-

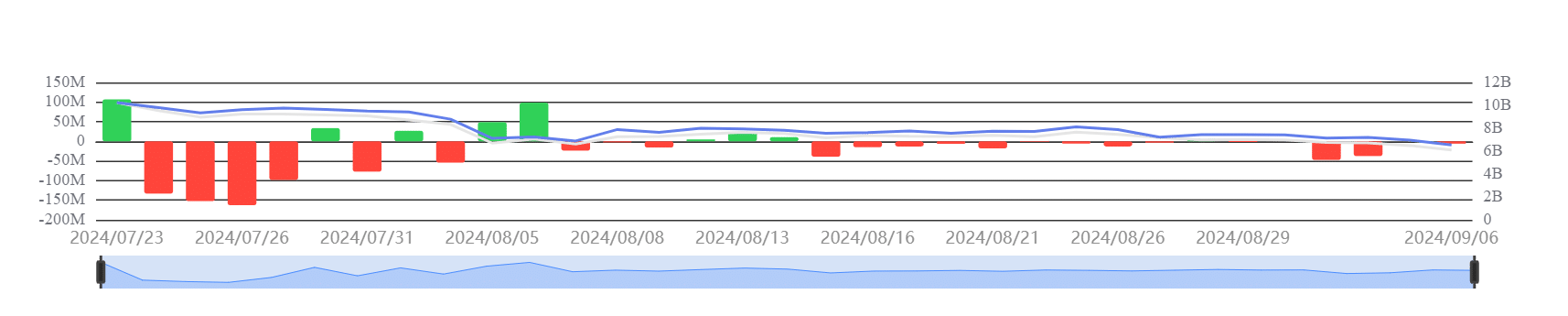

Spot ETH ETFs had netflows of -$91 million for the week.

The ETH ETF volume has not picked up, compared to the BTC ETF

As a seasoned crypto investor with a knack for deciphering market trends and understanding the nuances of asset management firms, I find myself both intrigued and cautious about the recent developments surrounding Ethereum ETFs. The entry of Monochrome Asset Management into the spot Ethereum ETF space in Australia is certainly a promising move, signaling the growing interest in passive ETH investment. However, the simultaneous withdrawal of VanEck’s Ethereum Futures ETF underscores the prevailing preference for direct exposure over futures offerings.

This week, Ethereum has been involved in significant developments regarding its Exchange Traded Funds (ETFs). A prominent financial institution declared it would cease supporting one of its Ethereum-related services. Simultaneously, another organization submitted an application for a new, direct Ethereum ETF.

During this particular week, there were several occurrences as the Ethereum Spot ETFs experienced minimal investment, adding to the ambiguous feelings surrounding Ethereum.

New Ethereum ETF feature in Australia

This week, Monochrome Asset Management, an Australian investment firm, disclosed that they’ve submitted an application for listing their Ethereum-focused ETF (IETH) on Cboe Australia. The announcement emphasized that the company intends to passively hold Ethereum, making IETH the first Australian ETF to do so in this manner. This action signifies Monochrome’s ongoing growth within the cryptocurrency ETF market, as they previously introduced their Bitcoin ETF in June 2024.

As Monochrome moves forward with its Ethereum ETF, another prominent financial company, VanEck, has decided to discontinue one of its Ethereum ETF offerings.

VanEck to shut down Ethereum Futures ETF

On September 6th, VanEck disclosed that their board has decided to liquidate their Ethereum Strategy ETF (EFUT), which is a type of ETF based on futures contracts for Ethereum.

The reason for shutting down the fund was due to low interest from investors. As stated, traders have favored spot Exchange-Traded Funds (ETFs) over Futures products instead. According to the announcement, trading of EFUT shares will end on September 16th. On or around the 23rd of September, the fund’s assets will be liquidated and distributed back to investors.

The actions taken by Monochrome and VanEck underscore the rising interest in spot Exchange-Traded Funds (ETFs) within the cryptocurrency market. Specifically, Monochrome’s introduction of its spot Ethereum ETF (IETH) mirrors this increasing trend. Meanwhile, VanEck’s choice to discontinue its Futures ETF shows a declining preference for Futures products as investors are opting for more direct exposure through spot ETFs instead.

Contrary to their initial popularity, there’s been a noticeable decrease in investment in spot ETFs over the last week, as indicated by the outflows.

Spot ETH ETF records consecutive outflows

Over the past week, as an analyst examining data from SoSoValue, I observed consistent withdrawals from Spot Ethereum ETFs across various exchanges. By the end of trading on September 6th, these outflows totaled approximately $6 million. This trend has resulted in a net loss for the week of around $-91 million.

– Read Ethereum (ETH) Price Prediction 2024-25

Moreover, currently, the combined outflows from ETFs tracking spot Ethereum are about $-568.30 million, suggesting a continuous pattern of investors choosing to remove their funds.

In other words, the current market situation has led investors to reduce or withdraw their investments in Ethereum over the past few weeks.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Gold Rate Forecast

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Elden Ring Nightreign Recluse guide and abilities explained

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

2024-09-07 23:03