- Ethereum ETFs yield sell pressure days after approval, signaling a sell the news scenario.

- Whales took advantage of ETF liquidity by shorting, triggering long liquidations.

As a seasoned financial analyst with extensive experience in the crypto market, I have witnessed firsthand how regulatory approvals can lead to significant sell pressure. With Ethereum [ETH] ETFs recently receiving approval for trading, I am not surprised that we are seeing a “sell the news” reaction unfold.

The third day has passed since Ethereum [ETH] ETFs obtained regulatory approval, marking the second day of trading. The behavior of Ethereum’s price during this time indicates a “sell-the-news” response.

Previously, we considered the potential for Ethereum ETFs facing outcomes similar to those seen following the approval of Bitcoin ETFs.

The price experienced a pullback after its earlier surge, which occurred prior to the regulatory approvals for Ethereum ETFs. Similarly, Ethereum ETFs have exhibited this pattern so far.

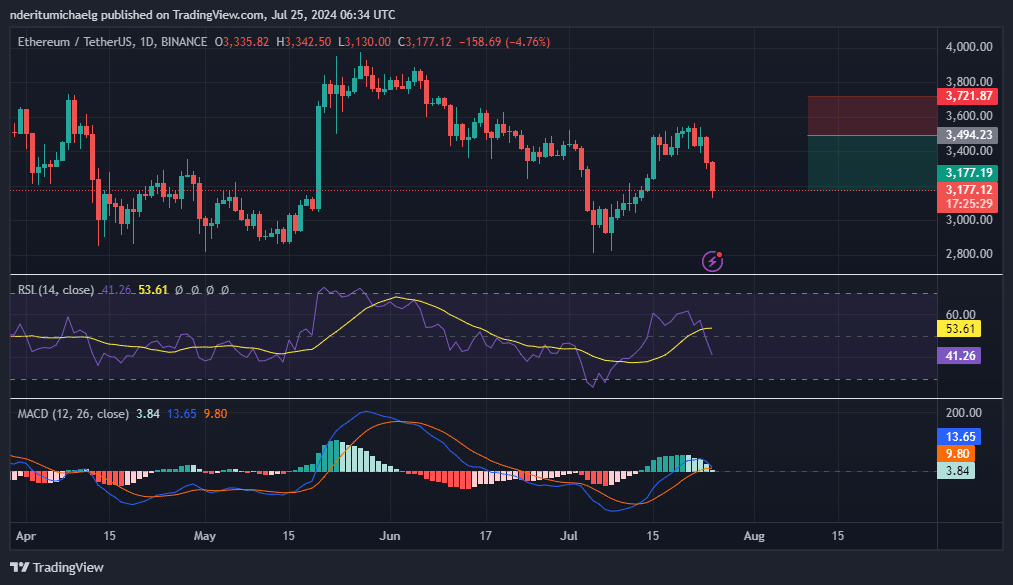

At the current moment, ETH‘s value was recorded at $3,177. This figure suggests that there has been a significant surge in selling activity. Compared to the price at the approval of the ETFs, there has been a decrease of more than 10%.

Before that point, the price of Ethereum was 21% higher than its July lows following a strong 15-day surge in value, just prior to the announcement of the ETF approvals.

As an analyst, I’ve noticed that ETH‘s MACD indicators have signaled a loss of bullish momentum. In fact, it was just about to turn negative. The volume levels we’ll see in the coming days will be crucial in determining if ETH’s downtrend will continue.

Based on the RSI reading, it seemed there was still potential for additional selling as it hadn’t yet reached oversold conditions. Additionally, our examination revealed that Ethereum’s next significant support lay beneath the $2,900 price point.

Whales on the hunt

Based on the selling pressure observed over the past three days, it’s possible that large Ethereum investors, referred to as “whales,” are capitalizing on the anticipated influx of liquidity from upcoming Ethereum Exchange-Traded Funds (ETFs).

According to data from Lookonchain, Grayscale transferred 140,044 Ethereum, equivalent to around $500 million, to Coinbase Prime over the past 24 hours. This transaction indicates that large-scale investors, or “whales,” are contributing to sell pressure within the market.

Currently, reduced Ethereum prices might be drawing in more purchasers as it continues to drop. According to Lookonchain, the BlackRock (iShares) Ethereum ETF has acquired approximately 76,669 ETH, equivalent to around $262 million.

Long liquidations intensify

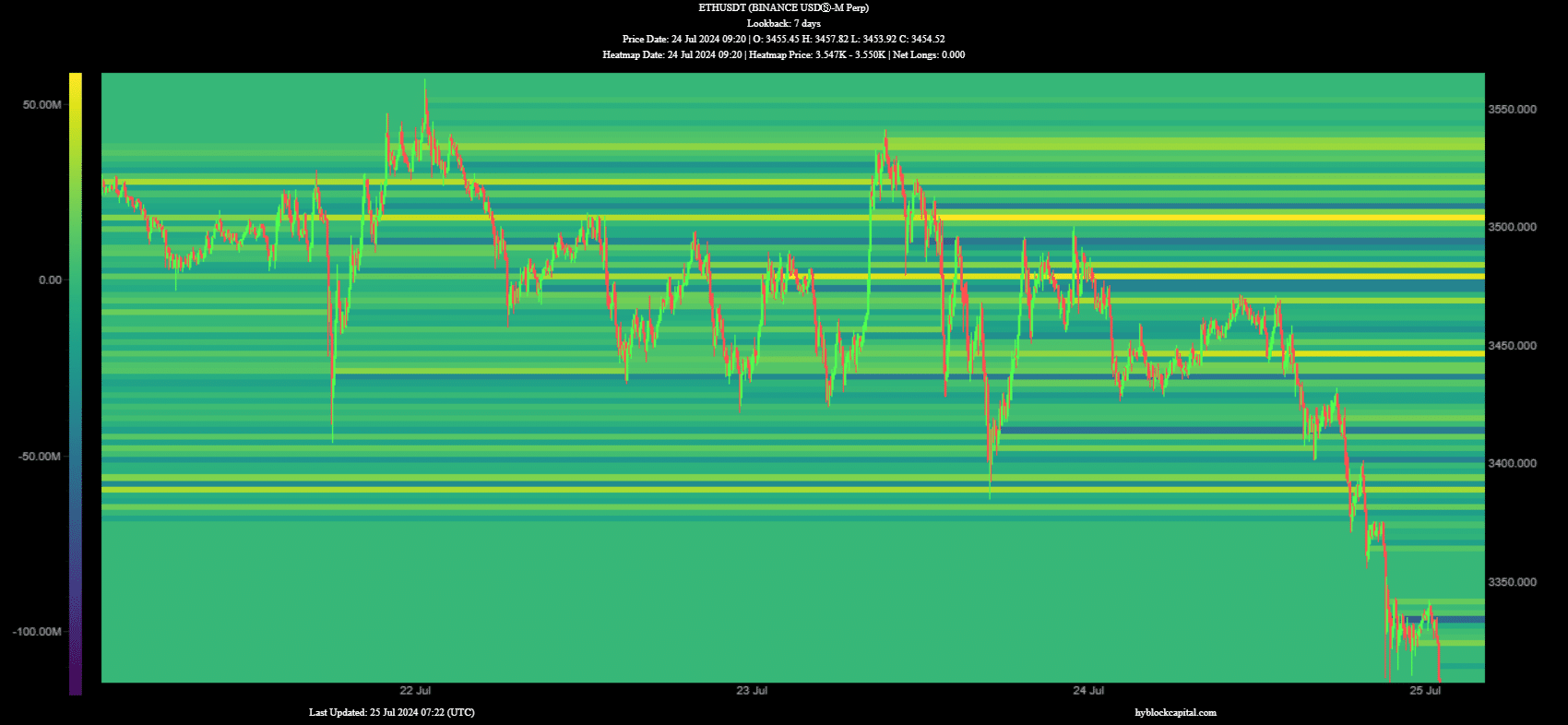

Based on the downtrend in prices, it appears that many investors holding long positions may have experienced losses. Upon examining HyblockCapital’s heatmaps, we uncovered the following details:

On July 23rd, the number of net long positions in the market reached almost 50 million at approximately $3,500. The heat map signals significant selling activity around this price point, leading to a decline in prices and bringing them down below $3,300 within the same day.

Read Ethereum’s [ETH] Price Prediction 2024-25

Approximately 44.76 million units were located at the $3455 mark on the 24th of July. The following significant zone on the heat map is next.

Additionally, we noted a significant increase in buy orders around the $3410 mark, which was subsequently followed by a notable concentration of red areas on the heat map indicative of numerous liquidations occurring close to the $3380 price point.

Read More

- PI PREDICTION. PI cryptocurrency

- How to Get to Frostcrag Spire in Oblivion Remastered

- S.T.A.L.K.E.R. 2 Major Patch 1.2 offer 1700 improvements

- Kylie & Timothée’s Red Carpet Debut: You Won’t BELIEVE What Happened After!

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- We Ranked All of Gilmore Girls Couples: From Worst to Best

- How Michael Saylor Plans to Create a Bitcoin Empire Bigger Than Your Wildest Dreams

- Quick Guide: Finding Garlic in Oblivion Remastered

- PS5 Finally Gets Cozy with Little Kitty, Big City – Meow-some Open World Adventure!

- Florence Pugh’s Bold Shoulder Look Is Turning Heads Again—Are Deltoids the New Red Carpet Accessory?

2024-07-26 03:04