- Ethereum ETFs saw $84.6 million in inflows, but still lag far behind Bitcoin ETF inflows.

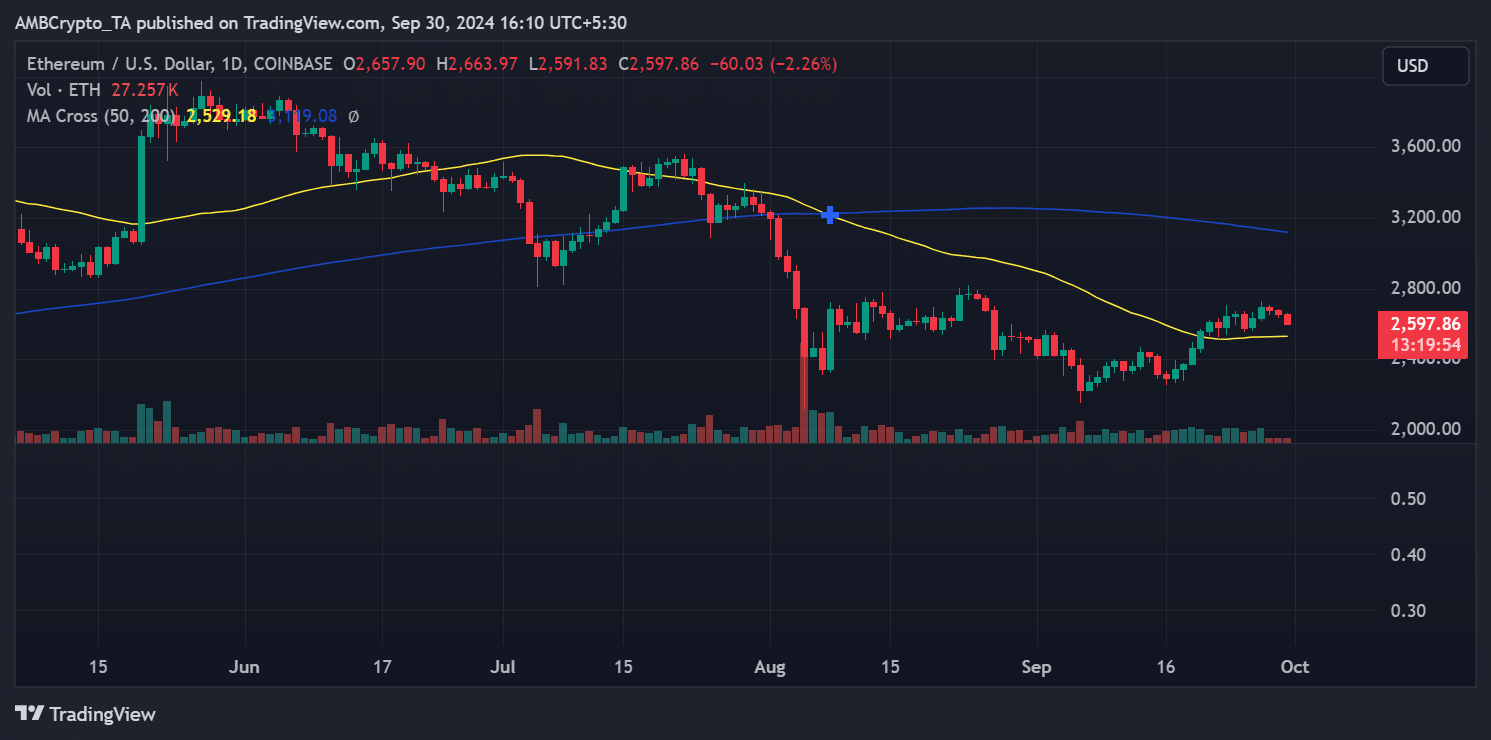

- Despite price dips, Ethereum remained above its 50-day moving average, indicating short-term bullish momentum.

As a seasoned crypto investor with over a decade of experience in this volatile market, I find the recent developments in Ethereum ETF inflows intriguing but not entirely surprising. While it’s heartening to see Ethereum ETFs recording their largest inflow since August, it’s disappointing to note that they still lag far behind Bitcoin ETFs.

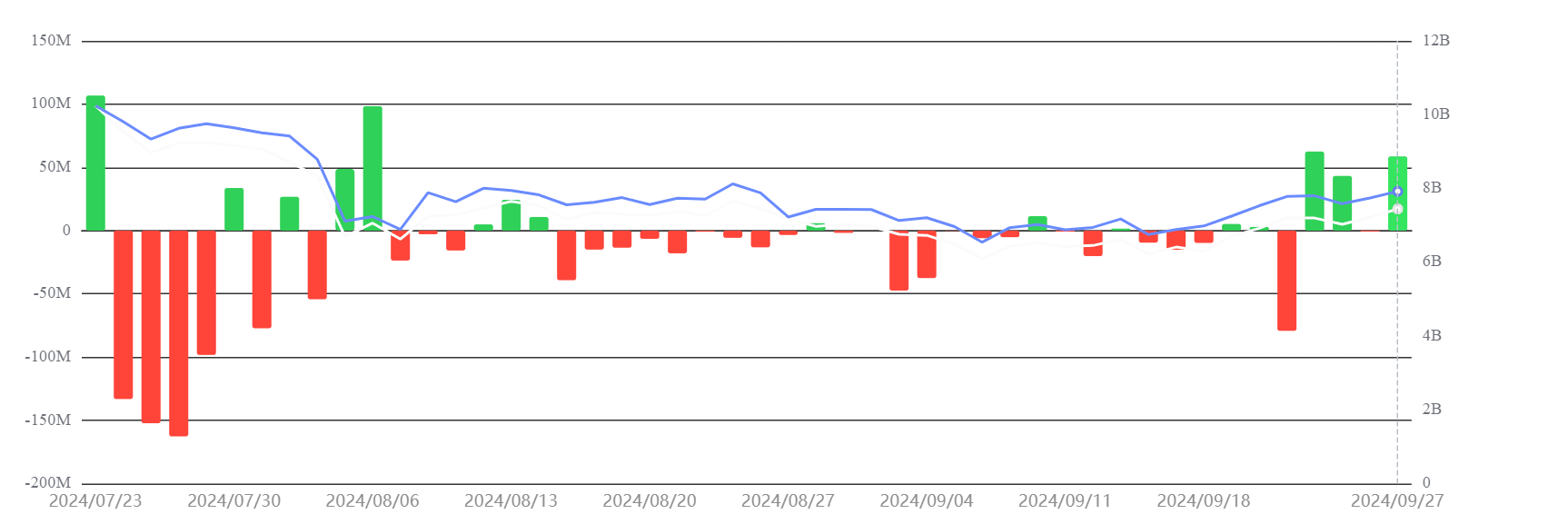

Data shows that there has been the greatest influx into Exchange Traded Funds (ETFs) based on Ethereum [ETH] in more than a month’s time recently.

Even though there’s more interest in ETH ETFs, the inflows are noticeably smaller compared to Bitcoin ETFs, indicating a greater appetite for Bitcoin-focused ETFs.

First weekly inflow since August

Last week, data from SosoValue indicates that Ethereum Exchange-Traded Funds (ETFs) experienced approximately $84.6 million in investments. These funds experienced positive investments on three out of the five trading days.

This week’s influx is at its peak since August 9th. Yet, even with this increase, the trading volume for Ethereum ETFs is significantly lower compared to Bitcoin’s ETF activity.

During the same period, Bitcoin Exchange-Traded Funds (ETFs) experienced a substantial increase of approximately $1.11 billion in investments. Daily inflows were observed throughout the week.

This was Bitcoin’s largest weekly inflow since the 19th of July.

Ethereum ETF still lagging behind Bitcoin

ETFs based on Ethereum started being traded in the United States on July 23rd, approximately half a year following the initiation of Bitcoin ETF trades.

Over a span of five weeks after the introduction of Ethereum Exchange Traded Funds (ETFs), these funds experienced approximately $500 million in total withdrawals, whereas Bitcoin ETFs registered more than $5 billion in new investments.

Bitcoin’s first-mover advantage is one of the reasons for this disparity.

The excitement surrounding Bitcoin’s ETF launch has driven significant inflows, while ETH’s ETF launch, though promising, has generated less buzz over time.

Furthermore, it’s worth noting that there is a significant disparity in market capitalization between these two assets. Bitcoin dominates with more than half (over 50%) of the total cryptocurrency market share, whereas Ethereum accounts for approximately 14%.

ETH price declines as September ends

In the past few days, Ethereum’s price has dipped, falling below the $2,600 level.

Currently, Ethereum is being exchanged for approximately $2,597, representing a decrease of more than 2% in value. However, even with this dip, Ethereum still hovers above its 50-day moving average, suggesting a temporary upward market momentum.

In simpler terms, the RSI (Relative Strength Index) was approximately 53, which supports the optimistic viewpoint indicated by the moving average, hinting at a potentially strong upward trend.

Realistic or not, here’s ETH market cap in BTC’s terms

Recently, there’s been an increase in investments into the Ethereum ETF following a quiet spell, but when compared to Bitcoin ETFs, it still lags significantly in terms of trading volume and popularity among investors.

Elements like Bitcoin’s initial lead in the market and its commanding presence significantly influence this pattern. Even with recent drops in value, Ethereum maintains an optimistic outlook, consistently staying above crucial technical benchmarks.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- LPT PREDICTION. LPT cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- WCT PREDICTION. WCT cryptocurrency

2024-10-01 02:15