-

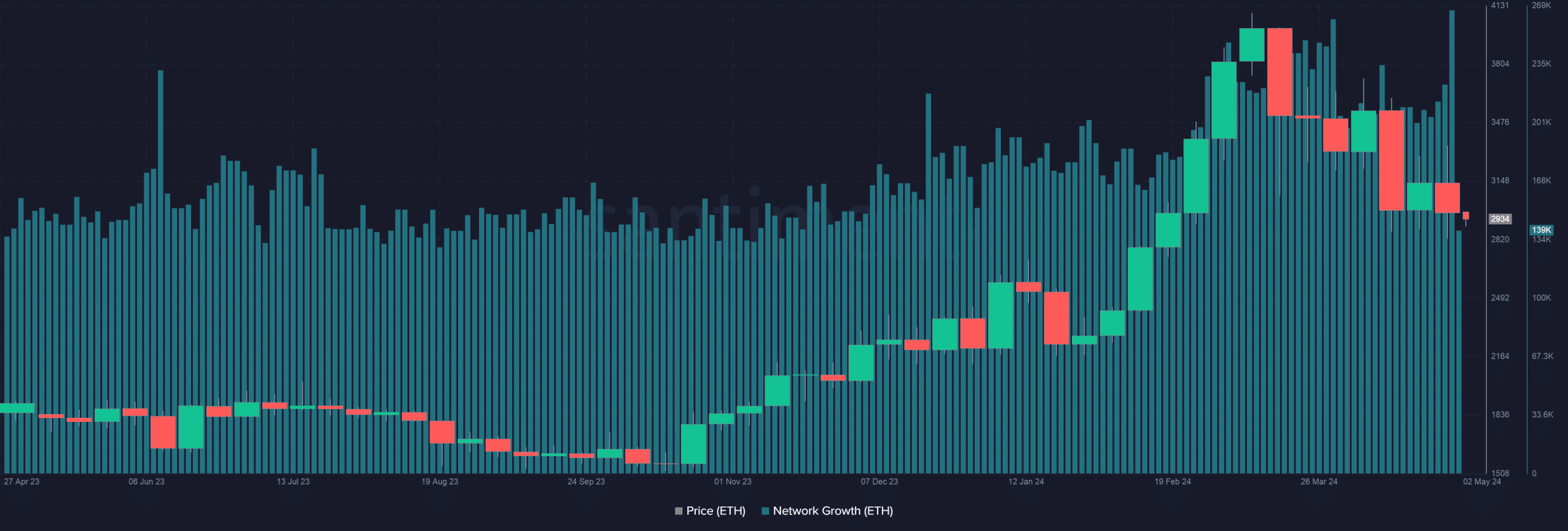

ETH saw the biggest 2-day stretch of network expansion since October 2022.

The addresses holding between 0 and 0.1 units of ETH increased significantly.

As a researcher, I find the recent Ethereum [ETH] market trends fascinating. Despite the sharp price drop below $3,000 and the 13.34% discount over the month, the network expansion and onboarding of new users indicate a strong confidence in ETH’s long-term potential.

Ethereum [ETH], the second largest cryptocurrency by market capitalization, experienced a significant decline in the last 24 hours, dropping below the $3,000 mark and reaching a price of $2,914 at the time of reporting. This represents a 3% decrease from its previous value. Over the past month, Ethereum has seen a price drop of approximately 13.34%.

The negative price action, however, did not appear to limit demand for the asset.

Unfazed users continue to snap ETH

As a researcher studying blockchain data, I’ve come across some intriguing insights from Santiment’s on-chain analytics. Ethereum experienced a significant surge in new users recently. Specifically, around 266,600 new wallets were created on the 28th and 29th of April – marking the most substantial two-day expansion since October 2022.

Expanding its network is a key indicator of whether a cryptocurrency like Ethereum (ETH) is experiencing growth or decline. The addition of new users signifies faith in ETH’s future prospects, disregarding short-term fluctuations.

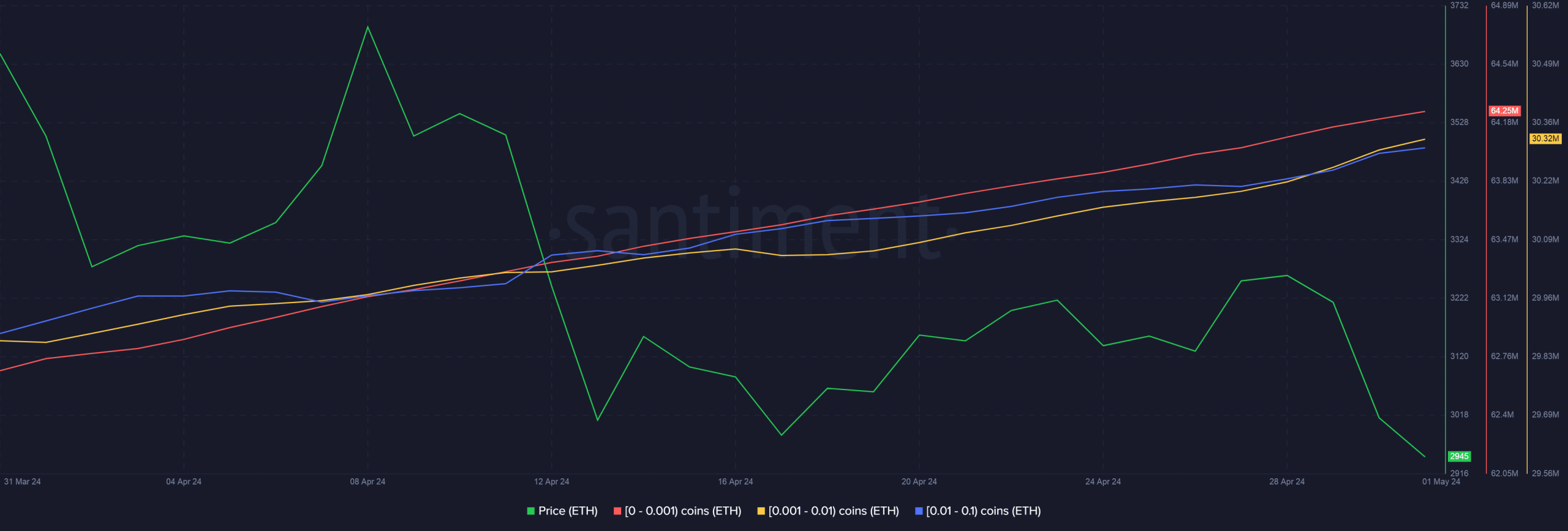

Retail users enter ETH market

Upon closer examination, it was discovered that a large number of retail users were hopping on the trend. According to AMBCrypto’s analysis of Santiment’s data, the number of Ethereum addresses holding between 0 and 0.1 units of ETH saw a notable rise, despite the declining prices.

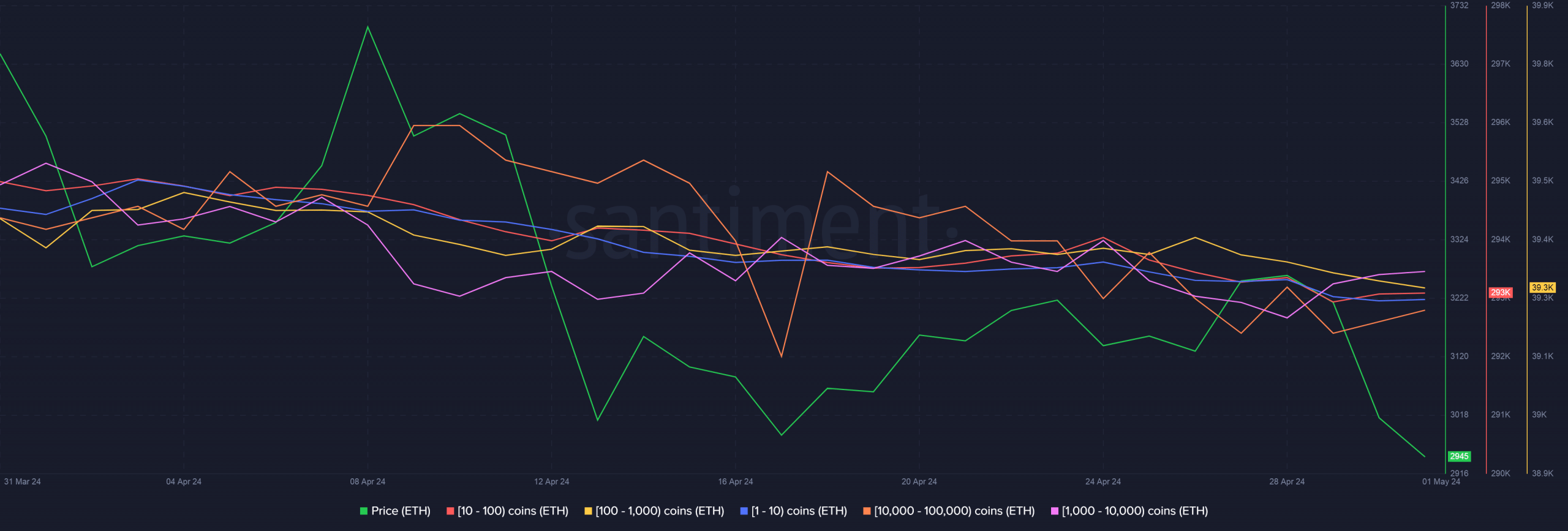

As a crypto investor, I’ve noticed an intriguing trend: those of us with holdings exceeding one Ethereum (ETH) have been selling off recently. This is clear from the decrease in ETH reserves we’re seeing.

As a crypto investor, I’ve noticed some intriguing data suggesting robust retail demand for Ethereum (ETH). If this trend continues, we might witness a much-needed relief rally in the near future due to these healthy inflows from individual investors.

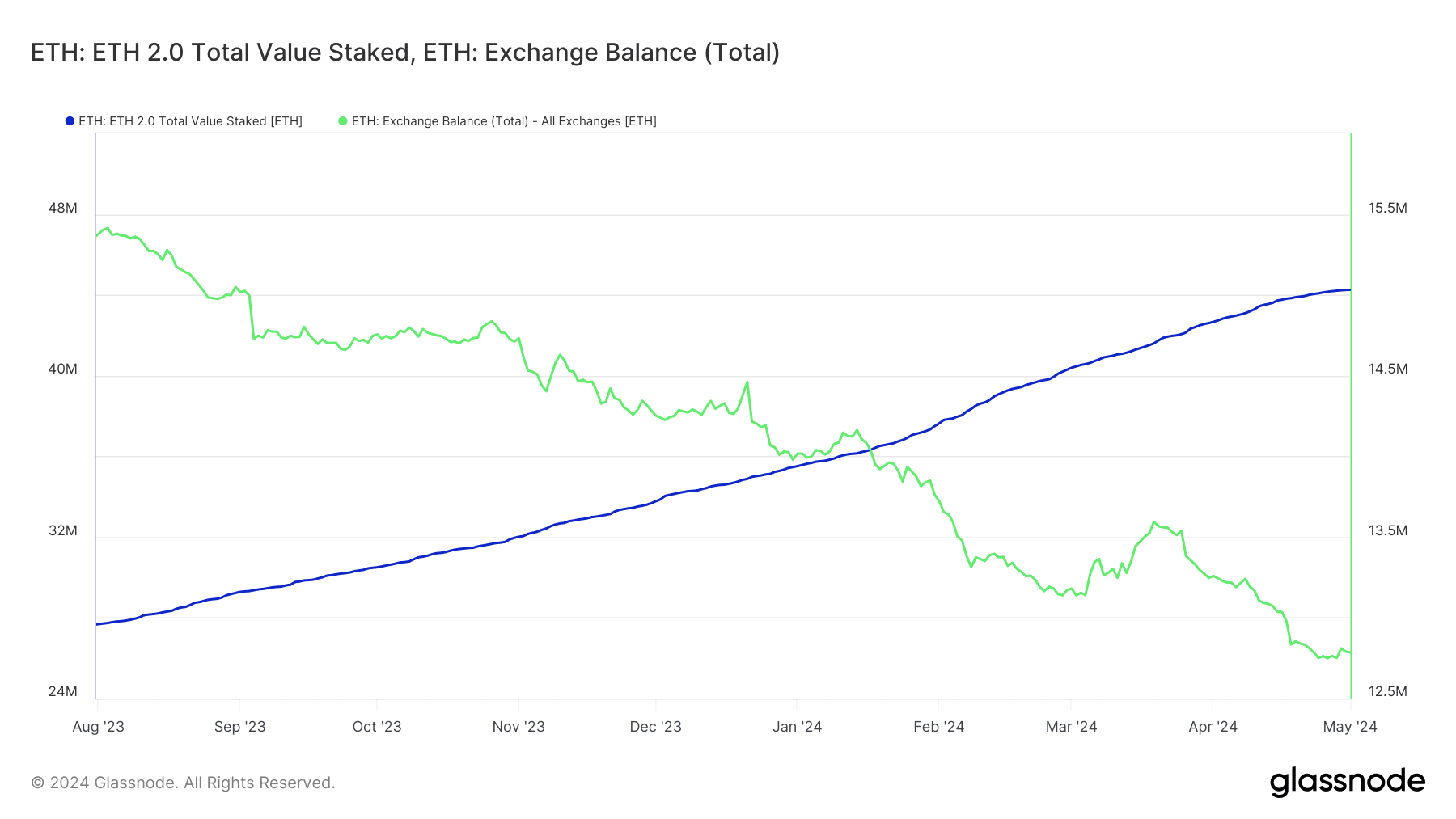

Is staking the driving force?

As a researcher studying the behavior of retail customers in the cryptocurrency market, I have observed that a significant number of them are attracted to purchasing Ethereum (ETH) due to the allure of the returns offered through Ethereum staking services.

According to AMBCrypto’s analysis based on Glassnode figures, the amount of Ethereum (ETH) staked in the network has reached a new high of 44.24 million coins, representing approximately 36% of ETH’s current circulating supply.

As a market analyst, I’ve observed that the amount of Ethereum (ETH) held on exchanges has been decreasing. Currently, there are approximately 12.79 million ETH tokens available on these platforms, which represents around 10% of the total circulating supply.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- LPT PREDICTION. LPT cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- WCT PREDICTION. WCT cryptocurrency

2024-05-02 13:11