-

DEX volume fell to $1.03 billion, however, indicators revealed that ETH’s price could jump.

The liquidation levels suggested that the altcoin could leave more shorts in liquidations.

As an experienced analyst, I believe that while the decreasing DEX volume and underwhelming price action of Ethereum [ETH] may suggest bearish sentiments for some, it is essential not to overlook the underlying indicators that point towards a potential bullish phase.

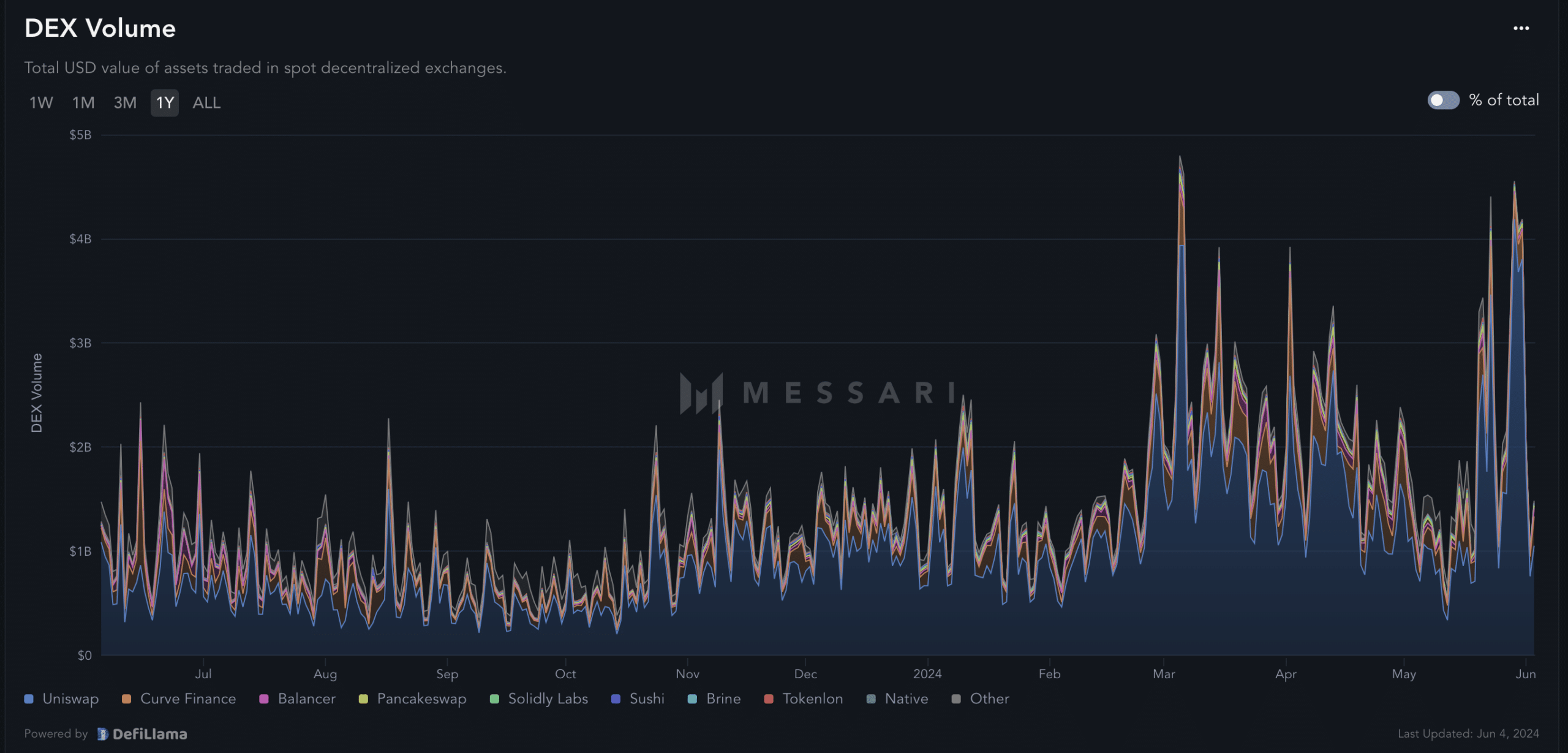

Over the last week, trading activity on Ethereum‘s decentralized exchanges has noticeably decreased, according to AMBCrypto’s confirmation. Specifically, on May 28th, data from Messari reported a trading volume of approximately $3.34 billion.

I analyzed the data and found that at the given point in time, the Decentralized Exchange (DEX) volume had dropped to $1.03 billion from its previous level of $3.24 billion. This represented a substantial decrease of approximately $2.21 billion. The reduction in DEX volume could potentially signal less liquidity available for Ethereum.

As a researcher studying on-chain trading activity, I’ve observed a decrease in the volume of Ethereum (ETH) transactions since last week. An alternative perspective is that this reduction could be indicative of diminished market interest or demand for Ethereum as an altcoin.

A “slight” fall is not the end

As a researcher studying the cryptocurrency market, I’ve observed that Ethereum (ETH) might face difficulties in experiencing significant price growth due to decreasing demand. Currently, ETH is priced at $3,763 – a 3.50% decrease from its value over the past week.

As an analyst, I’ve observed that the lackluster price performance of Ethereum is contributing to some skepticism among market participants regarding its role in the ongoing bull market.

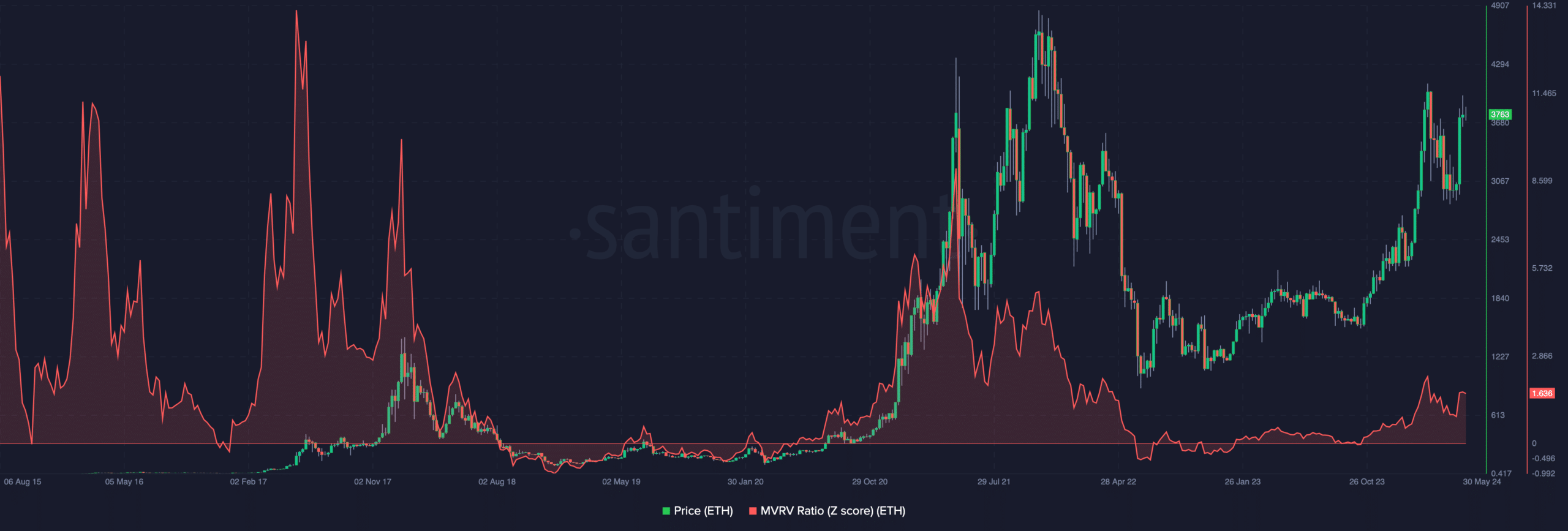

As a researcher, I discovered that AMBCrypto’s assessment wasn’t entirely accurate based on my analysis. This conclusion stemmed from the insights gleaned through the Market Value to Realized Value (MVRV) Z Score indicators. The MVRV metric has a robust correlation with price movements.

Based on the data, a cryptocurrency’s score being negative indicates that it’s currently in a bearish phase. In contrast, a positive score signifies a bullish trend. The chart below reveals that Ethereum last entered a bearish stage back in October 2023, hence transitioning into a bullish phase afterward.

At present, the Multi-Vintage MVRV Z Score stands at 1.63. By examining past bull market peaks, specifically in 2017 and 2021, we observed values of 14.19 and 4.76 respectively for this metric. If history repeats itself, Ethereum’s price may continue to rise.

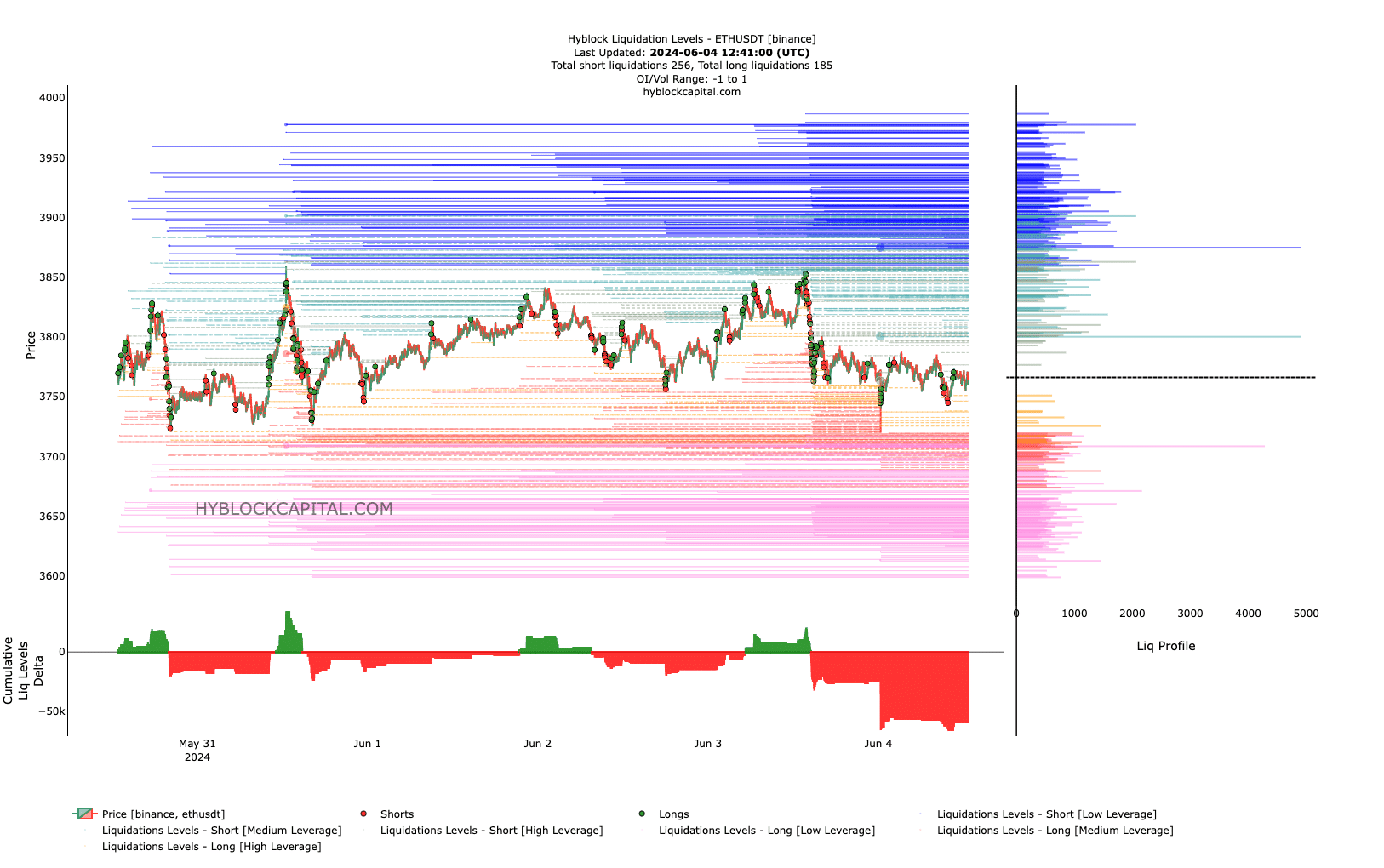

For future consideration, however, let’s focus on the immediate situation. At present, AMBCrypto examined the thresholds set by exchanges for closing traders’ positions against their will. These prices are referred to as liquidation levels.

Bears beware! ETH looks ready to recover

As a researcher, I’m sharing my perspective on why we should take action to avoid additional setbacks. Currently, Ethereum is at risk of undergoing significant liquidations between the prices of $3,882 and $3,946. This means that the price trend could potentially head in that direction.

As a crypto investor, I’ve also taken a closer look at the Cumulative Liquidations Levels Delta (CLLD) indicator. This metric tells us whether long or short liquidations have been more prevalent in recent market movements. A positive value for CLLD indicates that there have been more long positions being liquidated, while a negative reading suggests that short positions have been dominating the market.

Read Ethereum’s [ETH] Price Prediction 2024-2025

Examining the graph, the total value of negative CLLD transactions exceeded -$59 million in the past week through short liquidations.

Regarding the price, a bearish CLLD (Composite Linear Least Squares) indicator reading is actually good news for Ethereum. This means that those who have shorted Etherean in anticipation of a dip might miss out on the potential recovery. Consequently, Ethereum’s price could rebound, increasing the chances of reaching the projected price of $3,946.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

2024-06-05 08:07