- Ethereum’s price fell 2.7% after a $19.3 million transfer to Kraken.

- The transfer indicates possible sell-off activity by long-term Ethereum holders.

As a researcher with extensive experience in cryptocurrency markets, I find the recent Ethereum price drop intriguing. The 2.7% decline in ETH‘s value to $3,442 is noteworthy, especially since it follows a substantial transfer of approximately 5.5K ETH (worth around $19.3 million) from an Ethereum ICO whale to the Kraken exchange. This transaction may indicate possible sell-off activity by long-term Ethereum holders, which can lead to further price declines due to increased supply on the market.

As a researcher studying the cryptocurrency market, I’ve noticed that Ethereum [ETH], specifically, has experienced a setback of approximately 2.7% in the last 24 hours. Currently, it is being traded at a price of $3,442. This represents a significant retreat from its peak value in March, which surpassed $4,000.

As a researcher studying the Ethereum market, I’ve observed an intriguing development: data from the blockchain indicates that early investors from Ethereum’s initial coin offering (ICO), which dates back almost a decade, have recently begun selling off their holdings.

Whale moves and market ripples

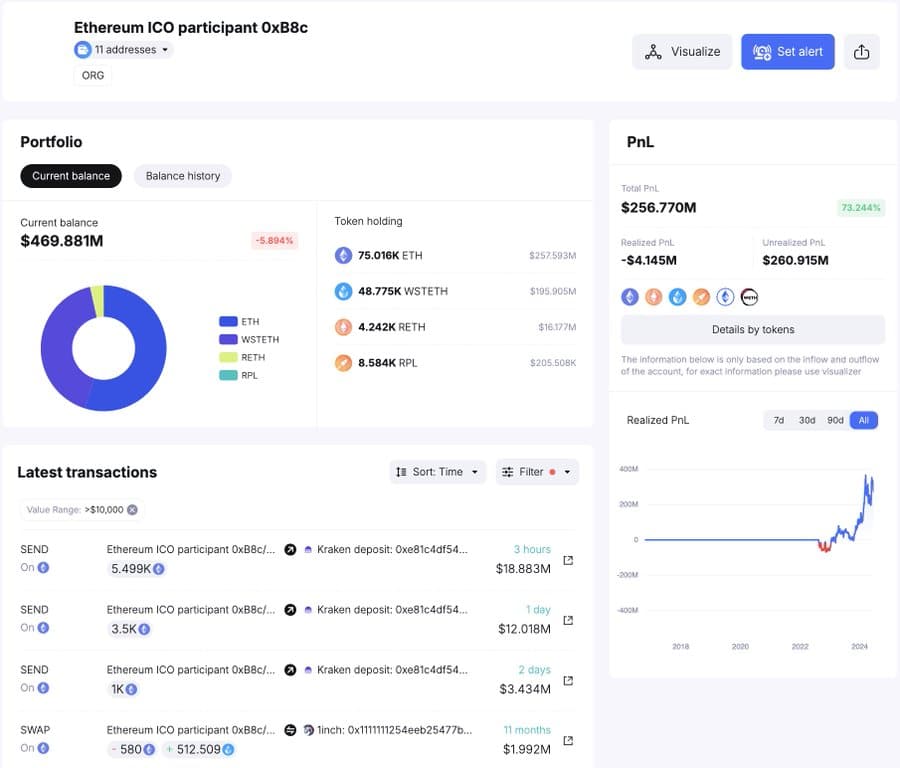

As a crypto investor closely monitoring Ethereum whale activity, I’ve recently noticed some intriguing on-chain data from SpotaChain. An Ethereum ICO whale has made a significant move by transferring a substantial amount of their holdings, equivalent to around 5,500 ETH or roughly $19.3 million, to the Kraken exchange. This could potentially indicate selling pressure or perhaps preparation for further transactions within the Kraken ecosystem. Keeping an eye on such developments can help inform investment decisions in the dynamic and evolving crypto market.

This move precedes a notable sell-off that pushed ETH’s price downwards.

As a researcher delving deeper into the subject, it becomes clear that this person obtained an impressive amount of 150,000 Ether tokens during Ethereum’s Initial Coin Offering (ICO) at an unbelievably low price of just $0.31 per token. Remarkably, they have been proactively handling their substantial crypto wealth.

Over the past few days, this whale has moved 10K ETH, valued at roughly $35.4 million, to Kraken.

I’ve analyzed their transaction history and found that despite conducting significant transactions totaling approximately 139,000 Ether, which is currently valued at around $469 million, they still hold roughly this amount of Ether in three separate wallets.

The moves of major market influencers can spark debates among investors regarding the possible consequences for prices.

As a researcher studying cryptocurrencies, I have observed that moving substantial quantities of digital assets to exchanges is often indicative of an intent to sell. Consequently, this action may result in price decreases due to the influx of additional coins or tokens into the market.

Diverging signals in Ethereum’s market

As an analyst, I’ve noticed a clear connection between the Whale’s Ethereum transactions and the fluctuations in ETH‘s market price. Each time the Whale makes large transfers, there seems to be a noticeable impact on the value of Ethereum.

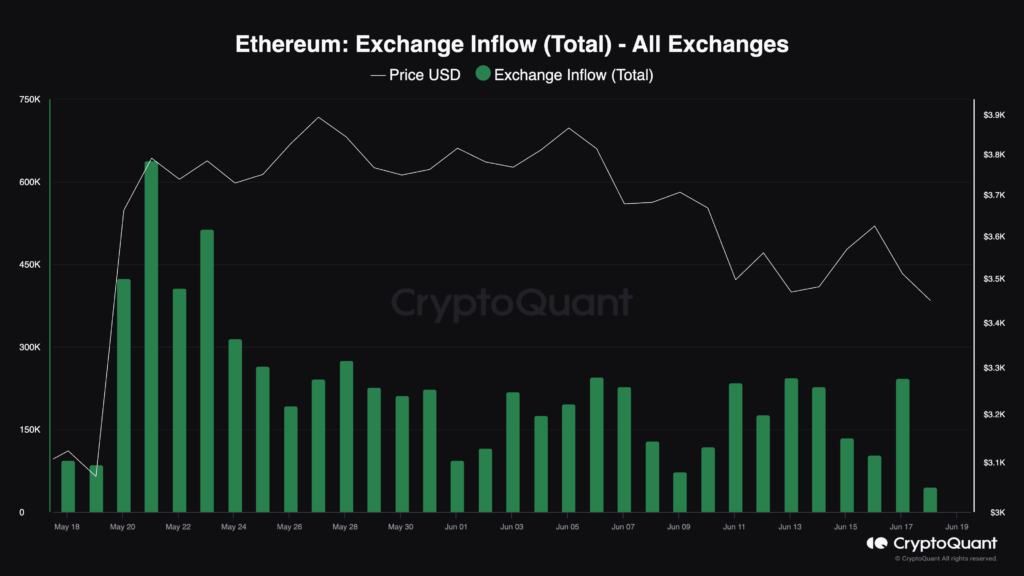

According to the comprehensive market analysis provided by CryptoQuant, there has been a significant reduction in Ethereum (ETH) transfers to cryptocurrency exchanges. The data shows that this figure dropped from approximately 600,000 ETH in March to under 50,000 ETH at present.

The pattern indicates that most investors are tending towards keeping their investments instead of offloading them, with only a few major entities showing a preference for selling.

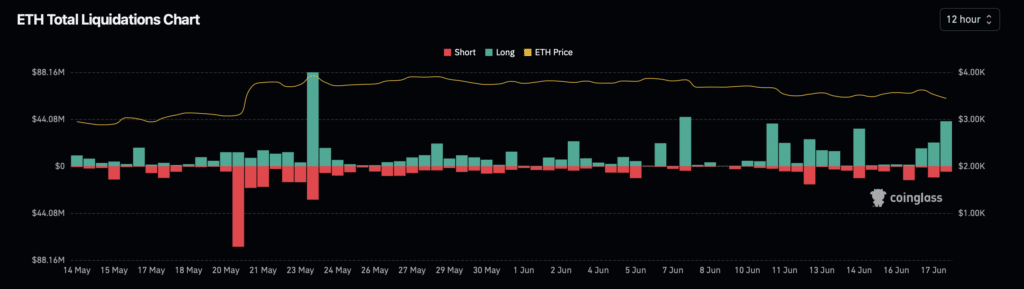

The latest market data from liquidation events presents a clear image of cryptocurrency markets’ instability. In the past day, Ethereum alone accounted for approximately $92.8 million in liquidations, adding to a grand total of $465.20 million across multiple digital currencies.

Such high liquidation volumes can exacerbate price declines, leading to further market instability.

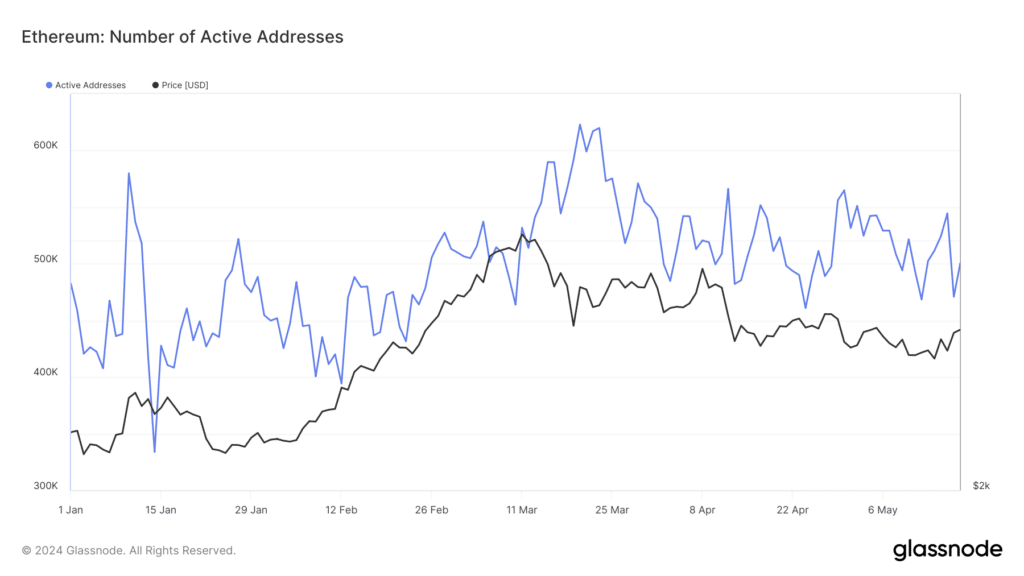

Despite the current gloomy outlook for Ethereum, there’s a silver lining. Data from Glassnode indicates a growing number of new Ethereum addresses, suggesting a surge in newfound interest and potential backing for the digital currency.

As an analyst, I would propose that this expansion could act as a cushion against significant price declines caused by mass sell-offs, thereby maintaining a relatively steady market value in the long run.

According to AMBCrypto’s analysis, the current prices could be approaching a lowest point, implying a possible reversal may occur soon.

If this evaluation is correct, the latest decrease in Ethereum’s price might offer an attractive purchasing option for investors who are confident in Ethereum’s future worth.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Clarkson’s Farm Season 5: What We Know About the Release Date and More!

- Jack Dorsey’s Block to use 10% of Bitcoin profit to buy BTC every month

- You Won’t Believe Today’s Tricky NYT Wordle Answer and Tips for April 30th!

2024-06-18 17:11