-

Grayscale makes U-turn on Mini Ethereum Trust, drops fees to 0.15%

Is that enough to minimize the potential ETHE outflows and keep ETH above $3K?

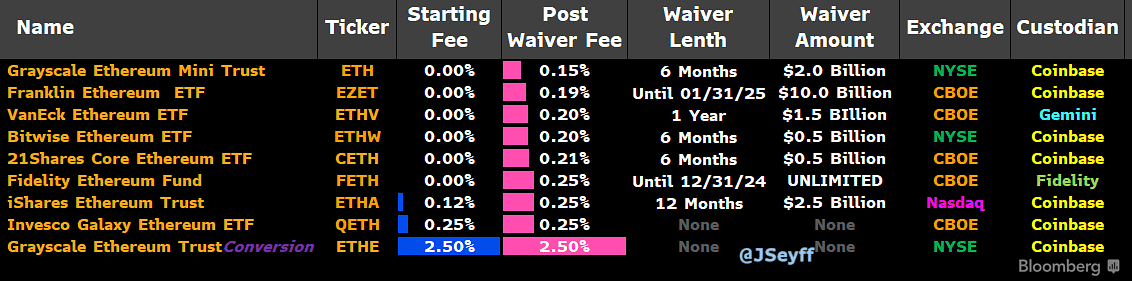

As a seasoned researcher with extensive experience in the crypto market, I’ve closely monitored Grayscale’s Ethereum ETF (ETH) and its high fees that put it at a significant disadvantage compared to its competitors. The recent 2.5% fee structure on ETHE was a huge turnoff for potential investors, leading to concerns of “outrage outflows” and downward pressure on ETH’s price above $3K.

On the seventeenth of July, there was significant backlash regarding the high 2.5% fees charged by Grayscale Ethereum [ETH] Trust, which was ten times more than that of its rival ETFs, such as ETHE.

Indeed, Eric Balchunas, a seasoned ETF analyst at Bloomberg, had issued a cautionary note. He predicted potential massive withdrawals in response to the high fees associated with Grayscale.

Furthermore, the Grayscale Ethereum Mini Trust, a new entity resulting from the conversion of ETHE, sets its management fee at 0.25%, aligning with industry leaders such as BlackRock, Fidelity, and Invesco.

Experts in the financial market expressed their concern over Grayscale’s decision to keep charging high fees on its ETHE product while failing to offer more affordable alternatives through its Mini Trust, deeming it a significant missed opportunity and a letdown.

It seems the issuer has read the market mood and updated its fee structure.

Grayscale drops Ethereum Mini Trust fees to 0.15%

In a recent amended S-1 filing on Thursday, Grayscale lowered the management fees for its ETH Mini Trust from 0.25% to 0.15%. Moreover, Grayscale is providing a complete fee waiver for the first $2 billion in assets under management, making it the most affordable option among its competitors.

Balchunas called the update a “good catch,” noting,

The “Mini me” Ethereum fee has been reduced to only 15 basis points, making it the most affordable in the market currently. This price decrease is expected to benefit the cause positively. Well done for noticing this significant change.

Nate Geraci, from ETF Store, initially criticized Grayscale for their high fees. However, after the recent update, he expressed approval by calling it a “clever decision.”

“Bravo, Grayscale…This is how you go for the jugular…Smart move IMO.”

On July 23rd, there will be an automated distribution of 10% of ETHE’s assets, amounting to approximately $10 billion at the current time, to form The Mini Trust (ETH).

As an analyst, I would express it this way: The Grayscale Ethereum Trust (ETHE) continues to charge a maximum fee of 2.5%, without any reduction or exemption.

An analyst from Thanefield Capital posits that the Mini fee update might lessen “significant outflow of funds in response to public outrage.”

Among ETFS currently available, this one now offers the most competitive fees. This fee advantage could potentially prevent assets under management from shifting away from Grayscale and lessen outflows for $ETHE. There are unconfirmed reports suggesting that the ETHE-to-ETH conversion is tax-exempt, which would be an additional bullish factor.

Ethereum price action

The price of Ethereum (ETH) remained steady around $3,500 on the chart before the anticipated approval and upcoming launch of the Ethereum-linked Exchange Traded Fund (ETF) next week.

Although the RSI indicator showed stronger than typical buying activity with its above-average reading, Ethereum investors need to surmount the resistance at $3,500 before targeting the next objective at $4,000.

If the anticipated launch of an ETH Exchange-Traded Fund (ETF) results in a “sell the news” scenario, then it’s essential to keep an eye on the price levels at $3,300 and the demand zone above $2,900.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

2024-07-19 13:12