- The merciless SEC, in its infinite wisdom, has postponed the judgment on ETH ETF staking and that charade called in-kind redemption until the distant, dystopian June of 2025. A dark day indeed!

- The bureaucratic leviathan, the SEC, has deigned to meet with the so-called “key players,” BlackRock among them, to ponder these monumental issues. As if such meetings ever yield anything but more delays and obfuscation.

The United States Securities and Exchange Commission (SEC), that bastion of regulatory tyranny, has once again delayed its pronouncements on staking and in-kind redemption for Ethereum [ETH] ETFs (exchange-traded funds). One might think they have nothing better to do than torment the hopeful investors. 🤔

The agency, ever hungry for more time to justify its existence, sought further delays on the staking application concerning two Grayscale spot ETH ETFs. The deadline, once a beacon of hope, has been cruelly extended to the 1st of June. Grayscale, poor souls, submitted their application way back in February. Such is the speed of justice in this land! 🐌

What Horrors Await ETH ETFs?

Others, like Bitwise, VanEck, 21Shares, Fidelity, Invesco Galaxy, and Franklin Templeton, have also groveled before the SEC, seeking similar staking provisions for their respective ETH ETF products. Each one hoping to escape the SEC’s wrath. 😥

As of this very moment, BlackRock alone has abstained from this pathetic display of supplication. Yet, Robert Mitchnick, BlackRock’s head of digital assets, has dared to publicly acknowledge the supposed benefits of staking. A dangerous game he plays, flirting with the SEC’s displeasure. 🔥

The regulator, in its infinite capacity for obstruction, has also delayed decisions on in-kind creation and redemption for both ETH and BTC ETFs. In-kind redemption, a concept so simple it confounds the SEC, allows the use of underlying assets like ETH or BTC, unlike the current cash settlements demanded by the Gary Gensler-led regime. A truly enlightened approach, if only the SEC could grasp it. 💡

The in-kind method, that beacon of efficiency, avoids taxable events and enhances liquidity. The regulator, however, prefers complexity and stagnation, pushing the in-kind decision deadline to the 3rd of June. A date that will surely bring more disappointment. 🗓️

That being said, the SEC’s crypto task force, those paragons of industry insight, have held roundtable discussions with key players, including Jito, MultiCoin Capital, and BlackRock, about crypto ETF staking and in-kind redemption. One can only imagine the level of understanding achieved in those hallowed halls. 🙄

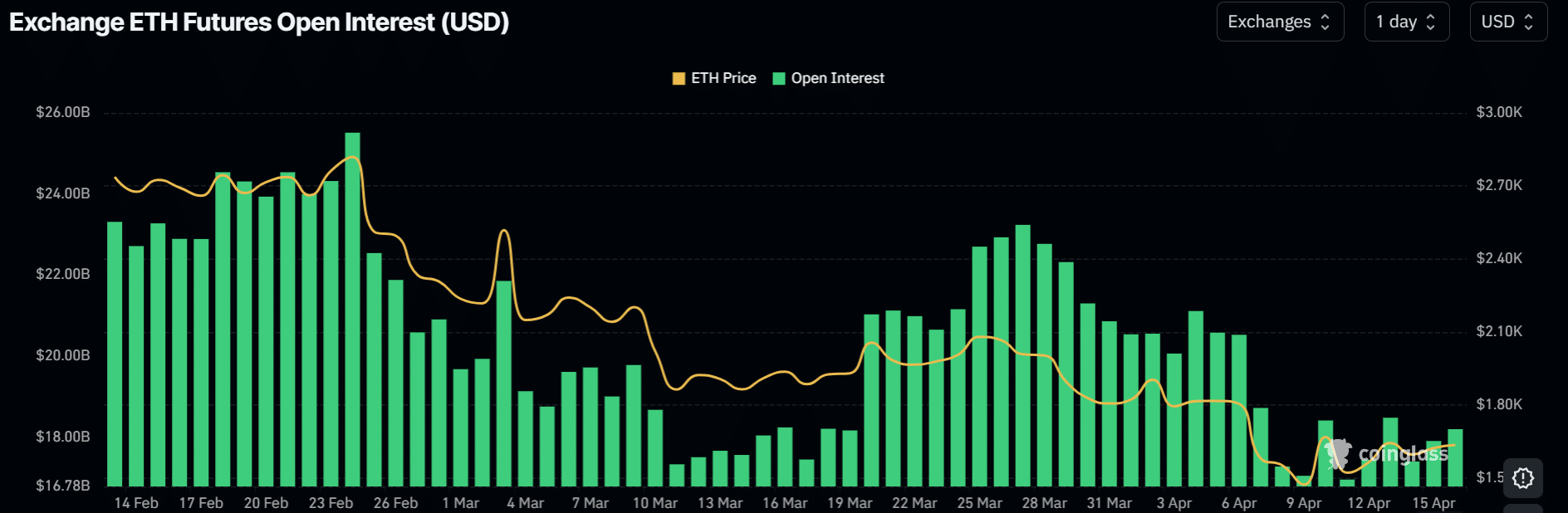

Meanwhile, this pathetic update has done nothing to stir speculative interest in ETH. According to the oracles at Coinglass, Open Interest (OI) has been in a state of decline since February, plummeting from nearly $26B to a mere $20 billion. A clear sign that hope has abandoned these shores. 📉

This meant that the bearish sentiment, that grim specter, persisted even after this so-called “update.” As if anyone expected anything different from the SEC. 🤷

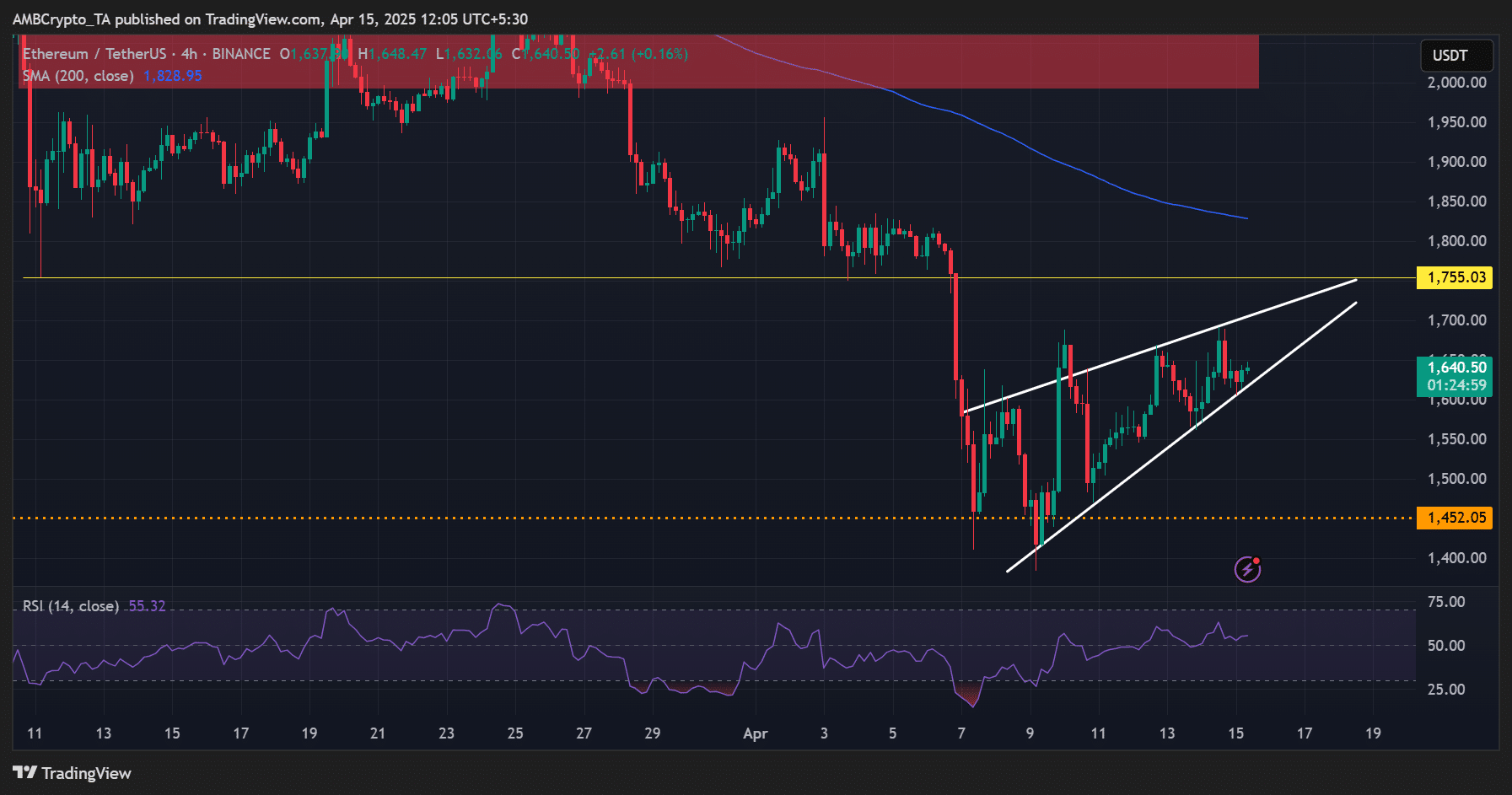

On the 4-hour price chart, ETH has traced a bearish rising wedge, a harbinger of doom that could drag it below $1500 once more if this pattern is validated. However, reclaiming $1.8K might, just might, allow the bulls to mount a feeble advance. But don’t hold your breath. 💨

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- LPT PREDICTION. LPT cryptocurrency

2025-04-15 14:21