- BlackRock leads Ethereum ETF approval by updating Form S-1, marking significant progress.

- Hashdex and Vanguard have either withdrawn their applications or decided against launching spot Ether ETFs.

As a researcher with experience in the crypto market, I’m excited about BlackRock’s recent progress in updating its Form S-1 for an Ethereum exchange-traded fund (ETF), which could lead to the first approved ETH spot ETF in the US. This is a significant development as it marks a major step towards the mainstream adoption of cryptocurrencies.

In June, it may be expected that Ethereum [ETH] ETFs will receive final approval since BlackRock has initiated the process by updating a crucial filing for their prospective launch.

The SEC, which is the United States securities regulatory body, has requested that entities planning to introduce Ethereum ETFs make revisions to their Form 19b-4 and Registration Statement S-1 submissions accordingly.

In the past, the SEC has given its approval to rule 19b-4 forms for eight different applications seeking to launch Ether Exchange-Traded Funds (ETFs). Among these applicants are BlackRock (BLK), Fidelity (FNF), Grayscale, ARK Invest, VanEck, Invesco Galaxy, and Franklin Templeton.

BlackRock’s bold move

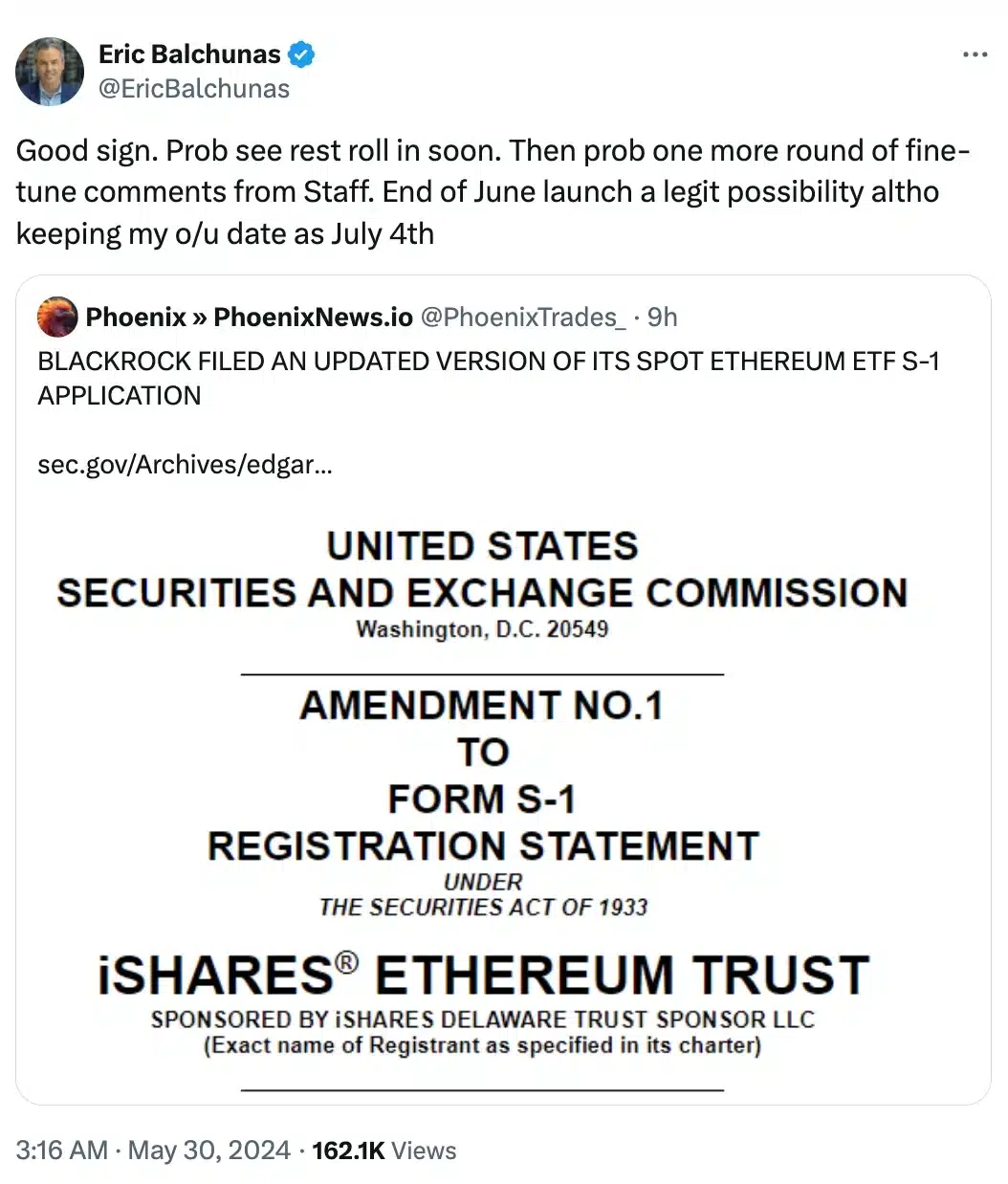

On May 29th, BlackRock filed an amended Form S-1 with the SEC for its iShares Ethereum Trust (ETHA), following the SEC’s approval of the trust’s 19b-4 application approximately a week prior.

In his latest commentary on X, Eric Balchunas, a senior ETF analyst at Bloomberg, observed.

Adding to the fray was James Seyffart, research analyst at Bloomberg, who said,

As a crypto investor, I’m thrilled to see that the anticipated engagement following the 19b-4 approvals on the S-1 filings is now materializing. The collaborative efforts between issuers and the Securities and Exchange Commission (SEC) are progressing towards the launch of spot Ethereum Exchange Traded Funds (ETFs).

Although Hashdex chose to withdraw its application for an Ether ETF following the Securities and Exchange Commission’s (SEC) approval of the first Ethereum-based ETF, not all applicants made similar progress in the process.

Nate Geraci, President of The ETF Store, pointed out a comparable trend in relation to Vanguard in his most recent tweet.

“No surprise, but Vanguard will NOT be offering spot eth ETFs on its brokerage platform…”

What’s the price situation?

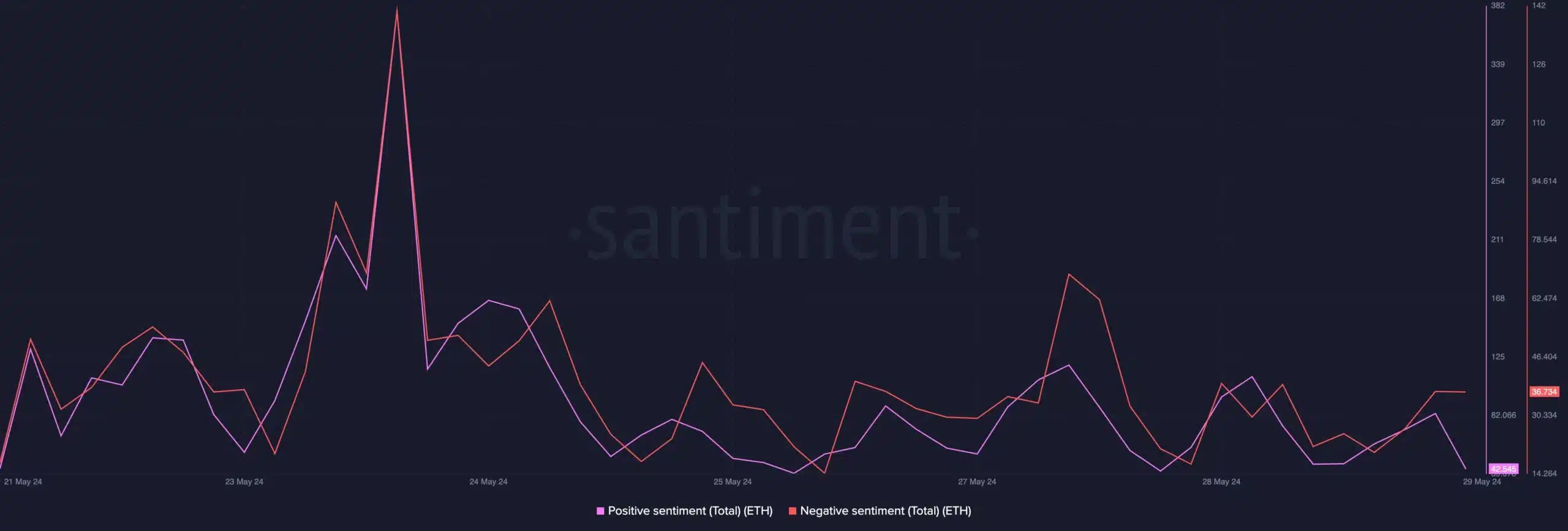

As an analyst, I’ve noticed that there are optimistic expectations regarding the potential approval of an Ether-backed spot exchange-traded fund (ETF). With this in mind, at the moment of putting this analysis together, Ethereum was trading for $3,769, representing a 2.45% decrease from its previous price.

As a researcher, I delved deeper into the data provided by Santiment, analyzed by AMBCrypto. The findings revealed an uptick in negative investor sentiment while positive sentiment was waning.

Optimistic outlook persists

In spite of the widespread pessimism regarding Ethereum, analyst Jaret Seiberg from TD Cowen’s Washington Research Group pointed out.

As a researcher, I’ve been closely monitoring the developments surrounding the ETH ETF approval. To my surprise, it has come sooner than anticipated – approximately six months ahead of schedule. However, in retrospect, this decision seemed inevitable once the SEC gave its green light to crypto futures ETFs.

He added,

“The next step could be an ETF with a ‘basket of crypto tokens’.”

As the anticipated final approval of the Ethereum ETF from the SEC is yet to come, it’s worth keeping an eye on any shifts in attitude among the regulatory body, particularly SEC Chair Gary Gensler, who has previously expressed skepticism towards cryptocurrencies.

Read More

- Gold Rate Forecast

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- PI PREDICTION. PI cryptocurrency

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Rick and Morty Season 8: Release Date SHOCK!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Masters Toronto 2025: Everything You Need to Know

2024-05-30 14:15