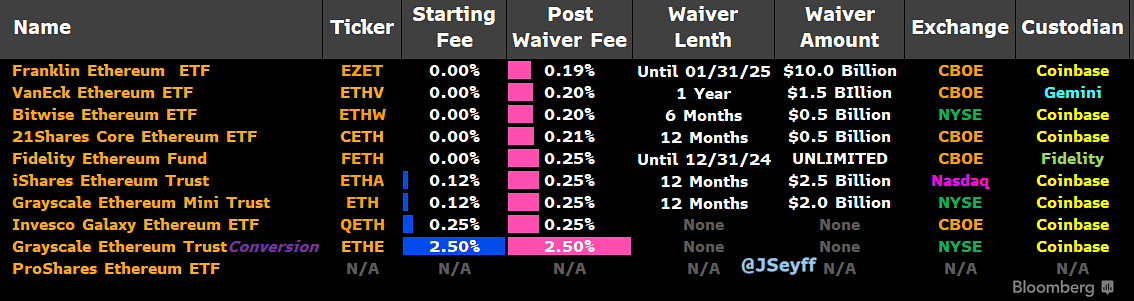

- Grayscale’s has a hefty 2.5% fee, 10X higher than its competition.

- BlackRock fees are set at 0.25% as the market expects outrage flows from Grayscale.

As a seasoned financial analyst with years of experience in the ETF industry, I have closely followed the developments surrounding Ethereum [ETH] ETFs and their fee structures. The recent announcement by potential issuers regarding their fees has certainly piqued my interest.

On Wednesday, prospective Ethereum [ETH] ETF creators adjusted their fee plans in anticipation of possible S-1 approvals and the subsequent rollout of these financial instruments on July 23rd.

Based on information from Bloomberg ETF analyst James Seyffart, approximately seven issuers hold waivers granted due to specific timeframes or asset thresholds.

Despite having the highest fees at 2.5%, Grayscale’s ETHE product, contrastingly, had significantly higher charges compared to BlackRock’s iShares Ethereum Trust which set their fees at a much lower rate of 0.25% after waiving some costs.

Grayscale’s ETHE has a constant fee of 2.5%, unlike BlackRock which charges 0.12% for the first year if the net assets are below $2.5 billion. After the conversion of Grayscale’s trust into an ETF on July 23rd, this higher fee will remain in place.

Ethereum ETF fee wars

Market commentators have expressed disappointment and criticism towards Grayscale’s recent action, with Nate Geraci of ETF Store going so far as to label it a “significant misstep.”

Eric Balchunas, an analyst at Bloomberg ETF, issued a warning. He pointed out that Grayscale’s fees were significantly higher than those of their competitors, potentially leading to substantial outflows due to public outrage.

The grayscale version isn’t getting any less monochrome whatsoever. This implies a significant edge over competitors, approximately ten times greater. Such a difference might stir some controversy. I believe the Mini ETF will be quite affordable though, possibly charging only 15 basis points. An intriguing market situation unfolds here.

From a comparative standpoint, it’s important to note that the Grayscale Ethereum Trust (ETH) and BlackRock had comparable fee structures. Specifically, ETH charged 0.25%, with a starting fee of 0.12%. Following the conversion, the Mini Trust is expected to be separated from ETHE.

“10% of $ETHE will be automatically spun off and into $ETH. $ETHE currently has $10 billion in assets. So $ETH should essentially start it’s life with $1 billion in assets.”

Although the Mini Trust charged lower fees, some industry analysts predicted substantial withdrawals from ETHE due to other reasons.

Per HODL15 Capital estimates, ETHE outflows could hit 50%-60% following the hefty fees.

“If Grayscale makes the same error in fees with $ETHE as they did with $GBTC, we could see outflows of approximately 50% to 60%. This represents around ten billion dollars in assets under management.”

Commissioner Hester Peirce of the Securities and Exchange Commission (SEC) has indicated that the possibility of an ETH Exchange-Traded Fund (ETF) allowing staking may be worth revisiting in light of impending political shifts in the United States.

In terms of pricing, Ethereum’s recent bounce back encountered a roadblock at the $3,500 mark. At the time of printing this, Ethereum was valued at approximately $3,400 and might look to challenge the $4,000 threshold if it successfully surpasses $3,500.

Read More

- Solo Leveling Season 3: What You NEED to Know!

- Rachel Zegler Claps Back at Critics While Ignoring Snow White Controversies!

- OM PREDICTION. OM cryptocurrency

- Captain America: Brave New World’s Shocking Leader Design Change Explained!

- Oshi no Ko Season 3: Release Date, Cast, and What to Expect!

- Oblivion Remastered: The Ultimate Race Guide & Tier List

- Gold Rate Forecast

- How to Get to Frostcrag Spire in Oblivion Remastered

- Fantastic Four: First Steps Cast’s Surprising Best Roles and Streaming Guides!

- Meta launches ‘most capable openly available LLM to date’ rivalling GPT and Claude

2024-07-18 22:15