-

Spot Ethereum ETFs flipped positive on 28th August after two weeks of consecutive outflows.

ETH price has also made a strong rebound, with the RSI bouncing from oversold levels.

As a seasoned crypto investor with a knack for spotting trends and patterns, I find the recent developments in Ethereum (ETH) particularly intriguing. After two weeks of consecutive outflows from ETH-focused Exchange Traded Funds (ETFs), the inflow on 28th August is a promising sign. The surge in net assets to $6.9 million indicates renewed interest and confidence in Ethereum, which aligns with my long-held belief that the market often underestimates the potential of this digital asset.

As an analyst, I observed a notable inflow into U.S.-traded Ethereum [ETH] exchange-traded funds (ETFs) on the 28th of August, following a two-week streak of outflows. Since their debut on the 23rd of July, these ETFs have recorded positive inflows only on nine occasions.

According to SoSoValue’s data, these particular products received approximately $5.84 million on Wednesday. This surge in inflows seems to align with the robust recovery of Ethereum prices. Currently, their total net assets amount to around $6.9 million.

The BlackRock iShares Ethereum Trust (ETHA) largely accounted for the recent positive inflows. The ETF had consecutive zero flows for five days since the 21st of August. It broke the streak on Wednesday with $8.4M inflows.

Fidelity also posted $1.26M in inflows, while the Grayscale ETF had $3.81M in outflows.

Over the past 24 hours, a series of favorable developments have boosted ETH, causing it to increase by almost 3%. Currently, ETH is trading at approximately $2,541 as I write this.

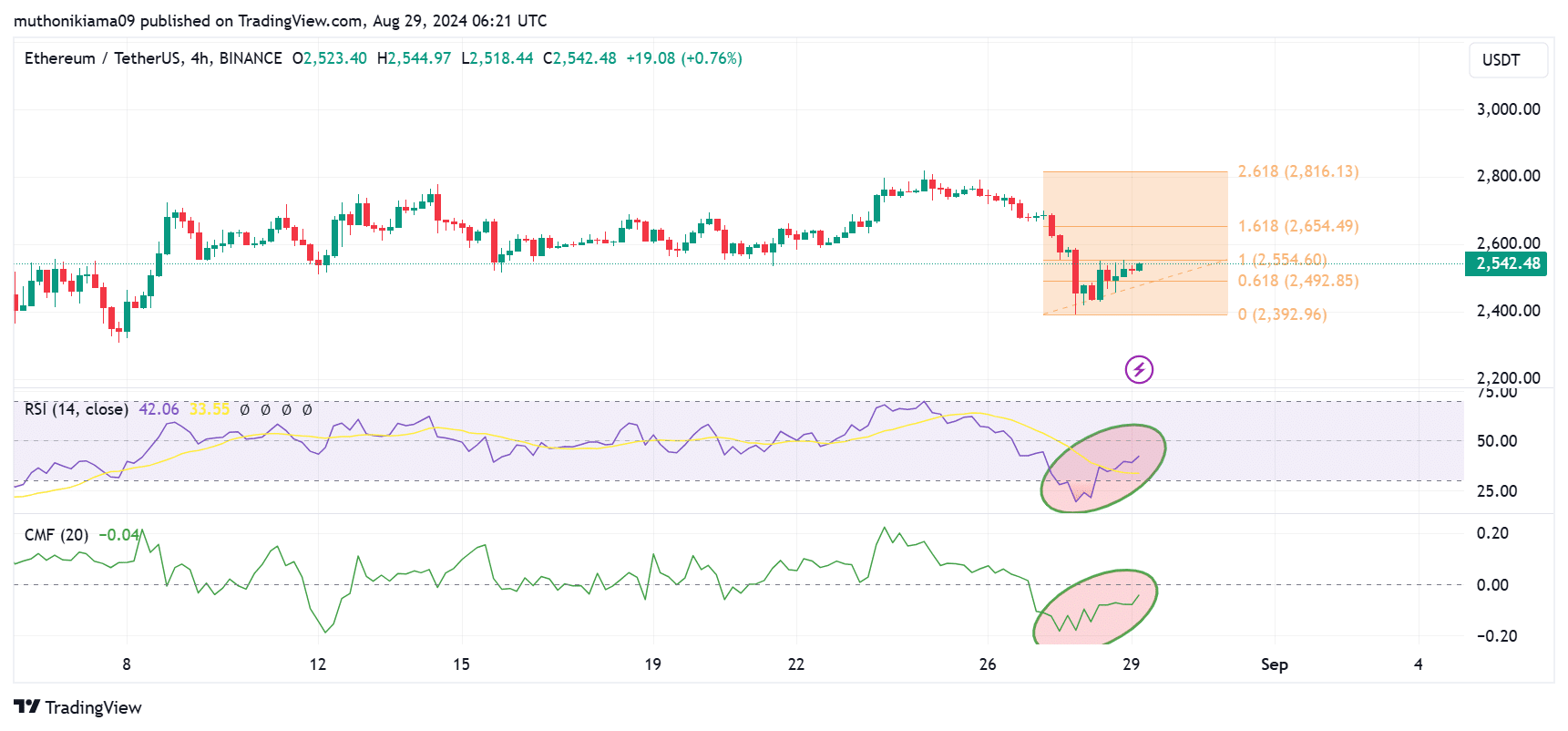

RSI shows a strong bounce

It seems like ETH‘s latest surge in price is being driven by buyers. Moreover, the Relative Strength Index (RSI), which measures overbought and oversold conditions, has rebounded from an area that indicates the market is oversold, falling below the 30 threshold.

The Relative Strength Index (RSI) line has significantly risen, showing increased highs followed by lower lows and surpassing the signal line, which signals a surge in bullish energy. The intersection also hints at a buying opportunity and the prolongation of the upward trend.

Nevertheless, even with this upward movement, the RSI (Relative Strength Index) still stands at 41. This suggests that buyers might want to hold off trading until the index reaches the neutral level of 50.

The Chaikin Money Flow also shows an uptick in buying pressure. However, given that this metric remains in the negative region, a flip to the positive is needed to confirm the uptrend.

After a rise in value, Ethereum (ETH) has jumped from its support point at $2,492 and is currently testing resistance at $2,554. If this upward trend persists and ETH manages to exceed $2,600, the next potential goal would be $2,800.

Recently, ETH has surpassed Bitcoin (BTC) in its performance, but trader DaanCrypto on platform X predicts that this growth might lead to a potential correction.

The trader expressed concern, stating that ETH appears to be temporarily outperforming Bitcoin by a slight margin, a situation that historically has resulted in discomfort throughout this year.

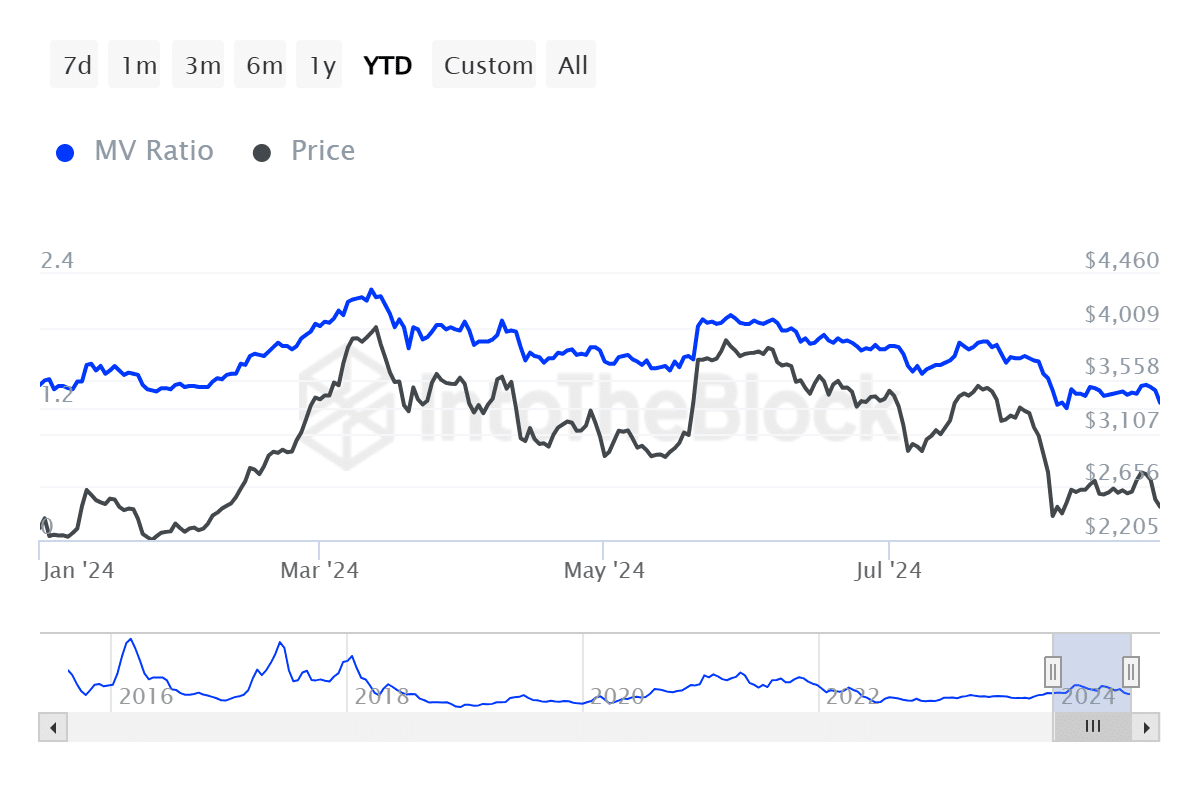

The Ethereum Market Value to Realized Value (MVRV) ratio has significantly decreased, which might indicate that Ethereum is currently underpriced. This could be an opportune moment for long-term investors to acquire the asset.

Read Ethereum’s [ETH] Price Prediction 2024 – 2025

The falling MVRM (Maker’s Value Realized minus Maker’s Value Unrealized) ratio might likewise indicate a market sell-off or capitulation following an extended period of pessimism regarding Ethereum.

As an analyst, I’ve noticed a shift in Ethereum funding rates, which now stand positive according to Coinglass data. This implies a rise in long positions and a growing optimism among investors, signaling a potential bullish trend.

Read More

2024-08-29 16:08