- Ethereum’s market dominance has dropped to range lows at 13%.

- The declining market share comes amid weakening demand, rising supply, and Bitcoin’s rising dominance.

As a seasoned analyst with over a decade of experience in the cryptocurrency market, I’ve seen my fair share of bull runs and bear markets. The current state of Ethereum [ETH] is a bit concerning, especially considering its declining market dominance.

Over the last year, Ethereum [ETH] hasn’t kept pace with Bitcoin [BTC]. In fact, Bitcoin has seen a rise of over 120% compared to this time last year, whereas Ethereum has only increased by roughly 50%.

The poor performance of Ethereum has led to a significant decrease in its market dominance, currently sitting at approximately 13.85%. This is a substantial fall from its yearly peak of almost 20%.

Several factors have spurred the declining dominance of the largest altcoin, and its underperformance against Bitcoin.

Bitcoin’s rising dominance

This year, Bitcoin’s influence or control over the cryptocurrency market has seen a notable rise. Since the beginning of the year, this measure has consistently reached new highs and has been trending within an upward-sloping channel.

One key factor triggering a rise in Bitcoin’s dominance is the high demand for spot Bitcoin exchange-traded funds (ETFs).

According to data from SoSoValue, over $57 billion in Bitcoin is being held by spot Bitcoin Exchange-Traded Funds (ETFs) at present. This substantial investment indicates a strong institutional appetite, which is contributing significantly to the favorable price trends.

Whales are selling Ethereum

The other factor causing a drop in Ethereum dominance is whale selling activity.

8th October marked the day a notable entity, who had taken part in the 2014 Initial Coin Offering (ICO), transferred 5,000 Ethereum (ETH) worth approximately $12 million to the platform Kraken.

Over the past fortnight, this whale has transferred approximately 50,000 units of Ethereum, worth around $125 million, to cryptocurrency exchanges, according to SpotOnChain’s data.

It’s worth noting that the Ethereum Foundation, known for its recent series of sales, has played a role in Ethereum’s relatively weak performance this year. To date, they have offloaded over $10 million worth of Ether (ETH) from their holdings.

An increase in Ethereum (ETH) being sold, but with no corresponding increase in demand, might cause Ethereum to trade within its current price range if additional buyers do not join the market.

Weak demand for ETH ETFs

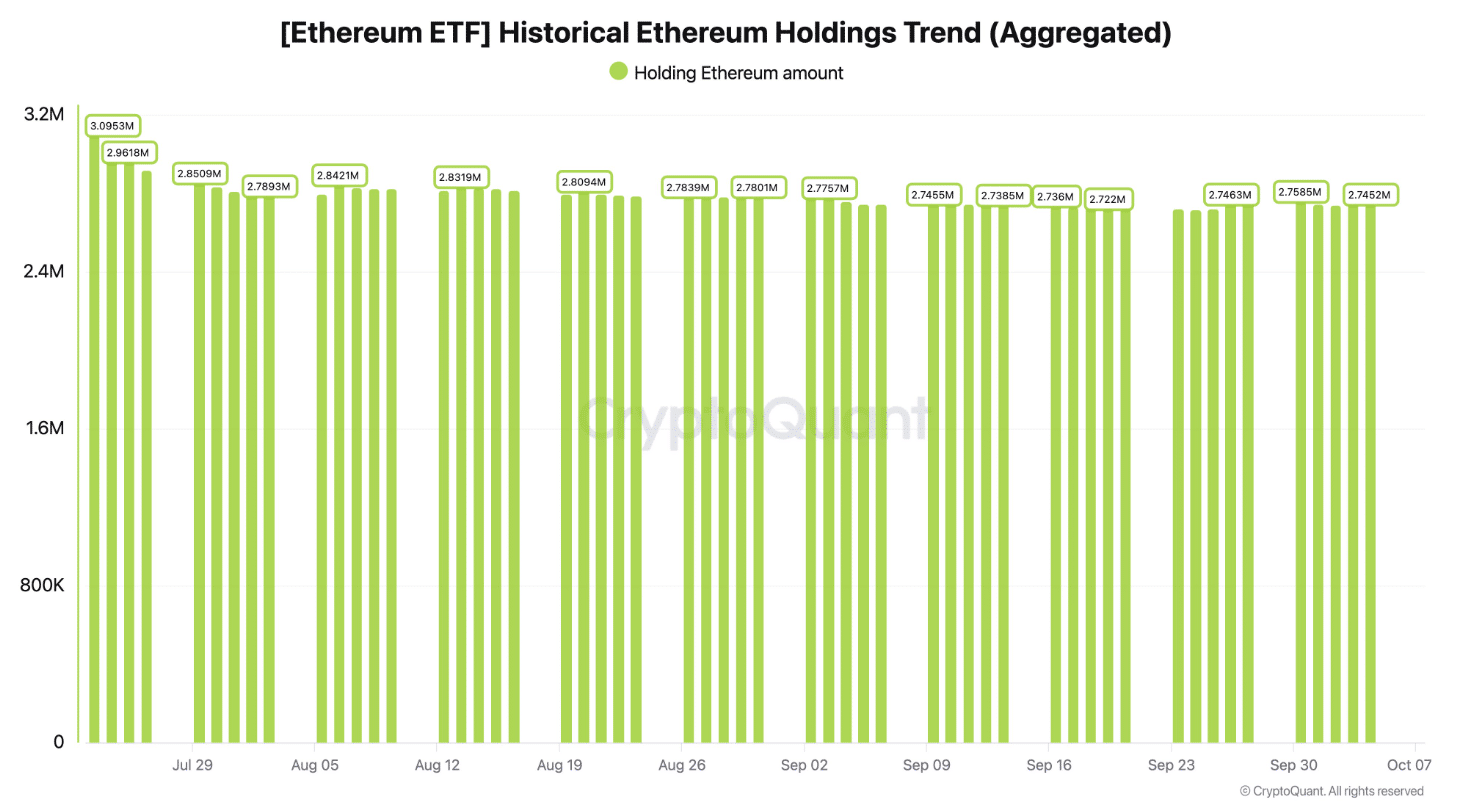

Contrary to Bitcoin, there’s been relatively less interest in Ethereum’s spot ETFs as indicated by the data from CryptoQuant. Since their launch in July, these ETFs have experienced a total of $849 million in redemptions.

As a researcher, I’ve observed an increase in outflows that can be attributed to the Grayscale Ethereum Trust. Additionally, Exchange-Traded Funds (ETFs) are grappling with a shortage of fresh investments coming in.

Over the past two days, the BlackRock spot ETH ETF hasn’t received any new investments, and similarly, the Fidelity Ethereum Fund has yet to attract any inflows this month, as reported by SoSoValue.

Despite the weak demand not propelling any significant growth for Ethereum, this situation has also led to a decrease in its overall influence or dominance within the cryptocurrency market.

Rising supply

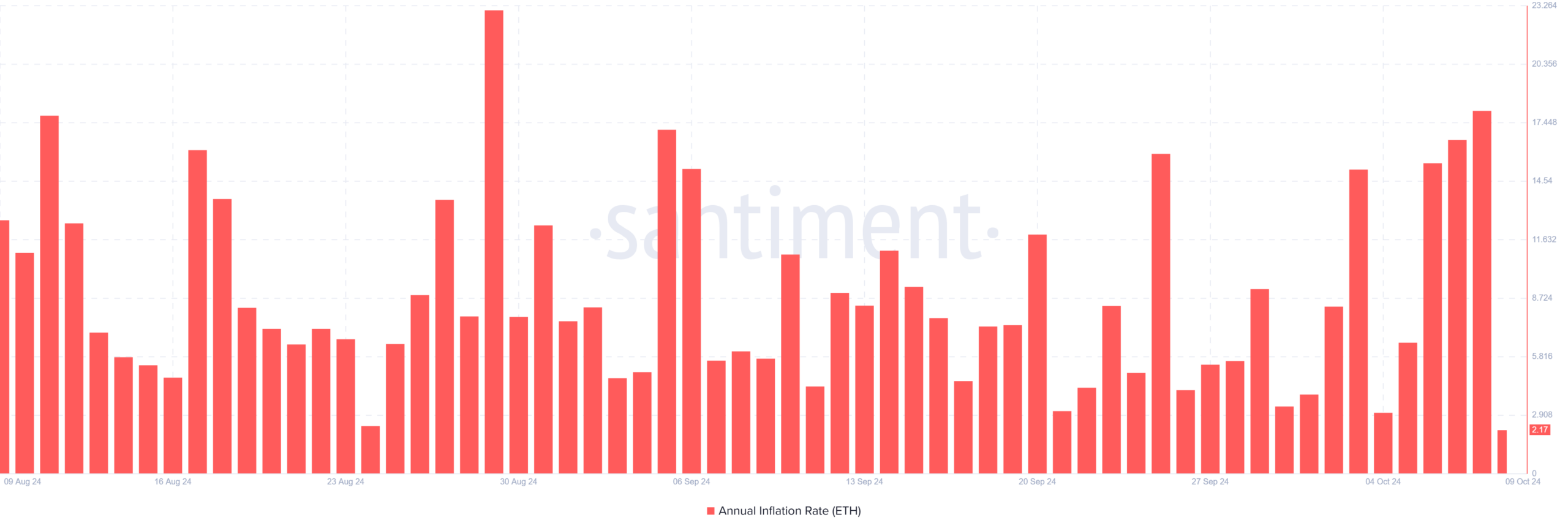

It appears that Ethereum is facing issues with its decreasing destruction pace, leading to an increase in its supply due to inflation. According to Ultrasound Money, over 43,000 Ethereum tokens have entered the circulating market within the past month.

According to data from Santiment, Ethereum’s annual inflation rate has just hit a high of 18% – a figure not seen since August.

Read Ethereum’s [ETH] Price Prediction 2024–2025

If there’s not enough new interest (demand) to handle the growing amount of Ethereum being offered for sale (supply), it could lead to a rise in selling pressure, potentially causing Ethereum to lose its position compared to Bitcoin and other alternative cryptocurrencies.

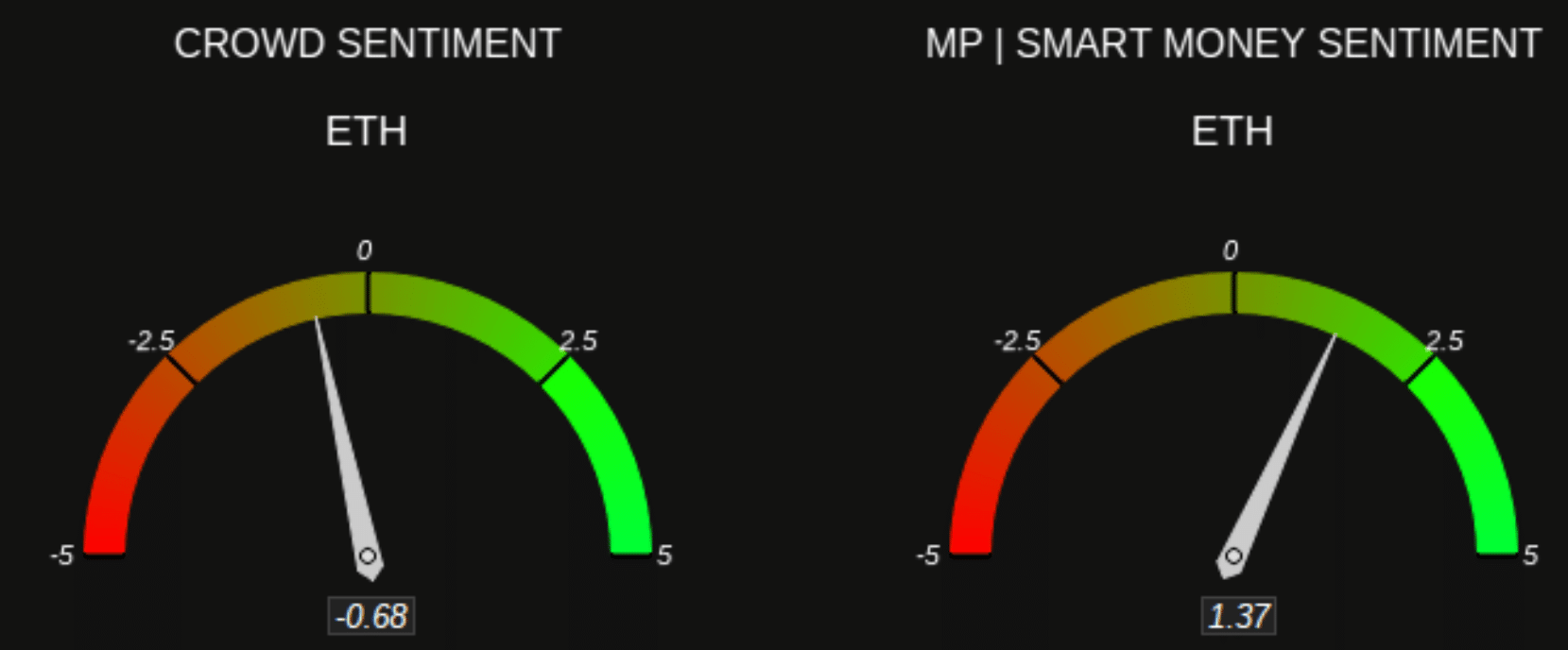

As I, an analyst, observe the current market landscape, it’s clear that Ethereum’s diminishing dominance is playing a role in shaping overall market sentiment. According to Market Prophit’s data, the majority of traders seem to be bearish towards Ethereum, while institutional investors or ‘smart money,’ as some call them, maintain a bullish stance. This disparity in outlook could potentially lead to interesting market dynamics in the near future.

Read More

- Why Tina Fey’s Netflix Show The Four Seasons Is a Must-Watch Remake of a Classic Romcom

- OM PREDICTION. OM cryptocurrency

- Disney’s Animal Kingdom Says Goodbye to ‘It’s Tough to Be a Bug’ for Zootopia Show

- Jujutsu Kaisen Reveals New Gojo and Geto Image That Will Break Your Heart Before the Movie!

- The Weeknd Shocks Fans with Unforgettable Grammy Stage Comeback!

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- Oblivion Remastered: The Ultimate Race Guide & Tier List

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- WWE’s Braun Strowman Suffers Bloody Beatdown on Saturday Night’s Main Event

- Jay-Z and Diddy Celebrate as Rape Lawsuit is Shockingly Dismissed!

2024-10-09 23:04