-

ONDO experienced significant trading activity as metrics suggest a further price increase in the short term.

The TVL of the protocol also jumped, suggesting reinforced trust for the project.

As a researcher with experience in the crypto market, I believe that Ondo’s [ONDO] recent price surge is significantly connected to Ethereum [ETH] and the approval of ETH spot ETFs by the U.S. SEC. The indirect relationship between ONDO and Ethereum was further solidified when Ondo Finance moved its assets to BlackRock’s BUIDL tokenization fund, which operates on the Ethereum blockchain.

Following the US Securities and Exchange Commission’s announcement that it had given its green light to eight Ethereum [ETH] spot exchange-traded funds (ETFs), Ondo’s [ONDO] price experienced a significant surge. Prior to this approval, the token was priced at $0.92.

I’ve noticed an impressive 13.26% price surge for ONDO within the past 24 hours, surpassing the $1 mark. You may be curious about the reason behind this significant development in relation to Ethereum. Let me explain from my perspective as an analyst:

In past writings, we’ve discussed how ONDO could potentially gain significant advantages from the surging trend of real-world asset (RWA) tokenization, even after its separation from Ethereum (ETH) at one instance.

Is ONDO and ETH now a couple?

In addition to this, the Ondo Finance team has lately transferred their assets to BlackRock’s BUIDL tokenization fund, which is based on the Ethereum blockchain for clarification.

Similar to how Ondo functions, BUIDL enables users to generate returns on their US dollar investments. Consequently, despite not being an Ethereum Layer 2 solution, Ondo can be considered a precursor or prototype in the blockchain realm.

As a crypto investor, I found it intriguing to notice that certain market players seemed to have predicted the recent shift. Approximately six days ago, on-chain information revealed that a trader exchanged 1,870 Ether for ONDO tokens at an average cost of around $0.95 each.

A different investor, who bought the digital token back in February, hasn’t sold it yet, even with a potential gain of 288%. This behavior implies that the token’s value might continue to rise and surpass the current price of $1.08.

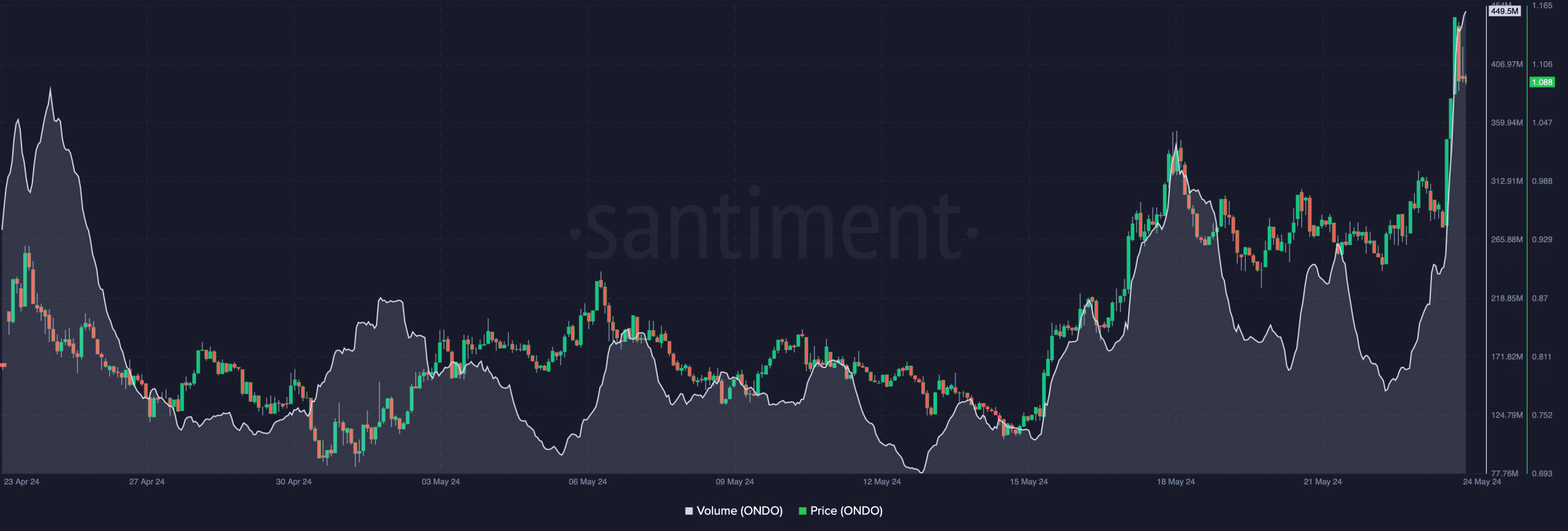

Additionally, AMBCrypto examined ONDO‘s trading volume. According to Santiment’s data, this figure reached a monthly peak of $449.5 million at the current moment.

The surge in demand, as indicated by the volume hike, is a clear sign of growing enthusiasm for the ONDO token. This trend, when considered along with the price fluctuations, hints at a potential further price rise for ONDO within the near future.

Why the price may be set to hit $2

If the current trend holds, I believe ONDO‘s price may reach around $1.20 in the near future. However, should the trading volume decrease as the price increases, this uptrend could lose its strength. In such a scenario, a potential drop below the $1 mark becomes a possibility, especially if there is significant profit-taking in the market.

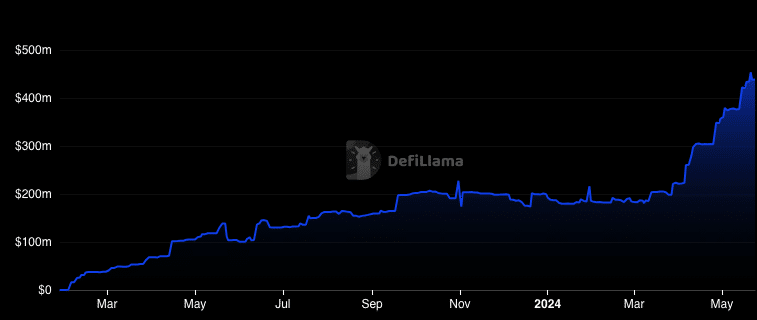

As a crypto investor, I believe that the Total Value Locked (TVL) is a significant indicator for the future prospects of a project. In simpler terms, TVL represents the total amount of dollars invested or “locked” within a specific blockchain protocol or decentralized finance (DeFi) application. By observing the TVL trend, I can gauge the level of confidence and commitment from other investors towards the project’s long-term success.

Using this measurement, you can determine the protocol’s vitality. An uptick in Total Value Locked (TVL) signifies an influx of liquidity, suggesting a robust and thriving condition for the protocol.

Simultaneously, a decrease suggested a contrary situation. As per DeFiLlama’s latest update, Ondo Finance’s Total Value Locked (TVL) has seen a significant surge and stood at an impressive $438.42 million at present.

As a crypto investor, I can tell you that the recent surge in this project’s value indicates strong confidence from market players. They obviously view the project as trustworthy and believe it has great potential for high returns. Based on current trends, we could see this metric reach $1 billion within the next few months.

Realistic or not, here’s ONDO’s market cap in ETH terms

Should this be the case, ONDO’s price might also benefit, and a rise to $2 to $4 could be possible.

The analysis of the project’s main site revealed that it provides a yearly return of 5.20% for US dollar deposits and 4.96% for US Treasuries.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- LPT PREDICTION. LPT cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- WCT PREDICTION. WCT cryptocurrency

2024-05-24 16:08