-

Ethereum ETFs have seen the light of day, but if history repeats itself, whales might put bulls in a chokehold.

Market indicators revealed the current state of ETH’s demand, including exchange flows.

As a seasoned researcher with a decade-long experience in the financial markets, I have witnessed numerous instances of market excitement leading to manipulation by whales. The recent approval of Ethereum ETFs by the SEC has created a wave of enthusiasm within the crypto community. However, history warns us that such situations can be a breeding ground for whale-induced sell pressure.

July 23rd holds significant historical value for the Ethereum [ETH] community. The United States Securities and Exchange Commission (SEC) has granted approval for the listing of ProShares’ and VQQQ’s Ethereum-linked exchange-traded funds (ETFs), paving the way for their trading commencement.

Experts predict that Ethereum ETFs will attract substantial investments, potentially bringing in billions of dollars within the next year.

The popularity of Bitcoin [BTC] ETFs indicates strong interest in the cryptocurrency market, and this trend is expected to carry over to Ethereum [ETH]. However, it’s important to remember that history serves as a reminder of potential risks before investing heavily in Ethereum.

Are Ethereum ETFs a sell the news event?

Historical market fervor has often presented opportunities for larger traders, or “whales,” to influence prices. A notable instance occurred following the approval of Bitcoin ETFs, resulting in significant price fluctuations.

Could the same thing turn out true for ETH following the spot ETFs approvals?

Based on information from Lookonchain, a single large investor transferred 8,762 Ether to Binance following the news that nine Ethereum Exchange-Traded Funds, with a combined value of over $30 million, had been approved.

As a researcher observing whale behavior, I interpret their actions as potential indicators of an impending exit from the market. They could be making preparations to sell some of their holdings for quick liquidity. This suggests a short-term exit strategy.

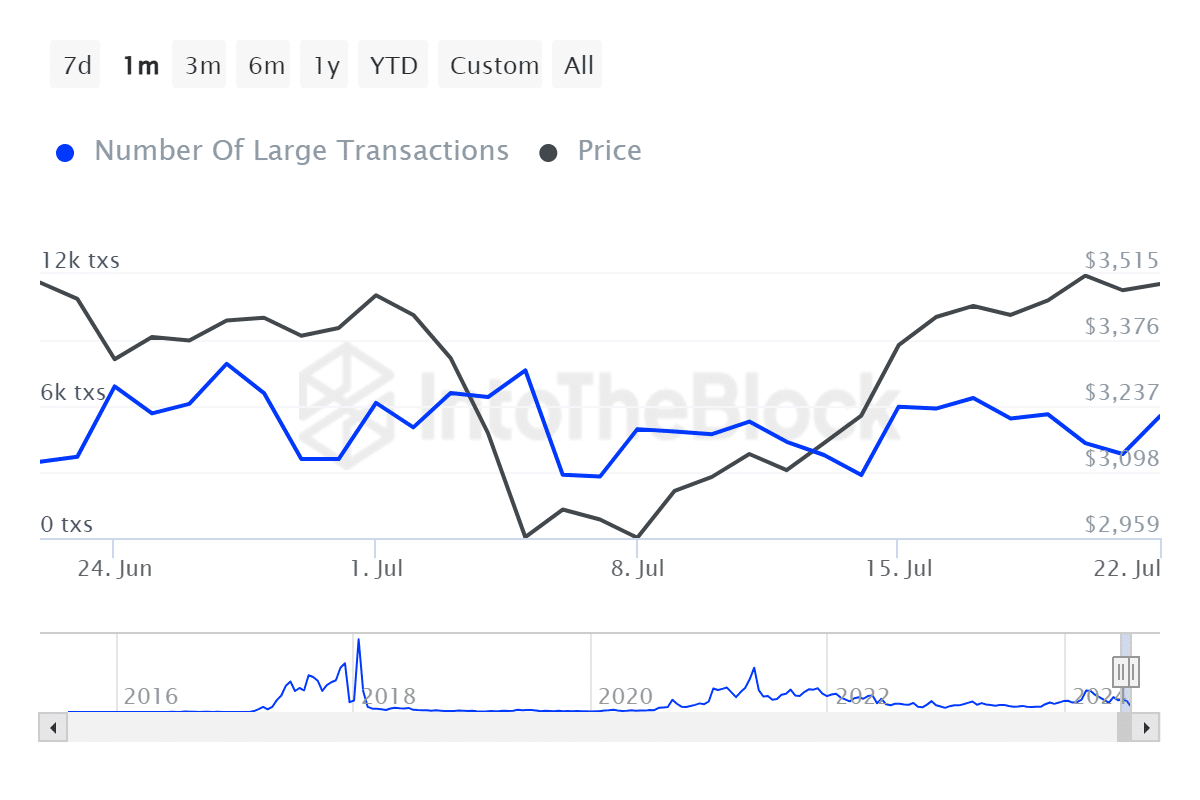

As a crypto investor, I delved into on-chain analytics to assess the extent of whale involvement in the current market scenario. Notably, data from IntoTheBlock indicated a surge in large transactions, specifically those involving addresses with a balance exceeding $100,000 worth of cryptocurrency.

The number of transactions jumped significantly, rising from 3,820 to more than 5,400 starting on the 21st of July, following a period of decreased activity since mid-July.

Around the same period when Ethereum ETF news gained prominence, a notable increase in activity from large investors, or “whales,” on AMBCrypto was observed. In order to ascertain if this activity indicated selling pressure, AMBCrypto chose to investigate further.

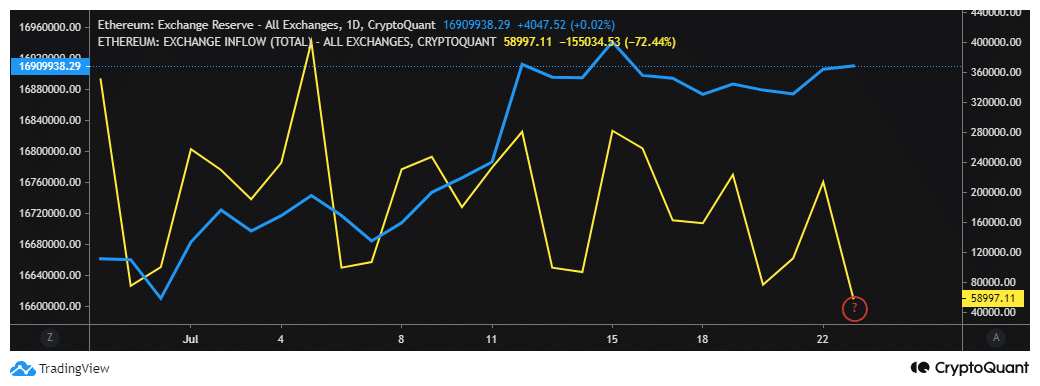

In the past three days, there has been a noticeable increase in crypto holdings in exchanges as indicated by CryptoQuant’s exchange reserve data. Meanwhile, the rate of new deposits into these exchanges has decelerated significantly within the same timeframe.

Are ETH whales cashing out?

In the past three days, there hasn’t been any clear sign from the metrics that whales sold Ethereum due to whale activity. On the other hand, there has been a rise in Ethereum’s exchange reserves.

Potentially signaling ETH sell pressure from addresses holding the cryptocurrency on exchanges.

Meanwhile, there’s been a deceleration in ETH inflows from exchanges. It seems that major Ethereum holders are keeping their assets in personal wallets for now, unwilling to sell.

Read Ethereum’s [ETH] Price Prediction 2024-25

To summarize, the recent announcement is new information. The behavior of whales and the overall market might yet undergo changes in response.

Based on historical trends, a surge in selling could potentially lead to a decrease in Ethereum’s price in the near future. However, it’s important to note that past events may not necessarily repeat themselves, and the current state of the broader cryptocurrency market could significantly impact Ethereum’s trajectory.

Read More

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- We Ranked All of Gilmore Girls Couples: From Worst to Best

- Jujutsu Kaisen Reveals New Gojo and Geto Image That Will Break Your Heart Before the Movie!

- Why Tina Fey’s Netflix Show The Four Seasons Is a Must-Watch Remake of a Classic Romcom

- How to Get to Frostcrag Spire in Oblivion Remastered

- Assassin’s Creed Shadows is Currently at About 300,000 Pre-Orders – Rumor

- Whale That Sold TRUMP Coins Now Regrets It, Pays Double to Buy Back

- Is the HP OMEN 35L the Ultimate Gaming PC You’ve Been Waiting For?

- S.T.A.L.K.E.R. 2 Major Patch 1.2 offer 1700 improvements

- First U.S. Born Pope: Meet Pope Leo XIV Robert Prevost

2024-07-24 07:03