-

Solana has weakened against Ethereum on the price charts

However, SOL maintained a bullish sentiment and market structure.

As a researcher with experience in cryptocurrency markets, I have closely observed the recent price dynamics between Solana (SOL) and Ethereum (ETH). While it’s true that Ethereum has seen a surge following the ETF approval news, Solana’s market structure remains bullish on higher timeframes.

Some market analysts believe that the continued debate over Ethereum [ETH] ETF acceptance may temporarily impact Solana [SOL] prices.

Since its inception, SOL has faced heightened criticism on social media platforms as the crypto market starts embracing the potential approval of an Ethereum Exchange-Traded Fund (ETF). Among the community members voicing their opinions is Nigel Eccles, a Solana developer and user. He remarked, […]

As a devoted supporter of Solana who began my journey with this blockchain in 2021, the recent Ethereum ETF approval news has left me disheartened. It feels as if Ethereum’s resurgence comes at the expense of Solana’s potential dominance, leaving me questioning its role in the future of decentralized finance.

Eccles stated that the approval of an ETH Exchange-Traded Fund (ETF) would recognize ETH as the authentic smart contract platform. Consequently, he expressed a preference for shifting towards ETH over continuing with Solana.

Although it’s past the point of no return to switch to the approved blockchain immediately, it’s still possible to make the transition. Consequently, I’ll be selling off my Solana tokens and investing solely in Ethereum as of now.

Is ETH eclipsing SOL?

As a crypto investor, I’ve noticed that Solana (SOL) didn’t keep pace with Ethereum (ETH) in price during the recent developments surrounding the ETF approvals on Monday and Tuesday. When checking the weekly performance based on CoinMarketCap data, Solana clocked in at a 29% gain while Ethereum boasted a stronger 25% increase.

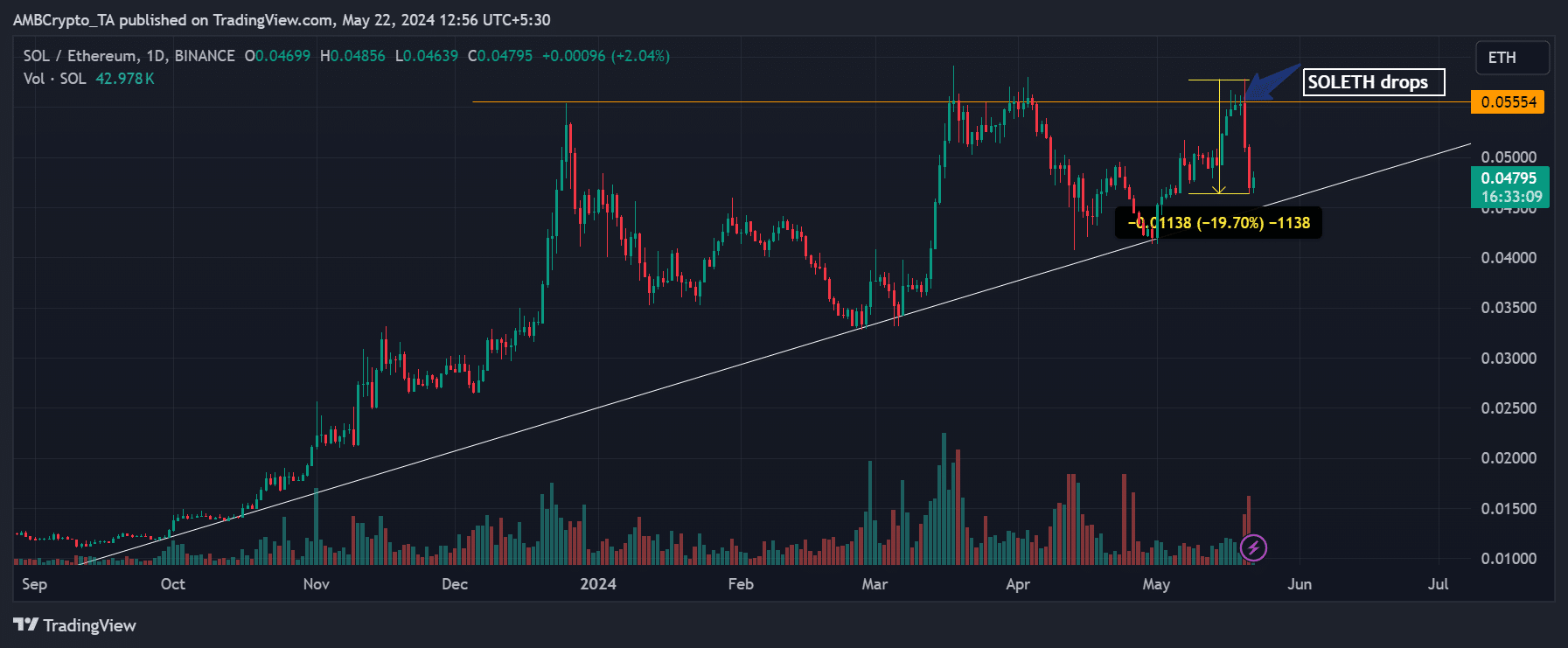

From my perspective as an analyst, on a fine-grained scale, the SOL-to-ETH ratio indicated that Solana’s value relative to Ethereum began to decrease early in the week.

For those unfamiliar, the SOL/ETH ratio measures how much more or less Solana (SOL) has performed compared to Ethereum (ETH). A higher value implies that SOL has outperformed ETH, while a decreasing ratio suggests a weaker SOL performance relative to Ethereum.

As a crypto investor, I’ve noticed that the Solana (SOL) to Ethereum (ETH) ratio took a hit, dipping by 19%. This translates to SOL losing 19% of its value compared to ETH, which was previously at a ratio of 0.05 but is now at 0.046.

As an analyst, I’ve observed that on Monday and Tuesday, Solana (SOL) lagged behind Ethereum (ETH) with two consecutive daily red candlesticks. At present, Ethereum is priced at $3,700, representing a 2% increase in the last 24 hours. In contrast, Solana is trading at $180, registering a minimal decrease of 0.5% during the same timeframe.

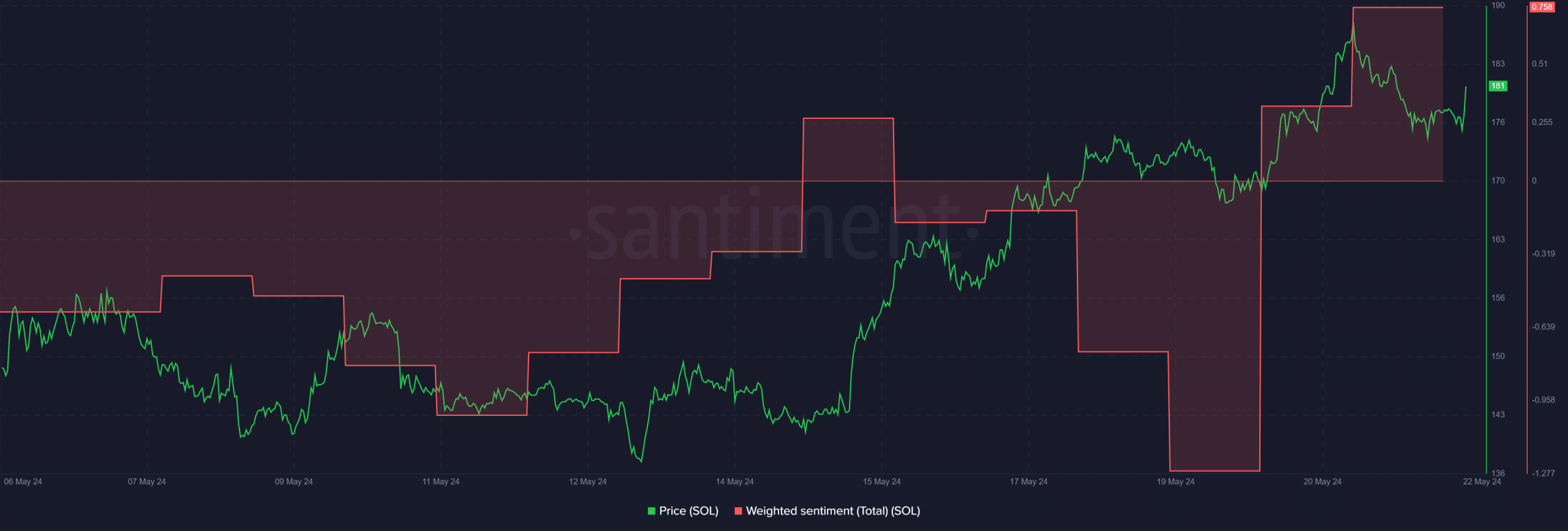

In spite of a less-than-stellar showing versus Ethereum and Eccles’ bearish take on Ethereum ETFs potentially affecting Solana, investors remained optimistic about Solana’s future, as evidenced by the favorable Weighted Sentiment.

As an analyst, I’ve observed that SOL has kept a bullish trend on longer timeframes. If the buyers manage to hold $180 as a short-term support level, SOL could potentially target the $200 mark.

Despite Ethereum ETF speculation causing hesitation for some market participants, there remained optimism among players regarding Solana’s potential. In contrast, Eccles expressed a less favorable view on the current market scenario.

Read More

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- Sea of Thieves Season 15: New Megalodons, Wildlife, and More!

- SOL PREDICTION. SOL cryptocurrency

- PI PREDICTION. PI cryptocurrency

- Bitcoin’s Golden Cross: A Recipe for Disaster or Just Another Day in Crypto Paradise?

- Has Unforgotten Season 6 Lost Sight of What Fans Loved Most?

- Owen Cooper Lands Major Role in Wuthering Heights – What’s Next for the Young Star?

- Michael Saylor’s Bitcoin Wisdom: A Tale of Uncertainty and Potential 🤷♂️📉🚀

2024-05-22 17:12