-

ETH ETF’s first-day results outperformed analysts’ estimates of 15-15% of BTC ETFs.

BlackRock’s ETHA led the way, but Grayscale bled out nearly a half-billion in outflows.

As a seasoned financial analyst with extensive experience in the crypto market, I have closely followed the development and debut of Ethereum [ETH] exchange-traded funds (ETFs) in the U.S. markets. Based on the data available, I am particularly intrigued by the impressive first-day results of these ETFs.

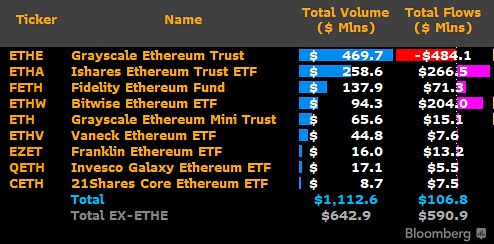

In their first day on the market, United States Ethereum (ETH) Exchange-Traded Funds (ETFs) recorded impressive trading volumes of over $1 billion. Notably, Grayscale’s ETHE, along with BlackRock and Fidelity’s Ethereum ETFs, garnered significant attention with trading volumes exceeding $100 million each on their debut day.

Apart from 21Shares, the other ETFs managed by Vaneck, Franklin, and Invesco Galaxy experienced significant trading activity each day, exceeding $10 million in volume.

According to Bloomberg’s data analysis, a total of $317.5 million was invested in the mentioned products, with BlackRock’s ETHA and Bitwise’s ETHW accounting for $266.5 million and $204 million respectively, contributing significantly to the net inflows of $107 million.

As a researcher analyzing the data, I’ve discovered that among all the investment products under consideration, Grayscale’s ETHE had the significant outflow amounting to $484.1 million. In contrast, its mini version, Grayscale’s ETHE mini, experienced an inflow of $15.1 million.

ETH ETF first day results beats analysts’ estimates

In spite of Grayscale’s significant outflows, the recorded trading volume exceeding $1 billion and net flows surpassing $100 million surprised analysts with figures beyond their expectations.

If Eric Balchunas, an analyst at Bloomberg, had previously predicted, these specific products would surpass their anticipated “20% of Bitcoin ETF” performance if BlackRock exceeded $200 million in trading volume.

As a crypto investor, I would interpret this information as follows: Based on BlackRock’s ETF as a benchmark, the trading volume of $ETHA after the first hour is expected to be roughly $50 million. If $ETHA manages to surpass $200 million by the end of the day, it will be performing better than our initial expectation that it should represent 20% of Bitcoin’s daily trading volume, given that $IBIT achieved a first-day trading volume of over $1 billion.

It’s intriguing that ETHA reached a trading volume of $258 million by the close of business on Tuesday. This figure represents approximately a quarter of BlackRock’s IBIT initial daily trading volume. Notably, this surpassed expectations.

As a analyst, I’d observe and express that Zaheer Ebtikar from crypto hedge fund Split Capital was thrilled to comment on the exceptional outcomes we’ve seen. These initial results surpassed even the most optimistic projections of industry analysts.

The final data from our side indicates approximately $1.3 billion in aggregate volume for Ethereum ETFs. This is around 28% of Bitcoin’s initial figure, making it a significant amount that surpasses many predictions which ranged between 15-20%.

Indeed, certain investments such as the VanEck Ethereum ETF (ETHV) surpassed their Bitcoin ETF counterparts in terms of initial performance. In response to these impressive gains, VanEck’s head of digital asset research, Mathew Sigel, expressed pride in the accomplishment.

“And proud that $45M of $ETHV traded, beating our day 1 $HODL volumes of $26M!”

As a crypto investor, I’ve noticed with concern that Grayscale’s ETHE experienced a significant outflow of $484.1 million on its first day, which is much more than the $95.1 million outflow during GBTC’s debut on 11th January. This large outflow raises valid concerns about the current state of ETHE.

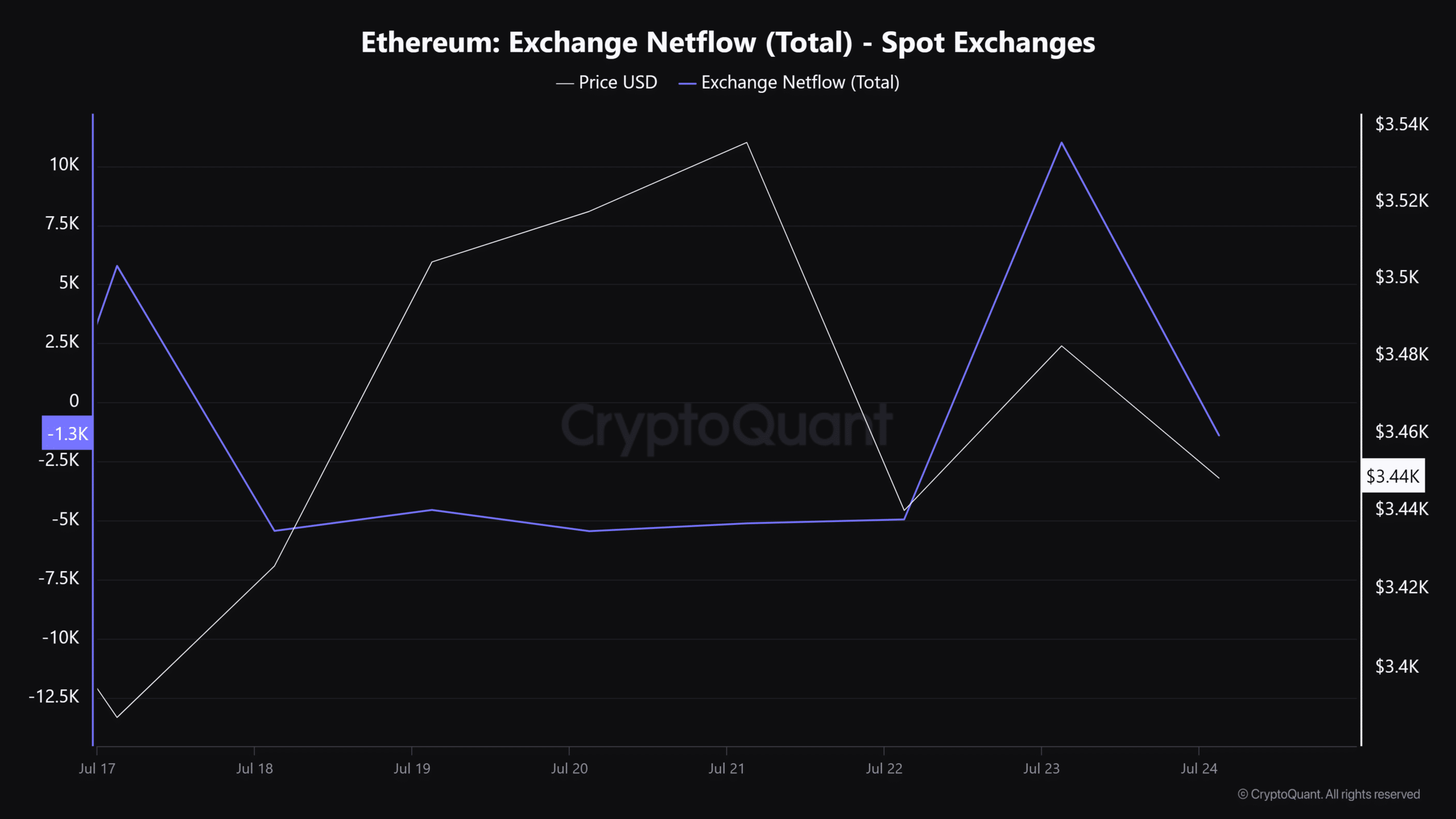

On the day of its ETF debut, the Ethereum price experienced a modest increase of approximately 1.25%, reaching a peak of around $3,540. However, by the time of publication, it had dipped slightly below $3,500.

After the ETF’s launch, there was minimal selling pressure on the ETH spot market, which was indicated by a decrease in exchange outflows.

The net flow of ETH shifting from exchanges to personal wallets saw an uptick, signifying a higher quantity of ETH being taken out compared to being deposited.

Read More

- Hut 8 ‘self-mining plans’ make it competitive post-halving: Benchmark

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- Jujutsu Kaisen Reveals New Gojo and Geto Image That Will Break Your Heart Before the Movie!

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- Shundos in Pokemon Go Explained (And Why Players Want Them)

- Kylie & Timothée’s Red Carpet Debut: You Won’t BELIEVE What Happened After!

- S.T.A.L.K.E.R. 2 Major Patch 1.2 offer 1700 improvements

- We Ranked All of Gilmore Girls Couples: From Worst to Best

- How to Get to Frostcrag Spire in Oblivion Remastered

- LUNC PREDICTION. LUNC cryptocurrency

2024-07-24 14:15