-

US spot ETH ETFs could hit $15 billion in net flows in the next 18 months

Despite the high chances of the ETF launch next week, more traders have shorted ETH.

As a crypto investor with some experience in the market, I find Matt Hougan’s analysis of US spot Ethereum ETFs intriguing. His projection of $15 billion in net flows within 18 months seems plausible considering the growing demand for Ethereum and the success of Bitcoin ETFs in Europe and Canada.

Although some analysts have expressed pessimistic views regarding the success of the US spot Ethereum [ETF], Bitwise CIO Matt Hougan remains optimistic about its prospects.

Hougan estimated the products could hit $15 billion in net flows in less than two years.

“Ethereum ETPs will attract $15 billion in net flows in their first 18 months on the market.”

Ethereum ETF: Why flows could hit $15B in 2025

As a crypto investor, I’ve noticed that Hougan’s perspective hinges on the comparison between Bitcoin (BTC) and Ethereum (ETH) in terms of their market shares and the assets under management (AUM) of Exchange-Traded Funds (ETFs) in Europe and Canada.

At the point of publication, Bitcoin’s [BTC] market capitalization stood at approximately $1.19 trillion, whereas Ethereum’s [ETH] was around $405 billion. However, according to Hogan’s assessment, Bitcoin held a market value of about $1.266 trillion (representing around 74% of the total), while Ethereum had a market capitalization of roughly $432 billion (approximately 26%).

As a crypto investor, I’ve noticed that Hougan identified a comparable demand trend for Exchange-Traded Products (ETPs) in Canada and Europe.

As a researcher studying the asset under management (AUM) of Bitcoin and Ethereum exchange-traded products (ETPs) in Europe and Canada, I observed some intriguing differences. In Europe, Bitcoin ETPs accounted for €4,601 (or 78%) of the total AUM, while Ethereum ETPs represented only €1,305 (or 22%). Conversely, in Canada, Bitcoin ETPs held an AUM of $4,942 CAD (approximately 77%), whereas Ethereum ETPs accounted for around $1,475 CAD (around 23%) of the overall AUM.

In summary, Hougan found that the given graphs represented the typical preference among investors in choosing between Bitcoin and Ethereum ETPs.

Based on Hougan’s analysis, if the assets under management (AUM) of US-listed Bitcoin exchange-traded funds (ETFs) reach $100 billion by the end of 2025, it is estimated that Ethereum ETFs could amass around $35 billion, given Ethereum’s approximate 26% share of the total cryptocurrency market.

As of this writing, Soso Value data revealed that BTC ETFs had amassed $52 billion in AUM.

However, Hougan added,

“ETHE will only convert when it holds $10 billion in assets. Therefore, the $35 billion figure does not represent actual inflows. Instead, the remaining amount is $25 billion.”

As an analyst, I would express it this way: I believe some analysts hold the view that the ETHE trust, which is Grayscale’s Ethereum investment product, could experience outflows akin to those of the GBTC trust once it converts into an exchange-traded fund (ETF).

As a researcher examining this data, I discovered that Huogan made an adjustment to the reported $25 billion figure by factoring in the EU’s market share of 22%. Consequently, the size of the market was reduced to approximately $18 billion.

Additionally, factoring likely lesser flows from carry trade seen in BTC ETFs, Hougan noted,

As a crypto investor, I’ve noticed that the carry trade strategy, which involves borrowing in a low-yield currency and investing in a high-yield one, hasn’t been consistently profitable for me when it comes to non-staked Ethereum (ETH). Therefore, I don’t anticipate the same carry-trade dynamics for newly launched Ethereum ETFs. Consequently, eliminating carry-trade assets from my model reduces my flow estimate from $18 billion to $15 billion.

Such a target would make the ETH ETPs a ‘big success,’ wrote Hougan.

How are ETH traders positioned for ETFs?

At the moment of publication, the second largest cryptocurrency by market cap was priced at around $3,300, representing a decrease of approximately 15% since it reached a peak of $3,900 following the partial Ethereum ETF approvals in late May.

Will it reverse the losses, as the market expects the ETF to launch next week?

According to the latest data from Polymarket’s prediction market, there is a 75% chance that an Ethereum-based Exchange Traded Fund (ETF) will be launched next week.

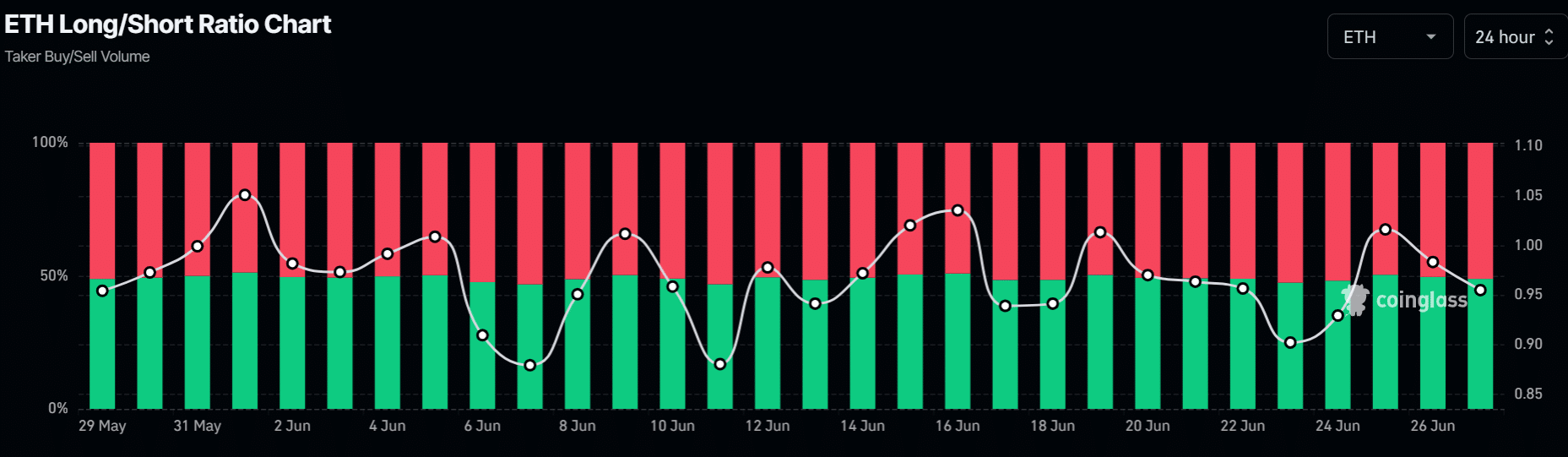

Despite the imminent launch of an ETF, there has been a rise in the number of traders betting against this asset. Short positions have increased from 49% to 51% over the last three days.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

2024-06-27 17:12