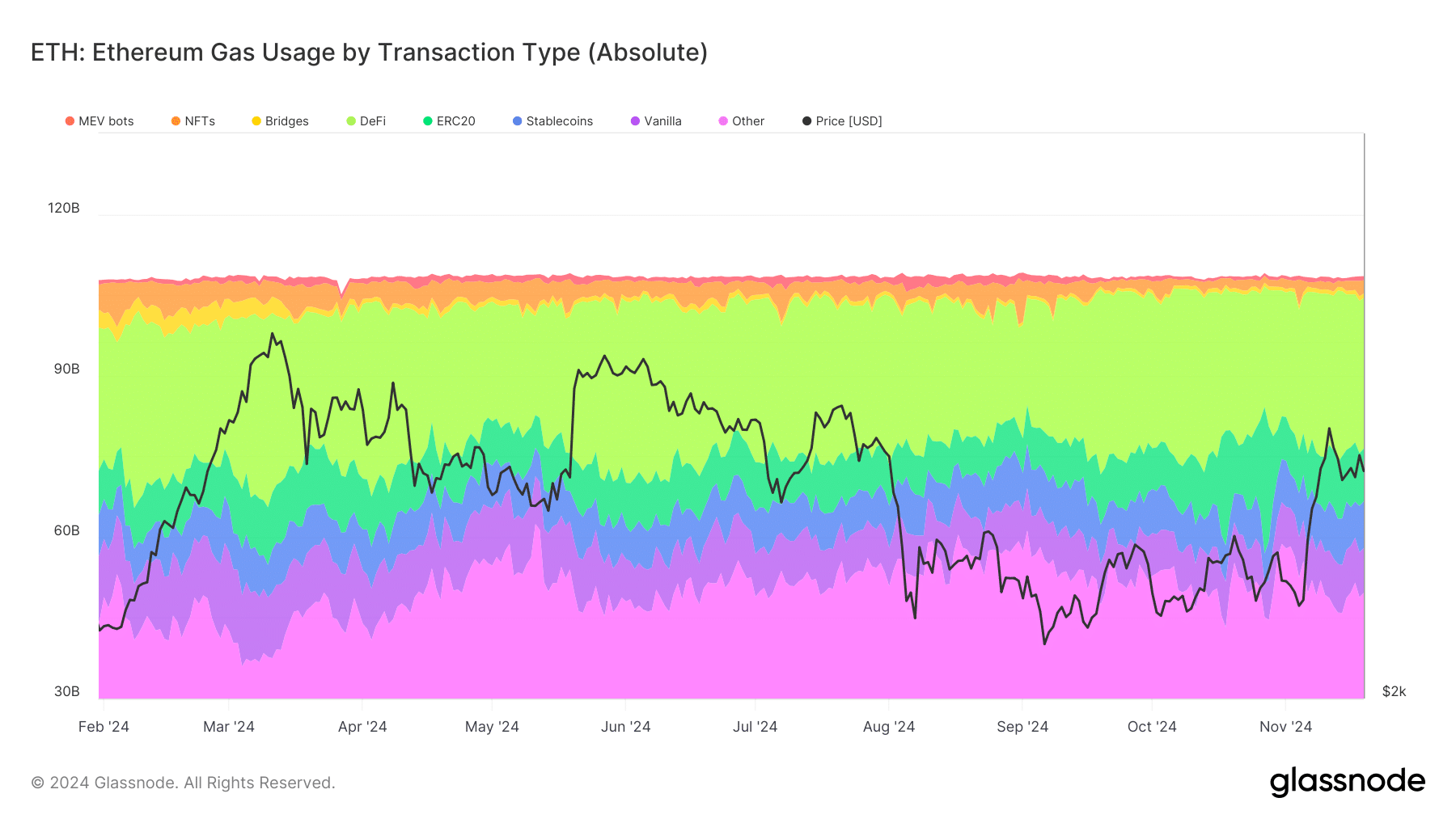

Based on Glassnode’s findings, there’s been a surge in gas usage across different transactions such as Decentralized Finance (DeFi), Non-Fungible Tokens (NFTs), and stablecoin transfers. A closer look at the data reveals that DeFi transactions account for the majority of gas consumption on the platform.

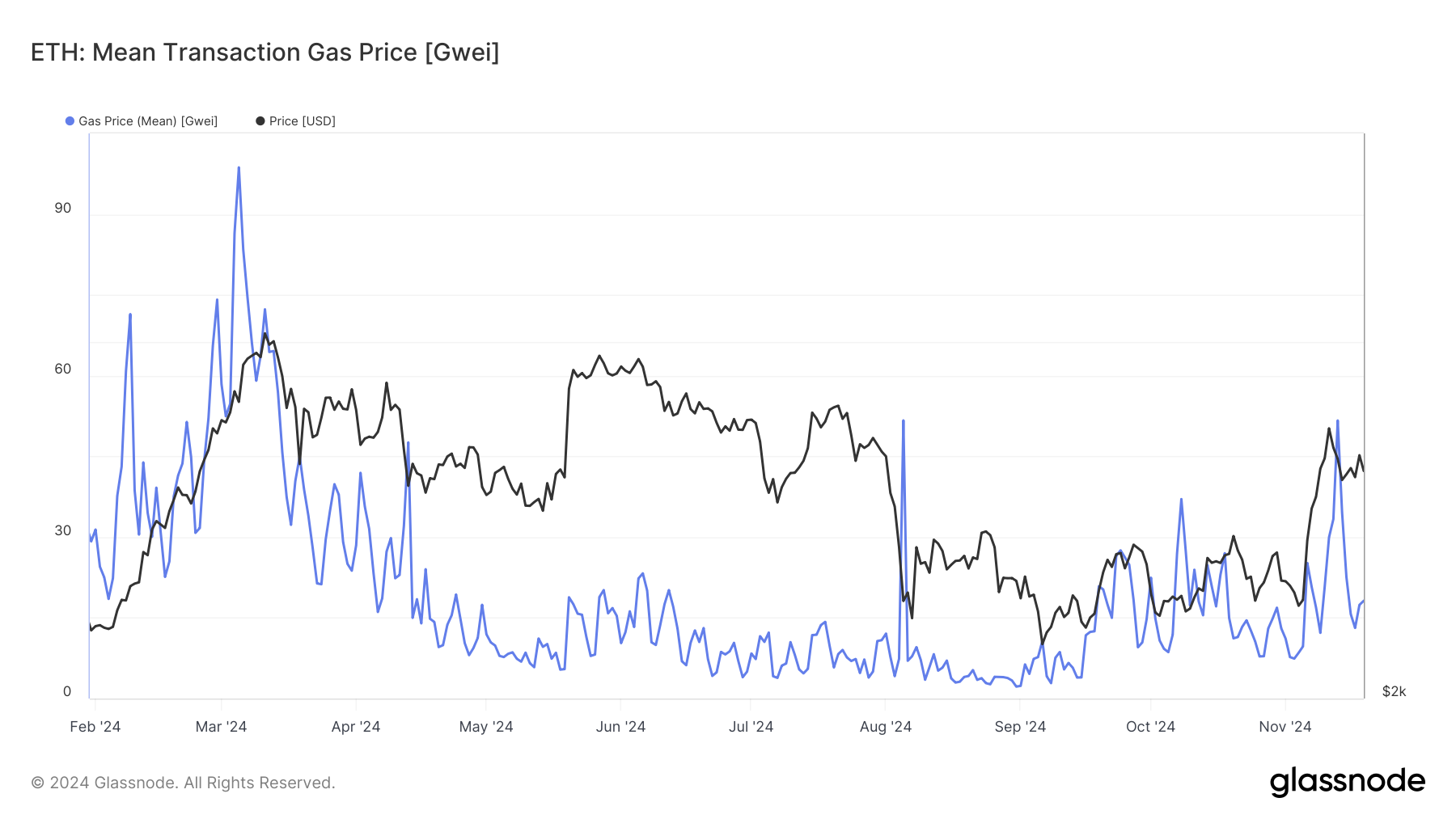

Additionally, our examination revealed a recent surge in gas costs, averaging approximately 50 Gwei. Typically, elevated gas fees correspond with increases in on-chain activity, which can be an early indicator of substantial ETH price fluctuations.

Ethereum’s price action and technical indicators

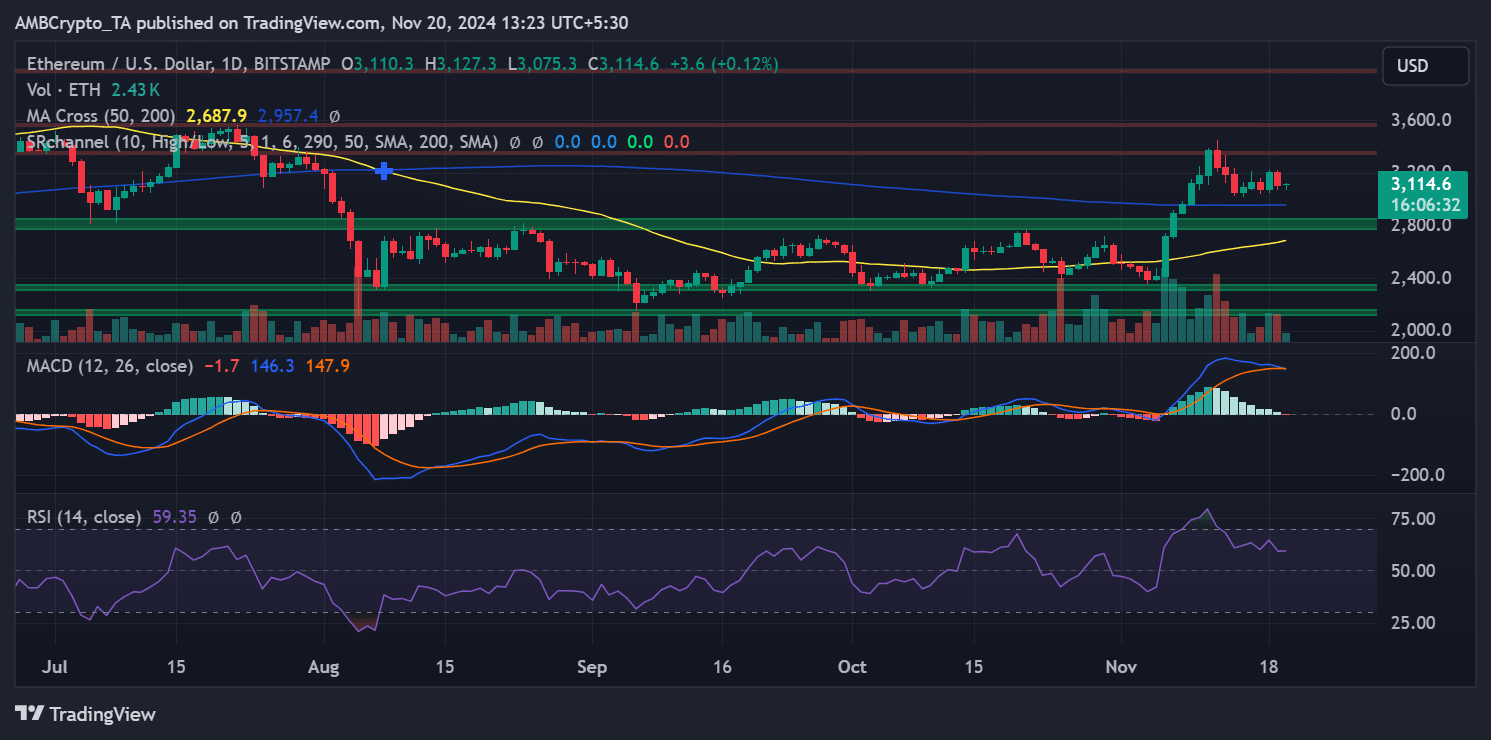

Despite the rise in network activity, Ethereum’s price action has remained subdued, trading around $3,114 at press time. The technical outlook revealed mixed signals as well.

Significantly, the short-term 50-day average price of approximately $2,687 is higher than the long-term 200-day average at about $2,957, suggesting a generally bullish market direction. However, the Moving Average Convergence Divergence (MACD) exhibits a slight downward trend, which could imply decreasing momentum.

Currently, the Relative Strength Index (RSI) stands at 59.35, indicating a balanced situation for Ethereum’s price. This means that Ethereum’s price might trend up or down over the short term.

Ethereum must break above critical resistance at $3,200 to sustain its bullish trajectory.

On the negative side, the $3,000 mark is significant because if it’s broken, it might trigger a lengthy period of stabilization or even a brief adjustment in the short term.

Will ETH follow the dApp volume surge?

The surge in transactions on Ethereum’s decentralized applications (dApps) highlights a high level of network interest. Yet, converting this activity into consistent price escalation hinges upon various elements.

As the DeFi (Decentralized Finance) and NFT (Non-Fungible Token) sectors grow further, it may significantly boost Ethereum’s inherent worth, sparking greater attention from investors.

As a crypto investor, I eagerly anticipate the impact of ecosystem updates like EIP-4844, also known as Proto-Danksharding. These upgrades promise enhanced scalability and network efficiency, which could significantly amplify Ethereum’s allure, making it an even more attractive choice for investors like myself.

Read Ethereum’s [ETH] Price Prediction 2024-25

Nevertheless, there are ongoing hurdles. Excessive transaction fees might discourage more users from joining, thus potentially hindering the ecosystem’s expansion.

As a researcher, I’ve observed that broader economic factors influencing Bitcoin‘s price movements might indirectly affect Ethereum’s potential to monetize its network activities. In simpler terms, the state of the global economy could potentially impact Ethereum’s earning capacity, given the connection between Bitcoin and Ethereum markets.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- SOL PREDICTION. SOL cryptocurrency

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- Despite Bitcoin’s $64K surprise, some major concerns persist

2024-11-21 02:16