- Spot Ethereum ETFs will potentially begin trading next Tuesday.

- The SEC is in the process of gathering final drafts from prospective spot Ethereum ETF issuers.

As a seasoned market analyst with over a decade of experience in following the cryptocurrency space, I have seen my fair share of market rumors and speculations. However, the latest news surrounding the potential approval of spot Ethereum ETFs next week has piqued my interest like never before.

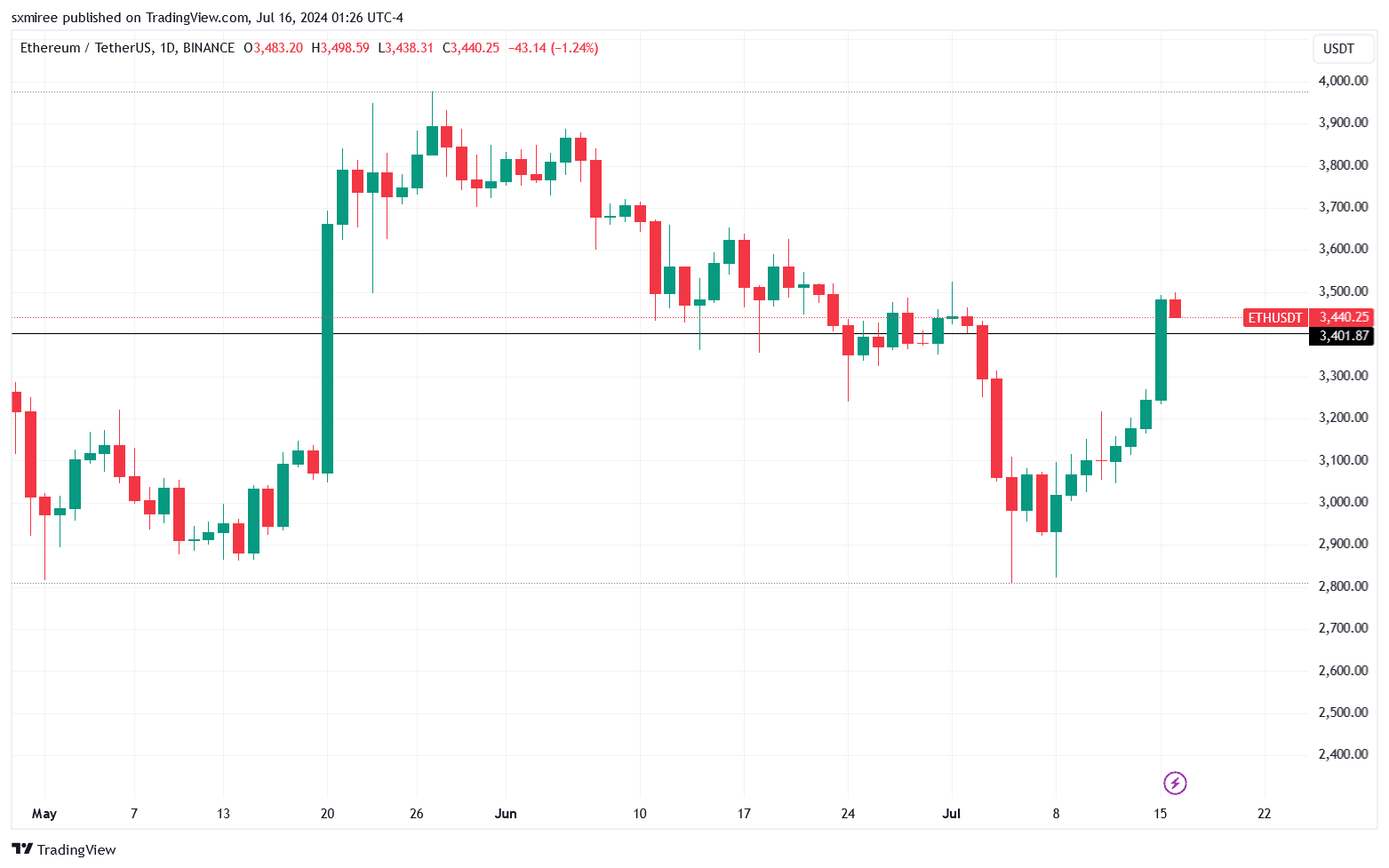

Today, Ethereum [ETH] surpassed $3400, reaching a peak price of $3,498 on CoinMarketCap. However, its upward trend faltered, and at the moment of writing, Ethereum was trading for $3,445 – marking a 3.64% increase in value over the past 24 hours.

Despite ETH recovering by 12.8% over the past week to trade above $3,000 at press time, it still represented a 13.2% decrease in value compared to its peak on March 11th.

Recent advancements follow closely behind news of an anticipated U.S. approval for a Spot Ethereum exchange-traded fund (ETF) in the upcoming week.

Spot Ethereum ETF Update

Nate Geraci, a prominent ETF market analyst, confidently anticipated this week that the SEC would swiftly grant approval to the re-filed registration statements.

In a Sunday post on X (formerly Twitter), Geraci wrote,

“Greetings crypto investor here, we’ve reached the pivotal moment in ETH ETF approval week. I personally believe that an announcement is imminent, and I can’t fathom any legitimate reasons for further postponement at this juncture. The issuers are prepared and eager to launch.”

In a separate statement, Bloomberg ETF analyst Eric Balchunas agreed with Geraci’s viewpoint, expressing that an unexpected obstacle emerging at the eleventh hour could be the sole factor hindering the launch.

“I was correct in my hunch. The SEC reached out to issuers today, asking them to submit their final S-1 forms along with fees by Wednesday. Then, they will request effectiveness on the Monday following that close week, allowing for a Tuesday, July 23rd launch.”

According to a report from Reuters published on the 15th of July, sources close to the situation revealed that the SEC is expected to approve the applications of at least three companies – BlackRock, VanEck, and Franklin Templeton – to initiate trading “coming Monday.”

Based on reliable sources, this approval stage hinges upon the submission of final documents by the issuers prior to the week’s end.

Market anticipation

As a researcher, I’ve noticed an increasing buzz in the market over the past few weeks following the SEC’s approval of applicant forms 19b-4 in May. The exact date of approval has yet to be disclosed, but the anticipation continues to grow.

In June, the US SEC delivered feedback on the filed S-1 forms, highlighting areas needing review.

Last week, the securities regulatory body requested that the eight prospective Ethereum ETF applicants update and resubmit their S-1 registration forms.

A proposed Ethereum ETF gaining approval is likely to bring about substantial changes in the Ethereum market and the larger cryptocurrency sector.

As an analyst, I would explain that Ether-linked ETFs represent a fresh opportunity for investors to access this popular altcoin via a legitimate financial instrument. These ETFs track the real-time price of Ether, making it a more convenient and secure way to invest compared to directly purchasing and managing cryptocurrencies.

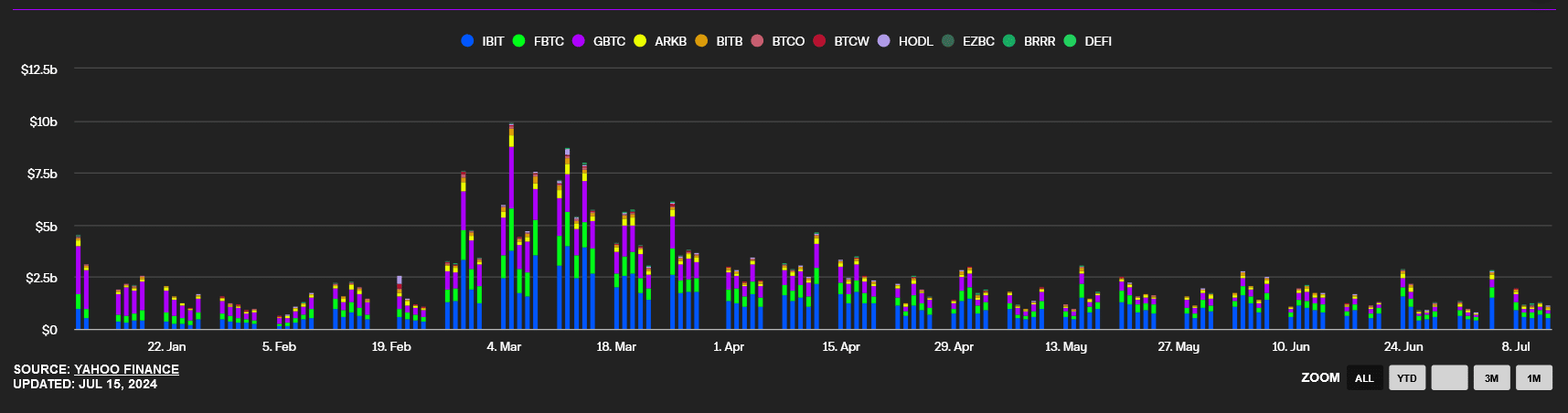

Market experts generally anticipate that Ethereum Exchange-Traded Funds (ETFs) may draw institutional investments, mirroring the surge of institutional interest in Bitcoin ETFs witnessed during the first half of the year.

As a crypto investor, I’ve noticed an impressive inflow of funds into U.S.-listed Bitcoin Exchange-Traded Funds (ETFs) since their debut this year. According to the latest data from Farside’s Bitcoin ETF flow table, a remarkable $16.12 billion has been poured into these investment vehicles.

Read Ethereum’s [ETH] Price Prediction 2024-2025

It’s important to mention that the proposed launch date aligns with the week of the 2024 Bitcoin conference in Nashville.

As an analyst, I’d describe it this way: From the 25th to the 27th of July, a notable conference is scheduled to take place. Some of its distinguished speakers include Michael Saylor, executive chairman at MicroStrategy, Cathie Wood, founder of ARK, Robert Kennedy Jr, an independent U.S. Presidential candidate, and Donald Trump, a Republican U.S. presidential hopeful.

Read More

- WCT PREDICTION. WCT cryptocurrency

- PI PREDICTION. PI cryptocurrency

- SUI’s price hits new ATH to flip LINK, TON, XLM, and SHIB – What next?

- Michelle Trachtenberg’s Mysterious Death: The Unanswered Questions

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- SOL PREDICTION. SOL cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- Upper Deck’s First DC Annual Trading Cards Are Finally Here

- Buckle Up! Metaplanet’s Bitcoin Adventure Hits New Heights 🎢💰

- Has Unforgotten Season 6 Lost Sight of What Fans Loved Most?

2024-07-16 09:14