-

ETH weekly recap reveals the sharpest decline since FTX days.

Leveraged liquidations may have had a strong hand in ETH’s performance.

As a seasoned analyst with over two decades of experience in the crypto markets, I’ve seen my fair share of rollercoaster rides – but Ethereum’s recent performance has been nothing short of exhilarating. The last time ETH dropped this sharply was during the FTX debacle, and here we are again.

Over the past week, Ethereum (ETH) has seen a significant up-and-down price trend, eroding the growing optimism that emerged at the end of July. So, let’s examine Ethereum’s performance during this volatile period.

As an analyst, I’d rephrase it as follows: Despite a minor dip in the final week of July, ETH exhibited a generally bullish trend overall. However, this upward momentum was temporarily halted by a strong surge of selling pressure in the same period, which ultimately thwarted any recovery attempts.

ETH tanked consecutively for the last 7 days, for an overall 36.59% drop.

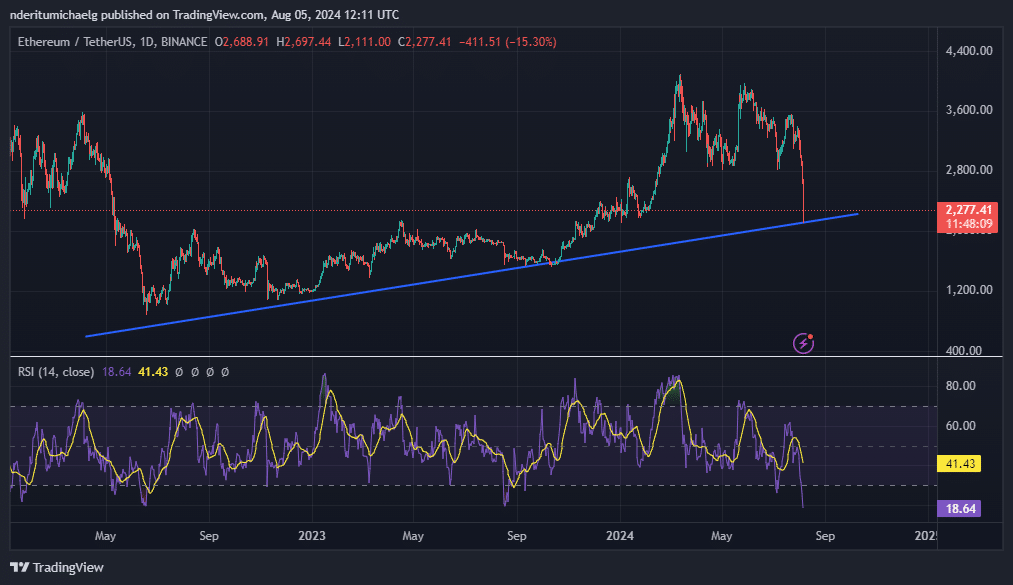

Recently, similar swift drops in ETH‘s value as we see now were last observed during the FTX crash in June of 2022. At the moment of reporting, ETH was trading at approximately $2,277.

Lately, a surge of selling has raised worries about potential further declines in the coming weeks. However, it’s important to note that while a downturn seems likely, there’s also a possibility that the buyers could retake control.

For ETH, several indications suggested a possible price rebound. One such sign was the price becoming excessively undervalued based on the Relative Strength Index (RSI).

2. Following a significant price decline, the market revisited a crucial rising support line, which incited some buying activity. Notably, Ethereum had already recovered by approximately 5% from this particular support level.

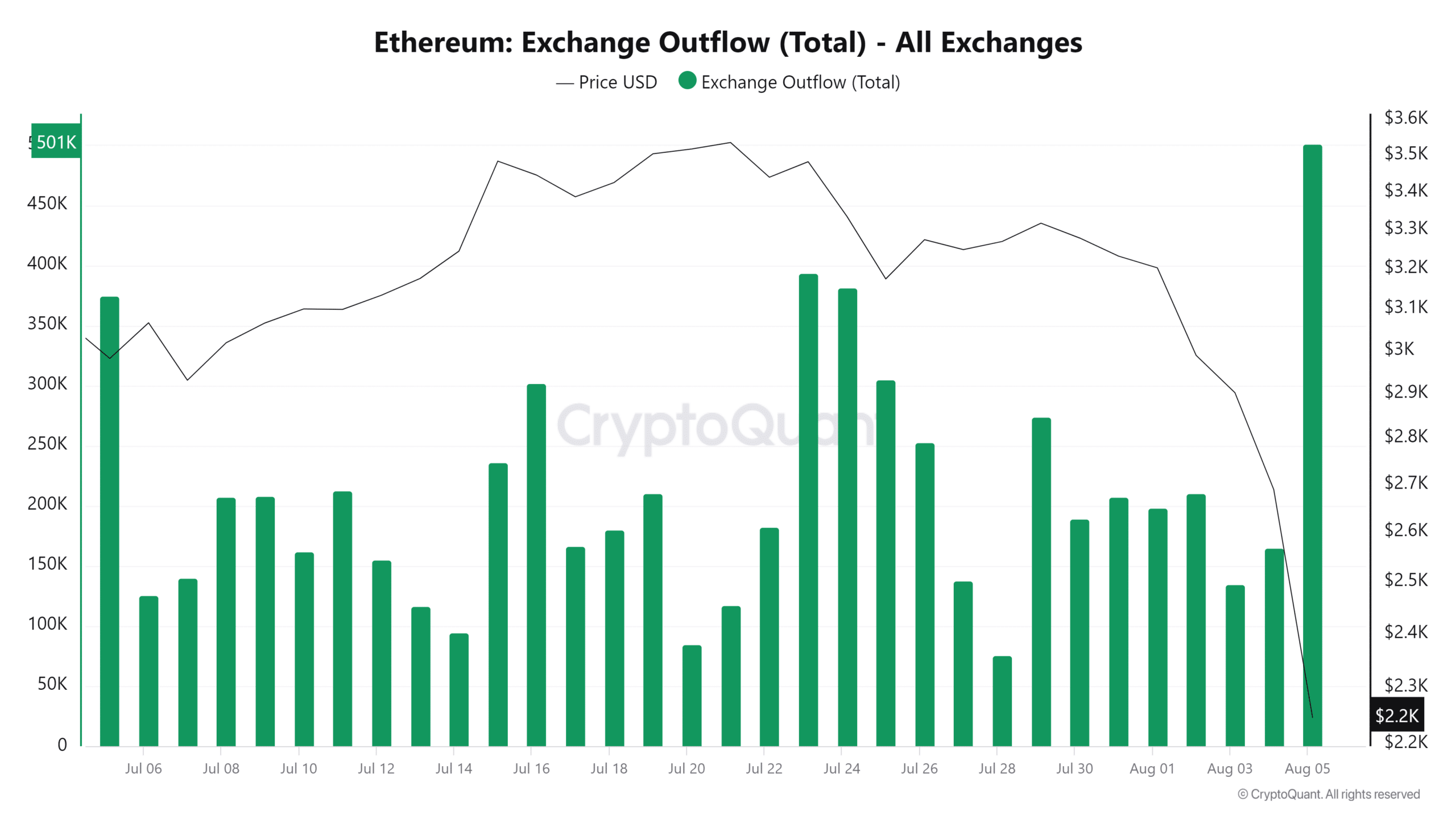

In the past day, there’s been a significant movement of Ethereum: approximately 501,000 ETH were withdrawn from exchanges, marking the largest daily withdrawal over the past 30 days.

During the same timeframe, inflows of 446,877 Ether (Ethereum’s native cryptocurrency) into exchanges were observed, marking the highest such inflow over the past 30 days.

This means ETH had higher outflows than inflows by roughly $119 million in dollar value.

1) The data flowing through these transactions could suggest that demand is rebounding, even at reduced costs. If the intense selling decreases, Ethereum could see a substantial resurgence.

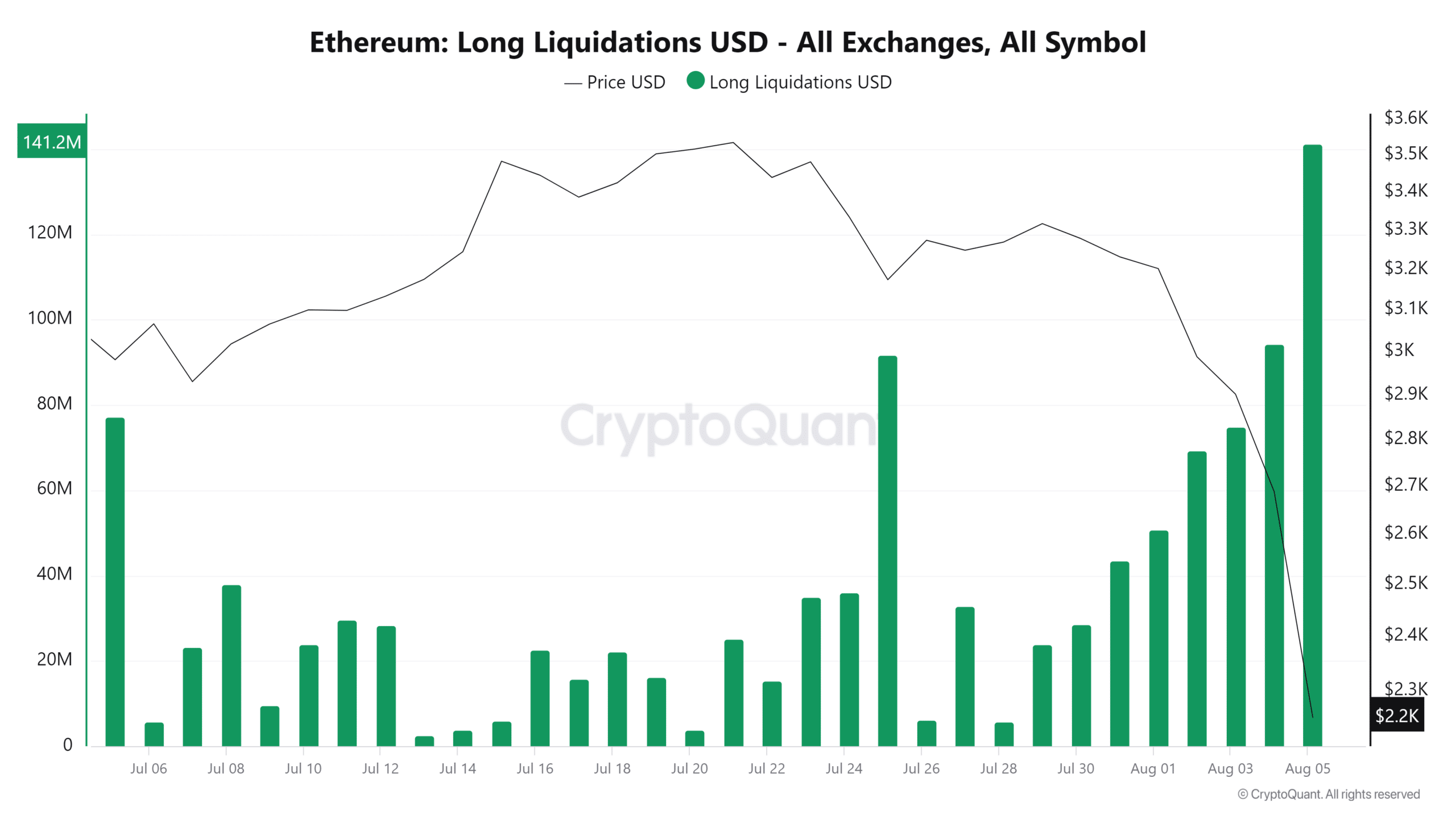

In the past day, a significant increase in long positions being closed (liquidated) was observed, with a total value of $141.2 million. This peak liquidation within the last 24 hours represents the highest single-day liquidation recorded over the last 30 days.

In the past 24 hours, the total value of short liquidations amounted to just $35.5 million. It’s possible that margin calls on highly-leveraged long positions could have exacerbated the price drop we saw during this period.

Read Ethereum (ETH) Price Prediction 2024-25

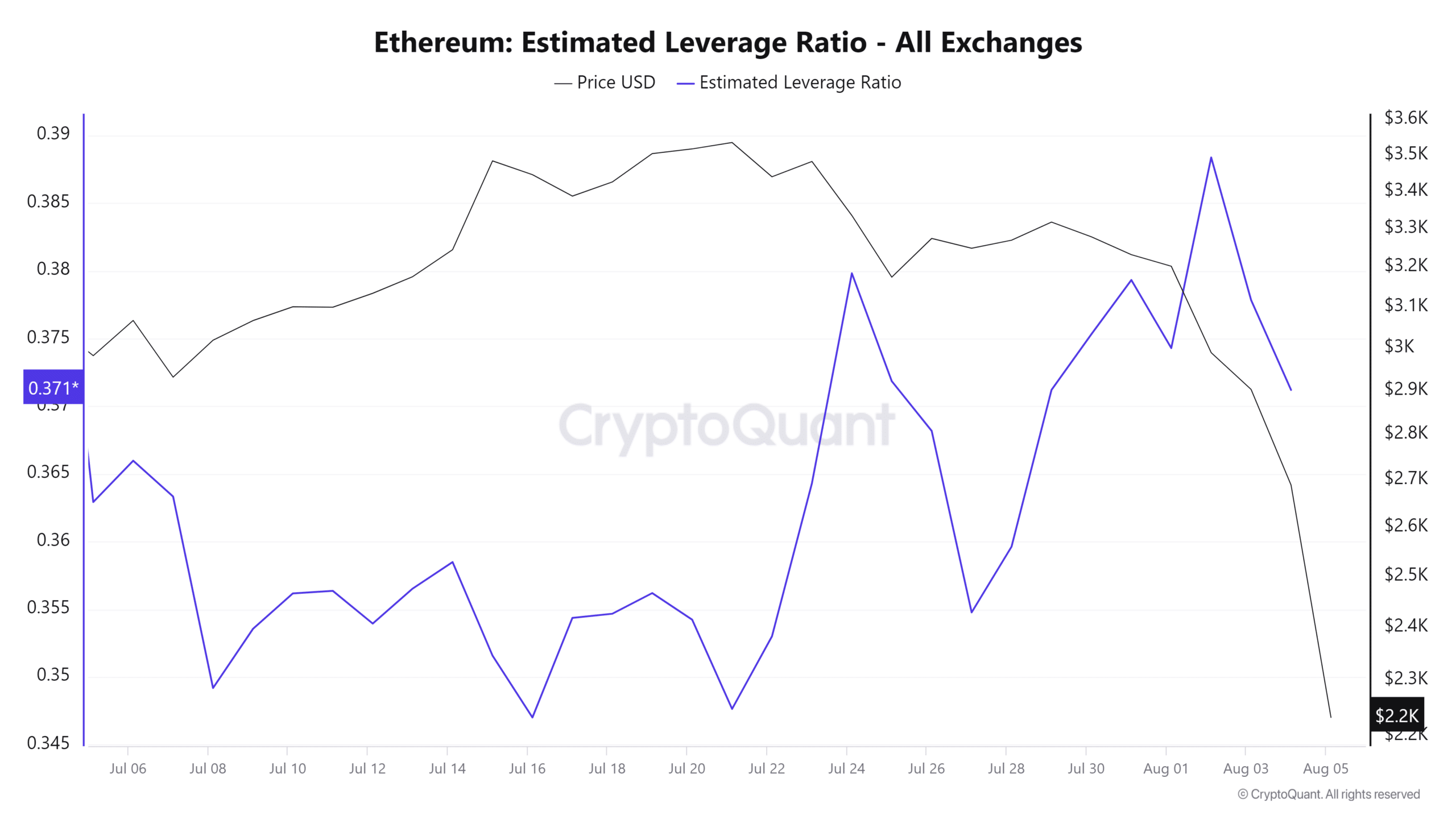

It’s possible that this factor has added to the increased market turbulence since there was a rise in demand for borrowing capital during the past week, leading to an increase in leveraged positions.

It’s quite possible that market volatility will decrease since recent margin calls have led to a reduction in leveraging. Yet, whether we see robust buying interest or ongoing selling pressure could depend on external market conditions.

Read More

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Masters Toronto 2025: Everything You Need to Know

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- The Lowdown on Labubu: What to Know About the Viral Toy

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Microsoft Has Essentially Cancelled Development of its Own Xbox Handheld – Rumour

- Gold Rate Forecast

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

2024-08-06 09:11