- The Ethereum ETF approval coincided with a shift in investor sentiment, as Bitcoin ETFs experienced outflows after weeks of consistent inflows.

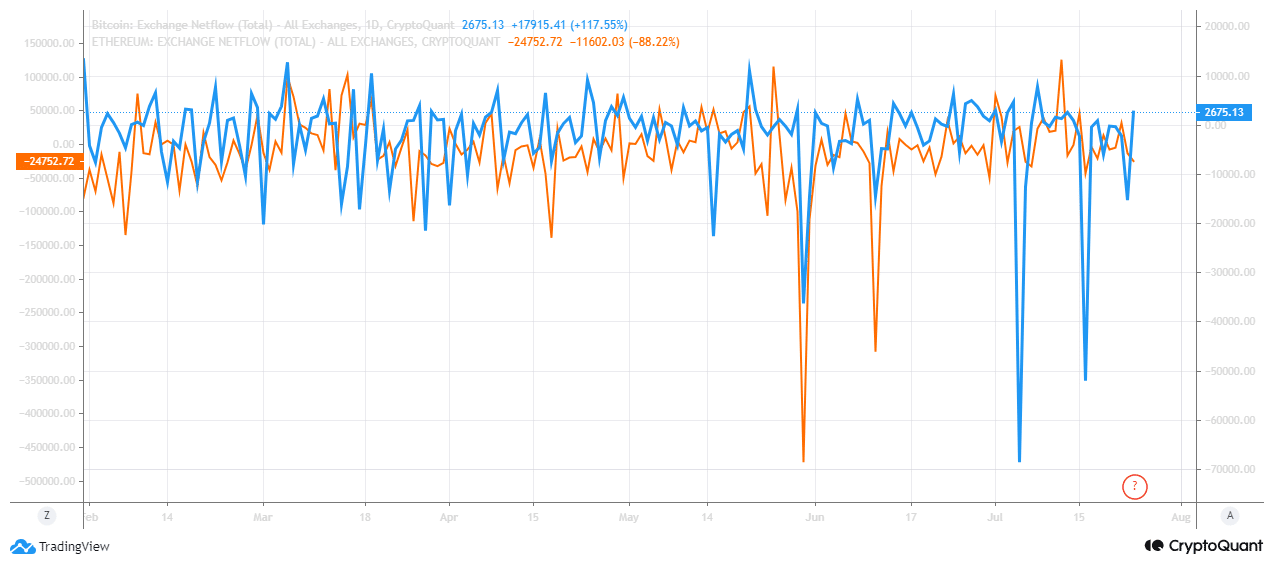

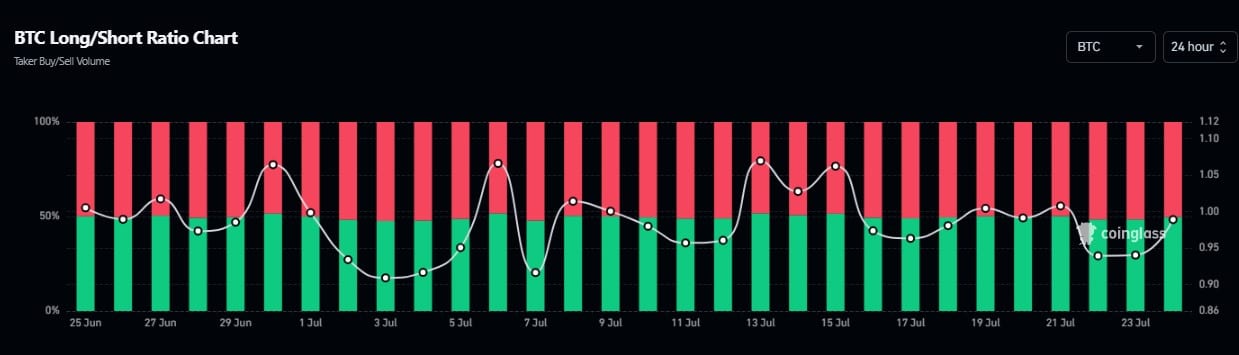

- Exchange net flows and long/short ratios indicated market uncertainty.

As a seasoned financial analyst with extensive experience in cryptocurrency markets, I have closely monitored the recent shifts in investor sentiment and exchange flows. The Ethereum ETF approval, coinciding with Bitcoin ETF outflows, has piqued my interest.

Recently, there’s been a notable change in the cryptocurrency market. After several weeks of continuous investments, Bitcoin [BTC] exchange-traded funds (ETFs) have seen their initial outflows.

The Ethereum [ETH] ETF approval preceded this modification, implying a potential connection between the two occurrences.

Ethereum steals the spotlight

The announcement of Ethereum ETFs appearing seems to have drawn investors away from Bitcoin. At the same time, it has rekindled enthusiasm for Ethereum, which could be weakening Bitcoin’s recent progress.

As an analyst, I’ve noticed an intriguing pattern in the recent occurrences between the two leading cryptocurrencies. This sequence of events has sparked growing curiosity among investors and market observers, fueling discussions about potential shifts in investment allocations between these digital assets.

Based on the data from CryptoQuant, there’s been a notable pattern emerging in terms of exchange inflows and outflows for Bitcoin. Specifically, an influx of 2675.13 BTC has entered exchanges recently, signifying that more coins have been moving into these platforms rather than being withdrawn.

From the opposite perspective, Ethereum saw a net outflow of approximately 24,753 Ether leaving exchanges, implying more Ether being taken out than put in.

I’d like to contribute to the discussion by mentioning that according to Ali Martinez’s latest tweet, Bitcoin seems poised for a breakout, potentially reaching a price of $67,000.

At the current moment, the Relative Strength Index (RSI) had shattered its downward trendline, yet it required advancing beyond $66,450 to unequivocally validate the bullish reversal.

BTC drops hints about market sentiment

An in-depth examination of Bitcoin’s long/short ratio chart, as presented by AMBCrypto using data from Coinglass, sheds light on the current market mood.

In the last 24 hours, the ratio has seen some ups and downs. Lately, there’s been a modest uptick in long positions, implying that investors, in spite of Bitcoin ETF withdrawals, remain hopeful about its future potential.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Is volatility on the horizon?

The blend of ETF withdrawals, changing exchange inflows, and varying Long/Short Ratios created a mosaic of market instability.

The approval of the Ethereum ETF might cause heightened market fluctuations in the upcoming weeks, as investors reevaluate their holdings accordingly.

Read More

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- PI PREDICTION. PI cryptocurrency

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- SOL PREDICTION. SOL cryptocurrency

- Studio Ghibli Creates Live-Action Anime Adaptation For Theme Park’s Anniversary: Watch

- Dragon Ball Z: Kakarot DLC ‘DAIMA: Adventure Through the Demon Realm – Part 1’ launches between July and September 2025, ‘Part 2’ between January and March 2026

2024-07-25 04:08