-

ETH volume soars past $1 billion during the first 24 hours.

The recent surge sparks investors optimism.

As a seasoned crypto investor, I have witnessed the ups and downs of the digital asset market for years. The recent approval and subsequent surge in trading volume for Ethereum [ETH] Exchange-traded funds (ETFs) has been an exciting development that has rekindled optimism among investors, myself included.

After a prolonged period of anticipation, Ethereum [ETH] Exchange-Traded Funds (ETFs) became available for trading on July 23rd. The cryptocurrency world had been looking forward to the launch of ETH ETFs with great interest.

After the recent green light given to Bitcoin ETFs, there’s been a lot of excitement and anticipation in the market regarding potential approvals of additional ETFs.

ETH ETF hits past $1 billion

As an analyst, I’m here to provide insights based on data. Last week, the CBOE gave its approval to nine Exchange Traded Funds (ETFs) tied to Ethereum (ETH). Shortly following this announcement, the NYSE gave the green light for trading these ETFs. In the initial hours of trading, the volume reached an impressive $110 million, but it didn’t stop there. Within a short timeframe, the trading volume surged, reaching a staggering $600 million.

Over the course of trading, the ETH ETF has experienced a significant increase in volume, exceeding $1 billion by the end of the business day. This figure represents more than a quarter of the trading volume achieved by BTC ETFs during their initial day of trading, astonishing the market.

During today’s trading sessions, I observed significant difference in trading volumes between the Ishares Ethereum Trust (ETHA) and IBIT. Specifically, ETHA recorded a notable volume of $694.5 million on its first day, whereas IBIT managed only $248 million.

It is evident from the data that Ethereum-based exchange-traded funds (ETFs) have outperformed their Bitcoin counterparts. The surge in interest for Ethereum ETFs can be attributed to their more affordable pricing in the market.

Significantly, this surge in activity has sparked lively debate among community members as analysts express varied perspectives. For example, Eric Balchunas expressed his insights on his X page several months ago. He pointed out the contrasting performance of Ethereum’s ETF and Bitcoin’s ETF.

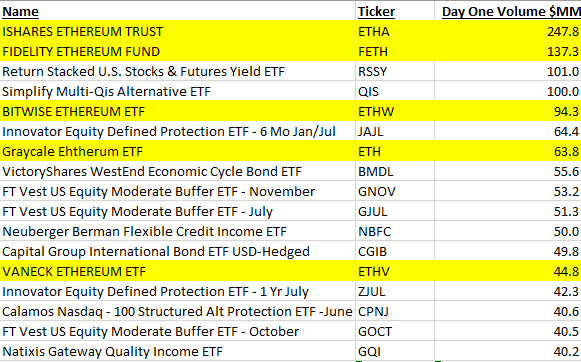

I was intrigued to explore the ranking of Ethereum-based ETFs in terms of trading volume on their debut day, relative to approximately 600 other launches over the past year. Surprisingly, excluding Bitcoin ETFs and Ethereum futures ETFs ($ETHA), $FETH would take the second place, $ETHW the fifth, and $ETH the seventh spot. $ETHV ranked in the thirteenth position. Notably, even the least traded among them, $CETH, still managed to secure a place within the top 10% when compared to typical new ETF launches. This data further highlights the uniqueness of these Ethereum ETFs.

Increased whale activity

Significantly, the green light for Ethereum ETFs (Exchange-Traded Funds) has sparked heightened interest and activity among different investors, most notably large Ethereum holders or “whales.”

Based on Santiment’s analysis, there has been a surge in whale transactions involving Ethereum ETFs following the announcement by CBOE regarding the start of trading. According to Santiment’s X (previously Twitter) post, this trend was observed.

The surge in Ethereum’s 9 newly launched spot ETFs since July 17th has noticeably influenced whale-level activities. In comparison to Bitcoin and USDT transactions on the Ethereum network, the number of ETH transfers valued over $100,000 has increased by 64% and 126%, respectively.

Whale behavior indicates a heightened level of confidence among investors regarding the future trajectory of the altcoin. They believe that Ethereum ETFs will eventually push prices upward, leading to enhanced profitability. Their faith in this direction is rooted in optimism about the crypto’s potential prospects.

Impacts on price charts

At present, Ethereum is priced at $3449 following a minimal 0.06% decrease within the last 24 hours. Moreover, there’s been a 1.10% decrease in its value over the past week.

Although ETH saw an increase in trading volume prior to approval, it experienced a drop of 12% following the approval process. The trading volume swelled by 30% before approval but subsequently shrank to 18.57%.

This suggests that Ether ETFs approval has not positively impacted price charts.

The market mood stays upbeat overall based on the MACD indicator’s findings. According to this technical analysis tool, the short-term moving average lies above the long-term one, which indicates strong buying momentum and a favorable market outlook.

Read Ethereum’s [ETH] Price Prediction 2024-25

As a researcher observing the data, I can confirm that a positive Average Order (AO) adds weight to my earlier observation. This finding signifies that the short-term trend is exhibiting a more robust growth compared to the long-term trend.

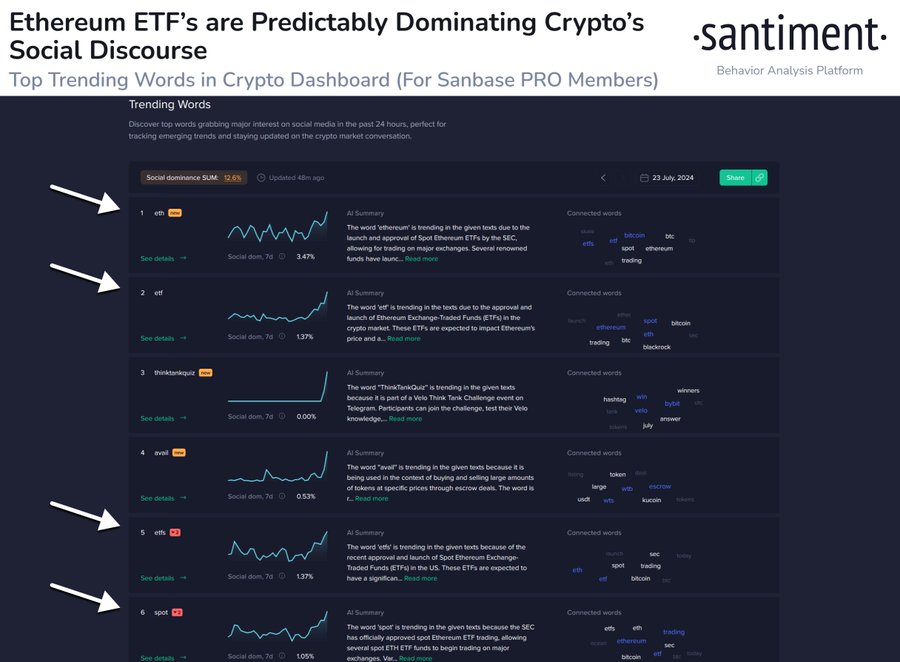

Based on Santiment’s data, the interest in ETH spot Exchange-Traded Funds (ETFs) has surged significantly prior to their launch. According to their report accessible via the X page, this trend is noticeably more pronounced compared to other ETFs.

On an extraordinary day, the public interest surrounding the terms “Ethereum,” “Spot,” and “ETF” has reached unprecedented levels. In the past 24 hours, Ethereum’s price against Bitcoin has risen by 3.4%. Traders are optimistic that this positive trend for crypto’s second largest market capitalization asset is only the beginning.

Read More

2024-07-24 16:08